Articles

June 24, 2021

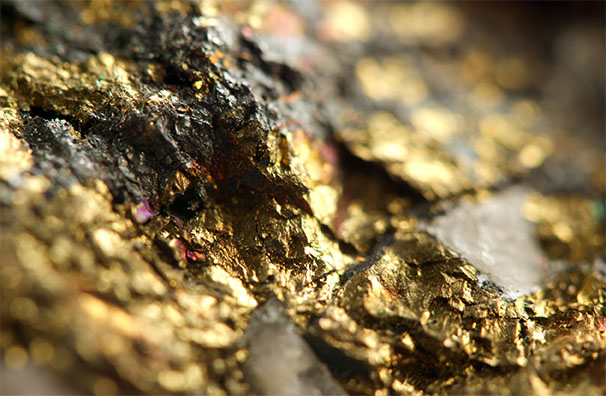

2021.06.24 At Freegold Ventures’ (TSX:FVL) flagship Golden Summit property in Alaska, a drill […]

June 24, 2021

2021.06.24 Following an earlier update on the company’s exploration plans in the prolific […]

June 24, 2021

2021.06.24 Zinc prices may have softened after hitting a 3-year high in May, […]

June 23, 2021

2021.06.22 After decades of neglect, allowing China to monopolize world graphite production, the […]

June 19, 2021

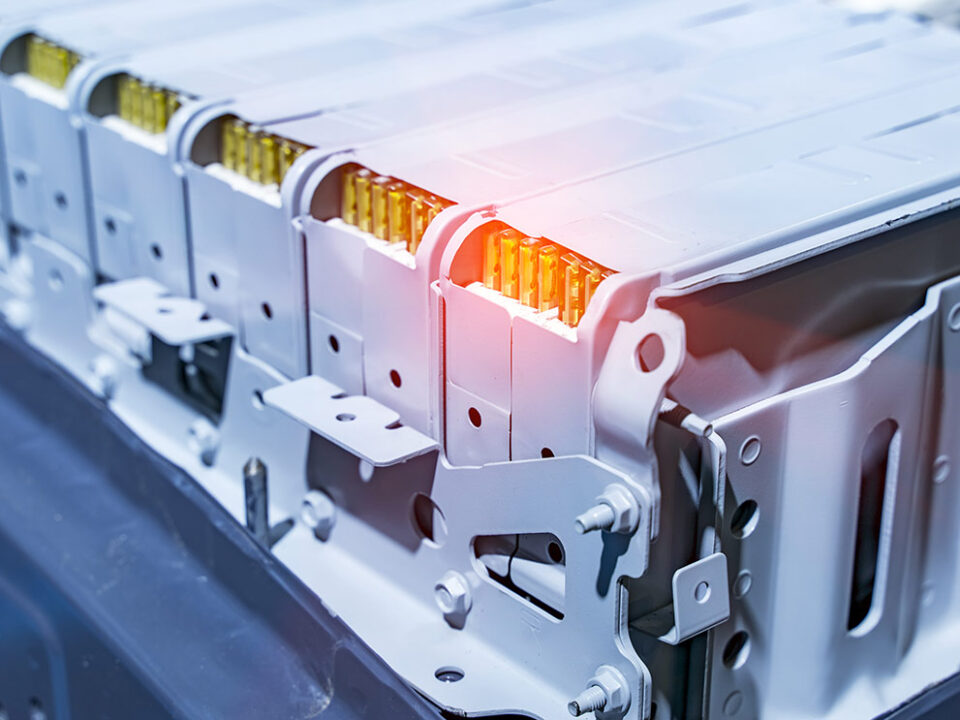

The lithium-ion battery has evolved over the years, incorporating new chemistries for different applications and increased performance.

June 19, 2021

The auto industry is bleeding from a dearth of semiconductors, used for example in heads-up displays, sensors, cell phone integration, and to enhance engine performance.

