Gold, silver, inflation and Quantifornication ‘out the wazoo’

2021.04.29

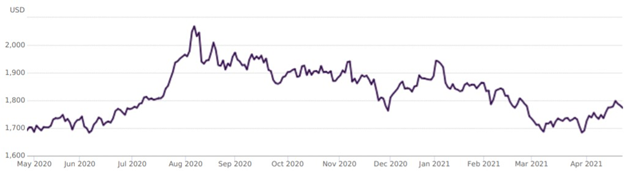

While precious metals have somewhat been subdued over recent weeks, there’s a storm brewing that could set gold, and by extension silver, on an upward trajectory once again.

First and foremost, bullion remains the go-to inflation hedge for investors. In light of renewed concerns about the pandemic and more money printing expected to inundate the markets, fears surrounding inflation have intensified.

In fact, a bond market gauge of US inflation expectations soared to the highest level in eight years this week, insinuating that another rally in gold is more likely than not.

Secondly, US Treasuries have begun to wane. As global Covid-19 cases continue to rise, more money has rotated into safe-haven bonds, prompting bond yields to drop. The greenback is also weakening, boosting the investment appeal of gold even further.

Then, there are the decision makers. Not only will more money printing – Quantifornication – by governments (i.e. the US) help to keep inflation expectations high, central banks around the globe are also starting to buy gold in massive amounts again.

China recently made headlines by opening up its borders to $8.5 billion worth of gold imports. Other governments are also joining the gold buying spree. India, another top gold consumer, just a record-breaking 160 tonnes in the month of March. This signals that asset demand for diversification purposes has picked up steam.

Moreover, we need to consider the possibility that mined supply of gold may not keep pace with demand. The latest World Gold Council report shows that there was a 4% decline in total gold supply in 2020, and this trend could continue as existing mines become more depleted.

All in all, these factors are pointing to another gold run in the making, and this would trickle down into the silver sector as it has in the past.

In this article, we take a look at some of the promising precious metals mining juniors that could well benefit from the next wave of gold storm, especially as supply becomes a focal point for major industry players as demand is showing no signs of backing down.

Magna Gold Corp. (TSXV: MGR, OTCQB: MGLQF)

One up-and-coming gold producer that we’ll definitely hear more about in the coming months is Magna Gold Corp. (TSXV: MGR, OTCQB: MGLQF).

Located 150 km north of Hermosillo, the state capital of the mineral-rich Sonora state, this 47,395-hectare property consists of two previously mined open pits — San Francisco and Chicharra — together with heap leach processing facilities and associated infrastructure.

The open pit mine first began commercial operations in 2010. Since then, it has produced over 820,000 ounces of gold, achieving yearly production of over 100,000 ounces on several occasions. Last year, the mine entered a period of residual leaching, during which it is expected to recover between 12,500 and 15,000 ounces of gold.

Recognizing that the San Francisco mine was one of the most successful mining operations in recent history in terms of economic performance and operational results, Magna decided to acquire the project in March 2020, and shortly after restarted mining and processing operations from the La Chicharra open pit.

Plans are also underway to resume open-pit mining in the San Francisco pit and initiate underground mining at the higher-grade lenses in the south wall of the pit.

In fall 2020, the company completed a pre-feasibility study (PFS) for the San Francisco mine, showing nearly 100 million tonnes of resources grading 0.446 g/t Au, for 1.43 million ounces of contained gold in the ground.

“We have close to 800,000 ounces of gold that we’re going to extract from the mine over the next seven years, at a rate of 70,000 ounces per year,” Magna’s chief executive Arturo Bonillas elaborated on his company’s production plans moving forward.

The Mexico-focused miner is currently optimizing the project and in the process of increasing the mineral reserves at the San Francisco mine. The goal is to establish an operation capable of producing around 100,000 ounces per year for 10 years, providing for an approximate 45% increase from production levels outlined in the PFS.

In addition to San Francisco, Magna holds a portfolio of high-quality gold and silver assets in Mexico’s historically productive regions. These include the exploration-stage Mercedes gold project, also in Sonora, where the company aims to begin mining in Q2 2021 and produce 20,000 ounces.

Other notable projects that will surely see more development in the coming months are the San Judas gold project, located 43 km away from the San Francisco mine, and the newly acquired Margarita silver project, where Magna is currently working on a feasibility study.

