August 30, 2022

August 30, 2022

2022.08.30 Graphite One (GPH:TSXV; GPHOF:OTCQX) has undergone a major de-risking event with the […]

Do you like it?

August 26, 2022

August 26, 2022

Adam Hamilton 2022.08.26 The mid-tier and junior gold-miners’ stocks in their sector’s sweet […]

Do you like it?

August 24, 2022

August 24, 2022

By Frik Els 2022.08.24 Copper is on track for its worst monthly run […]

Do you like it?

August 18, 2022

August 18, 2022

2022.08.18 Getchell Gold (CSE:GTCH, OTCQB:GGLDF) continues to expand the high-grade North Fork Zone at […]

Do you like it?

August 14, 2022

August 14, 2022

2022.08.14 Max Resource (TSXV:MAX; OTC:MXROF; Frankfurt:M1D2) is one step closer to drilling its CESAR […]

Do you like it?

August 12, 2022

August 12, 2022

2022.08.12 Dolly Varden Silver (TSXV:DV, OTC:DOLLF) has returned a set of impressive drill […]

Do you like it?

August 12, 2022

August 12, 2022

2022.08.12 By Australian mining standards, a large part of New South Wales remains […]

Do you like it?

August 10, 2022

August 10, 2022

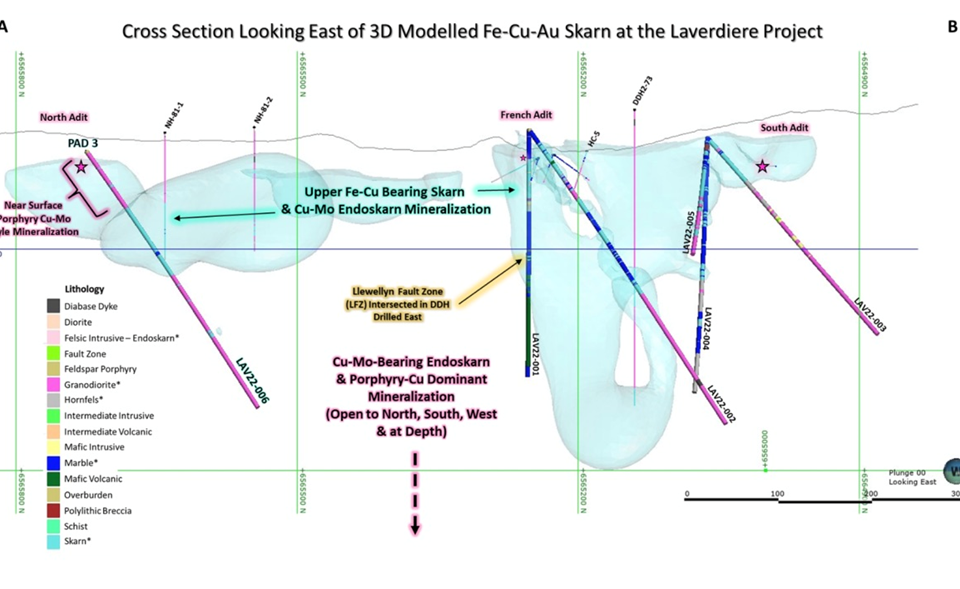

2022.08.10 The first two holes of the 2022 drill campaign at the Laverdiere […]

Do you like it?

August 2, 2022

August 2, 2022

2022.08.01 Renforth Resources’ (CSE:RFR, OTCQ: RFHRF, FSE:9RR) ends the summer field program at […]

Do you like it?

July 29, 2022

July 29, 2022

2022.07.29 The pain in the silver market could soon find some relief. While […]

Do you like it?

July 29, 2022

July 29, 2022

2021.07.28 Getchell Gold (CSE:GTCH, OTCQB:GGLDF) continues to post impressive results from its 2022 […]

Do you like it?

July 27, 2022

July 27, 2022

2022.07.27 Gold is a commodity with limited supply, therefore it cannot be “created” […]

Do you like it?

