Electrification

July 21, 2024

By Katharina Buchholz – Statista As of 2024, 60 countries and territories around […]

June 2, 2024

By Petra Sorge – Bloomberg German Chancellor Olaf Scholz praised the move by Volkswagen […]

May 28, 2024

By Tom Randall – Bloomberg For every sign of an EV slowdown, another suggests […]

May 28, 2024

By Al Root – Barron’s BYD’s Seagull doesn’t look all that threatening. It’s a […]

May 18, 2024

By David Williams – Real Clear Wire Electric vehicles (EVs) may be the most […]

April 30, 2024

2024.04.27 Investors in stocks, bonds and commodities should be aware of the rate […]

April 25, 2024

By Peter Zimonjic – CBC News According to a government statement released to […]

April 25, 2024

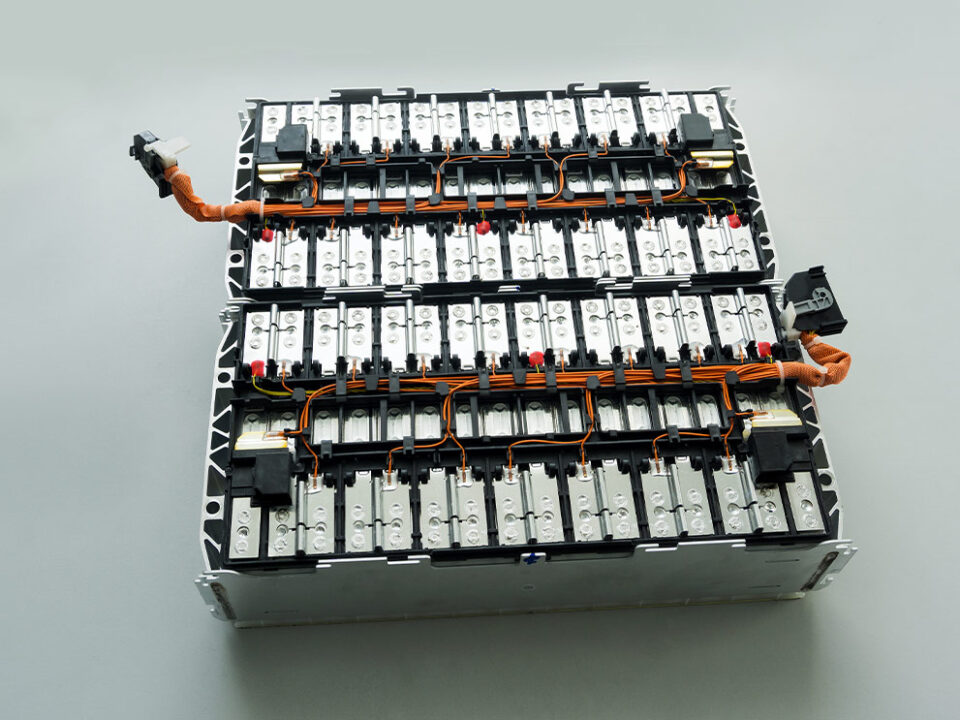

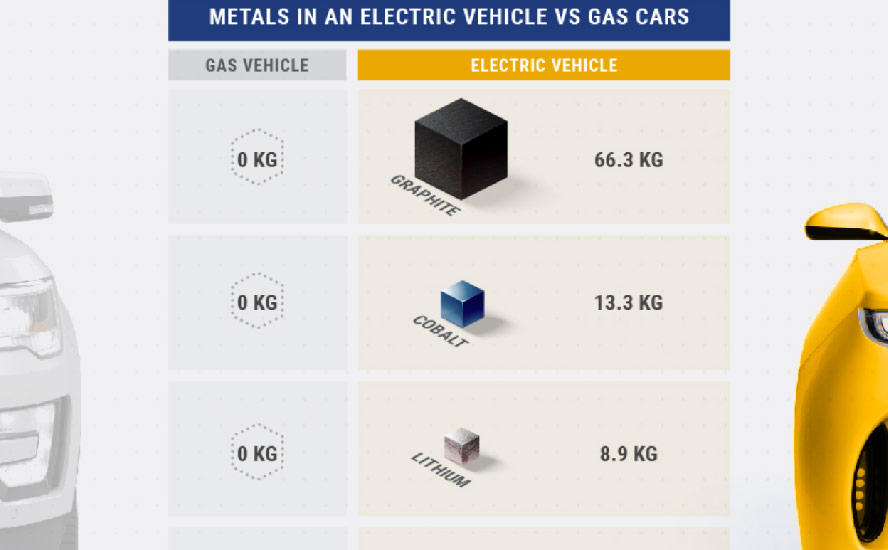

From Mining.com Making a battery for an electric vehicle typically requires mining hundreds […]

