Uncategorized

December 29, 2021

2021.12.29 CRESCAT CAPITAL Normally, as part of the creative destruction process in economic […]

December 20, 2021

2021.12.20 虽然2021年在很大程度上对黄金来说是乏善可陈的一年,但随着我们进入新的一年,贵金属的潮流可能正在转变。 本周,尽管美联储(Federal Reserve)如一些人所预期的那样表示将提前结束大规模刺激计划,但金价保持强劲,这表明其通胀目标已经实现,加息步伐将加快。 市场人士一直认为,更高的利率可以通过增加高收益投资的吸引力来压低金价。美联储周三宣布后黄金的初始表现似乎就是如此。 然而,该黄色金属最终抵消了损失,甚至反弹得更高,因为市场一直预期央行会采取更鹰派的举动。 与美联储声明同时发布的预测显示,官员们预计明年将适当上调3/4个百分点。去年3月,在新冠疫情爆发期间,美国央行全面降息1个百分点,而在采取紧急行动后,一直保持基准利率稳定。 考虑到所有因素,一些人实际上认为这是促使黄金在2021年强劲收尾的动力。 TD Securities 大宗商品策略全球主管巴特·梅莱克(Bart Melek)向彭博社解释道:“黄金市场从最初的下跌中恢复,因为美联储似乎只比市场定价稍微强硬。”。 Melek […]

December 11, 2021

2021.12.11 Dolly Varden Silver Corp. (TSXV: DV) (OTC: DOLLF) 位于一个以其丰富的黄金资源而闻名的地区,作为一家探索不列颠哥伦比亚省金三角的纯银矿商,其地位得天独厚。 该公司的旗舰和同名项目拥有多达四座历史上活跃的银矿,其中包括两座在1919年至1959年间曾产出过2000万盎司白银的矿床。 勘探重点目前是扩大 Torbrit […]

November 29, 2021

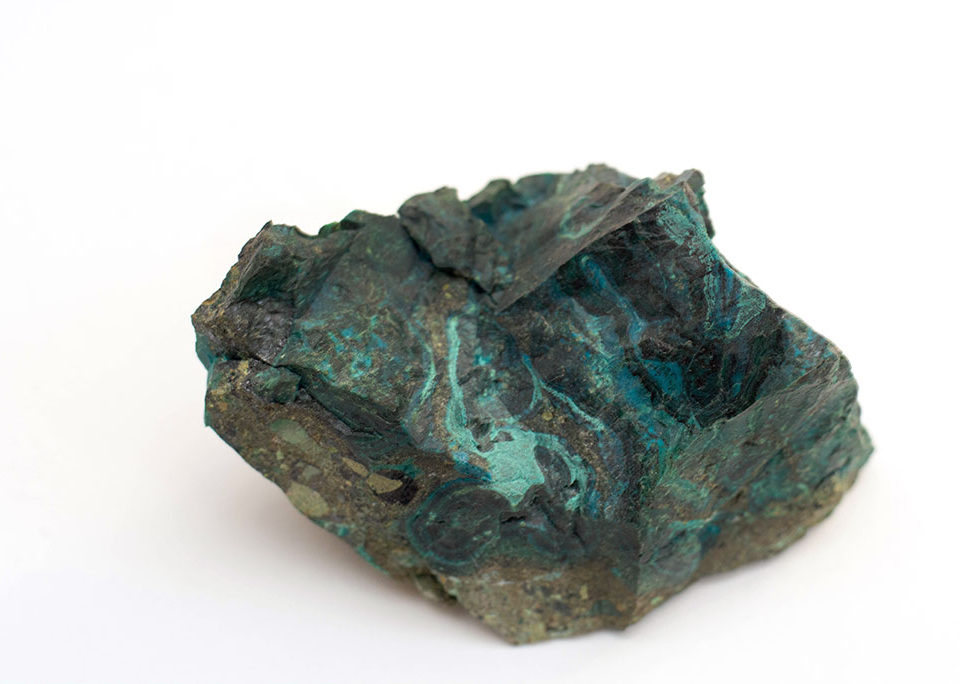

2021.11.29 铜广泛用于建筑、发电和输电,使其成为民用基础设施更新的关键金属。 Roskill 预测,在人口和GDP增长、城市化和电力需求的推动下,到2035年世界铜消费总量将超过4300万吨。 这十年,随着全球对汽车电气化的推动,对铜的需求即将起飞,因为典型的电动汽车 (EV) 使用的金属大约是普通内燃机 (ICE) 汽车的四倍。 咨询公司 AlixPartners 估计,目前仅占全球汽车总销量2%的电动汽车到2030年将占总销量的24%。据预测,到2025年,对电动汽车的投资总额可能达到3300亿美元。 为了在2030年使美国新车总数的一半成为电动汽车,总统拜登已经呼吁政府支出1740亿美元来推动电动汽车的发展,其中包括1000亿美元的消费者激励措施。 […]

