Renforth delivers more promising results from Parbec, Surimeau drill programs

2021.04.19

Renforth Resources Inc. (CSE: RFR) (OTCQB: RFHRF) (FSE: 9RR) continues to deliver good news for shareholders, this week announcing new assay results for the 2020 drill program on its wholly owned Parbec open-pit constrained gold deposit in Quebec.

Parbec Assay Results

The latest press release gives highlights of assays received for PAR-20-114, PAR-20-118, and a portion of PAR-20-121, all drilled as part of the 2020 program at Parbec, where 9,644m were drilled in phase one of a drill program designed to support a new 2021 resource estimate.

The entire program finished at 15,569m of drilling completed, with the assay results for a total of 35 drill holes in both phase one (fall 2020) and phase two (winter 2021) of the program still outstanding.

The three drill holes (two complete, one partial) reported in the April 13 press release continue Renforth’s success in drilling at Parbec with, again, each hole drilled returning gold values of interest. The results were highlighted by PAR-20-121, which returned 1.54 g/t Au over 10.75m.

A week earlier, Renforth announced assays for five other holes drilled in the fall 2020 program: PAR-20-116, PAR-20-106, PAR-20-107, PAR-20-108 and PAR-20-109.

As reported, each of the results given below is accretive to the overall gold endowment of the Parbec deposit and are expected to positively impact a resource estimate calculation:

- PAR-20-116: 1.46 g/t Au over 49.6m, from 108.9m to 158.5m down the hole

- PAR-20-106: 1.32 g/t Au over 4.45m, from 211.35m to 215.8m down the hole

- PAR-20-107: 4.02 g/t Au over 4m, from 141m to 145m down the hole

- PAR-20-108: 2.05 g./t over 1.5m, from 156.65m to 158.15m down the hole

- PAR-20-109: 0.69 g.t Au over 12.85m, from 136.15m to 149m down the hole

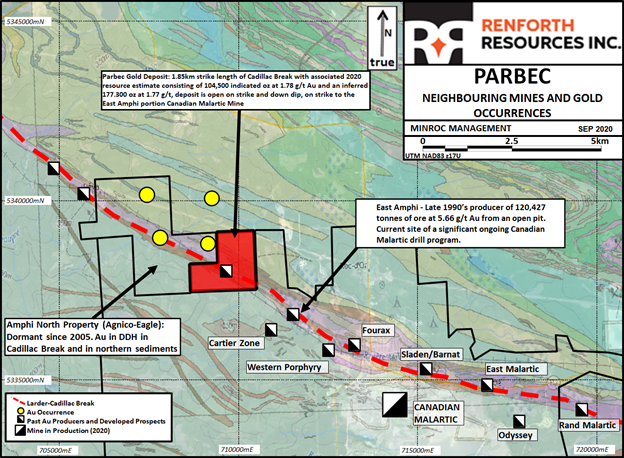

Parbec, which sits on 1.8 km of the Cadillac Break, neighbours the Canadian Malartic, Canada’s largest gold mine, currently an open pit.

In May 2020, an NI 43-101 open-pit constrained resource estimate was prepared for the Parbec project, showing 104,500 oz gold in the indicated category and 177,300 oz gold in the inferred category.

However, Renforth subsequently drilled over 15,000m as part of the 2020 program and has obtained positive results to date (as seen above), which will require a restatement of the resource estimate.

In addition to new data, the company intends to incorporate the results of 62 drill holes drilled between 1986 and 1993 in the upcoming resource estimate, assuming that the lab results from holes twinned in the winter 2021 drilling support the inclusion. These results were not used in the May 2020 resource estimate.

The new resource estimate is anticipated to be completed in summer 2021, though the timeline is dependent on the receipt of assays.

Surimeau Drilling Update

Meanwhile, Renforth has also been making significant progress at its Surimeau District property, a brownfield project covering an area of 215km2 south of the Cadillac Break among current and former producing mines.

