Manning Ventures positioned to capitalize on the robust dynamics of global iron ore sector

2021.05.11

Iron ore is a mined raw material from which crude iron, also known as pig iron, can be economically extracted. Nearly all of the world’s mined iron ore is used to make steel, which is an essential part of our modern infrastructure (structures, automobiles, machinery, etc.).

To produce one tonne of steel, roughly 1.5 tonnes of iron ore are required. The higher the iron content in the ore, the higher it is graded and the more valuable it becomes.

China currently consumes more iron ore than any other nation, as it’s by far the world’s biggest steel producer. In fact, its output is greater than all other steelmaking countries in the world combined.

According to data published by China’s National Bureau of Statistics, the country churned out a record 1.05 billion tonnes of crude steel in 2020 — 6% more than the previous year — with “demand boosted by Beijing’s stimulus measures for infrastructure such as bridges and roads and both new commercial and residential buildings.”

This year, steel output from Asia’s leading economy is set to surpass that total.

From January to February, its crude steel output rose nearly 13% compared with a year earlier, as mills increased production in expectation of more robust demand from the construction and manufacturing sectors.

The Metallurgical Industry Planning and Research Institute is projecting a 1.4% rise to 1.065 billion tonnes for 2021, implying a corresponding increase in China’s iron ore demand to meet that output.

Iron Ore Rally

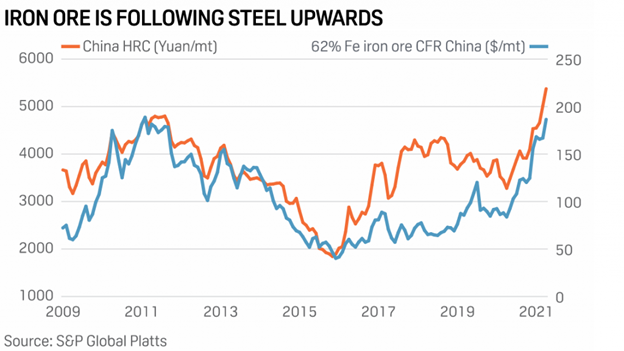

Iron ore prices recently broke a new record amid a sustained rally in commodities prices as demand from top consumer China remains as robust as ever.

Because China’s domestic iron ore supply is relatively low-grade and expensive to process, many steelmakers there find it cheaper and more efficient to import high-grade iron ore.

According to data from Fastmarkets MB, benchmark 62% Fe fines imported into Northern China (CFR Qingdao) are now changing hands for over $195 per tonne – up more than 130% over the past 12 months.

In 2020, spot prices of iron ore with 62% iron content for delivery to China jumped 73%, according to SteelHome consultancy.

At the center of the latest rally is rising steel prices, from Asia to North America. Steel demand remains strong as economies – China in particular – continue their massive investments in steel-intensive infrastructure.

The World Steel Association forecasts global steel demand to grow 5.8% this year to exceed pre-pandemic levels, followed by another 2.7% increase the year after. China’s consumption, about half of the global total, will keep growing from record levels.

Last week, inventories of main steel products in China – rebar, wire rods, coils and plates – fell 5% from the prior week, while apparent consumption grew 5.3%, data from Mysteel consultancy showed.

Strong demand may encourage Chinese mills to continue ramping up steel output, even as the market tries to digest the impact of the removal of steel export tax rebates and import tariffs announced last month.

Supply Reform

On the other hand, China is also trying to rein in its world-leading steel supply. It views the supply boom during the coronavirus crisis as a contributing factor to the nation’s rising carbon emissions, in contrast to other big economies.

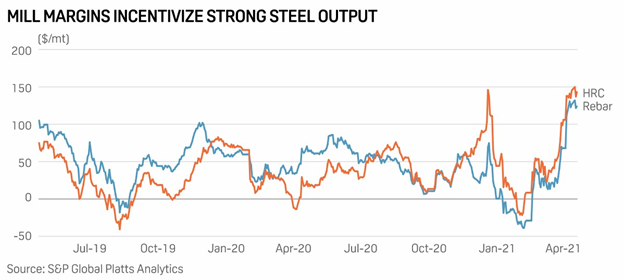

Measures aimed at cleaning up the world’s biggest steel industry have pushed mill profitability to the highest in more than a decade, which according to CRU Group analysts “incentivize mills to build up stocks and to charge more high-grade ore to lift productivity.”

Production restrictions in China’s top steelmaking city of Tangshan during the peak demand season have brought down stocks at commercial warehouses and created a “bullish atmosphere” for the market, Sinosteel Futures analysts said in a note to Reuters.

According to S&P Global Platts, China’s domestic hot-rolled coil prices have risen around 12% since early March, reaching their highest level since mid-2008.