July 23, 2022

July 23, 2022

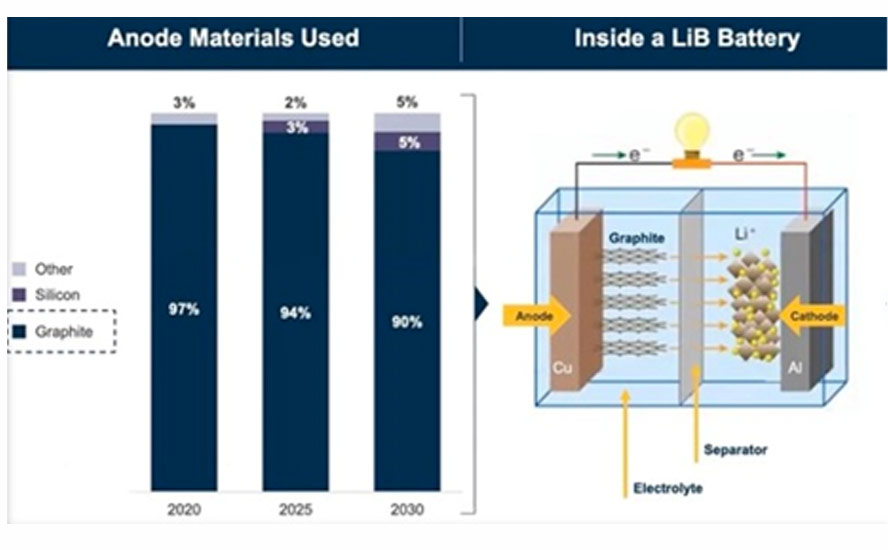

2022.07.23 Recently, attention has turned to the shortfall of raw materials that is […]

Do you like it?

July 22, 2022

July 22, 2022

2022.07.22 Although EV market share is still tiny compared to traditional vehicles, that […]

Do you like it?

July 20, 2022

July 20, 2022

2022.07.20 Capital inputs account for about half the total costs of mine production […]

Do you like it?

July 15, 2022

July 15, 2022

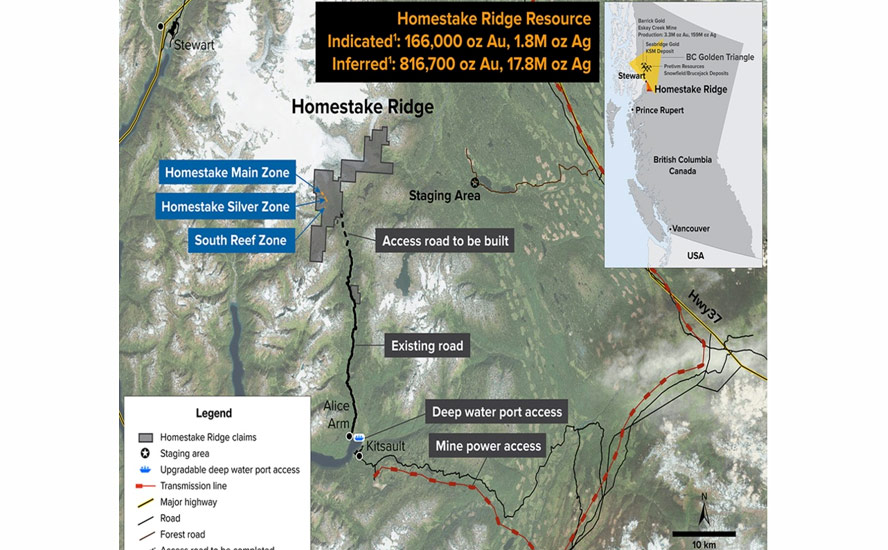

2022.07.15 A 30,000-meter drill program in northwestern British Columbia is shapely up nicely, […]

Do you like it?

