Decarbonization

July 21, 2024

By Katharina Buchholz – Statista As of 2024, 60 countries and territories around […]

June 2, 2024

By Petra Sorge – Bloomberg German Chancellor Olaf Scholz praised the move by Volkswagen […]

May 28, 2024

By Tom Randall – Bloomberg For every sign of an EV slowdown, another suggests […]

May 28, 2024

By Al Root – Barron’s BYD’s Seagull doesn’t look all that threatening. It’s a […]

May 18, 2024

By David Williams – Real Clear Wire Electric vehicles (EVs) may be the most […]

April 16, 2024

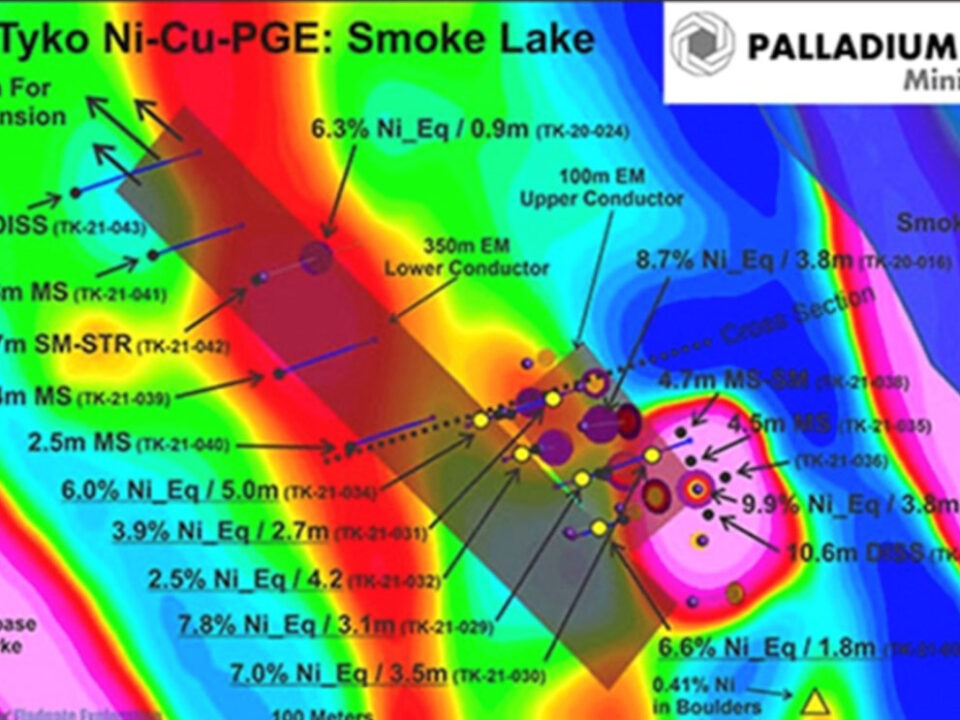

By Jacob Lorinc – Bloomberg News When the group of mining executives arrived […]

January 4, 2024

2024.01.04 America’s largest graphite resource, and one of the biggest in the world, says […]

October 25, 2023

By Jacob Lorinc, Thomas Biesheuvel, and James Attwood Rising costs to build Teck Resources Ltd.’s flagship copper project […]

October 4, 2023

By Elements Visual Capitalist Water service lines, crucial for connecting buildings to the […]

September 25, 2023

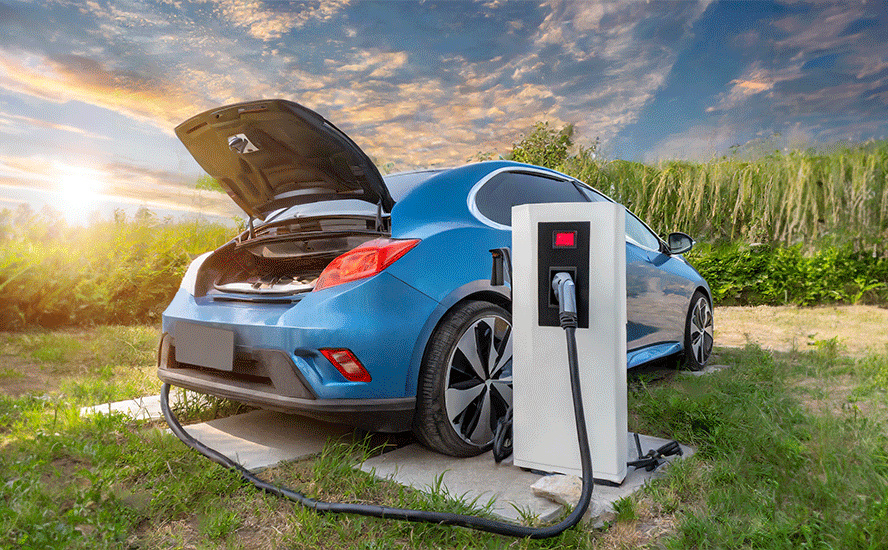

By Felix Richter Charging infrastructure plays a pivotal role in facilitating the global shift […]

