Energy Metals

December 17, 2023

December 17, 2023

By Ari Natter Tenex, a Russian state-owned uranium company, is warning American customers that […]

Do you like it?

December 15, 2023

December 15, 2023

By Visual Capitalist In 2022, the total copper scrap recycled in the U.S. […]

Do you like it?

September 29, 2023

September 29, 2023

2023.09.29 Copper is one of the most important metals with more than 20 […]

Do you like it?

August 27, 2023

August 27, 2023

2023.08.27 The electrification of the global transportation system doesn’t happen without graphite. That’s […]

Do you like it?

May 11, 2023

May 11, 2023

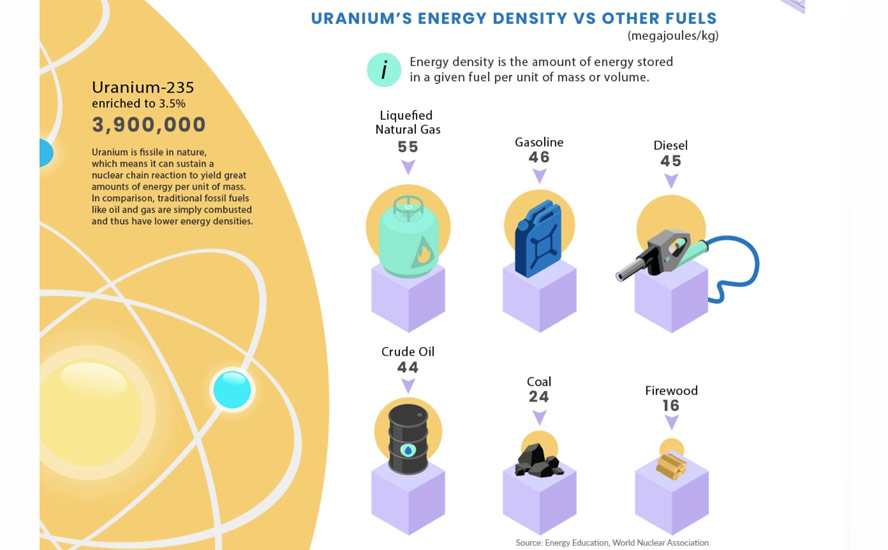

In 2021, global uranium requirements from reactors totaled 62,496 tonnes. By 2040, that […]

Do you like it?

April 29, 2023

April 29, 2023

2023.04.29 Graphite One (TSXV:GPH, OTCQX:GPHOF) aims to become the first vertically integrated domestic […]

Do you like it?

December 9, 2022

December 9, 2022

2022.12.09 Some of the largest copper mines are seeing their reserves dwindle; they […]

Do you like it?

August 14, 2022

August 14, 2022

2022.08.14 Max Resource (TSXV:MAX; OTC:MXROF; Frankfurt:M1D2) is one step closer to drilling its CESAR […]

Do you like it?

May 13, 2022

May 13, 2022

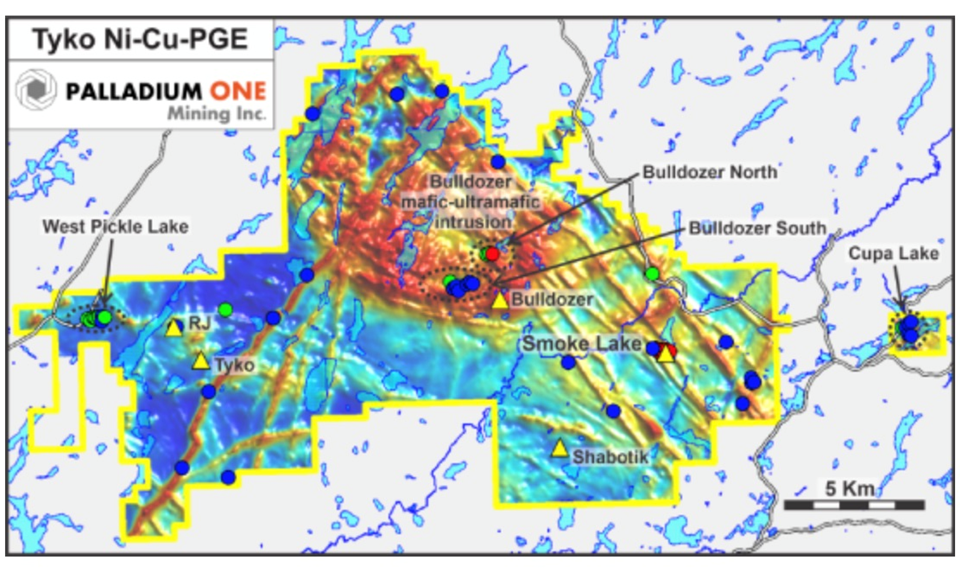

2022.05.13 Palladium One Mining (TSXV:PDM, OTCQB:NKORF, FRA:7N11) continues to outline a high-grade nickel-copper […]

Do you like it?