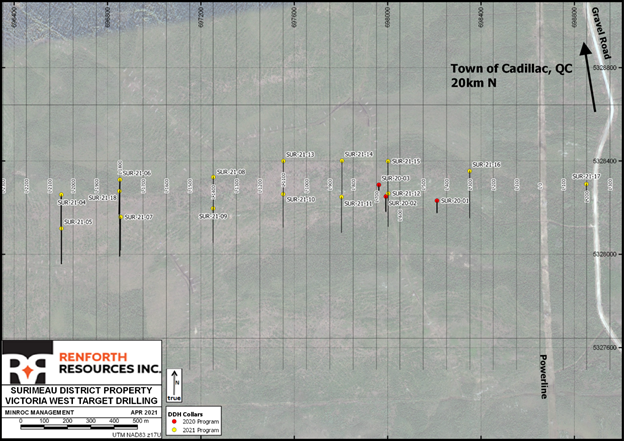

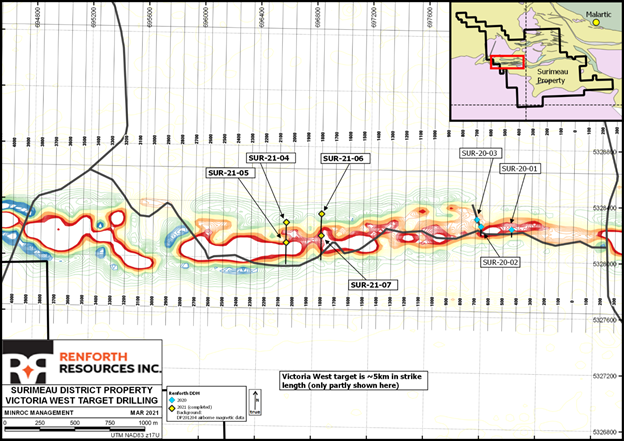

In late March, the company commenced a 3,500m drill program at Surimeau, which hosts gold, nickel, copper, zinc and other metals in various settings at several locations on the large property. This program, planned to be 16 holes, is on the Victoria West Target Area, a nickel-rich VMS target that has been explored historically and by Renforth over a strike length of 5km within a 20km long magnetic anomaly associated with intrusives.

To date, the Renforth team has successfully drilled off 2.2km of this strike length. Significant chalcopyrite, sphalerite and pyrrhotite mineralization was identified in each hole drilled. The mineralized anomaly is now proven to be up to 250m in width, further confirming the interpretation that it could be a nickel-bearing ultramafic body that occurs alongside a sediment- and volcanic-hosted copper-zinc VMS-style mineralization.

There remains 4km of strike length along the anomaly to the west within the property boundary and 12km to the east which has never been prospected or drilled, except in the very eastern end, where the Colonie showing has been identified historically and verified by Renforth.

So far, the company has completed 13 of the drill holes, with drilling ongoing in the 14th hole (SUR-21-17), in 2,892m. The final hole planned in the program, SUR-21-18, is an undercut of two earlier holes (SUR-21-06 and SUR-21-07) that gave visual mineralization in multiple lithologies between them. Samples have been selected, split, and delivered to the lab for this program, with results arriving imminently.

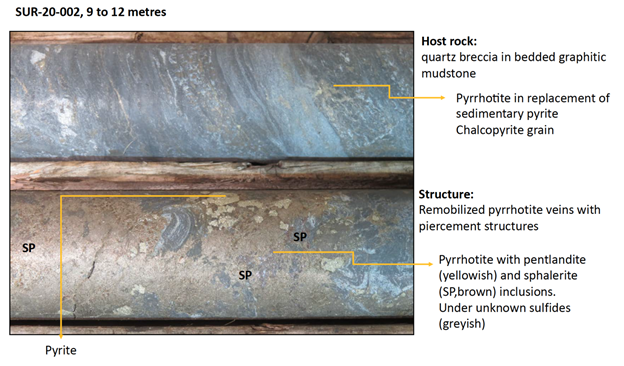

As reported in the March 31 release, four holes (SUR-21-04, SUR-21-05 and SUR-21-06, SUR-21-07) in 813m of drilling were completed to the west of three drill holes (SUR-20-01 through 03) from the fall 2020 program. The visual results from these new holes revealed the presence of nickel, copper and zinc sulphide mineralization hosted primarily in bands of graphitic siltstones and quartzites within thick bands of ultramafics, as also observed in the holes drilled last fall.