November 22, 2021

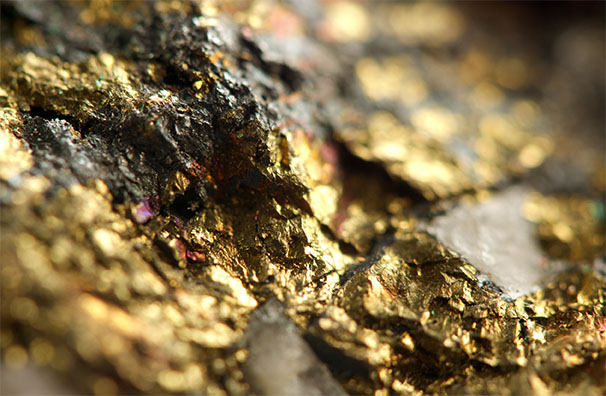

2021.11.22 黄金项目最有希望的迹象是,一个大型钻探项目立即产生了卓越的成绩,从最初的几个钻孔收获重大的分析结果,以支持未来的资源扩张。 这正是 Goldshore Resources Inc.(TSXV:GSHR)(OTC:GSHRF)(FRA:8X00)在其位于安大略省西北部的旗舰 Moss Lake 黄金项目中所发生的情况,该项目于今年早些时候由中端黄金生产商 Wesdome 接管。 该公司目前正在该地开展10万米的大规模钻探计划,该计划将持续约一年,直至2022年年中。 到目前为止,钻探的结果没有令人失望,这让我们对一个历史上高产金矿区内的重要矿化系统有了一个大致的了解。 […]

November 11, 2021

2021.11.11 悄悄地,黄金市场已经历了一段复苏期,由于通胀压力不断累积,黄金市场最近攀升至2个月以来的最高水平。 美国最新就业和工资数据等经济指标几乎没有改变决策者的观点。美联储仍然认为这一通胀是暂时的,因此不会加速加息。英格兰银行似乎也在效仿。 但许多分析师不敢苟同。一些人甚至认为,央行已经失去了对通胀的控制,让市场暂时自生自灭。 这是因为自9月份以来,投资者愿意买入更多黄金作为对冲工具,过去几周黄金价格的走势就是明证。 据密切关注形势的人士称,黄金仍有上涨空间,一旦通胀最终开始,黄金将被视为一种“创造价值”的机会。 此外,黄金开采公司也会升值;它们很可能是2020年等另一轮涨势的最大受益者。 最近,矿业界两位最大的人物预测,投资者很快就会意识到,全球通胀压力远比预期的更大,这可能导致金价升至3000美元/盎司 虽然当今有大量的初级矿业公司持有黄金项目,但我们(AOTH)已将目光投向了那些仅位于世界顶级黄金开采管辖区内、具有高增长优势的项目。 新兴安大略黄金公司 当我们提起世界上最大的黄金猎场时,很难忽视加拿大的安大略省。 该省至少有20个矿山在运营,每年生产超过73000盎司黄金,是全国最多的。它所有地区的金矿开采都很活跃,包括Timmins、Red Lake […]

October 30, 2021

2021.10.30 黄金价格最近反弹到1800美元/盎司的关键位置 — 创下一个多月来的新高 — 建立于比央行试图描述的更令人担忧的通货膨胀所导致的市场恐惧势头。 最近,AOTH就全球物价上涨的现象发表了观点,并认为我们目前经历的通货膨胀不会是美联储多次强调的那样仅仅是“暂时的”。 有鉴于此,考虑到黄金作为”避风港“的传统作用及其在高国债时期的历史表现,我们相信持有黄金(在一定程度上还有白银)可以作为通胀失控的保险。 通货膨胀压力 从今年黄金的表现来看,人们可能不会认为这个市场仍然处于看涨状态。 但若深入研究今年的全球经济趋势,我们可以看到为什么大多数人对贵金属保持着平静的信心。 在过去的几周里,我们看到了从铝到天然气的大宗商品价格如何飙升至几十年来的最高点(在某些情况下甚至创下历史新高),因为供应链继续受到新冠疫情余震的冲击。 尽管黄金在这段时间内基本上保持停滞,但全球通胀压力不断上升的警告信号已经足够多,这将导致越来越多的投资者开始购买黄金作为保护措施。 […]

October 25, 2021

2021.10.25 Pampa Metals Corp. (CSE: PM) (FSE: FIRA) (OTCQX: PMMCF) 在智利阿塔卡马地区矿产丰富的地带寻找斑岩发现的过程中继续取得重大进展。 本周,这家初级矿工提供了有关其 Block […]

October 14, 2021

2021.10.14 在过去的一周里,几宗涉及锂公司的重大交易成为采矿业的头条新闻。 然而这应该不足为奇。自年初以来,电池金属一直呈上升趋势。继第三季度初第二次反弹后,锂价格已飙升至2018年以来的最高水平。 在全球排名第一的电动汽车市场中国,碳酸锂价格在过去一年中上涨了近五倍,并接近历史高位。 由于供应紧张和电池需求稳定,该原料的价格在10月份保持在每吨16.5万元(约合2.5万美元)左右,距离9月下旬创下的17.7万元的历史高点不远。 根据世界领先的电池供应链研究机构和价格报告机构基准矿产情报公司(BMI)追踪的价格指数(包括碳酸锂和氢氧化锂),今年迄今为止,锂价格上涨了惊人的160%。 此次涨势正值全球推动减少污染的能源之际,汽车制造商和电池制造商竞相确保锂等所谓“面向未来的商品”的供应。 中国锂购热潮 这一现象在中国显而易见。国内的众多企业近期一直在积极地寻求获得电池材料的交易,以在全球电动汽车供应链中确立主导地位。 中国第一电池制造商宁德时代(CATL)最近以高于赣峰锂业的报价成功收购了加拿大矿业公司 Millennial Lithium Corp. […]