July 11, 2022

July 11, 2022

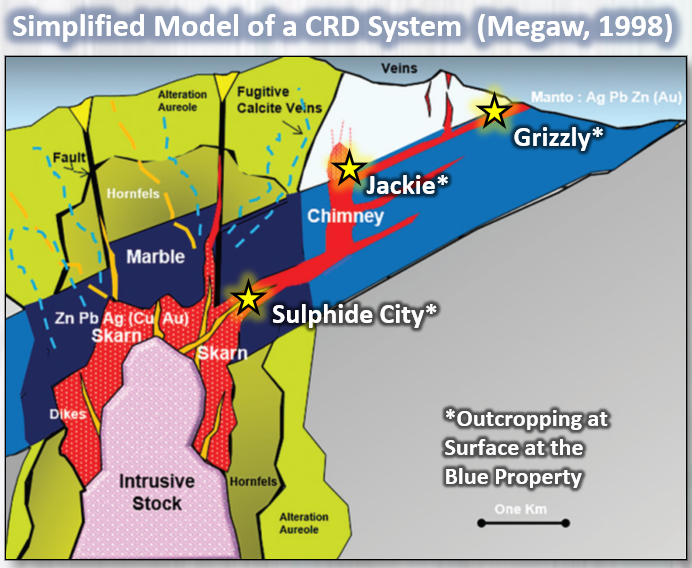

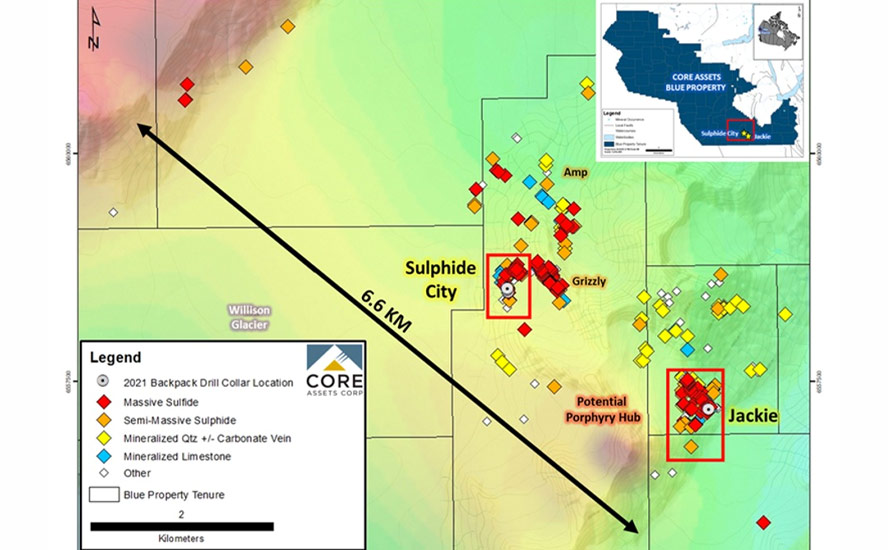

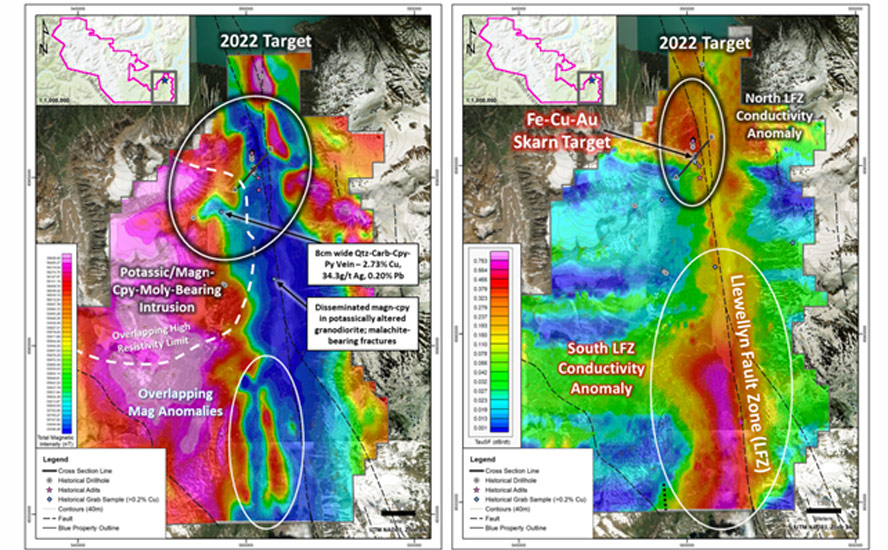

2022.07.11 Core Assets (CSE:CC) (FSE:5RJ) (OTC.QB:CCOOF) has just completed Phase 1 drilling at […]

Do you like it?

July 8, 2022

July 8, 2022

2022.07.08 Based in North Vancouver with an office in Sweden, Norden Crown Metals […]

Do you like it?

July 7, 2022

July 7, 2022

2022.07.07 Consistently ranked as one of the world’s top three gold producers, Australia […]

Do you like it?

June 27, 2022

June 27, 2022

2022.06.27 Unlike poorer nations whose populations need the metals revenue to pay for […]

Do you like it?

June 27, 2022

June 27, 2022

2022.06.27 Fondaway Canyon is an advanced-stage gold property located in Churchill County, Nevada. […]

Do you like it?

June 25, 2022

June 25, 2022

2022.06.25 Only two weeks into drilling its Laverdiere Skarn-Porphyry Project, Core Assets (CSE:CC) […]

Do you like it?

June 24, 2022

June 24, 2022

2022.06.24 The New England Orogen is a significant mineral province that forms the […]

Do you like it?

June 16, 2022

June 16, 2022

2022.06.06 The first hole of the program, FCG22-17, was collared on the canyon […]

Do you like it?

June 15, 2022

June 15, 2022

2022.06.15 Max Resource (TSXV:MAX; OTC:MXROF; Frankfurt:M1D2) has just closed the final CAD$2.4 million of […]

Do you like it?

June 11, 2022

June 11, 2022

2022.06.11 Recently concluded prospecting at Renforth Resources’ (CSE:RFR, OTCQB:RFHR, FSE:9RR) Surimeau property in Quebec […]