May 1, 2022

May 1, 2022

2022.05.01 One of the most important pieces of news that mining investors usually […]

Do you like it?

March 21, 2022

March 21, 2022

2022.03.21 The current commodity price surge puts Palladium One Mining (TSXV:PDM, OTC:NKORF, FSE:7N11) […]

Do you like it?

January 8, 2022

January 8, 2022

2021.01.08 In 2022, renewable energy and electrification of the global transport system stand […]

Do you like it?

November 30, 2021

November 30, 2021

2021.11.30 The mining industry is on the hunt for large deposits that have […]

Do you like it?

November 12, 2021

November 12, 2021

2021.11.12 A lot of our recent focus has been on the copper market, […]

Do you like it?

November 4, 2021

November 4, 2021

2021.11.04 Regarding all of the mined commodities, copper stands out as more bullish […]

Do you like it?

November 3, 2021

November 3, 2021

2021.11.03 Regarding all of the mined commodities, copper stands out as more bullish […]

Do you like it?

August 21, 2021

August 21, 2021

2021.08.21 It’s no secret by now that the world will need more lithium […]

Do you like it?

August 11, 2021

August 11, 2021

2021.08.11 Max Resource Corp (TSXV:MXR, OTC:MXROF, Frankfurt:M1D2) is making good headway at its […]

Do you like it?

July 31, 2021

July 31, 2021

2021.07.31 Lomiko Metals (TSXV:LMR, OTC:LMRMF, Frankfurt:DH8C) is exploring for lithium and graphite in […]

Do you like it?

July 13, 2021

July 13, 2021

2021.07.13 Drills could soon pierce targets at Victory Resources’ Smokey Lithium project (CSE:VR, FWB:VR61, […]

Do you like it?

June 10, 2021

June 10, 2021

One junior mining company that has set sights on extracting more value out of its precious/metals projects during this auspicious period is Mountain Boy Minerals Ltd. (TSX.V: MTB; OTCQB: MBYMF; Frankfurt: M9UA), which has six active projects spanning 604 square kilometres (60,398 hectares) in the prolific Golden Triangle of northern British Columbia.

Do you like it?

June 4, 2021

June 4, 2021

Getchell Gold’s (CSE:GTCH, OTCQB:GGLDF) Fondaway Canyon is an advanced-stage gold property located in Churchill County, Nevada. The project has been the subject of multiple exploration campaigns in the late 1980s and early 1990s.

Do you like it?

May 30, 2021

May 30, 2021

One company committed to developing America’s next lithium supply is Cypress Development Corp. (TSX-V: CYP) (OTCQB: CYDVF) (Frankfurt: C1Z1), which presently holds a 100% interest in the Clayton Valley lithium project in southwest Nevada.

Do you like it?

