Bullish copper narrative continues to build

- Home

- Articles

- Environment Clean Energy

- Bullish copper narrative continues to build

2021.04.28

New chapters of the copper success story that started in 2020 are being written as the tawny-colored metal basks in the glory of global climate pledges, and an economic recovery from the pandemic underpinned by strengthened industrial demand.

Price surge

Copper on Tuesday extended gains to the highest in a decade on the back of a return to global growth especially in China, the first country to recover from the pandemic, and the United States, whose economy is plowing ahead despite remaining under the thumb of covid-19.

Economists expect the US economy grow at an annualized 6.8%, following a 4.3% GDP expansion in the first quarter.

At time of writing spot copper was trading at $4.48 a pound, down slightly from $4.51 reached earlier in the day. Powering past a 10-year high on Monday, the industrial metal is within a nickel of the record $4.56/lb set in February 2011 at the top of the last commodities super-cycle.

From one year ago, copper is up a massive 93%.

The main factors driving prices higher are increased Chinese orders amid a strong manufacturing sector; expectations of a return to growth following a disastrous 2020; trillions in promised green and blacktop infrastructure spending particularly in the US, Europe, and China; and supply disruptions resulting from virus-related mine closures.

The climate imperative

Cleaning up the planet will not be possible without major reductions in carbon emissions, and no metal is more important than copper in powering energy systems and green technologies.

According to the Copper Alliance, renewable energy uses up to 12 times more copper than conventional power systems, and improves energy efficiency. The organization predicts copper consumption will increase more than 40% by 2035, driven partly by solar and wind power, and electric vehicles.

Consider the following quotes regarding copper and the climate imperative, pulled from the headlines in recent days:

- Alternative energy systems have a high—and often, unappreciated—materials intensity, of which copper is a major constituent. To quantify the relationship, 30,000 BEVs can consume as much copper as a skyscraper, like the 600,000 square meter Yi Fang Center in Shenzhen (Chinese buildings are close to 50% of global building stock). To turn over just 1/3 of the global passenger vehicle fleet (China currently comprises about 1/3 of passenger vehicles in operation) would require placing into service more than 300 million BEVs. These could collectively contain 20 million tonnes of copper, almost equal to current annual total world consumption. (Forbes)

- The U.S. recovery is accelerating and President Joe Biden’s $2.25 trillion infrastructure plan will highlight sectors like electric cars, driving further gains in commodities critical to the green-energy transition. That’s coming alongside a continued economic boom in China, where a push to reduce emissions is filtering through to supply cuts for some metals just as demand is picking up. (Bloomberg)

- Treasury Secretary Yellen laid out what CNBC described as a “bold climate agenda”, making clear what many have long suspected: That under Biden, Yellen will openly collaborate with her former No.2, Fed Chairman Jerome Powell, to realize the MMT-enabled vision laid out in AOC’s ‘Green New Deal‘. (Zero Hedge)

- Traditionally, roughly half of all copper demand has come from new building construction and infrastructure… and China has been the single biggest market by far. With many global economies in or entering recovery phases, cyclical demand is on the upswing. Green initiatives around the world offer a secular tailwind as well. The European Green Deal, President-elect Joe Biden’s ambitious climate plan, and China’s target of carbon neutral by 2060 all point to increasing incremental demand for copper. (Barron’s)

- “Copper is going to be a key metal required to build out the infrastructure that will deliver renewable, lower-carbon energy to end users,” said Daniel Greenspan, senior analyst and resource team director with CIBC Asset Management. “We believe significant mine supply response will be required to meet this new area of demand growth and a higher copper price will be needed to incentivize the new production into the market. (Advisor’s Edge)

Copper super-cycle

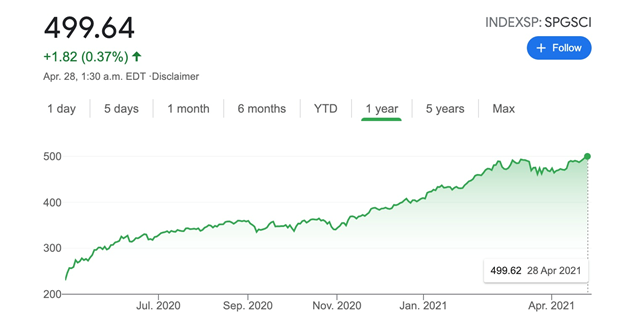

In fact, copper may be at the leading edge of a new commodities “super-cycle”, evidenced by the most prominent commodity index, the S&P GSCI, nearly doubling since last March.