June 17, 2021

June 17, 2021 随着夏季勘探季节的临近,Dolly Varden Silver Corp. (TSXV:DV)(OTC:DOLLF) 本月早些时候宣布已开始对该公司位于不列颠哥伦比亚省西北部潮水附近的同名白银项目进行实地活动。 2021年勘探计划 今年的勘探是一个为期两年的计划的第一阶段,主要目标是积极扩大和升级托布里特 (Torbrit)银矿床和多个富银卫星区,最终把该项目推进成为BC省的下一个高品位银矿。 此外,公司的地质团队已在整个地区发掘出多个具有前景的目标。除了为地下通道和勘探工作做准备的道路和场地升级之外,公司还设想了一个 […]

June 17, 2021

Entheon Biomedical appears to be well on its way to developing a safe and effective solution for treating addiction and substance-use disorders, potentially changing the way society approaches drug addiction.

In April the company launched the industry’s first psychedelics genetic test kit, setting it on a path to creating more value out of data and technology to serve its customers.

In April the company launched the industry’s first psychedelics genetic test kit, setting it on a path to creating more value out of data and technology to serve its customers.

June 15, 2021

2021.05.09 麦格纳黄金 (Magna Gold) (TSXV:MGR, OTCQB: MGLQF) 本周对其收购墨西哥的San Francisco金矿的计划进行了最后的修改。 为了将San Francisco重建成一个盈利的矿山,麦格纳在2020年春天同意以公司近20%的股本收购这个位于索诺拉州的项目,并在12个月后支付现金。 本周五,公司宣布成了收购协议的后半部分,即向供应商Argonaut Gold(TSX:AR) […]

June 11, 2021

What’s the point of making supposedly “green” battery components when the refining process is so dirty?