“We have seen a bit of an additional iron ore demand for the purpose of increasing inventories,” CRU Group’s principal analyst Erik Hedborg explained in a Bloomberg interview.

Hence, expectations are mounting that benchmark iron ore prices will soon reach $200 a tonne as Chinese steelmakers ramp up production and iron ore demand continues to improve.

Kim Christie, a senior analyst at consultancy firm Wood Mackenzie, says “iron ore prices could go higher in the short-term and exceeding $200 a tonne is definitely possible.”

Citigroup also expects benchmark prices to hit $200 within weeks, estimating a supply deficit of 18 million tonnes during the first three quarters of 2021.

Meanwhile, Morgan Stanley has called China’s supply reforms a possible “game changer” for demand for premium iron ore, with grade differentials unlikely to normalize any time soon.

China-Australia Tensions

Also fueling iron ore’s relentless surge is the intensifying diplomatic spat between China and Australia. On May 6, China “indefinitely” suspended all activity under a China-Australia Strategic Economic Dialogue, further exacerbating the strained relationship between the two countries.

Australia is by far the biggest iron ore producer in the world, followed by Brazil. Accordingly, Australia is China’s top supplier of the raw material.

Last year, Australian shipments rose 7% to 713 million tonnes, about two-thirds of China’s import needs, data from the General Administration of Customs showed. Another 700-800 million tonnes of iron ore are estimated to be shipped to China this year.

As such, there are growing concerns that souring relations between Beijing and Canberra may eventually disrupt that bilateral iron ore trade.

While “China is unlikely to ban imports of Australian commodities which they rely heavily on as it will impact the domestic economy,” as Wood Mackenzie senior economist Yanting Zhou put it, chances are China may look into ways to reduce its reliance on Australia.

Remember, Chinese steelmakers tend to prefer high-grade ore (defined as over 65% iron content), which limits the number of viable sources.

India, for example, is also a major iron ore producer, but two-thirds of its past exports to China had less than 58% iron content, according to Indian mining industry estimates. While imports from India jumped a significant 88% to 45 million tonnes last year, that figure accounted for just 1.8% of China’s import total.

In West Africa, China has interests in several mines with abundant iron ore reserves, but most of them remain inaccessible due to bureaucratic wrangling and limited capital. Even with these foreign projects up and running, their aggregate production would be a small fraction of the global market share dominated by top producers Australia and Brazil.

Still, even without any political tensions, Australia and Brazil alone could not meet China’s demand for iron ore at this rate, increasing the need for China to further diversify its iron ore supply in the long term.

Manning Ventures Inc.

One up-and-coming miner looking to capitalize on this supercharged commodity cycle is Canada’s Manning Ventures Inc. (CSE: MANN) (CNSX: MANN.CN) (Frankfurt: 1H5). The junior’s business approach is to acquire and explore a diversified set of projects across the country’s mineral-rich regions, with the aim of finding impactful resource discoveries.

Thus far, Manning has assembled two iron ore projects in Quebec with past exploration history, carrying high development upside.

Lac Simone

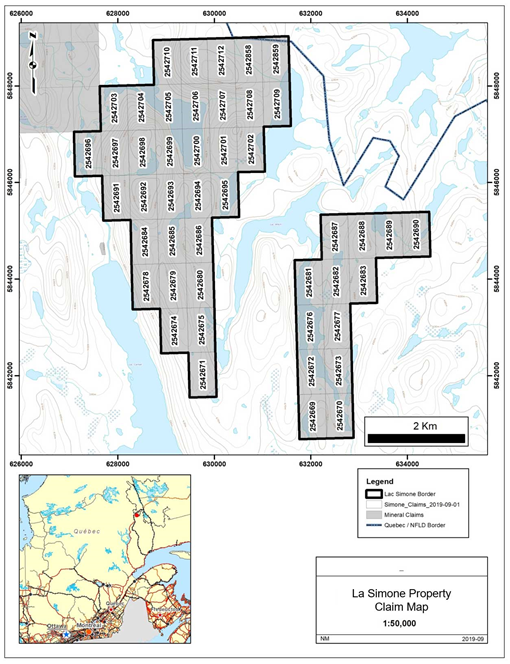

The Lac Simone property is situated approximately 2-10 km south of Fermont, Quebec, which is accessible directly by road from Quebec City (see map below). The entire project consists of 63 mineral claims in two claim blocks totalling nearly 3,300 hectares in area.

The westernmost claims may be accessed via gravel road south of Fermont. Access to the other parts of the property may be gained by boat in the summer, snowmobile in the winter, or via helicopter or float/ski-plane year-round.

Approximately 3 km to the west is Champion Iron Mines’ Moiré Lake deposit, which contains a mineral resource estimate of 164 million tonnes grading 30.5% FeT in the indicated category and 417.1 million tonnes grading 29.4% FeT in the inferred category.