August 23, 2023

By Rimmi Singhi Amid heightening climate concerns, countries worldwide are fast transitioning to […]

June 18, 2023

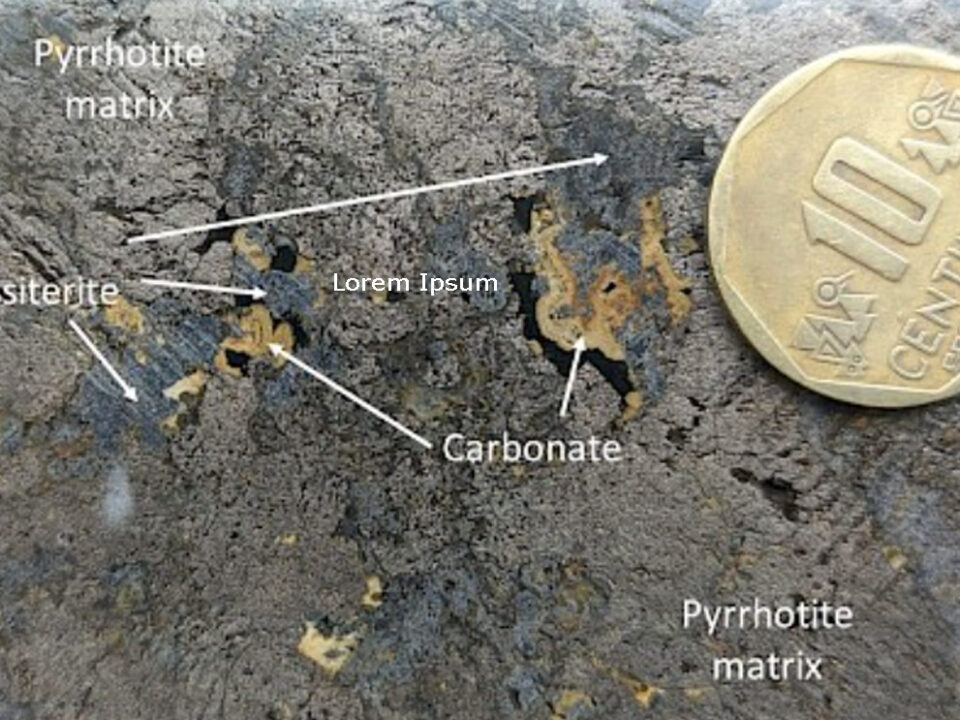

By Jacob Lorinc The only metal output that has increased at Barrick since […]

May 31, 2023

By Alan Kennedy Renewable energy, in particular solar power, is set to shine […]

February 23, 2023

By Katharina Buchholz The European Union last week approved a law that will ban the sale […]

February 2, 2023

2023.02.02 The transition from fossil fuels to electrified transportation and renewable energy is […]

February 5, 2022

2022.02.05 We have come to terms that a global transition to clean energy […]

November 5, 2021

2021.11.15 The road to upgrading America’s infrastructure is long and costly. A report […]

November 1, 2021

2021.11.01 https://www.financialsense.com/podcast/20100/big-three-commodities-electrification-and-decarbonization Rick Mills, author of the aheadoftheherd.com newsletter, discusses the long-term investment […]