June 10, 2021

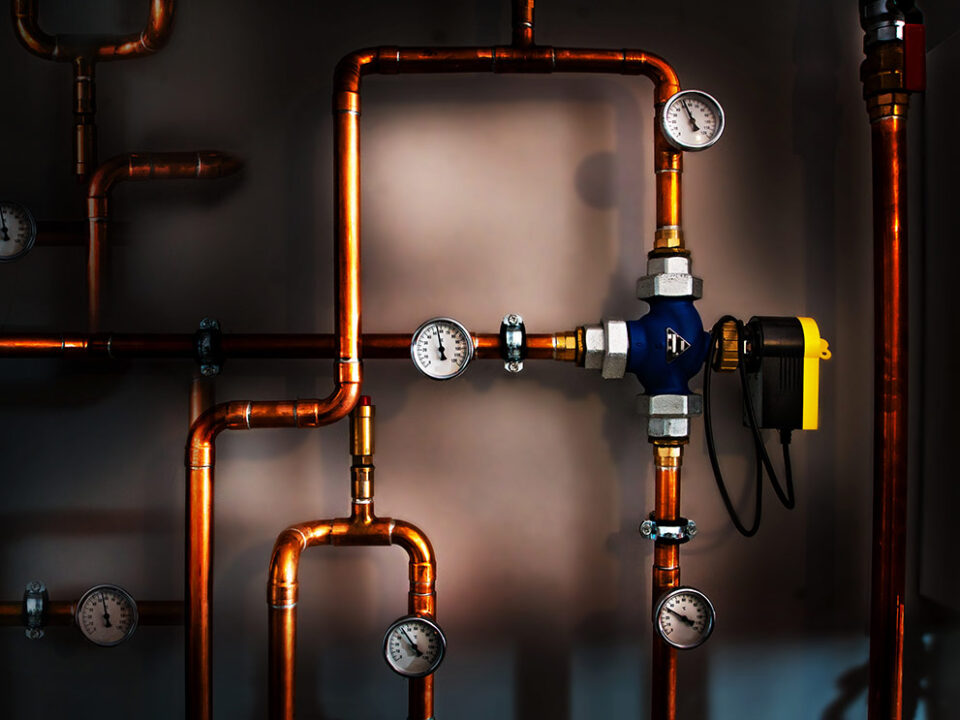

May 12, 2021 伴随着近几年的大麻股、比特币、科技股,到2020年的黄金和白银的投资热潮,基本金属一直遭受着投资者们的忽视。而如今由于铜、铁矿石、锌和铅的价格的不断上涨,资本也逐渐开始涌向了基本金属。 下面的图表说明了一切。中国是全球最大的大宗商品消费国,其需求火爆,加上近年来国家关闭了一些锌矿等供应紧张因素,这些金属正在蓬勃发展。 铜也是如此; 该金属大部分来源于南美洲,而为了防止冠状病毒在的传播,那里的许多铜矿在去年被迫关闭。 初级矿业公司历来是大宗商品价格上涨的最佳杠杆。而在支持矿业的管辖区拥有优质贱金属矿床的企业将从中受益。 弗雷德里克森矿 Norden Crown (诺登皇冠金属公司) (TSXV:NOCR,OTC:NOCRF,Frankfurt:03E) […]

June 8, 2021

2021.05.09 多利瓦尔登公司(Dolly Varden) (TSX.V:DV, OTC:DOLLF) 旗下的白银资产由两个过去生产的银矿床Dolly Varden和Torbrit组成。它们曾是不列颠哥伦比亚省(或卑诗省)悠久的采矿历史的一部分,在1919至1959年间产出2000万盎司白银,测定出每吨矿石的白银含量高达2200盎司(超过72千克)。 实际上,Dolly Varden/North Star矿曾经是大英帝国最富的银矿之一,在 1919 年至 1921 […]

June 5, 2021

2021.05.25 现货银在2020年8月跃升至每盎司28.32美元,创下了七年来的最佳表现。尽管价格在去年秋天有所回落,但今年全年仍上涨了47%,比黄金22%的涨幅翻了一番还多。 而在一月下旬,自网友们在Reddit的WallStreetBets论坛发贴触发买入通知后,白银价格再一次上涨。在一系列的购买中,白银价格一度冲破了28美元,并曾触及31美元,然后回落。自3月份以来,这种白色金属的交易价格一直在26美元至28美元之间的一个相当窄的区间内浮动。 然而,由于货币和工业需求的强劲驱动,白银市场的前景极其乐观。 根据白银协会(Silver Institute)发布的2021年世界白银调查报告,今年全球白银需求量预计将超过供应量7%(供应量增加8%,需求量增加15%)。 全球需求将由对工业和投资级实物白银的投资主导。这是全球经济复苏的结果,也是基于2020年良好的硬币和银条购买量。因此,白银协会预计今年的白银价格将大幅上涨至33% 事实上,通过分析市场的供给和需求,我们可以进一步理解对白银的乐观叙述。在这样做的同时,我们更有信心称之为采银业的巅峰。 采银业的巅峰 大多数读者和投资者应该对峰值资源的概念有所耳闻;它所指的是产量年复一年不再增长的那一点。该资源在这一点达到一个巅峰,随即下降。 注意,我们并没有说“白银的巅峰”。在AOTH,我们区分了总银供应量(即回收银与开采银的结块)和矿山供应量。 在计算银需求与供应的真实情况时,我们不计算银回收(大多数回收银是工业级的)。我们更想知道的并真正关心的是每年开采的银的供应量是否满足每年对银的需求。而答案明显是没有! 举例说明: […]

May 27, 2021

Joe Biden’s position on mining has always been murky.

Publicly the veteran Senator turned US President says all the right things to show mine workers he is on their side. Away from the cameras Biden is listening to the anti-mining left wing of his Democratic Party controlled by liberal progressives and environmentalists, doing whatever he can to scupper new mining projects and oil pipelines.

Publicly the veteran Senator turned US President says all the right things to show mine workers he is on their side. Away from the cameras Biden is listening to the anti-mining left wing of his Democratic Party controlled by liberal progressives and environmentalists, doing whatever he can to scupper new mining projects and oil pipelines.

May 25, 2021

The US Federal Reserve is insisting that recent increases in the price of food, construction materials, used cars, personal health products, gasoline, and appliances reflect transitory factors that will quickly fade with post-pandemic normalization. But what if they are a harbinger, not a "noisy" deviation?