September 30, 2021

2021.09.30 自2020年以来,铜一直是大宗商品市场的最大赢家之一。 这种红色、闪亮的工业金属不仅是我们经济增长的重要组成部分,而且对于全球向可持续能源过渡也是必不可少的。 作为世界上最大的消费国,中国已将减少碳排放作为优先事项,目标是到2030年将其碳强度(单位GDP的排放量)比2005年的水平降低65%以上。到2060年,它希望完全中和碳排放。 在美国,拜登政府设定的目标是到2035年实现100%无碳污染电力,然后到2050年实现碳中和。美国的气候计划还将要求电动汽车在2030年至少占国家新汽车销量的一半。 由于在电动汽车的制造过程中铜是必不可少的(实际上,它使用的铜是普通汽车的4倍),因此全球对铜的需求以前所未有的速度增长,并且没有放缓的迹象。 与此同时,在所有可再生能源技术中,风能和太阳能光伏发电系统的铜含量最高,这使得铜在实现我们的气候目标方面变得更加重要。 据铜业联盟 (Copper Alliance) 称,风力涡轮机每兆瓦需要2.5-6.4吨铜用于发电机、电缆和变压器。光伏太阳能发电系统每兆瓦使用约5.5吨铜。 惠誉(Fitch Solutions)的研究表明,到2030年,电力和可再生能源行业以及汽车行业的“绿色需求”将分别占铜总需求的7.9%。 […]

September 18, 2021

September 17, 2021 说到铜矿开采,世界上没有比智利更好的地方了。 该南美国家是迄今为止世界上最大的铜生产国,也是黄金和其他矿产的重要生产地。 全球五大铜矿区中有三个位于阿塔卡马沙漠(Atacama Desert)北部,那里有世界级的富铜矿带和世界上最大的铜矿。目前世界排名前十的铜矿(按产量计算)有四个位于智利。 尽管新冠疫情造成了动荡的一年,智利在2020年仍成功生产了570万吨铜,占全球产量的四分之一以上。其铜产量是世界第二大铜生产国秘鲁的两倍多。 主要为铜矿开采的副产品,精炼黄金的产量也达到了140万盎司。 智利目前是大型和中型矿业公司寻找大型铜矿的理想场所。该国家拥有全球最大的铜储量(2亿吨),因此它的主导地位不会轻易减弱。 智利拥有悠久的采矿历史,早于西班牙殖民时代。在西班牙人到来之前,印加人在智利北部开采砂金。除了黄金,土著人还开采本土铜,生产铜首饰和武器。铜在智利的使用可以追溯到公元前500年。 黄金、白银和铜在18世纪直接被出口到西班牙。在1811年和1825年发现银矿之后,人们开始对拉塞雷纳(La Serena)以北的北奇科(North […]

September 11, 2021

2021.09.11 在对其位于魁北克的 La Loutre 石墨项目进行初步经济评估(PEA)并取得卓越的结果后,Lomiko Metals Inc.(TSXV:LMR)(OTC:LMRMF)(FSE:DH8C)上个月宣布公司聘请了 Ausenco Engineering Inc. 全资子公司 Hemmera 来完成项目的环境基线研究。 […]

September 2, 2021

2021.09.02 在世界两大经济体之间日益紧张的贸易关系的最新插曲中,出于对强迫劳动的担忧,美国现在正式禁止从中国进口太阳能电池板。 此举的影响可能是巨大的;太阳能是目前美国增长最快的新发电来源。 美国能源部最新简报指出,太阳能占当今全国发电量的3%,而拜登政府希望到2035年将这一比例提高到40%以上。 然而,太阳能电池板的生产由中国主导。最新的进口禁令可能对将可再生能源引入美国家庭构成新的挑战。 经过与多家电力公司的讨论,Roth Capital Partners太阳能行业分析师Philip Shen报告道美国边境最近扣留了一家制造商生产的电池板,该制造商生产的电池板能够产生约100兆瓦的电力,每年足以为约29000户家庭供电。 将所有受影响的制造商加起来,我们会看到许多计划中的太阳能项目将受到严重影响,这可能会彻底破坏拜登政府的气候计划。 太阳能电池板用银 鉴于美国政府决定将人权议程置于气候目标之上,这可能迫使政府寻求替代方案,包括支持国内生产。这对美国(和加拿大)那些能够提供制造太阳能电池板所需关键成分的产商来说是个好兆头。 约占太阳能电池板总成本的6%,白银是重要的原材料之一。该贵金属具有很高的导电性,易于采用成本效益高的丝网印刷工艺,是太阳能光伏电池的关键部件。平均约2平方米的面板可使用高达20克的银。 […]

