Norden Crown developing Broken Hill Type ‘look-alike’ as investors pump billions into silver & base metals ETFs

2021.05.12

Ignored by investors for years as the herd chased marijuana stocks, bitcoin, tech, and in 2020, gold and silver, capital is returning to base metals thanks to prolonged runs on copper, iron ore, zinc and lead. The charts below say it all. These metals are booming due to a combination of red-hot demand from China, the world’s top commodities consumer, and supply constraints such as a number of zinc mines being closed in recent years; or in the case of copper, mines shuttered temporarily to prevent the spread of coronavirus in South America, where most of the red metal is mined.

Junior mining companies historically offer the best leverage to rising commodity prices, meaning that juniors with quality base metal deposits in mining-friendly jurisdictions are poised to benefit.

Fredriksson Gruva

Norden Crown Metals (TSXV:NOCR, OTC:NOCRF, Frankfurt:03E) is searching for high-grade silver and zinc deposits in Scandinavia. The Canadian firm recently started drilling at Fredriksson Gruva, a past-producing Swedish mine originally discovered in 1976.

Based on historical drilling data and 3D modeling, the company projected that the mineralization does not end below historical mine workings, and instead continues, as suggested by regional drilling done by past explorers looking for iron deposits.

The evidence so far is proving this theory correct.

Having completed the first three drill holes, the company has successfully shown not only that the mineralization continues at depth, but that it has qualities consistent with a Broken Hill Type (BHT) deposit.

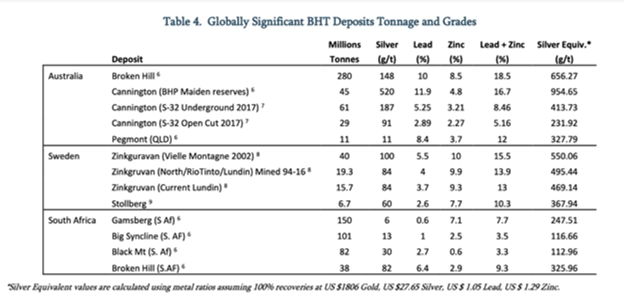

BHT silver-zinc-lead deposits constitute some of the largest and highest-grade ore deposits in the world (see Table 4 below). The namesake deposit, Broken Hill in New South Wales, Australia, represents the largest accumulation of lead, zinc and silver on Earth. Broken Hill Types constitute a distinctive type of stratiform, sediment hosted lead-zinc mineral deposit. They are distinguished from other silver-zinc-lead deposits by the chemistry of the sediment that hosts them, and they are usually associated spatially and temporally with volcanism.

The three discovery holes (569m), part of an 11-hole, 2,365-meter diamond drill program at Norden Crown’s Gumsberg property, intersected significant (ie. wide, high-grade) mineralized widths ranging from 8.13 to 13.60 meters of precious and base metals massive and semi-massive sulfide mineralization, in a geological setting unique to the BHT clan of silver-rich zinc-lead ore deposits.

“We are delighted to present to our shareholders robust silver-zinc-lead intersections which are part of a bona fide Broken Hill Type mineralizing system at Fredriksson Gruva; the widths and grades intersected beneath the historical mine workings suggest that the Gumsberg Project has exceptional growth potential,” said Patricio Varas, Norden Crown’s chairman and CEO, in the March 1 news release. “Massive sulphide deposits are special because it is possible to delineate large tonnages from comparatively small drill footprints due to the high density of the mineralization. To put these results into perspective, Norden Crown’s GUM-20-09 intercept is comparable in width to the height of a three-storey building.”

The drill program’s objective was to demonstrate that the mineralization continues below the Fredriksson mine workings, which extend to 91m depth, and to confirm historical silver-zinc-lead grades, thicknesses and continuity.

The findings from the first three holes confirm that Norden Crown is into a Broken Hill-type deposit such as those found in Australia, South Africa and parts of the Bergslagen mining district of southern Sweden where Gumsberg is located.

Reported grades from mined ore are remarkably consistent, and past drilling rarely missed mineralization, which Varas says is very encouraging for further resource expansion.

‘Paper silver’ surge

Norden Crown is exploring for silver, zinc and lead at an auspicious time for both precious and base metals.

In late January silver kicked higher after a Reddit WallStreetBets subpost triggered a call to buy. A flurry of purchases saw silver blow past $28 and touch $31 briefly, before falling back. Since March, the white metal has been trading in a fairly tight range between $26 and $28.

However, the silver outlook is extremely positive due to a combination of strong monetary and industrial demand drivers.

According to the Silver Institute, global demand for silver will rise to 1.025 billion ounces in 2021, the highest in eight years, led by investments in industrial and investment-grade physical silver, ie., bars and coins.

“The outlook for the silver price in 2021 remains exceptionally encouraging, with the annual average price projected to rise by 46 percent to … $30,” it said in a statement.

“Given silver’s smaller market and the increased price volatility this can generate, we expect silver to comfortably outperform gold this year.”

Investment demand is also surging for silver-backed exchange-traded funds (ETFs), also known as ‘paper silver’.

ETFs’ silver holdings rose last year by a record 10,229 tonnes, more than double the previous record increase in 2009 during the financial crisis. According to the Silver Institute, by the end of 2020, the number of ounces held in silver ETFs surpassed 1 billion for the first time, reaching 1.07 billion ounces, or 33,182 tonnes.