May 24, 2021

May 24, 2021

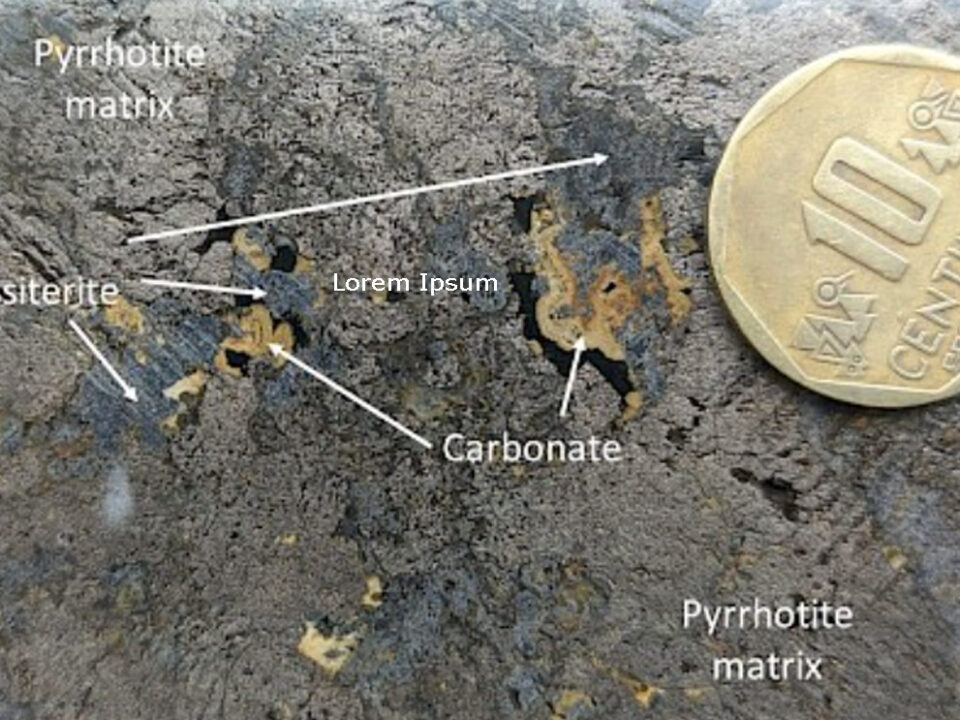

Energy and precious metals explorer Max Resource Corp. (TSX.V: MXR; OTC: MXROF; Frankfurt: M1D2) continues to make significant progress at its flagship CESAR project in northeastern Colombia, along what is considered to be the world’s largest copper-producing belt in the Andean.

Do you like it?

May 16, 2021

May 16, 2021

One international mining company that is committed to exploring Nevada’s mineral-rich regions is Victory Resources Corp. (CSE: VR) (FWB: VR61) (OTC: VRCFF), which has been actively looking at precious metals opportunities in the state and recently expanded its focus to battery metals.

Do you like it?

May 12, 2021

May 12, 2021

As base metals prices continue to attract investor interest, I’m keeping a close eye on juniors like Norden Crown, whose Fredriksson Gruva target, and its resemblance to a Broken Hill Type deposit, appears to have the scale, the grades and the consistency of mineralization to interest a major.

Do you like it?

May 11, 2021

May 11, 2021

I’m looking forward to seeing what Lomiko has planned for its lithium and graphite properties in Quebec and upcoming shareholder catalysts.

Do you like it?

May 8, 2021

May 8, 2021

What’s the point of making supposedly “green” battery components when the refining process is so dirty?

Do you like it?

May 6, 2021

May 6, 2021

Demand for graphite used in EV batteries is set to increase by 15 times over the next decade, rising from 200,000 to 3 million tonnes annually. On the other side of the equation, global graphite supply is expected to remain tight for the foreseeable future. Last year, the world’s total output came to 952,600 tonnes, a staggering 15% decline over 2019.

With an intensifying national focus surrounding EV raw materials, it’s no surprise that high-priority designation was given earlier this year to Graphite One Inc. (TSX-V:GPH) (OTCQB:GPHOF) to develop what is possibly the largest known graphite resource in the US.

With an intensifying national focus surrounding EV raw materials, it’s no surprise that high-priority designation was given earlier this year to Graphite One Inc. (TSX-V:GPH) (OTCQB:GPHOF) to develop what is possibly the largest known graphite resource in the US.

Do you like it?

May 5, 2021

May 5, 2021

Copper’s broad use in various industrial sectors including construction, transportation and telecommunications, makes it a reliable early indicator of economic activity.

In fact, “Dr. Copper’s” ability to predict which way the global economy will go, has earned it a PhD in economics.

In fact, “Dr. Copper’s” ability to predict which way the global economy will go, has earned it a PhD in economics.

Do you like it?

April 29, 2021

April 29, 2021

According to the Silver Institute, global demand for silver will rise to 1.025 billion ounces in 2021, the highest in eight years, led by investments in industrial and investment-grade physical silver, ie., bars and coins.

“The outlook for the silver price in 2021 remains exceptionally encouraging, with the annual average price projected to rise by 46 percent to … $30,” it said in a statement.

“The outlook for the silver price in 2021 remains exceptionally encouraging, with the annual average price projected to rise by 46 percent to … $30,” it said in a statement.