May 23, 2021

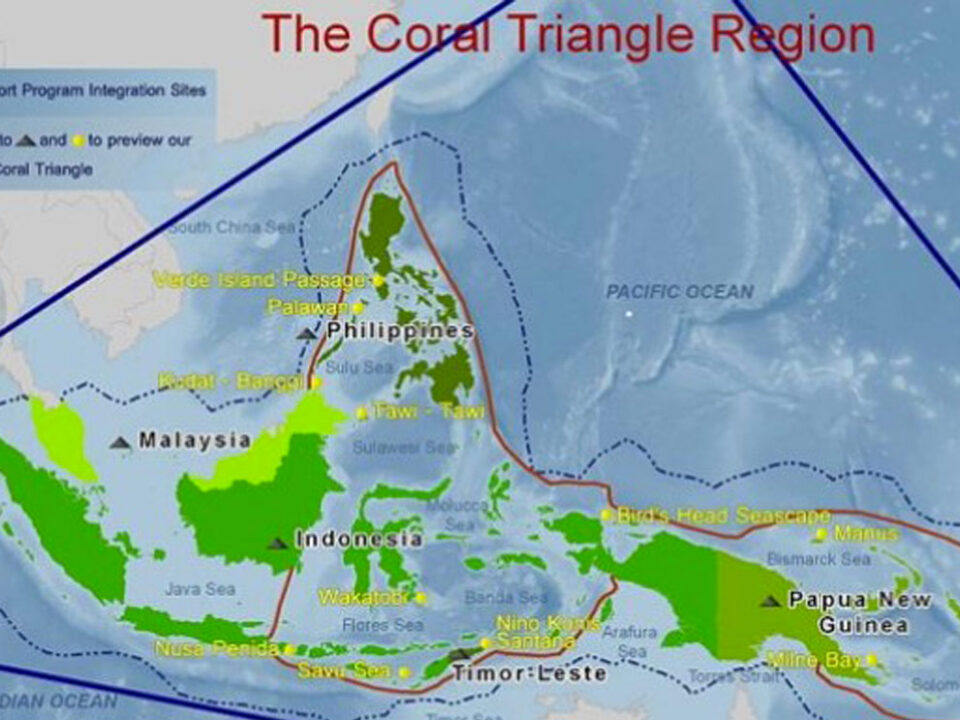

Resource nationalism is the tendency of people and governments to assert control, for strategic and economic reasons, over natural resources located on their territory. It has been identified as one of the key risks for investors in the natural resources sector.

Miners are easy targets because mining is a long-term investment and one that is especially capital intensive. Mines are also immobile, so mining companies are at the mercy of the countries in which they operate. Outright seizure of assets happens using the twin excuses of historical injustice and environmental or contractual misdeeds. There is no compensation offered and no recourse.

Miners are easy targets because mining is a long-term investment and one that is especially capital intensive. Mines are also immobile, so mining companies are at the mercy of the countries in which they operate. Outright seizure of assets happens using the twin excuses of historical injustice and environmental or contractual misdeeds. There is no compensation offered and no recourse.

May 15, 2021

2021.05.15 加密货币市场的增长在2021年丝毫没有缓慢的迹象。 尽管比特币的价格在最近几周停滞不前,但随着更多资金涌入类似的投资产品,其他数字货币仍在飙升至新高,并有望能获得与四年前加密热潮类似的巨额收益。 全球十大加密货币中已有五种在过去一周创下了新高。 截至周一午夜,全球加密市场的市值创下了略高于2.5万亿美元的纪录。尽管占市场近一半的比特币下跌了1%,但整个市场的价值在此期间仍然增加了超过2000亿美元。 以太坊打破纪录 其中最大的赢家是以太币,是仅次于比特币的全球第二大加密货币。以太币在本周一突破了4000美元的关口,创下新高。 作为以太坊区块链的数字代币,以太币最近出现了抛物线式上涨,随着更多的投资者在寻求从比特币以外的加密货币获中得更大的回报。自4月初以来,以太币的市值已经上涨了40%,而这期间以太坊的市值增加了1300亿美元。 包括摩根大通(JPMorgan)在内的专家将以太坊的优势归因于机构和零售交易人士对其日益增长的兴趣。比特币的支持者认为它是一种类似黄金的价值存储,而以太坊则不同于比特币;以太坊是一种分散式互联网的基础设施,而不是由中央当局维护。 它构成了当今流行的“去中心化金融” (DeFi,或Decentralized Finance)加密趋势的基础;DeFi所指的是一种促进传统银行机构之外借贷的点对点平台。 欧盟贷款机构欧洲投资银行(European […]