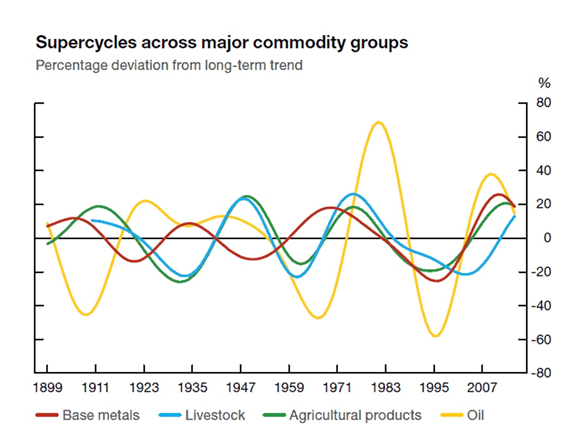

Since the mid-19th century there have been four super-cycles, defined as “decades long, above trend movements in a wide range of base material prices.” The last one was the 2000’s commodities boom, driven by China’s insatiable hunger for fuels, metals, building materials and foodstuffs, as its economy grew at double digits.

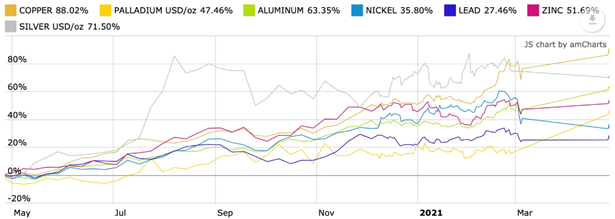

Recent gains in the prices of a number of industrial metals (see a one-year chart below) have triggered talk of a new commodities cycle driven primarily by the so-called new green economy.

As noted, for that to happen, the price rises would need to be sustained, year after year, something that has yet to be determined. One commodity though appears to have the staying power, and that is copper.

“As major economies embrace sustainability and the switch from fossil fuel to electric solutions gains momentum, copper will be central to that green revolution,” Forbes writes in a recent article.

Not only is the red metal essential to construction, transportation and telecommunications, but it also has a critical role to play in the shift to climate-friendly solutions. These include batteries, EVs, solar panels, wind turbines, connecting renewable energy to the grid, and building out 5G networks.

Interestingly, Forbes remarks that efforts to “go green” could drive a long-lasting copper super-cycle:

This broad dynamic of increasing copper demand coupled with relatively inflexible supply will likely prevail for several years. Global commitments to green infrastructure, transition to electric vehicles and ESG aware investors seem like long term demand drivers. Meanwhile, suppliers have been cautious on exploration spending.

Higher prices will eventually bring more supply online, but given the long mine development cycle, that will take time and keep prices elevated. Therefore, copper should be well positioned for an extended bull run over the next decade.

Max Layton, the managing director for commodities research at Citigroup, has a slightly different take on the copper super-cycle:

“The bullish outlook is decarbonization-led, and I’m totally onboard with that for the next three to four years, but the super part of this cycle is actually more related to the scale of global stimulus,” he told Bloomberg earlier this week.

For example, President Biden’s $2.3 trillion infrastructure spending package, currently before Congress, is aimed at transitioning the US transportation system to battery-powered vehicles and supporting renewable wind and solar energies over carbon-based sources like coal and natural gas.

China, the world leader in electric vehicles and battery production, is also moving forward rapidly on its plans to electrify and decarbonize. President Xi Jinping last fall announced the country is aiming for carbon neutrality by 2060. (carbon neutral means emitting the same amount of carbon dioxide into the atmosphere as is offset by other means)

The country wants to raise the amount of power generated from solar and wind to 11% in 2021 from 9.7% in 2020, and says it will boost the share of non-fossil fuels in primary energy consumption to around 25% by 2030.

