Commodities

October 8, 2024

2024.10.02 US stocks ripped higher on Monday, with all three indexes closing at […]

September 24, 2024

2024.09.21 Donald Trump has once again waded into an issue he doesn’t understand […]

September 18, 2024

By Jordan Finneseth – Kitco News During periods of easy money, risk assets like […]

September 17, 2024

From Desjardins At its June 5 meeting, the Bank of Canada kicked off its […]

September 7, 2024

By Katharina Buchholz – Statista After global food prices had climbed to unprecedented […]

September 6, 2024

From Goehring & Rozencwajg We first unveiled this chart (shown below) in our 1Q2019 letter […]

September 3, 2024

By Matthew Fox – Business Insider Commodities are the place to be for investors […]

August 25, 2024

By Avi Salzman – Barron’s Jeff Currie has been charting the path of commodities […]

August 9, 2024

From The Economist The Big Mac is much the same everywhere. But its price, interestingly, […]

June 28, 2024

From Goehring & Rozencwajg Adam Rozencwajg and Yra Harris joined the Financial Repression […]

June 1, 2024

From Goehring & Rozencwajg Leigh Goehring, Managing Partner at G&R and a seasoned […]

May 30, 2024

From Bloomberg Odds are growing that 2024 will become the hottest year in […]

April 30, 2024

2024.04.27 Investors in stocks, bonds and commodities should be aware of the rate […]

March 30, 2024

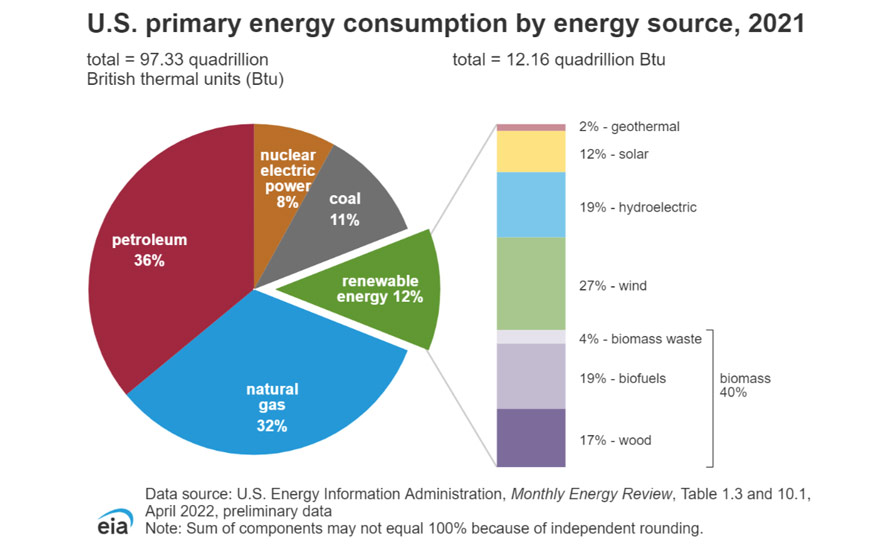

By NeoMam Studios – Visual Capitalist The U.S. is the second biggest exporter […]

March 29, 2024

From Mining.com Commodities usually rally when central banks cut interest rates, bolstering the […]

March 21, 2024

From Goehring and Rozencwajg Commodities were mixed during the fourth quarter. The Goldman […]

January 18, 2024

By Wolf Richter – Wolf Street Per-capita disposable income, adjusted for inflation (total […]

January 11, 2024

By Dorothy Neufeld – Visual Capitalist It was a challenging year for commodity […]

November 29, 2023

By Peter Millard – Bloomberg The Panama Canal Authority, which normally handles about 36 ships […]

November 26, 2023

2023.11.26 China is already gobbling up copper and copper ore at an incredible […]

November 17, 2023

By Our World in Data Food is the palate’s poetry, the body’s fuel, […]

November 13, 2023

By Doug Alexander Drought has made the Panama Canal a chokepoint for the flow […]

October 31, 2023

By Frank Giustra The mining industry has had its share of abuse over the […]

September 8, 2023

By Goehring & Rozencwajg Commodities and related natural resource markets were broadly weak […]