Do you like it?

April 28, 2021

April 28, 2021

New chapters of the copper success story that started in 2020 are being written as the tawny-colored metal basks in the glory of global climate pledges, and an economic recovery from the pandemic underpinned by strengthened industrial demand.

Do you like it?

April 27, 2021

April 27, 2021

The United States is back in the fold of countries pledging to reduce greenhouse gas emissions, and that is helping to drive demand for an assemblage of metals that a global push to decarbonize and electrify is expected to require.

Do you like it?

April 24, 2021

April 24, 2021

Joe Biden came to power as the 46th US president expecting to spend more on green energy and clean technology. Just how much more is starting to be revealed.

Do you like it?

April 19, 2021

April 19, 2021

Renforth Resources Inc. (CSE: RFR) (OTCQB: RFHRF) (FSE: 9RR) continues to deliver good news for shareholders, this week announcing new assay results for the 2020 drill program on its wholly owned Parbec open-pit constrained gold deposit in Quebec.

Meanwhile, Renforth has also been making significant progress at its Surimeau District property (nickel, copper, zinc), a brownfield project covering an area of 215km2 south of the Cadillac Break among current and former producing mines.

Meanwhile, Renforth has also been making significant progress at its Surimeau District property (nickel, copper, zinc), a brownfield project covering an area of 215km2 south of the Cadillac Break among current and former producing mines.

Do you like it?

April 17, 2021

April 17, 2021

2021.04.17 New Videos showing expanded Geological Model of Gold Zones: Fondaway Canyon, Nevada […]

Do you like it?

April 17, 2021

April 17, 2021

The big question is, will there be enough copper for future electrification needs, globally? Plus all the other modern-day uses of copper?

The short answer is no, not without a massive acceleration of copper production worldwide.

Global leaders have set strict decarbonization targets that require green-focused infrastructure built with copper. This, combined with a massive rise in government expenditures and years of underinvestment, has investment bank Goldman Sachs predicting that another commodity super-cycle is on the horizon.

The short answer is no, not without a massive acceleration of copper production worldwide.

Global leaders have set strict decarbonization targets that require green-focused infrastructure built with copper. This, combined with a massive rise in government expenditures and years of underinvestment, has investment bank Goldman Sachs predicting that another commodity super-cycle is on the horizon.

Do you like it?

April 15, 2021

April 15, 2021

As the first company ever to explore all of the copper and silver-rich areas covered by the CESAR property, Max has so far identified multiple copper-silver target zones, all with significant potential to expand further, demonstrating the presence of a widespread highly prospective copper-silver district.

Do you like it?

April 15, 2021

April 15, 2021

Tinka Resources’ (TSX.V:TK, OTCQB:TKRFF) Ayawilca polymetallic project in Peru just got a whole lot more interesting with the discovery of a new tin zone, that is expected to add significant value to what is already the largest zinc development project in Latin America and one of the biggest zinc resources held by a junior explorer.

Do you like it?

April 11, 2021

April 11, 2021

“The adage of ‘if it can’t be grown it must be mined’ serves as a reminder that electric vehicles, transitional energy, and a green economy start with metals. The supply chain for batteries, wind turbines, solar panels, electric motors, transmission lines, 5G — everything that is needed for a Green Economy starts with metals and mining. Demand for these metals, principally lithium, nickel and cobalt on the battery side and copper, uranium and rare earth elements on the energy side is expected to rise rapidly.”

Do you like it?

April 9, 2021

April 9, 2021

Dolly Varden’s goal is to try and extend Torbrit through some step-out drill holes, and to get into the high-grade, 500g to 1kg material. There are early indications of other Torbrit “look-alikes” along a 4.5-km trend. Through drilling, Dolly Varden wants to prove up another Torbrit and drastically increase the size of the resource which in all categories is about 44Moz at an average grade of 300 g/t. A key part of the exploration thesis is the fact that the rocks hosting the mineralization on the property are the same age as some of the other large deposits found in the Golden Triangle including Eskay Creek.

Do you like it?

April 5, 2021

April 5, 2021

Years of neglecting its critical metal supplies is catching up with the United States, as demand for the raw materials needed to build a new green economy that rejects fossil fuels gears up.

Do you like it?