Moreover, copper figures prominently in China’s long-term plans. The Made in China 2025 initiative seeks to end Chinese reliance on foreign technology by investing in a number of key sectors, including new vehicles and power equipment.

Both “MIC2025” and China’s Belt and Road Initiative (BRI) are part of Beijing’s most recent Five-Year Plan, which calls for developing and leveraging control of “core technologies” such as high-speed rail, power infrastructure and new energy, all of which require extensive copper.

It’s important to remember, China already consumes around half of the world’s global refined copper.

Bulls and bears

Commodities giant Trafigura sees copper soaring past record highs of $10,000 a tonne, before accelerating to $12,000 to $15,000/t over the next decade, based on western economies continuing to recover from the pandemic, and global spending on electrification and decarbonization.

Trafigura’s demand case for copper is built upon the rest of the world taking a greater share of copper consumption than previously, when China’s push for urbanization led demand.

“China is very much keeping up its side of the deal,” said Graeme Train, senior economist at Trafigura. “And then in the rest of the world, we really are starting to see some breakout in demand conditions now.”

The world’s leading copper trader also believes tight supply sets copper apart from other metals, and that the strain on supply, as the green revolution takes hold, will be too much to avoid a price spike.

“I’m not sure about the commodities super-cycle, but I’m 100% sure about the copper super-cycle,” the firm’s head of copper trading Kostas Bintas said in a media interview.

Trafigura is far from alone in its bullish forecasts.

In a recent report titled ‘Copper is the new oil’, Goldman Sachs estimates prices will average $11,000 a tonne over the next 12 months, but by 2025 could hit $15,000/t ($6.80/lb). Citi Bank sees copper reaching $12,000 next year.

Certainly Chinese investors are hungry for the metal — aggregate open interest in Shanghai Copper Futures Exchange copper is at its highest in more than a year. Over at the Comex, hedge fund managers made bullish copper bets in the week ended April 20.

“Marco-economic data continues to point to strong demand conditions for copper,” an analyst with Commonwealth Bank of Australia, wrote in a note.

Mining magnate Robert Friedland, whose Ivanhoe Mines is building the largest undeveloped copper deposit in the world, Kamoa-Kakula in the Congo, recently said copper has become so crucial, finding enough of it has become “a national security issue”.

So good are copper’s fundamentals, some are calling attention to its role as inflation hedge. Grizzle notes the last time inflation was a major problem, during the 1970s, the copper price almost tripled in two years. The site also points out that despite recent price increases, now is still a good time to buy copper, given its relatively low-price vs historical levels, citing the Bloomberg Commodity Index chart.

However like all good rallies, there are risks of it ending in tears. After a stampede into long positions upon last year’s covid-related price lows, net longs have more than halved since February, Reuters metals columnist Andy Home points out, while short positions are steadily creeping higher. A similar trend is forming on the London Metals Exchange (LME).

Cheerleading the bear camp is the lingering problem of covid-19. A rise in coronavirus cases and new variants could derail re-opening plans and slam the brakes on industrial demand, as the covid crisis in India starkly warns. Investors are also watching to see whether China pulls back on its stimulus, which could slow the copper rally.

China warning

Could that actually happen? Home makes some interesting points regarding the role of the Chinese leadership in the copper market. First, he notes Premier Li Kequiang earlier this month pledged to strengthen control of raw materials, because high commodity prices are pressuring companies’ costs.

Second, the Ministry of Industry and Information Technology (a name that appears ripped straight from the pages of ‘1984’) has warned it is determined to keep a lid on commodity inflation.

Third, Home points out that state entities are thought to hold up to 2 million tonnes of copper in storage and could easily release their reserves to bring down the price (global copper use per year is 20 million tonnes so 1.66 months supply – Rick), as Beijing did when copper hit a record $10,000 per tonne in 2010-11 (Copper Shenanigans from Beijing – read for the truth Rick).