September 6, 2023

2023.09.06 Mining — like any other sector — has experienced its fair share […]

September 6, 2023

2023.09.06 与任何其他行业一样,采矿业在过去十年中也经历了相当多的问题,影响了其整体声誉和效率。 现在面临着为全球能源转型提供足够矿物的艰巨挑战,该行业必须深入挖掘——无论是字面上还是隐喻上——以提高其绩效。 但问题的根源是多方面的,阻力来自各个方面。关键问题包括全球技能短缺、环境和人权问题以及资金的可用性和使用。 在这些问题得到解决之前,采矿业的价值将无法最大化,并且该行业可能在未来十年遭受同样的命运。 下面,我们将探讨采矿业长期可持续发展的每一个主要障碍,以及该行业已经(或尚未)采取哪些措施来减轻这些风险。 关键技能差距 采矿业面临的最大挑战之一是劳动力老龄化和后继人才缺乏造成的技能差距日益扩大。 科罗拉多矿业学院研究和技术转让副总裁沃尔特·科潘 (Walter Copan) 表示,采矿业正面临着严重的技能差距,再加上即将到来的预期退休人数方面的所谓“灰色海啸”,情况更加严重。 德勤今年早些时候发布的一项研究显示,近 […]

August 27, 2023

By Doug Casey International Man: Since 2020, coups have replaced pro-Western governments in Guinea, […]

August 11, 2023

2023.08.11 The markets for two of agriculture’s staple crops, rice and wheat, are […]

August 10, 2023

2023.08.10 Global warming has raised the economic status and political importance of critical […]

August 10, 2023

By The Economist Latin America is no stranger to supplying the world with […]

August 8, 2023

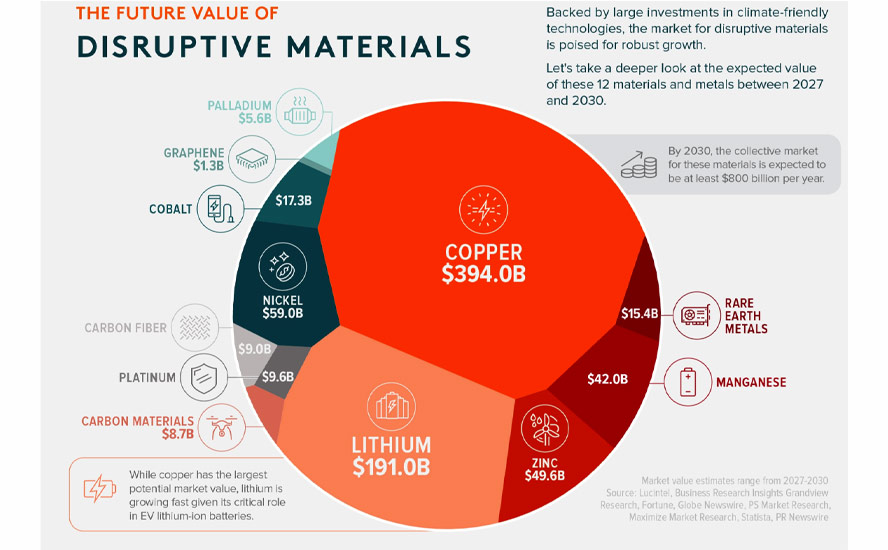

By Niccolo Conte The push towards a more sustainable future requires various key […]

August 5, 2023

By Goehring & Rozencwajg Are we in a commodity supercycle? In this episode, Adam […]

July 27, 2023

2023.07.27 By now, we’ve probably surrendered to the fact that food prices will […]

July 27, 2023

2023.07.27 到目前为止,我们可能已经接受了这样一个事实:世界各地的食品价格将继续变得更加昂贵。 在加拿大,平均食品杂货账单不断上涨。对一些家庭来说,现在已经难以承受。 6 月份,加拿大食品通胀同比增长 9.1%,紧跟 5 月份增长的 9%。 与正在放缓的 2.8% 的总体通胀率相比,食品价格的走势似乎是一个大问题。 加拿大统计局上个月通过 […]

July 24, 2023

By Goehring & Rozencwajg Incredibly, by 2016 commodity prices had sold off to […]

June 18, 2023

Warming temperatures and thawing sea ice could soon allow for the expansion of […]

May 5, 2023

2023.05.05 The idea that commodity markets can only yield short-term gains isn’t entirely […]

May 2, 2023

By Bruno Venditti In recent years, commodity prices have reached a 50-year low […]

March 8, 2023

2023.03.08 Has anybody noticed there is something strange going on in commodities? Whether […]

February 23, 2023

By Aran Ali A select number of materials have a critical role to […]

February 2, 2023

2023.02.02 The transition from fossil fuels to electrified transportation and renewable energy is […]

January 30, 2023

By Bruno Venditti 2023.01.30 Wealthy countries consume massive amounts of natural resources per […]

January 28, 2023

2023.01.28 The shift to a world powered by renewable energy and run on […]

January 28, 2023

By Egon von Greyerz 2023.01.28 “The risk of over-tightening by the European Central Bank […]

January 22, 2023

By Brian Boone 2023.01.22 So far, in the 2020s, farmers, food processors, suppliers, […]

January 18, 2023

By Thomas Biesheuvel, Dinesh Nair and Jack Farchy, with assistance from Archie Hunter, Annie […]

January 17, 2023

By Govind Bhutada 2023.01.17 Hard commodities had a roller coaster year in 2022. […]

January 1, 2023

What gets me, though, is how bad Canadian politicians are at negotiating. Here we finally have a resource that should give us significant leverage in dealing with our largest trading partner, ie., critical metals. In return for offering our minerals and our mining expertise, what are we asking for in return? I’ve yet to discover anything in print.