April 25, 2024

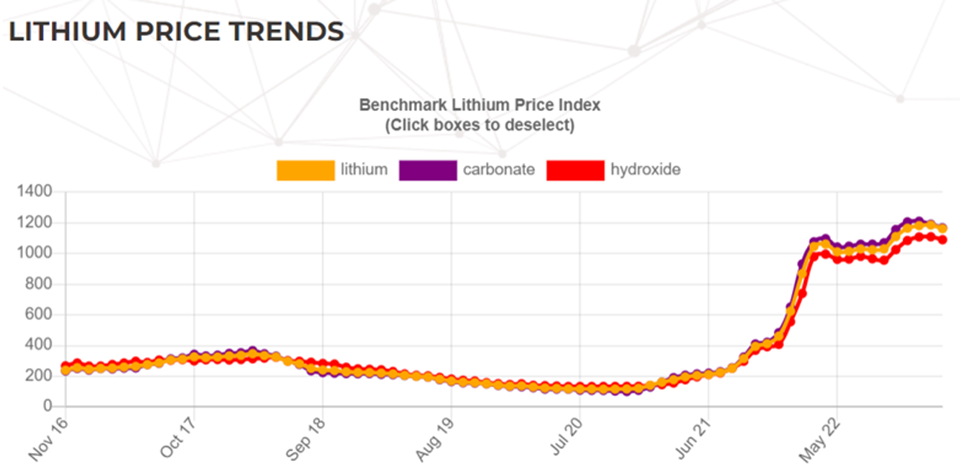

Fen The Economist There are good reasons to expect demand to pick up. […]

April 16, 2024

By Jacob Lorinc – Bloomberg News When the group of mining executives arrived […]

January 12, 2024

By Ella Nilsen, CNN fund 47 projects in 22 states and Puerto Rico – […]

January 4, 2024

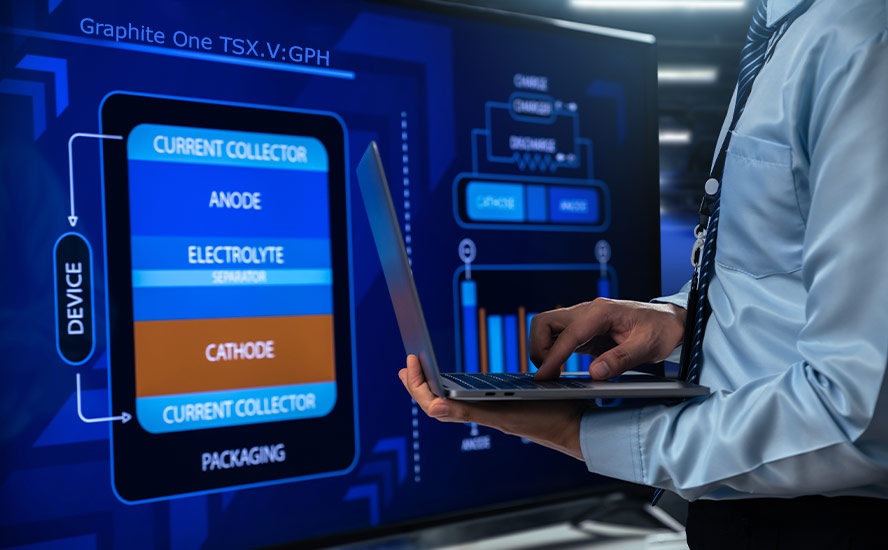

2024.01.04 America’s largest graphite resource, and one of the biggest in the world, says […]

December 23, 2023

2023.12.21 China, the world leader in electric vehicles and battery production, is moving […]

November 25, 2023

By Nelson Bennett – Mining.com Meeting the 2030 targets for electric vehicle mandates […]

October 31, 2023

By Frank Giustra The mining industry has had its share of abuse over the […]

October 25, 2023

By Jacob Lorinc, Thomas Biesheuvel, and James Attwood Rising costs to build Teck Resources Ltd.’s flagship copper project […]

October 4, 2023

2023.10.04 Behind Ontario’s mineral wealth is the geological advantage offered by the Mid-Continental […]

October 4, 2023

By Elements Visual Capitalist Water service lines, crucial for connecting buildings to the […]

September 25, 2023

By Felix Richter Charging infrastructure plays a pivotal role in facilitating the global shift […]

August 23, 2023

Copper Road kicks off 2023 drill program to confirm copper mineralization at JR Zone – Richard Mills

2023.08.23 Copper Road Resources Inc. (TSXV: CRD) is kicking off its 2023 summer […]

August 23, 2023

203.08.23 Copper Road Resources Inc. (TSXV: CRD) 正在极具前景的 JR 区启动 2023 年夏季钻探计划,该计划是位于安大略省巴彻瓦纳湾地区的 Copper […]

August 23, 2023

By Rimmi Singhi Amid heightening climate concerns, countries worldwide are fast transitioning to […]