May 15, 2021

One company that aims to address the common problems faced by blockchain networks is Arcology, a blockchain company 30% owned by Codebase Ventures Inc. (CSE: CODE) (FSE: C5B) (OTCQB: BKLLF).

Inspired by the challenges associated with ethereum's mass adoption, the Arcology team is developing a radically new blockchain ecosystem designed to scale at unprecedented speed by reducing costs and increasing enterprise capabilities.

Inspired by the challenges associated with ethereum's mass adoption, the Arcology team is developing a radically new blockchain ecosystem designed to scale at unprecedented speed by reducing costs and increasing enterprise capabilities.

May 14, 2021

Continuing the US (and Canadian) economic recovery is obviously important but it should not come on the backs of the poor who bear the most weight of inflation, particularly increases in food prices.

Government officials need to be aware of how their monetary and fiscal policies are impacting the most vulnerable in society.

Government officials need to be aware of how their monetary and fiscal policies are impacting the most vulnerable in society.

May 3, 2021

Look up the word sustainable in the Oxford English dictionary and you get the following definition: “avoidance of the depletion of natural resources in order to maintain an ecological balance.”

Unfortunately the world’s ecological balance has not been right for a very long time. As a society, we are consuming resources far more quickly than we are replacing them, which is the very definition of unsustainable.

Unfortunately the world’s ecological balance has not been right for a very long time. As a society, we are consuming resources far more quickly than we are replacing them, which is the very definition of unsustainable.

April 29, 2021

2021.04.29 Freegold – part 1 Freegold – part 2 Richard (Rick) Millsaheadoftheherd.comsubscribe to […]

April 23, 2021

温哥华矿业公司Max Resource Corp. (TSXV:MXR) (OTC:MXROF) (Frankfurt: M1D2) 在今年位于哥伦比亚的CESAR项目勘探中再次证实了该矿的巨大开发潜力,进一步确立了该项目应属于一个地区规模的沉积物构造的铜银矿系统。