August 28, 2021

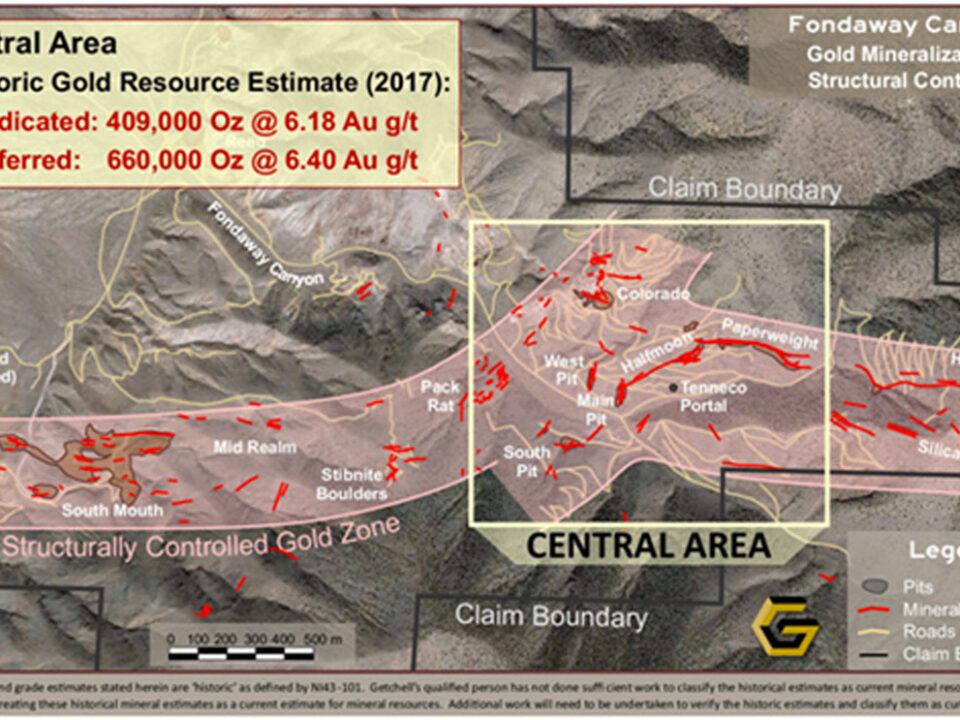

2021.08.28 Getchell Gold Corp. (CSE: GTCH) (OTCQB: GGLDF) 继续在位于内华达州的旗舰Fondaway Canyon项目中获得绝佳的钻探结果,为其扩大2020年发现的高品位金矿化的目标迈向关键的一步。 本月早些时候,该公司公布的2021计划的第一个钻孔(FCG21-07)取得了令人印象深刻的结果。该钻孔在33米的不间断矿化中返回了3.0克/吨金,包括4.6米以上的7.8克/吨金层段。 而在本周,该公司宣布了第二个钻孔(FCG21-08)并得到了的更好的化验结果。该钻孔来自同一个井场,旨在进一步确定了Colorado西南延伸带。 Colorado西南部最好的钻孔 […]

August 19, 2021

2021.08.19 阿拉斯加长期以来一直被列为世界上最好的金矿开采区之一,也是美国境内较大的黄金生产地。 该州丰富的采矿历史可追溯到19世纪中期,当时俄罗斯探险家首次在基奈河发现砂金,引发了断断续续的黄金发现。直到1867年所有权转让给美国,美国探矿者才得以北上,正式开启了持续了半个世纪的淘金热。 如今,几乎所有目前在美国运营的大型和小型砂金矿都位于阿拉斯加。该州目前拥有多达五座大型硬岩金矿,包括诺克斯堡(Kinross)、波戈(Northern Star)和肯辛顿(Coeur Mining)。 尽管过去阿拉斯加各地都在开采黄金,但费尔班克斯 (Fairbanks)、朱诺 (Juneau) 和诺姆 (Nome) 周围的地区目前主导着该州的黄金开采业。 在费尔班克斯附近,一家持有大量未开发黄金资源的初级矿业公司是Freegold […]

August 12, 2021

2021.08.12 随着其位于内华达州的旗舰Fondaway Canyon项目钻探工作的进展,Getchell Gold Corp.(CSE:GTCH)(OTCQB:GGLDF)现已收到2021年钻探计划第一个钻孔的化验报告。 结果当然也没有让人失望,并进一步证实了该公司关于Fondaway在世界排名第一的采矿区存在重要金矿化系统的假设。 钻孔结果 2021年计划的第一个钻孔 (FCG21-07) 是从Colorado矿坑向西南方向钻的(参见下图)。 FCG21-07与在2020年钻孔计划中的两个孔(FCG20-02和FCG20-03)是从同一个井场钻取的。当时在FCG20-02和FCG20-03中遇到的黄金截获物分别为1.9克/吨(超过43.5米)和2.0克/吨(超过49.0米),彼此相距75米。 FCG21-07在这两个2020黄金截流之间钻孔,以建立Colorado西南延伸带在这一宽距离上的横向连续性。它与比相邻钻孔品位更高的金矿层段相交,在33.0米的不间断矿化中,金品位为3.0克/吨,包括4.6米以上,金品位为7.8克/吨的层段。 这成为了连续第六个与Fondaway […]

August 5, 2021

2021.08.05 在创下每盎司2075.47美元的历史新高近一年后,黄金价格现已回落至2020年初的水平。 几个月来,投资者逐渐远离黄金等避险资产,期望经济能够从这场疫情中完全复苏,央行最终会收紧政策。 然而,这些投资者可能需要重新考虑。 首先,不断增加的新冠病毒疫情仍可能使我们对经济复苏的希望破灭,特别是在新的Delta变异病毒肆虐的情况下。其次,我们还没有感受到央行维持经济运行的货币和财政政策的长期损害。 在最近接受彭博社采访时,Quadiga Igneo基金经理迭戈·帕里利亚(Diego Parrilla)提到,“人为低利率造成了太大而无法破裂的资产泡沫”;这将使央行很难在不冒崩溃风险的情况下实现正常化。 这在某种程度上得到了美联储鸽派消息的证实。上周,美联储主席杰罗姆·鲍威尔(Jerome Powell)坚称,尽管对经济持乐观态度,但“远未考虑加息”,这给那些指望美联储开始逐渐减少其货币支持的人泼了一盆冷水。 “就速度而言,逐渐变细的过程将是缓慢的,”帕里拉说。他曾在2016年正确预测了黄金将在5年内攀升至历史最高水平。 “我认为,推动黄金走强的因素不仅依然存在,而且实际上已经得到加强,”这位来自马德里的基金经理强调,并补充称,在未来3-5年的复苏过程中,他甚至可能看到黄金价格达到每盎司3000-5000美元。 正如世界黄金协会(World […]