Are we in a new copper super-cycle, or the same old China cycle which has defined pricing for over a decade? Home’s answer:

If the latter, copper and other raw materials are going to face the increasing headwind of a slowing Chinese demand pulse.

If, however, the super-cycle super-bulls are right, the Chinese infrastructure momentum will pass to the rest of the rest of the world, compensating for any cyclical slowdown in China.

Supply squeeze

At AOTH we fall squarely in the latter camp. The demand pressure about to be exerted on copper producers in the coming years all but guarantees a market imbalance, resulting in copper becoming scarcer, and dearer, with each ambitious green initiative rolled out by governments, whose backs are against the wall due to negative fall-out from global warming.

Why can’t we just mine more copper?

The problem is existing copper mines are running out of ore, and the capital being invested in new mines is far below the level needed.

According to research by S&P Global Market Intelligence, of 224 sizable copper deposits discovered in the past 30 years, only 16 have been found in the last decade.

S&P notes that copper producers have been more interested in making their existing operations more efficient, than making new discoveries, meaning the industry lacks flexibility to quickly ramp up production.

It takes seven to 10 years, at minimum, to move a copper mine from discovery to production. In regulation-happy jurisdictions like Canada and the US, the time frame is more like 20 years.

The pipeline of copper development projects is the lowest it’s been in decades.

As previously reported, global mined copper production will drop from the current 20Mt to below 12Mt by 2034, resulting in a supply shortfall of 15Mt. By then, over 200 copper mines are expected to run out of ore, with not enough new to take their place.

Of the properties that might lend themselves to a significant boost in copper production, thereby serving to address this coming shortage, few are anywhere close to completion.

Referring to Mining.com’s list of the world’s top 10 copper projects, the #2 Pebble mine in Alaska had its water permit rejected by federal regulators in November, casting doubt on whether the huge copper porphyry, in development for decades, will ever become a mine.

Number 4 on the list, Reko Diq in Pakistan, has been in limbo for a decade, because the provincial government of Baluchistan considers the mining lease application to be incomplete and unsatisfactory.

Only two of the top 10 are in the United States, the other eight are in sketchy jurisdictions for mining including Ecuador (Cascabel), Argentina (Taca Taca, El Pachon), Papua New Guinea (Frieda River) and Tampakan in the Philippines.

Currently only two on the list are under construction, Kamoa-Kakula in the DRC and Udokan in Russia, making the majority of these projects unhelpful in addressing the copper supply shortage that threatens to squeeze the industry.

On top of the structural supply problem, copper miners face more immediate concerns.

Port workers in Chile, the world’s top copper producer, on Monday launched a national strike against the government’s pandemic relief policies, thereby threatening shipments.

A rise in covid-19 cases in the country despite having one of the world’s best vaccination rates could mean further supply disruptions, echoing temporary mine closures done last year to prevent the spread of the virus.

Last April around 15% of the world’s copper mines were offline or operating at reduced capacity because of covid-related disruptions.

Also in Chile, a congressional mining committee has approved a draft of a bill that would tax mining companies at a higher rate when the price increases. If passed, miners would pay between 15% and 75%. The industry has indicated the proposal would stifle investment and make Chile less competitive.

The original text had a 3% flat tax on copper.

Conclusion

Without copper, the electrification of the global transportation system and the decarbonization of energy cannot happen.

Will there be enough copper for future electrification needs, globally? And remember, in addition to electrification, copper will still be required for all the standard uses, including copper wiring used in construction and telecommunications, copper piping, and copper needed for the core components of airplanes, trains, cars, trucks and boats.

The short answer is no, not without a massive acceleration of copper production, and exploration, worldwide.

Unlike the previous super-cycle, which depended on China, the next structural bull market will be driven by spending on green energy, for which copper is a key ingredient.

To avoid ecological catastrophe, we must reduce our reliance on fossil fuels, clean up our environment, embrace renewable energies, and continue down the path of electrifying the global transportation system.

Bottom line? We need to find a lot more copper.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.