Do you like it?

June 10, 2022

June 10, 2022

2022.06.10 Energized by a set of stellar drill results and two new hires, […]

Do you like it?

June 6, 2022

June 6, 2022

2022.06.06 Drilling at Getchell Gold’s (CSE:GTCH, OTC:GGLDF) flagship Fondaway Canyon gold project is […]

Do you like it?

June 4, 2022

June 4, 2022

2022.06.04 Energized by two new hires, Graphite One (TSXV:GPH, OTCQX:GPHOF) is anticipating a […]

Do you like it?

June 3, 2022

June 3, 2022

2022.06.03 Core Assets’ (CSE:CC, OTC.QB: CCOOF, Frankfurt: 5RJ) Blue property commands 1,116 km² […]

Do you like it?

June 2, 2022

June 2, 2022

2022.06.02 We all know Elon Musk just doesn’t shy away from blockbuster deals […]

Do you like it?

May 27, 2022

May 27, 2022

2022.05.27 Fresh off a $13 million financing involving big name investors like Hecla […]

Do you like it?

May 25, 2022

May 25, 2022

2022.05.25 For today’s article I’m going to do something very unusual, and that […]

Do you like it?

May 24, 2022

May 24, 2022

2022.05.24 Copper is one of our most important metals with more than 20 […]

Do you like it?

May 18, 2022

May 18, 2022

2022.05.18 Despite an economic slowdown in China due to the return of the […]

Do you like it?

May 17, 2022

May 17, 2022

2022.05.17 Flush from the exercise of warrants connected to a 2021 private placement, […]

Do you like it?

May 14, 2022

May 14, 2022

2022.05.14 Renforth Resources Inc. (CSE: RFR) (OTCQB: RFHRF) (FSE: 9RR) 已开始其2022年在魁北克省 Surimeau 地区项目的实地考察计划,跟进先前沿 […]

Do you like it?