July 24, 2023

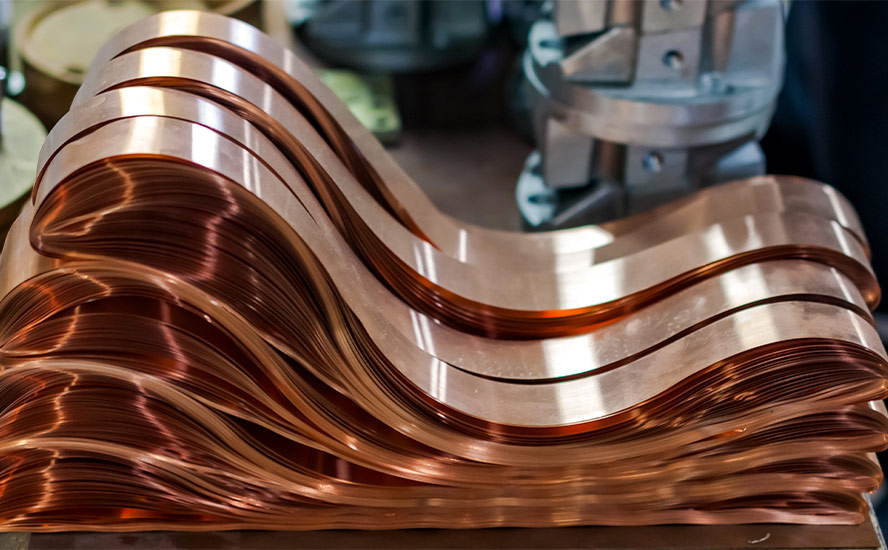

2023.07.24 Simply put, the road to reaching net zero begins and ends with […]

July 24, 2023

2023.07.24 简而言之,实现净零排放的道路始于铜,终于铜。所有支持可再生能源的基础设施都使用大量铜,因为金属是高效的电和热导体。 为了保持能源转型的继续,将需要数百万英尺的铜线来加强世界电网,并且还需要数十万吨的铜线来建设风能和太阳能发电厂。例如,海上风力涡轮机每兆瓦发电量含有 8 吨铜。 电动汽车现在是需求快速增长的一个来源,其使用的铜量是汽油动力汽车的两倍多,汽油动力汽车的铜含量约为 30 公斤。更不用说,平均每个家庭都有超过 180 公斤的铜,这提醒我们这种金属是多么不可或缺。 综上所述,展望未来,对铜的需求将是惊人的。 铜供应缺口 麦肯锡预计,到 […]

June 18, 2023

By Jacob Lorinc The only metal output that has increased at Barrick since […]

May 31, 2023

By Alan Kennedy Renewable energy, in particular solar power, is set to shine […]

February 23, 2023

By Amanda Stephenson The biggest winner was the mining sector, which grew 174 […]

February 23, 2023

By Katharina Buchholz The European Union last week approved a law that will ban the sale […]

February 17, 2023

By Bloomberg Almost 60% of total EV spending occurred in just the last […]

February 9, 2023

By Liam Denning 2023.02.09 America’s energy angst was easier to gauge before the energy transition: You […]

February 2, 2023

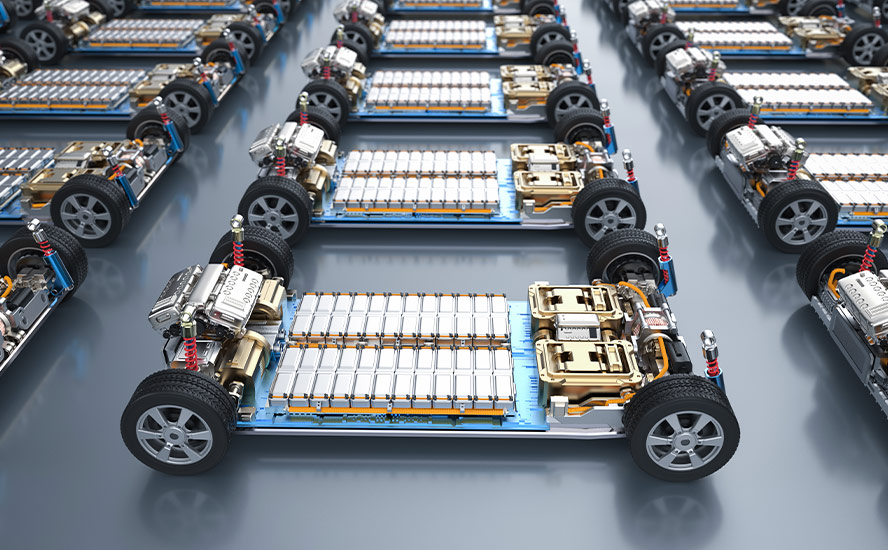

2023.02.02 The transition from fossil fuels to electrified transportation and renewable energy is […]

January 25, 2023

By Mark Burton 2023.01.25 Top metal producers called on the European Union to […]

January 24, 2023

2023.01.24 At AOTH we’ve been writing about the coming copper supply deficit for […]

December 2, 2022

2022.12.02 An upcoming copper supply deficit could be hastened by an uptick in […]

November 9, 2022

2022.11.09 Copper is one of the most important metals with more than 20 […]

November 1, 2022

2022.11.01 According to data collected by The Book of Deals, via cargroup.org, in 2021 […]

March 11, 2022

2022.03.11 Copper The global copper supply crisis is getting deeper with each passing […]

February 14, 2022

2022.02.14 The move away from fossil-fuel-powered vehicles to EVs run on batteries is […]