With numerous projects in its pipeline and still pursuing further growth opportunities in one of the world’s top mining jurisdictions, Magna is not just any gold-silver junior.

As it continues to ramp up production at the former San Francisco mine, we believe Magna is on the verge of achieving intermediate status and leading the next line of mid-tier precious metals producers in Mexico.

Dolly Varden Silver (TSXV: DV, OTC: DOLLF)

Silver, like gold, has picked up steam in recent months as a result of monetary drivers. Even better, industrial demand for silver is going to soar, which places the metal’s value in a prime spot to grow for years.

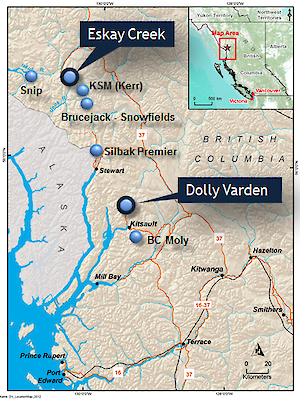

While mines with silver as a by-product are found across the world – there are only 75 pure silver ones – one particular area we have identified to be an emerging high-grade silver district is BC’s Golden Triangle, where mineral exploration company Dolly Varden Silver (TSXV: DV, OTC: DOLLF) is developing an 8,800-hectare project of the same name.

According to the company, the property hosts a robust high-grade mineral resource and is considered to be highly prospective for hosting further high-grade deposits, being on the same structural and stratigraphic belts that host numerous other renowned deposits such as Eskay Creek and Brucejack.

An NI 43-101 resource estimate completed by Dolly Varden in 2019 revealed 32.9 million ounces of silver in indicated resources, and 11.5 million more inferred, adjacent to the historical deposits. Exploration work that went into the resource estimation confirmed that the mineralization is similar to that mined at Eskay Creek and the one being developed at Pretium’s Valley of the Kings deposit (Brucejack mine).

The Dolly Varden property hosts as many as four historically active silver mines including Dolly Varden (1919-1921), which produced 1.3 million ounces at a grade of 1,109 g/t Ag, amongst the richest silver mines of the British Empire.

Then there’s the Torbrit mine (1949-1959), which produced 18 million ounces at a grade of 466.3 g/t Ag plus base metal credits. At one point, Torbrit was the 3rd largest silver producer in Canada.

But despite the long production history, Dolly Varden is still making new discoveries. Since 2017, the company has drilled over 66,000 metres in 213 holes.

Last year’s step-out drilling at Torbrit was highlighted by 351 g/t over 12.75m, including a higher-grade 1,083 g/t Ag intercept over 2.7m. The best infill drill hole featured 302 g/t Ag over 31.95m, including 642 g/t Ag over 4m.

Results released later on showed consistent intervals of high-grade silver mineralization to support what could be an economically attractive underground bulk-mining operation. It’s extremely rare for such a high-grade silver project to exist in Canada, offering investors diversification outside of Mexico and South American primary silver camps.

What’s more, Dolly Varden didn’t rule out a potential gold discovery either, pointing to the million-ounce-plus resource at the Homestake property nearby, so there’s more at play here than just silver.

So far, only 3% of the property has been explored by the company in detail, leaving plenty of upside for future growth.

Freegold Ventures Ltd. (TSX: FVL)

Next up is Freegold Ventures Ltd. (TSX: FVL), holder of an advanced-stage gold asset in Alaska, which has a long mining history and significant mineral resources that remain relatively underexplored to this day.

The company’s flagship project is Golden Summit, located just a 30-minute drive from the city of Fairbanks, within one of the richest placer gold districts in Alaska. Major Kinross Gold currently operates a large open pit mine (Fort Knox) nearby and has produced over 8 million ounces there to date.

Freegold considers Golden Summit to be a large bulk-tonnage gold project with significant room for expansion. As many as 80 gold occurrences have already been documented, with more than 6.75 million ounces of placer gold having been produced from the creeks draining the property.

Following an extensive drilling campaign during 2011-2013, the company was able to delineate a sizeable resource of 79.8 Mt at 0.66 g/t Au (1.68 Moz ounces) in the indicated category, plus more than 248 Mt at 0.61 g/t Au (4.84 Moz) in the inferred category.