August 3, 2021

2021.08.03 在恢复勘探活动近两个月后,ZincX资源公司(TSXV:ZNX)本周宣布其2021年钻探计划圆满结束,目标为位于BC省Akie项目的Cardial Creek锌矿床。 然而,公司在计划的结尾却迎来了一个惊喜。更新的预算和比预期更快的钻井速度使ZincX能够在原钻井计划的基础上完成另外两个共达850米的钻孔,而原先的钻井计划只包含了三个钻孔。 因此,在先前宣布的两个钻孔的基础上,公司本月后半段又完成了三个钻孔,使该项目扩展到了五个钻孔,共达2670米。 钻井更新 在最新公告中,ZincX宣布2021年钻探计划的第三个钻孔已顺利完成,并达到了预期的深度。 该钻孔(A-21-157)针对高品位岩心的东南部区域,周围有历史钻孔A-05-33、A-06-40和A-13-105。 该区域的钻探结果包括A-05-33中13.77米(真实宽度)的10.54%锌+铅和16.01克/吨银,以及A-06-40中10.36米(真实宽度)的8.52%锌+铅和11.55克/吨银。 钻孔A-21-157在369.10米的深度处与Cardiac Creek区相交,该区域继续与狭窄页岩层互层,井下深度为409.63米;总表观宽度为22.65米。 该区域的特点是有丰富的硫化物层,与黑色页岩的狭窄层段互层。这些硫化物矿层的特征是丰富的灰色闪锌矿层理和次级暗棕色细粒层间黄铁矿。富含闪锌矿的硫化物矿层在某些地方接近一米厚。 典型的“斑驳”结构在整个区域内较弱,但在闪锌矿占优势的岩层内局部强烈发育。矿化带以黑色页岩中丰富的层状至球状层状重晶石结束。 […]

July 23, 2021

Mountain Boy Minerals Ltd. (TSXV: MTB) (OTCQB: MBYMF) (Frankfurt: M9U) 备受期待的位于不列颠哥伦比亚省的American Creek旗舰项目钻探计划在近日即将展开。

该公司本周宣布,详细的结构测绘以及地下测绘和采样目前已在进行中。钻探工作将很快进行,预计将在本月底之前开启。

July 17, 2021

2021.07.17 在采矿业中,新的发现往往都会得到各大企业的关注,但真正引起投资者注意的是该矿物体的规模。 远在哥伦比亚东北部未经开发的地区,矿业公司Max Resource Corp. (TSX.V: MXR; OTC: MXROF; Frankfurt: M1D2) 目前持有一个有望成为大型地区规模的铜银矿项目。 近几个月来,公司在不断的扩大其CESAR项目的开发区域,并证实了它可与世界上最好的沉积物承载系统相媲美的假设。 […]

July 6, 2021

2021.06.28 随着各国陆续为其人口接种新冠疫苗,并且由于较早的封锁、旅行限制和社会疏远而导致的感染率下降,全球经济正在缓慢的复苏,从而刺激了对汽车、电子产品、服装和城市更新基础设施(例如新的道路、桥梁和水系统)的需求。 鉴于大规模的联邦刺激措施和病毒的减弱,美国经济正处于升温状态,从而导致对商品和服务的需求超过了公司的供应能力。 再加上与病毒相关的供应链瓶颈,包括一些行业的劳动力短缺导致工资上涨,美国的通胀率创下了13年来最大增幅 (+5%)。 作为世界第二大经济体和最大的大宗商品消费国,中国相对毫发无损地走出了疫情。 5月份工业生产飙升6.6%,第一季度GDP则惊人的增长了18.3%;这是自1992年中国开始保持季度记录以来的最高增幅。 这就解释了为什么工业金属的价格会出现如此惊人的波动,特别是考虑到铜和锌等一些金属正面临短缺,这也是我们AOTH多年来一直在讨论的问题。 如下图所示,铜、银、锌、铅、镍、铝和钯在过去一年都出现了大幅上涨。 工业金属 工业金属在地壳中相对常见,比贵金属更便宜、更容易开采。 然而,尽管铜和镍的价格低于银和金,但工业金属由于其许多用途在世界经济中发挥着极其重要的作用。 铜被用建筑、交通和电信等众多行业,是经济增长的领先指标。它预测未来经济状况的能力使它获得了“经济学博士”的称号,因此有了“铜博士”的绰号。 […]

June 24, 2021

2021.06.24 At Freegold Ventures’ (TSX:FVL) flagship Golden Summit property in Alaska, a drill […]

June 24, 2021

2021.06.24 Following an earlier update on the company’s exploration plans in the prolific […]

June 24, 2021

2021.06.24 Zinc prices may have softened after hitting a 3-year high in May, […]

June 23, 2021

2021.06.22 After decades of neglect, allowing China to monopolize world graphite production, the […]

June 19, 2021

The lithium-ion battery has evolved over the years, incorporating new chemistries for different applications and increased performance.