April 2, 2021

April 2, 2021

Though early stage, the possibility of widespread sulfide nickel mineralization at Surimeau looks promising. The grades and rock value given here are conservative; the 0.224% Ni used to calculate the rock value of US$41.83 per tonne is based on only three intercepts from three holes drilled at Surimeau, less than 200m. Highlights from summer 2020 grab sampling show grades up to 0.495% Ni. If those grades start showing up in drill core, Renforth could really be onto something.

Do you like it?

April 2, 2021

April 2, 2021

As Victory Resources Corp. (CSE: VR) (FWB: VR61) (OTC: VRCFF) continues to scale up mining operations on multiple properties across North America, the company has made a significant management change to reflect its broadening exploration focus that now includes battery metals.

Do you like it?

March 23, 2021

March 23, 2021

Goldman Sachs says that the next structural bull market for commodities will be driven by spending on green energy.

The fossil-fueled based transportation system needs to be electrified, and the switch must be made from oil, gas, and coal-powered power plants to those which run on solar, wind and thorium-produced nuclear energy. If we have any hope of cleaning up the planet, before the point of no return, a massive decarbonization needs to take place.

In a recent report, commodities consultancy Wood Mackenzie said an investment of over $1 trillion will be required in key energy transition metals over the next 15 years, just to meet the growing needs of decarbonization.

The fossil-fueled based transportation system needs to be electrified, and the switch must be made from oil, gas, and coal-powered power plants to those which run on solar, wind and thorium-produced nuclear energy. If we have any hope of cleaning up the planet, before the point of no return, a massive decarbonization needs to take place.

In a recent report, commodities consultancy Wood Mackenzie said an investment of over $1 trillion will be required in key energy transition metals over the next 15 years, just to meet the growing needs of decarbonization.

Do you like it?

March 21, 2021

March 21, 2021

The thawing of permafrost is yet another manifestation of climate change, that populations living near it will have to deal with in the coming decades as global warming accelerates, particularly in the polar regions

Mining is often deemed complicit in the rise of greenhouse gas emissions, given its use of heavy machinery and ground disturbance, but in this case, in areas where the ground is permanently frozen but starting to thaw, operations can be negatively impacted, and big miners are having to shell out millions. We have seen the implications of thawing permafrost at Teck’s Red Dog Mine in Alaska, and at Norilsk Nickel’s Oktyabrsky and Taimyrsky mines in Siberia.

The problem is not going away; in fact, there is every indication it will get worse.

Mining is often deemed complicit in the rise of greenhouse gas emissions, given its use of heavy machinery and ground disturbance, but in this case, in areas where the ground is permanently frozen but starting to thaw, operations can be negatively impacted, and big miners are having to shell out millions. We have seen the implications of thawing permafrost at Teck’s Red Dog Mine in Alaska, and at Norilsk Nickel’s Oktyabrsky and Taimyrsky mines in Siberia.

The problem is not going away; in fact, there is every indication it will get worse.

Do you like it?

March 19, 2021

March 19, 2021

Peru-focused Tinka Resources (TSXV:TK, OTCP:TKRFF) has the backing of a major player in the Peruvian zinc and silver market, adding significant heft to its flagship Ayawilca zinc-silver play.

Nexa Resources (TSX:NEXA), one of the world’s largest zinc producers, and owner of the only zinc smelter in Peru, purchased 28.895 million common shares from an arms-length shareholder, giving the Luxembourg-based firm an 8.8% stake in Tinka.

The transaction means Tinka Resources now has two major miners as shareholders — the other being Buenaventura SA (NYSE:BVN) — along with JP Morgan UK.

Nexa Resources (TSX:NEXA), one of the world’s largest zinc producers, and owner of the only zinc smelter in Peru, purchased 28.895 million common shares from an arms-length shareholder, giving the Luxembourg-based firm an 8.8% stake in Tinka.

The transaction means Tinka Resources now has two major miners as shareholders — the other being Buenaventura SA (NYSE:BVN) — along with JP Morgan UK.

Do you like it?

February 27, 2021

February 27, 2021

21.02.27 Industrial metals are on an absolute tear with no signs of slowing […]

Do you like it?

February 23, 2021

February 23, 2021

2021.02.23 Gold and copper are up, the dollar is down, and bond yields […]

Do you like it?

June 23, 2020

June 23, 2020

2020.06.23 Gold surged on Monday after a spike in coronavirus cases worldwide dashed […]