April 17, 2021

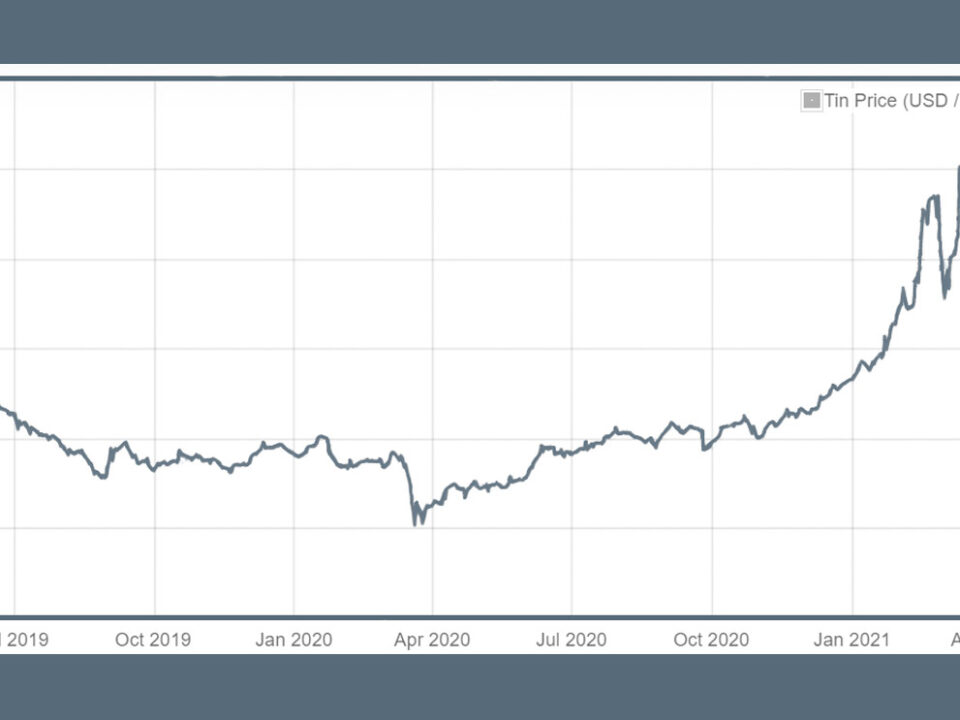

By David Duval As with other base metals, zinc prices were impacted negatively […]

April 14, 2021

Gold prices ticked higher on Tuesday after inflation data showed US consumer prices rose in March for the fourth straight month and inflation hit its highest level in 2.5 years.

The US Federal Reserve, whose dual mandate is to keep inflation in the “Goldilocks zone” of around 2% and to control unemployment, has been downplaying inflation, telling the public that even if prices rise, it will only be temporary.

The US Federal Reserve, whose dual mandate is to keep inflation in the “Goldilocks zone” of around 2% and to control unemployment, has been downplaying inflation, telling the public that even if prices rise, it will only be temporary.

April 13, 2021

ESG was a dominant theme running through this year’s AME Roundup conference in Vancouver.

Ross Beaty, chairman of Pan American Silver and Equinox Gold, said “It’s just critical. Every single meeting you have with investors, it’s number one on the topic (list).”

Ross Beaty, chairman of Pan American Silver and Equinox Gold, said “It’s just critical. Every single meeting you have with investors, it’s number one on the topic (list).”

April 10, 2021

As pioneers of a leading-edge addiction recovery solution based on psychedelic medicine, Entheon Biomedical Corp. (CSE: ENBI) (FSE: 1XU1) has been actively expanding its business over the past weeks. The culmination of that work is the release of a potentially groundbreaking product in the field of psychedelic therapy, which would also represent the company’s first revenue stream.

April 9, 2021

Amid bombastic statements that scared US consular officials and alienated allies, like calling North Korea’s Kim Jong-un “rocket man”, rejecting the Iran nuclear deal and declaring that the US embassy would be moved from Tel Aviv to Jerusalem, former President Trump occasionally had flashes of brilliance.

One such instance was said to have occurred regarding Taiwan.

According to John Bolton’s memoir, Trump liked to point to the tip of a Sharpy and say, “This is Taiwan,” then motion to the desk in his Oval Office and say “This is China. Taiwan is like two feet from China, we are 8,000 miles away. If they invade there isn’t a f&%*ing thing we can do about it.”

One such instance was said to have occurred regarding Taiwan.

According to John Bolton’s memoir, Trump liked to point to the tip of a Sharpy and say, “This is Taiwan,” then motion to the desk in his Oval Office and say “This is China. Taiwan is like two feet from China, we are 8,000 miles away. If they invade there isn’t a f&%*ing thing we can do about it.”

March 31, 2021

As the fight against the coronavirus continues to take center stage, an insidious environmental problem is getting worse: plastic pollution.

The global health crisis has prompted a rush for single-use plastic just as governments around the world were taking steps to curtail or ban its usage. Demand has surged for everything from face shields and gloves to takeaway food containers and bubble wrap for online shopping — most of which cannot be recycled and is ending up as waste.

The global health crisis has prompted a rush for single-use plastic just as governments around the world were taking steps to curtail or ban its usage. Demand has surged for everything from face shields and gloves to takeaway food containers and bubble wrap for online shopping — most of which cannot be recycled and is ending up as waste.