June 19, 2021

The auto industry is bleeding from a dearth of semiconductors, used for example in heads-up displays, sensors, cell phone integration, and to enhance engine performance.

June 17, 2021

June 17, 2021 随着夏季勘探季节的临近,Dolly Varden Silver Corp. (TSXV:DV)(OTC:DOLLF) 本月早些时候宣布已开始对该公司位于不列颠哥伦比亚省西北部潮水附近的同名白银项目进行实地活动。 2021年勘探计划 今年的勘探是一个为期两年的计划的第一阶段,主要目标是积极扩大和升级托布里特 (Torbrit)银矿床和多个富银卫星区,最终把该项目推进成为BC省的下一个高品位银矿。 此外,公司的地质团队已在整个地区发掘出多个具有前景的目标。除了为地下通道和勘探工作做准备的道路和场地升级之外,公司还设想了一个 […]

June 15, 2021

2021.05.09 麦格纳黄金 (Magna Gold) (TSXV:MGR, OTCQB: MGLQF) 本周对其收购墨西哥的San Francisco金矿的计划进行了最后的修改。 为了将San Francisco重建成一个盈利的矿山,麦格纳在2020年春天同意以公司近20%的股本收购这个位于索诺拉州的项目,并在12个月后支付现金。 本周五,公司宣布成了收购协议的后半部分,即向供应商Argonaut Gold(TSX:AR) […]

June 10, 2021

May 12, 2021 伴随着近几年的大麻股、比特币、科技股,到2020年的黄金和白银的投资热潮,基本金属一直遭受着投资者们的忽视。而如今由于铜、铁矿石、锌和铅的价格的不断上涨,资本也逐渐开始涌向了基本金属。 下面的图表说明了一切。中国是全球最大的大宗商品消费国,其需求火爆,加上近年来国家关闭了一些锌矿等供应紧张因素,这些金属正在蓬勃发展。 铜也是如此; 该金属大部分来源于南美洲,而为了防止冠状病毒在的传播,那里的许多铜矿在去年被迫关闭。 初级矿业公司历来是大宗商品价格上涨的最佳杠杆。而在支持矿业的管辖区拥有优质贱金属矿床的企业将从中受益。 弗雷德里克森矿 Norden Crown (诺登皇冠金属公司) (TSXV:NOCR,OTC:NOCRF,Frankfurt:03E) […]

June 8, 2021

2021.05.09 多利瓦尔登公司(Dolly Varden) (TSX.V:DV, OTC:DOLLF) 旗下的白银资产由两个过去生产的银矿床Dolly Varden和Torbrit组成。它们曾是不列颠哥伦比亚省(或卑诗省)悠久的采矿历史的一部分,在1919至1959年间产出2000万盎司白银,测定出每吨矿石的白银含量高达2200盎司(超过72千克)。 实际上,Dolly Varden/North Star矿曾经是大英帝国最富的银矿之一,在 1919 年至 1921 […]

June 5, 2021

2021.05.25 现货银在2020年8月跃升至每盎司28.32美元,创下了七年来的最佳表现。尽管价格在去年秋天有所回落,但今年全年仍上涨了47%,比黄金22%的涨幅翻了一番还多。 而在一月下旬,自网友们在Reddit的WallStreetBets论坛发贴触发买入通知后,白银价格再一次上涨。在一系列的购买中,白银价格一度冲破了28美元,并曾触及31美元,然后回落。自3月份以来,这种白色金属的交易价格一直在26美元至28美元之间的一个相当窄的区间内浮动。 然而,由于货币和工业需求的强劲驱动,白银市场的前景极其乐观。 根据白银协会(Silver Institute)发布的2021年世界白银调查报告,今年全球白银需求量预计将超过供应量7%(供应量增加8%,需求量增加15%)。 全球需求将由对工业和投资级实物白银的投资主导。这是全球经济复苏的结果,也是基于2020年良好的硬币和银条购买量。因此,白银协会预计今年的白银价格将大幅上涨至33% 事实上,通过分析市场的供给和需求,我们可以进一步理解对白银的乐观叙述。在这样做的同时,我们更有信心称之为采银业的巅峰。 采银业的巅峰 大多数读者和投资者应该对峰值资源的概念有所耳闻;它所指的是产量年复一年不再增长的那一点。该资源在这一点达到一个巅峰,随即下降。 注意,我们并没有说“白银的巅峰”。在AOTH,我们区分了总银供应量(即回收银与开采银的结块)和矿山供应量。 在计算银需求与供应的真实情况时,我们不计算银回收(大多数回收银是工业级的)。我们更想知道的并真正关心的是每年开采的银的供应量是否满足每年对银的需求。而答案明显是没有! 举例说明: […]

May 25, 2021

The US Federal Reserve is insisting that recent increases in the price of food, construction materials, used cars, personal health products, gasoline, and appliances reflect transitory factors that will quickly fade with post-pandemic normalization. But what if they are a harbinger, not a "noisy" deviation?