October 20, 2021

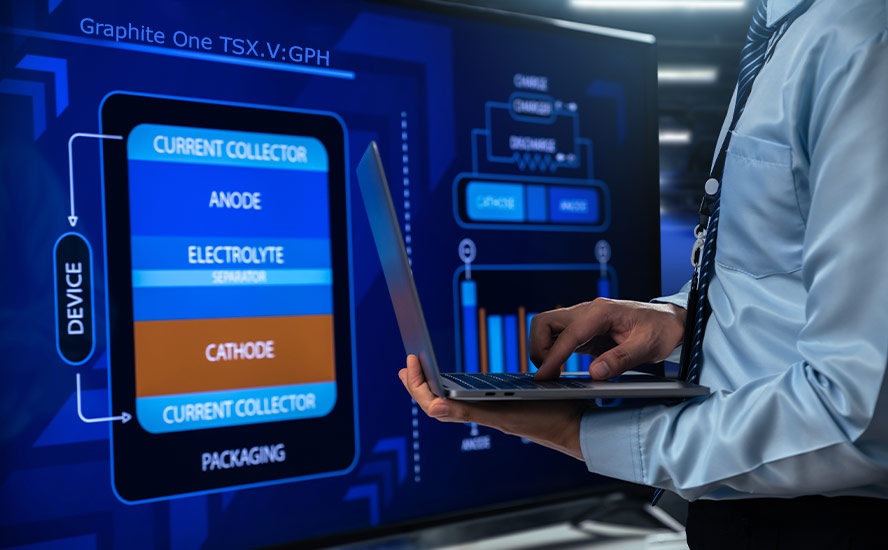

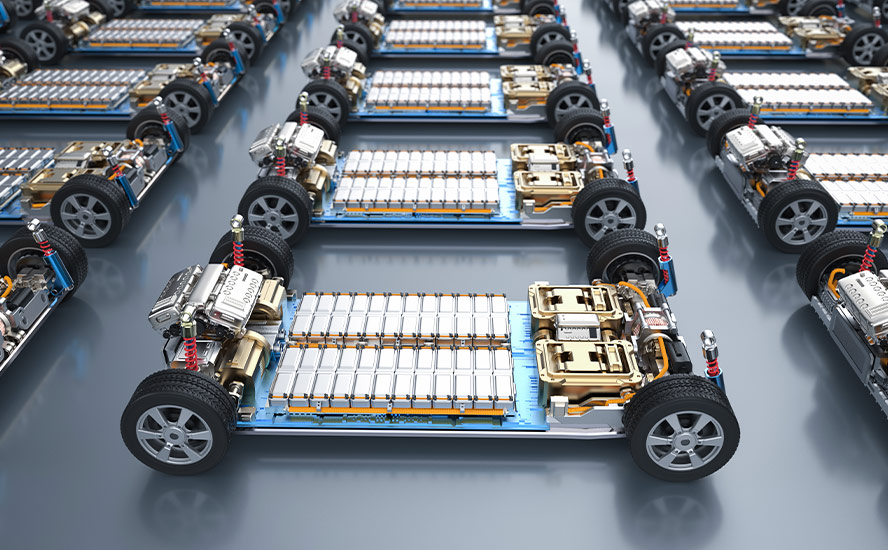

2021.10.20 A lithium-ion (Li-ion) battery is a type of rechargeable battery technology common […]

August 23, 2021

2021.08.23 Commodities are considered one of the best places to park investment capital […]

May 27, 2021

Joe Biden’s position on mining has always been murky.

Publicly the veteran Senator turned US President says all the right things to show mine workers he is on their side. Away from the cameras Biden is listening to the anti-mining left wing of his Democratic Party controlled by liberal progressives and environmentalists, doing whatever he can to scupper new mining projects and oil pipelines.

Publicly the veteran Senator turned US President says all the right things to show mine workers he is on their side. Away from the cameras Biden is listening to the anti-mining left wing of his Democratic Party controlled by liberal progressives and environmentalists, doing whatever he can to scupper new mining projects and oil pipelines.

May 3, 2021

Look up the word sustainable in the Oxford English dictionary and you get the following definition: “avoidance of the depletion of natural resources in order to maintain an ecological balance.”

Unfortunately the world’s ecological balance has not been right for a very long time. As a society, we are consuming resources far more quickly than we are replacing them, which is the very definition of unsustainable.

Unfortunately the world’s ecological balance has not been right for a very long time. As a society, we are consuming resources far more quickly than we are replacing them, which is the very definition of unsustainable.

April 13, 2021

ESG was a dominant theme running through this year’s AME Roundup conference in Vancouver.

Ross Beaty, chairman of Pan American Silver and Equinox Gold, said “It’s just critical. Every single meeting you have with investors, it’s number one on the topic (list).”

Ross Beaty, chairman of Pan American Silver and Equinox Gold, said “It’s just critical. Every single meeting you have with investors, it’s number one on the topic (list).”

March 31, 2021

As the fight against the coronavirus continues to take center stage, an insidious environmental problem is getting worse: plastic pollution.

The global health crisis has prompted a rush for single-use plastic just as governments around the world were taking steps to curtail or ban its usage. Demand has surged for everything from face shields and gloves to takeaway food containers and bubble wrap for online shopping — most of which cannot be recycled and is ending up as waste.

The global health crisis has prompted a rush for single-use plastic just as governments around the world were taking steps to curtail or ban its usage. Demand has surged for everything from face shields and gloves to takeaway food containers and bubble wrap for online shopping — most of which cannot be recycled and is ending up as waste.