Pyrrhotite seems to be the most common sulphide at this point in the program. Pentlandite, chalcopyrite and sphalerite are seen within or adjacent to the pyrrhotite. Chalcopyrite is also often seen within silica-rich veinlets and stringers. The graphitic siltstones and quartzites are often silicified, while being low in carbonate minerals.

The mineralized package of lithologies seen to date is approximately 200m in thickness (measured north/south) with sediments to the north and south. The Victoria West system strikes approximately 5km east to west, as evidenced by geophysics, historic work, and Renforth’s surface work and drilling.

Rare Battery Metal Play

What makes Renforth’s Surimeau District intriguing is that unlike many copper-zinc VMS systems around the world, this property also happens to host an ultramafic sulfide nickel system at surface nearby.

While the scale of this nickel sulfide system remains to be seen, Renforth considers it to be representative of another “Outokumpu-like” occurrence, referring to a district in eastern Finland known for several unconventional sulfide deposits with economic grades of copper, zinc, nickel, cobalt, silver and gold. Between 1913 and 1988, about 50 million tonnes of ore averaging 2.8% Cu, 1% Zn and 0.2% Co, along with traces of Ni and Au, were mined from three deposits in that district.

Historic surface sampling in the Victoria target area on the Surimeau property had values as high as 0.503% Ni. Such findings were later supported by Renforth’s exploration team from grab sampling in summer 2020, which returned values up to 0.495% Ni.

As mentioned earlier, drilling completed by Renforth in the area further supported the hypothesis of a widespread nickel sulfide mineralization.

A rare nickel discovery at Surimeau could prove to be significant, considering the global nickel market is currently undersupplied relative to demand as a result of economies moving towards clean energy initiatives, starting with the electrification of our transportation systems.

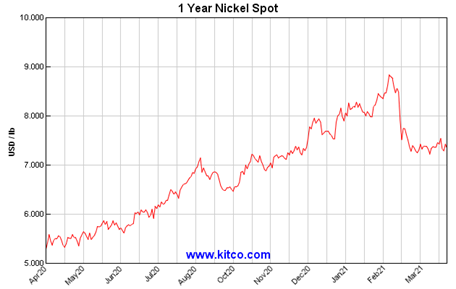

High-purity nickel is one of the required ingredients used in electric vehicle batteries, and more of the metal would be needed in the future as more EVs are called upon. In 2020, we’ve seen both the demand and price of the metal shoot up, and this upward trajectory is likely to continue for years.

According to a report by Roskill, released by the European Commission’s Joint Research Centre, global nickel demand is in for an exponential growth spurt. Based on the premise that automotive electrification will represent the better part of the metal’s end-use for the next two decades, the report says demand will jump from 92,000 tonnes in 2020 to 2.6Mt in 2040, a near three-fold increase.

In the report, Roskill predicts that a supply deficit will form in 2027 and then remain over the rest of the outlook period. The research firm also says that the availability of feedstock (ie. nickel sulfide mines) will be the biggest bottleneck in the nickel sulfate supply chain and would be the cause of the market potentially going into a structural deficit after 2027.

Conclusion

As the world’s nickel market would only tighten from now on, the industry is in dire need of fresh supply. As such, Renforth could become an interesting nickel play for investors looking for value amid the current EV boom.

Not to mention, its Surimeau property also offers exposure to other base metals critical to the green revolution: zinc, copper and even traces of cobalt.

Recent drill results have looked promising, strengthening the company’s belief that there is a large-scale nickel sulfide mineralization developing at the Surimeau District.

On top of that, the company has been reporting spectacular drill results from the nearby Parbec gold project, which we expect to drastically increase the deposit’s resources — perhaps even to 500,000 oz.

If all goes according to plan, 2021 is shaping up to be a great year for Renforth, as evidenced by its stock price, which has gone up by 50% since the beginning of the year.

Renforth Resources

CSE:RFR, OTC:RFHRF, WKN:A2H9TN

Cdn$0.10 2021.04.17

Shares Outstanding 251m

Market cap Cdn$25.1m

RFR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Renforth Resources (CSE:RFR). RFR is an advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.