The Financial Times states that silver inflows are expected to slow to 4,666 tonnes this year, but that is still a big increase by historical standards, with decreased investment demand offset by increased industrial usage.

“Silver’s growing use in electronics and in photovoltaics (solar panels) should buttress demand as the energy transition and electrification of our energy systems gathers pace,” the FT quotes Nitesh Shah, research director at WisdomTree, a New York-listed asset manager.

Base metals ETFs on fire

All the action in metals ETFs is usually centered around precious metals, but funds anchored by base metals are gaining serious traction thanks to the above-mentioned price increases.

Consider the following excerpts from a May 9, 2021 Bloomberg article, titled ‘Investors Bet Billions That Metals Bull Run Isn’t Stopping’:

- The race to grab a piece of the action is still accelerating, with record amounts flooding into some metal-focused exchange-traded products. That’s a trend worth watching because ETPs offer an easy route in for retail investors, whose numbers have swelled in the past year, and open the door for more institutional investors.

- Assets in the BlackRock World Mining Fund rose by $3.1 billion to a six-year high of $7.5 billion in the six months through April. Even so, the fund is well below the 2011 peak of $18 billion, suggesting the influx could yet have much further to run.

- Among the investors to react most forcefully as copper started to rebound last March were a group of technically sophisticated algorithmic traders known as commodity-trading advisers [CTAs]. Parsing reams of data, they were a driving force in the early surge in bullish investor positioning. “The CTAs didn’t necessarily know why they were doing it — they were just doing it based on historical correlations and trends — but they happened to make the correct call.”

- Unlike larger precious-metals markets, exchange-traded products have never gained much traction in copper, but that’s changing rapidly. From a low base, net inflows into the WisdomTree Copper exchange-traded commodity fund, the largest of its kind, have surged $366 million this year, lifting assets under management to a record $841 million. The five largest industrial metals ETPs saw their biggest ever inflows in April.

- Commodity-index funds offer another way to invest in metals like copper, as well as energy and agricultural products, and inflows have been surging in recent months. Citigroup estimates show assets held in such funds rose about 8% to $249 billion in April, helping to lift overall assets under management in commodities products to a record high of $684 billion.

Conclusion

A junior mining company’s success is always predicated, to some extent, on how the metals the junior is exploring for are doing. Companies with the good fortune to be raising money and drilling during a bull market will always have an easier time than their counterparts exploring for minerals that happen to be out of favor.

Norden Crown’s Fredriksson Gruva deposit in Sweden has, in order of importance, zinc, lead and silver. Holdings in silver-backed ETFs last year hit a record 1 billion ounces. This year, it’s base metals’ chance to hog the limelight. Copper ETFs like the WisdomTree Copper fund are attracting record inflows. The five largest industrial metals exchange-traded products saw their biggest ever infusion in April.

Not only does Norden Crown have the wind at its back as far as its commodities focus, the company is working in one of the world’s best jurisdictions for mineral exploration.

Scandinavia is considered the most important mining district in the European Union, containing a variety of deposit types such as volcanogenic massive sulphides (Cu, Zn, Pb, Au, Ag), orogenic gold (Au), layered intrusions (Ni, PGE, Ti+V), as well as new kinds like iron oxide-copper-gold (IOCG) and shale-hosted Ni-Zn-Cu deposits.

In terms of ore and metal production, Sweden is currently Europe’s leading mining nation. The Scandinavian country accounts for 91% of the continent’s iron ore, as well as 9% of its copper and 24-39% of its lead, zinc, silver and gold.

Geologically, most of Sweden’s landmass is part of the Baltic Shield, which has the oldest rock in Europe and is a world-leading source of industrial metals such as iron, nickel, copper and platinum group elements. Due to its resemblance to the Canadian Shield and cratons in South Africa, the Baltic Shield is also a rich source of gold and diamonds.

The prosperity of Sweden’s mining industry goes hand-in-hand with the nation’s political stability, which has a solid legal system.

Mining operations are governed by the Swedish Minerals Act, which sets out a well-defined regulatory framework for exploration and mining permits. Exploration rights are valid for three years and can be extended for up to 15. Once a concession is granted, it is valid for 25 years, with a possible 10-year extension.

The short permitting process is a key advantage over many other mining jurisdictions. Where getting a drill permit can take years or even decades in some places, in Sweden it would be a matter of months.

Owing to its heavy investments in transportation infrastructure, Sweden boasts a rail network exceeding 15,000 km as well as more than 70 ports along its coastline. This, coupled with its extremely low electricity costs, presents another benefit for mining operations.

The nation is also known for innovation and green technologies. Three of the world’s leading mining equipment suppliers — Epiroc, Sandvik and ABB — are Swedish companies.

As base metals prices continue to attract investor interest, I’m keeping a close eye on juniors like Norden Crown, whose Fredriksson Gruva target, and its resemblance to a Broken Hill Type deposit, appears to have the scale, the grades and the consistency of mineralization to interest a major.

Norden Crown Metals

TSXV:NOCR, OTC:BORMF, Frankfurt:03E

Cdn$0.09 2021.05.11

Shares Outstanding 133m

Market cap Cdn$12.6m

NOCR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Norden Crown (TSX.V:NOCR). Norden is an advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.