Lac Simone was explored primarily by Jubilee Iron Corp. between 1956 and 1964. During that time, Jubilee completed ground and airborne magnetic and geological surveys at the northernmost magnetic anomaly, as well as mini-bulk sampling with basic metallurgical testing and three diamond drill holes.

Surface sampling in “test pits” indicated 35.51% Fe with positive concentration tests yielding 66.02% Fe. While locations of these test pits were not explicitly indicated, it’s likely that they are found near the historical drill holes, Manning said.

Of the three drill holes completed, mineralized intervals of up to 16.15 metres of 29.05% Fe were recovered. Follow-up drilling to define a resource was recommended but is not believed to have been completed.

No further work was documented until 2011, when Nevado Resources Corp. conducted a heli-borne magnetic survey.

Hope Lake

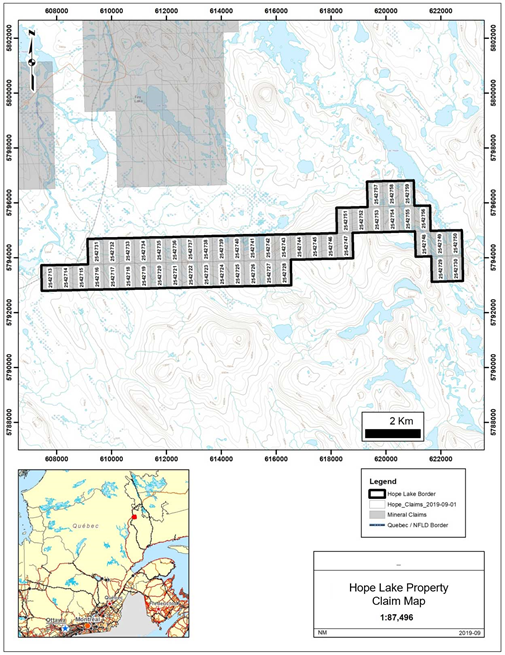

The Hope Lake property is situated approximately 60 km south of Fermont, and is also accessible directly by road from Quebec City (see map below). The project consists of 68 mineral claims totaling more than 3,500 hectares in one contiguous claim block.

The westernmost part of the property may be accessed via a maintenance trail that follows the Quebec Cartier railway line privately owned by ArcelorMittal – the world’s largest steel company. The trail may be accessed south of ArcelorMittal’s Fire Lake mine, located 5 km north of Manning’s property. Access to eastern parts of the property may be gained via helicopter or float/ski-plane year-round.

Like Lac Simone, the Hope Lake property was primarily explored in the past by Jubilee Iron Corp., which completed ground and airborne magnetic and geological surveys at the northernmost magnetic anomaly and two diamond drill holes.

In 1959, 12 samples were collected at the east end of the current property, with results averaging 34.18% FeT. One of the two drill holes did not make it to bedrock, while the other hole was drilled vertically and struck lean silicate (grunerite) iron formation from 3.7 m to 23.5 m.

In 1962, Jubilee performed basic metallurgical testing of samples collected from three surface zones in 1959. Magnetic concentration tests performed on these samples returned results of 68.4%, 68.4, and 68.1% Fe.

The Hope Lake property has also been part of several exploration campaigns over recent years.

In 2006, Voisey Bay Geophysics Ltd. flew a heli-borne magnetic and radiometric survey for Fancamp Exploration Ltd. and Sheridan Platinum Group Ltd. In 2008, Geophysics GPR International Inc. flew a heli-borne magnetic, radiometric and VLF survey for Champion Minerals Inc.

In 2011, Fugro Airborne completed airborne gravimetric, magnetic and LIDAR surveying on the westernmost part of the current claims on behalf of Champion Iron Mines.

In 2011, Champion Iron visited 28 outcrops and collected 8 samples from the eastern part of the current property that average 28.7% FeT, indicating that the property hosts high-grade quartz-hematite +/- magnetite iron formation.

In 2013, Champion Iron visited 20 outcrops and collected 8 samples from the western part of the current property that average 33.7% FeT, again indicating that the property hosts high-grade quartz-hematite +/- magnetite iron formation.

Manning is currently planning preliminary exploration programs at both Lac Simone and Hope Lake. These programs – expected to begin in the coming weeks – are designed to provide additional geological data, confirm the location of historical outcrops where high grades of Fe have been documented, and collect structural measurements to guide future drilling work.

“With prices at 10-year highs, we are positioned to capitalize on the robust dynamics of the iron-ore sector,” Manning’s CEO Alex Klenman said in this week’s media release.

Manning Ventures Inc.

CSE:MANN, Frankfurt:1H5

Cdn$0.30, 2021.05.10

Shares Outstanding 42.2m

Market cap Cdn$12.6m

Mann website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Manning Ventures (CSE:MANN). Manning is an advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.