May 15, 2021

2021.05.15 加密货币市场的增长在2021年丝毫没有缓慢的迹象。 尽管比特币的价格在最近几周停滞不前,但随着更多资金涌入类似的投资产品,其他数字货币仍在飙升至新高,并有望能获得与四年前加密热潮类似的巨额收益。 全球十大加密货币中已有五种在过去一周创下了新高。 截至周一午夜,全球加密市场的市值创下了略高于2.5万亿美元的纪录。尽管占市场近一半的比特币下跌了1%,但整个市场的价值在此期间仍然增加了超过2000亿美元。 以太坊打破纪录 其中最大的赢家是以太币,是仅次于比特币的全球第二大加密货币。以太币在本周一突破了4000美元的关口,创下新高。 作为以太坊区块链的数字代币,以太币最近出现了抛物线式上涨,随着更多的投资者在寻求从比特币以外的加密货币获中得更大的回报。自4月初以来,以太币的市值已经上涨了40%,而这期间以太坊的市值增加了1300亿美元。 包括摩根大通(JPMorgan)在内的专家将以太坊的优势归因于机构和零售交易人士对其日益增长的兴趣。比特币的支持者认为它是一种类似黄金的价值存储,而以太坊则不同于比特币;以太坊是一种分散式互联网的基础设施,而不是由中央当局维护。 它构成了当今流行的“去中心化金融” (DeFi,或Decentralized Finance)加密趋势的基础;DeFi所指的是一种促进传统银行机构之外借贷的点对点平台。 欧盟贷款机构欧洲投资银行(European […]

April 29, 2021

2021.04.29 Freegold – part 1 Freegold – part 2 Richard (Rick) Millsaheadoftheherd.comsubscribe to […]

April 23, 2021

温哥华矿业公司Max Resource Corp. (TSXV:MXR) (OTC:MXROF) (Frankfurt: M1D2) 在今年位于哥伦比亚的CESAR项目勘探中再次证实了该矿的巨大开发潜力,进一步确立了该项目应属于一个地区规模的沉积物构造的铜银矿系统。

April 17, 2021

By David Duval As with other base metals, zinc prices were impacted negatively […]

November 14, 2020

2020.11.14 With the winter season looming, Mountain Boy Minerals Ltd. (TSX.V: MTB) has […]

November 12, 2020

2020.11.12 In mature brownfield exploration, where a junior resource company is working on […]

November 10, 2020

2020.11.10 Identifying the opportunity in an undervalued project is where that “sweet spot” […]

November 7, 2020

2020.11.07 Das von Max Resource Corp. (TSX-V:MXR, OTC:MXROF, FWB:M1D1) betriebene Projekt CESAR im […]

October 31, 2020

2020.10.31 Max Resource Corp’s (TSX-V:MXR, OTC:MXROF, FSE:M1D1) CESAR project in northeastern Colombia lies at the […]

October 30, 2020

2020.10.30 Shortly after expanding its exploration focus towards Australia with the purchase of […]

October 29, 2020

2020.10.29 Mining is a relatively straightforward business: any producing asset has a limited […]

October 17, 2020

2020.10.17 British Columbia’s Premier Mine opened in 1918 and was the largest gold […]

October 16, 2020

2020.10.16 Ever since Newmont’s discovery of the large Carlin deposit in the 1960s, […]

October 14, 2020

2020.10.14 Last week we reported that Sentinel Resources has staked and acquired eight […]

October 9, 2020

2020.10.09 Fresh off its recent “rebranding” into a gold miner, K9 Gold Corp. […]

October 8, 2020

2020.10.08 This year’s gold’s bull has resulted in hundreds of juniors flocking to […]

October 6, 2020

2020.10.06 When it comes to gold mining jurisdictions in Canada, the Abitibi Greenstone […]

October 5, 2020

2020.10.05 Max Resource Corp. (TSX.V:MXR, OTC:MXROF, Frankfurt:M1D1) continues to expand the surface mineralization […]

October 2, 2020

2020.10.02 Sentinel Resources (CSE:SNL, US OTC PINK:SNLRF) has already acquired a silver-gold project […]

September 30, 2020

2020.09.30 Continuing with drill results from the Läntinen Koillismaa (LK) PGE-Cu-Ni Project in […]

September 24, 2020

2020.09.24 Renforth Resources (CSE:RFR, OTC:RFHRF, WKN:A2H9TN) is making good progress at its Parbec […]

September 24, 2020

2020.09.24 Since November 2019, Max Resource Corp. (TSX-V: MXR) has been identifying stratabound […]

September 24, 2020

2020.09.24 Seit November 2019 ist Max Resource Corp. (TSX-V: MXR) in seinem Kupfer-Silber-Projekt […]

August 19, 2020

Brad Aelicks: Diligence Report 2020.08.19 In Nov 2019, as a private company, New […]