May 14, 2022

May 14, 2022

2022.05.14 Renforth Resources Inc. (CSE: RFR) (OTCQB: RFHRF) (FSE: 9RR) has begun its […]

Do you like it?

May 13, 2022

May 13, 2022

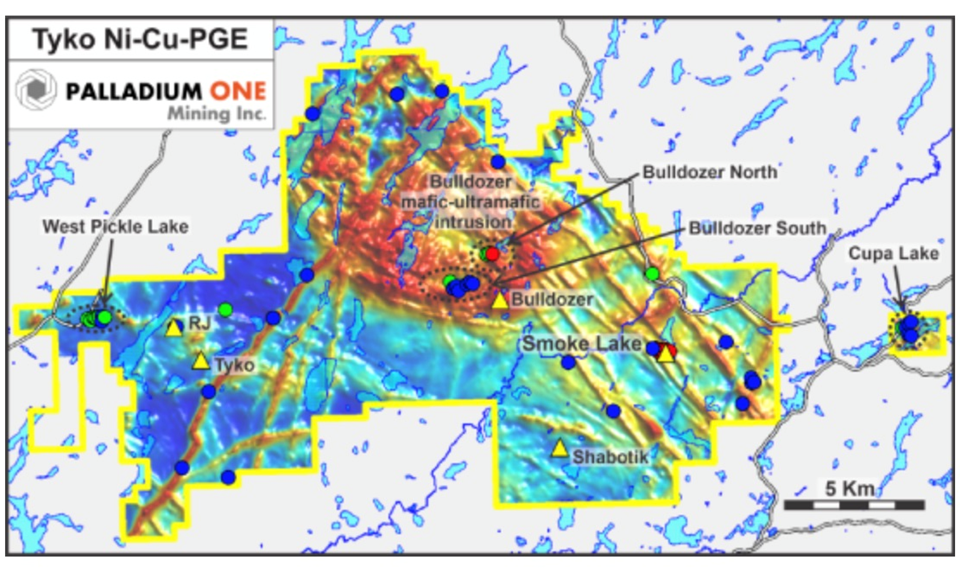

2022.05.13 Palladium One Mining (TSXV:PDM, OTCQB:NKORF, FRA:7N11) continues to outline a high-grade nickel-copper […]

Do you like it?

May 13, 2022

May 13, 2022

2022.05.13 Periods of stock market volatility are difficult even for the most battle-hardened […]

Do you like it?

May 12, 2022

May 12, 2022

2022.05.12 Junior mining is as much about holding land, as hunting for minerals. […]

Do you like it?

May 11, 2022

May 11, 2022

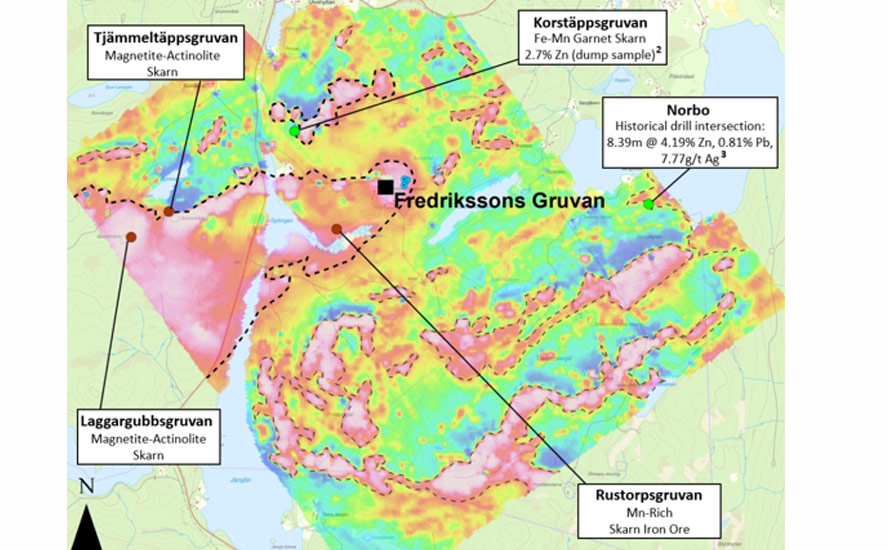

2022.05.11 Norden Crown Metals (TSXV:NOCR, OTC:NOCRF, Frankfurt:03E) is searching for high-grade silver and zinc […]

Do you like it?