A subsequent PEA in 2016 outlined a constrained open pit 24-year operation with peak annual gold production of 158,000 ounces and average annual gold production of 96,000 ounces.

While the bulk of the resource is hosted by the Dolphin intrusive, its extent is not yet known. Freegold believes this intrusive is likely the driver of high-grade mineralization found at the old Cleary Hill mine — the largest lode gold producer in the Fairbanks mining district. Recent drill programs by the company (2020-2021) have been designed to test that hypothesis and to advance the project through pre-feasibility.

Should that interpretation prove to be correct, then we’re looking at even more resources at higher grades than originally known, paving the way for another success story in a historically productive gold district.

Getchell Gold Corp. (CSE: GTCH, OTCQB: GGLDF)

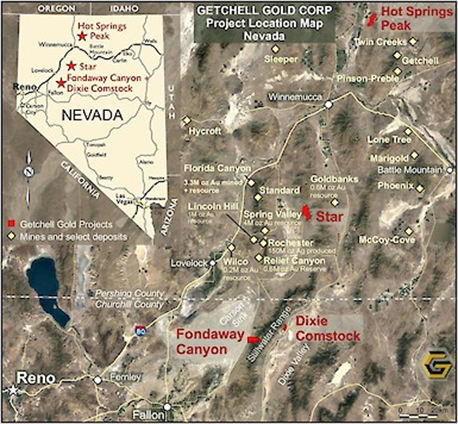

When we talk about world-class gold mining districts, Nevada is usually the first place that comes to mind. This US state is home to at least 23 major gold mines and ranks #4 in terms of worldwide gold production (5.5 Moz annually and 152 Moz produced in the last 30 years).

This is where Toronto-based junior Getchell Gold Corp. (CSE: GTCH, OTCQB: GGLDF) is looking to bring its Fondaway Canyon project in Churchill County back into production.

Fondaway Canyon is an advanced-stage project that has a history of previous surface exploration and mining in the late 1980s and early 1990s, as well as a sizable resource base. A technical report released in 2017 showed an estimated 409,000 oz of indicated resources grading 6.18 g/t Au and 660,000 oz inferred grading 6.4 g/t Au — for a combined 1.1 million oz.

Recent exploration has been focused on the Central Target Area, which Getchell believes is the “nexus for the gold mineralizing system observed at the project.”

So far, that claim has been backed up with promising drill results last year; all five holes drilled in the Central Area have returned gold intercepts, which included both new high-grade gold zones and broad mineralization.

“It’s not very often that every hole of an exploration drill program returns gold intersections as good as or better than anticipated,” Getchell president Mike Sieb stated at the time.

Recently, the company presented a new geological model based on the 2020 drilling, showing thick zones of gold mineralization as deep as 800m from the surface that remain open laterally and downdip.

According to Getchell, the new model has substantially expanded the previously modelled extents of the gold mineralization at Fondaway Canyon, boosting our confidence that this could be another significant gold mineralizing system found in Nevada.

Meanwhile in Pershing County, Nevada, the company is also advancing the formerly producing Star Point copper mine and the Star South prospect, providing investors with exposure to not only gold but also a foundational base metal of the global economy.

Renforth Resources Inc. (CSE: RFR, OTCQB: RFHRF, FSE: 9RR)

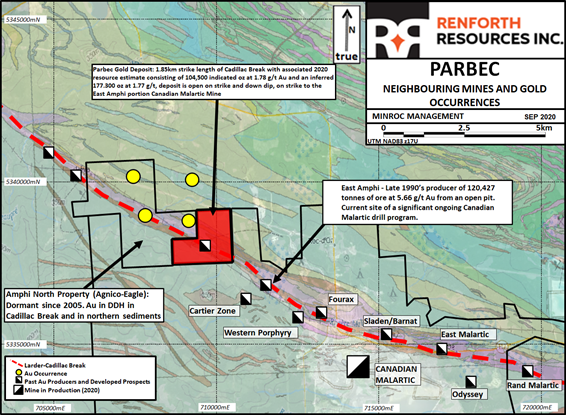

Another region rich in gold endowments is Québec’s Abitibi Gold Belt. This is the primary source of gold in Canada and home to numerous world-class gold deposits including the Canadian Malartic, Canada’s largest operating open-pit gold mine.