August 13, 2020

2020.08.13 Silver Dollar Resources (CSE:SLV) has finalized a letter of intent (LOI) with […]

August 12, 2020

2020.08.12 Getchell Gold (CSE:GTCH) hasn’t let the pandemic impede plans to explore Fondaway […]

August 12, 2020

2020.08.12 Cypress Development Corp (TSX-V:CYP) was one of the few bright spots on […]

August 11, 2020

2020.08.11 Shareholders in Mountain Boy Minerals (TSX-V:MTB) are clearly expecting big things from […]

August 11, 2020

2020.08.11 Renforth Resources (CSE:RFN) was rocking Monday, as the market digested news of […]

July 31, 2020

2020.07.31 Since November 2019, Max Resource Corp. (TSX.V:MXR) has been identifying copper and […]

July 31, 2020

2020.07.31 Cypress Development Corp’s (TSX-V:CYP) prefeasibility study (PFS) on its Clayton Valley Lithium […]

July 25, 2020

2020.07.25 Great Thunder Gold (CSE:GTG) has the first part of its 2020 exploration […]

July 17, 2020

2020.07.17 With a rich gold mining history that spans over 100 years, the […]

July 14, 2020

2020.07.14 Max Resource Corp (TSX-V:MXR) continues to expand the surface mineralization at its […]

July 14, 2020

2020.07.14 Area plays, where one exploration company makes a discovery, then others rush […]

July 10, 2020

2020.07.10 Quebec is one of the best jurisdictions to explore for gold. Not […]

July 5, 2020

2020.07.05 Max Resource Corp. (TSX-V:MXR) continues to make good headway at its CESAR […]

July 4, 2020

2020.07.04 The 2,800-million-year-old Abitibi Greenstone Belt is one of the world’s largest Archean […]

July 4, 2020

2020.07.04 If real estate is all about location, location, location, success in mineral […]

June 17, 2020

2020.06.17 Boreal Metals (TSX-V:BMX, Frankfurt 03E) has just signed a deal with major […]

June 9, 2020

Brad Aelicks: Diligence Report 2020.06.09 On May 6th 2020 Freegold Ventures (TSX:FVL) released […]

May 29, 2020

2020.05.29 Gold prices tracked higher Thursday on fresh safe haven demand, and first-quarter […]

May 23, 2020

May 19, 2020

2020.05.19 There are times in the junior resource markets when a company slips […]

May 13, 2020

2020.05.13 The second most significant event in the life of a junior resource […]

May 12, 2020

2020.05.12 Getchell Gold (CSE:GTCH) announced on October 17, 2019 a binding letter of agreement with Canarc Resource […]

May 9, 2020

2020.05.09 When looking for an investment the approach I take involves looking at […]

April 10, 2020

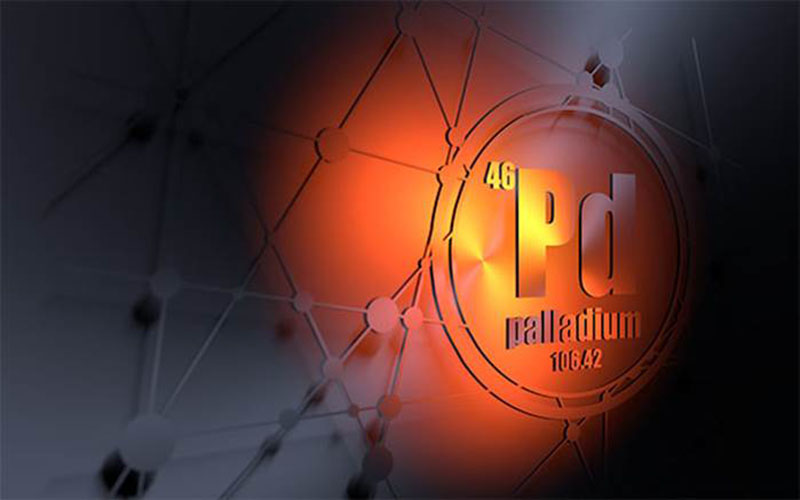

2020.04.10 Palladium One (TSX-V:PDM) has significantly increased the exploration potential at its LK […]

April 3, 2020

2020.04.03 Max Resource Corp. (TSX-V:MXR) continues to make good headway at its Cesar […]

March 28, 2020

2020.03.28 Silver has some of the same properties as gold, making it suitable […]

March 25, 2020

2020.03.25 Colombia was the world’s main source of platinum until 1820 and the […]

March 5, 2020

2020.03.05 Max Resource Corp (TSX-V:MXR) saw a 25% gain in its share price […]

February 29, 2020

2020.02.29 Max Resource Corp (TSX-V:MXR) has found more mineralization at its Cesar copper+silver […]

February 29, 2020

2020.02.29 The first results of Palladium One’s (TSX-V:PDM) IP survey are in, and […]

February 29, 2020

2020.02.29 Cypress Development Corp (TSX.V:CYP) has passed a critical milestone en route to […]

February 29, 2020

2020.02.29 Nearly a month of straight gains for gold came to an end […]

February 15, 2020

2020.02.15 The mining of critical minerals is finally getting the attention it deserves […]

February 15, 2020

2020.02.15 The discoveries keep on coming from Max Resource Corp. (TSX-V:MXR, OTC:MXROF, FSE:M1D2), […]

February 15, 2020

2020.02.15 Key to being a successful junior resource investor is doing your due […]

January 31, 2020

2020.01.31 Boots-on-the-ground exploration has opened up exciting new possibilities at Palladium One’s (TSX-V:PDM) […]

January 22, 2020

2020.01.22 Good ol’ boots-on-the-ground prospecting by Max Resource (TSX-V:MXR) geologists has borne some […]

January 18, 2020

2020.01.18 Friday was the day to be trading palladium, with the catalytic converter […]

January 18, 2020

2020.01.18 Inomin Mines (TSX-V:MINE) has made its Fleetwood VMS project near Vancouver, BC more […]

January 18, 2020

2020.01.18 Palladium has found another gear as it races past $2,200 an ounce, […]

January 14, 2020

2020.01.14 Arizona may be famous for its gems, but it was silver that […]