December 16, 2022

2022.12.16 For decades, China has dominated critical minerals, with Canada and the US, […]

December 12, 2022

2021.12.12 Dried-up rivers and alarmingly low reservoir levels are manifestations of climate change. […]

December 7, 2022

2022.12.07 The economist who predicted the financial crisis sees a “long and ugly” […]

November 16, 2022

2022.11.16 Canada and the United States are finally getting serious about protecting their […]

November 11, 2022

2022.11.11 Gold and silver prices jumped on Thursday following the release of October’s […]

October 24, 2022

2022.10.24 Chrystia Freeland is Canada’s Deputy Prime Minister and the Minister of Finance. […]

September 26, 2022

2022.09.26 It appears the days of being a “one trick pony” mining company […]

September 22, 2022

2022.09.22 At the Federal Reserve’s annual retreat in Jackson Hole, Wyoming, Chairman Jerome […]

September 6, 2022

2022.09.06 At the start of August, British homeowners saw an 80% increase in […]

August 23, 2022

2022.08.23 Inflation is at a 40-year high, making commodities, which protect investments from […]

August 19, 2022

2022.08.19 Years of neglecting its critical metal supplies is finally catching up with […]

July 16, 2022

2022.07.16 Copper is one of our most important metals with more than 20 […]

July 12, 2022

2022.07.12 The South China Morning Post reported in January that China is fast-tracking 102 major […]

July 6, 2022

2022.07.06 In George Orwell’s book ‘1984’, the world is divided among three superpowers, […]

June 29, 2022

2022.06.29 Last week was a bad one for mining & metals. Amid fears […]

June 23, 2022

2022.06.23 Inflation is at a 40-year high, making commodities, which protect investments from […]

May 31, 2022

2022.05.31 With inflation in the US reaching its highest in 40 years, there […]

May 30, 2022

2022.05.30 A comparison of this year’s grocery bills to last year’s yields a […]

May 19, 2022

2022.05.19 In economics parlance, the term “soft landing” refers to a cyclical slowdown […]

April 26, 2022

2022.04.26 For shrewd investors looking to diversify their portfolios with low-risk, high-return assets, […]

April 24, 2022

2022.04.24 In our last article, ‘If it can’t be grown it must be […]

April 24, 2022

2022.04.24 Last year mining analysts Mike Kozak and Matthew O’Keefe of Cantor Fitzgerald […]

April 14, 2022

2022.04.14 The new “commodities super-cycle” touted by many including Goldman Sachs, may be […]

February 25, 2022

2022.02.25 In 2021, commodities outperformed all other asset classes, and they are expected […]

February 14, 2022

2022.02.14 The move away from fossil-fuel-powered vehicles to EVs run on batteries is […]

February 12, 2022

2022.02.12 Commodities are considered one of the best places to park investment capital […]

December 28, 2021

The modernization and electrification of our global transportation system will require a change hitherto unprecedented in the history of civilization. Not even the shift from horse and buggy to the crank-start Ford Model T can compete with what it will take to electrify the billion-plus cars on the planet’s roads, and eventually put a complete stop to noxious tailpipe emissions resulting from the combustion of gasoline and diesel fuel, that are poisoning the air we breathe.

For now, thorium is a theoretical solution to our energy dilemma, but it could be much more than that. A concerted effort to develop thorium reactor technology could provide stable, clean, base-load power for millions, something that is not possible with renewables due to the intermittency factor and the current early stages of renewable battery storage technology. It is safer and better for the environment than uranium and can even use radioactive waste as feedstock for the nuclear reaction, thus killing two birds with one stone. The market is not yet ready for thorium, but when it is, a whole new mining sector and supply chain will be born.

For now, thorium is a theoretical solution to our energy dilemma, but it could be much more than that. A concerted effort to develop thorium reactor technology could provide stable, clean, base-load power for millions, something that is not possible with renewables due to the intermittency factor and the current early stages of renewable battery storage technology. It is safer and better for the environment than uranium and can even use radioactive waste as feedstock for the nuclear reaction, thus killing two birds with one stone. The market is not yet ready for thorium, but when it is, a whole new mining sector and supply chain will be born.