Neighbouring the Canadian Malartic and sitting on 1.8 km of the Cadillac Break is the Parbec project currently being developed by Renforth Resources Inc. (CSE: RFR, OTCQB: RFHRF, FSE: 9RR). Since fall 2020, the company has completed over 15,000 meters of drilling on the property, and the results have all returned gold values of interest, indicating there are much larger resources than previously shown.

Prior to recent drilling, an open-pit constrained resource estimate was prepared for the Parbec project (May 2020), showing 104,500 oz gold in the indicated category and 177,300 oz gold in the inferred category.

A new resource estimate is expected this year, which will surely be worth anticipating.

Aside from Parbec, the company is also developing the brownfield Surimeau District property, which hosts gold, nickel, copper, zinc and other metals in various settings at several locations on the large property. Current exploration focus is on a nickel-rich VMS target that has been explored historically.

What makes Surimeau intriguing is that unlike many copper-zinc VMS projects around the world, this property also happens to host an ultramafic sulfide nickel system at surface nearby, which Renforth believes to be a widespread nickel sulfide mineralization. Such a discovery would be significant considering the rising demand for high-purity nickel used in electric vehicle batteries.

Max Resource Corp (TSXV:MXR, OTC:MXROF, Frankfurt: M1D2)

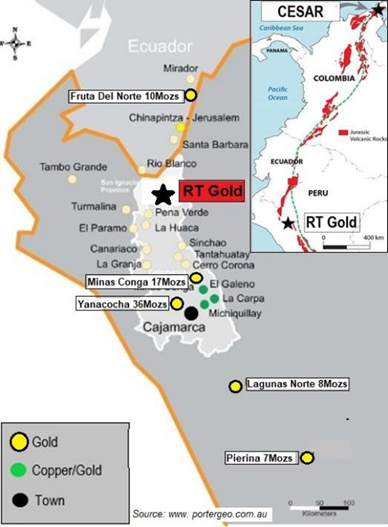

In northeastern Colombia, there exists a massive sedimentary system along the Andean Belt covering hundreds of kilometers of highly prospective copper-silver mineralization. This is where we find Max Resource Corp (TSXV: MXR, OTC: MXROF, Frankfurt: M1D2) and its CESAR project, which covers a district-scale size of over 2,500 km2.

As the first company to explore the copper and silver-rich areas covered by the CESAR property, Max has already identified multiple target zones (CESAR North, CESAR South, and CESAR West), all of which host significant discoveries with potential to expand even further.

What is more compelling about the CESAR project is that it bears a striking resemblance in terms of grade, scale, and mineralogy to the world-class Kupferschiefer deposits found in Poland, which are the #1 silver producer in the world and the largest source of copper in Europe.

However, the main difference between the Kupferschiefer and CESAR deposits is that the Kupferschiefer orebody starts at 500 m below surface, while CESAR’s copper-silver mineralization starts at surface, giving the latter an upper hand.

To this day, the company continues to make new copper-silver discoveries along this large sedimentary system and expand the surface “Kupferschiefer-style” mineralization at CESAR.

Max believes they’re looking at a potential district-scale, and perhaps even regionally extensive, mineralized system, and we tend to agree.

To demonstrate that potential, the junior miner has secured multiple non-disclosure agreements to advance the project, including a collaboration agreement with an industry-leading copper producer.

Max is also exploring the RT Gold property in northern Peru. The project consists of two contiguous mineral concessions covering 1,983 hectares and sits along the Condor mountain chain, forming the geological belt that hosts world-class deposits such as Fruta Del Norte and Yanacocha.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Magna Gold Corp. (TSXV: MGR, OTCQB: MGLQF). MGR is a paid advertiser on his site aheadoftheherd.com

Richard does not own shares of Dolly Varden Silver Corp. (TSX:DV OTC:DOLLF). DV is a paid advertiser on his site aheadoftheherd.com

Richard Mills own shares of Freegold Ventures (TSX.V:FVL).

Richard owns shares of Getchell Gold (CSE:GTCH). GTCH is a paid advertiser on his site aheadoftheherd.com

Richard does not own shares of Renforth Resources (CSE:RFR). RFR is an advertiser on his site aheadoftheherd.com

Richard owns shares of Max Resources (TSX.V:MXR). MXR is an advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.