May 9, 2022

May 9, 2022

2022.05.09 Poised to replicate the success of last year’s drilling at its flagship […]

Do you like it?

May 7, 2022

May 7, 2022

2022.05.07 Around 80% of Chilean copper production comes from copper-moly porphyry deposits, with […]

Do you like it?

May 6, 2022

May 6, 2022

2022.05.06 Copper is one of our most important metals with more than 20 […]

Do you like it?

May 5, 2022

May 5, 2022

2022.05.05 Graphite One (TSXV:GPH, OTCQX:GPHOF) is aiming to become the first vertically integrated […]

Do you like it?

May 4, 2022

May 4, 2022

2022.05.04 The allure of gold goes back thousands of years. Due to its […]

Do you like it?

May 2, 2022

May 2, 2022

2022.05.02 Although gold offers neither a yield (bonds, GICs) nor a dividend (stocks […]

Do you like it?

May 1, 2022

May 1, 2022

2022.05.01 One of the most important pieces of news that mining investors usually […]

Do you like it?

April 29, 2022

April 29, 2022

2022.04.29 Zinc is the fourth most used metal today in terms of annual […]

Do you like it?

April 28, 2022

April 28, 2022

2022.04.28 Shortly after its discovery of copper occurrence at the Laverdiere project, Core […]

Do you like it?

April 23, 2022

April 23, 2022

2022.04.23 Magna Gold Corp. (TSXV: MGR, OTCQB: MGLQF), which is already producing gold […]

Do you like it?

April 21, 2022

April 21, 2022

2022.04.21 Speaking at the 2022 World Copper Conference in Santiago, Chile, CRU’s Erik […]

Do you like it?

April 20, 2022

April 20, 2022

2022.04.20 Gold has a long history of prominence in human civilizations dating back […]

Do you like it?

April 20, 2022

April 20, 2022

2022.04.20 The mainstreaming of cryptocurrency has made many of us wonder whether it […]

Do you like it?

April 19, 2022

April 19, 2022

2022.04.19 With the electric vehicle revolution taking off at full throttle, automakers worldwide […]

Do you like it?

April 17, 2022

April 17, 2022

2022.04.17 2022 was looking like another underwhelming year for silver, which was stuck […]

Do you like it?

April 15, 2022

April 15, 2022

2022.04.15 By Bob Moriarty RooGold, a Canadian with 13 Nice Aussie Gold & […]

Do you like it?

April 15, 2022

April 15, 2022

2022.04.15 Coming off a series of property transactions last year and name change […]

Do you like it?

April 15, 2022

April 15, 2022

2022.04.15 BC-focused explorer Core Assets (CSE:CC, OTC.QB: CCOOF, Frankfurt: 5RJ),currently advancing the province’s most […]

Do you like it?

April 13, 2022

April 13, 2022

2022.04.13 One of the clearcut winners of the 2022 commodity rally has to […]

Do you like it?

April 12, 2022

April 12, 2022

2022.04.12 Gold has always been the prized metal of mankind for its artistic […]

Do you like it?

April 12, 2022

April 12, 2022

2022.04.12 Norden Crown Metals (TSXV:NOCR, OTC:BORMF, Frankfurt:03E) is focused on discovering silver, zinc, […]

Do you like it?

April 11, 2022

April 11, 2022

2022.04.11 At AOTH we believe Max Resource Corp’s (TSXV:MAX; OTC:MXROF; Frankfurt:M1D2) CESAR property has […]

Do you like it?

April 9, 2022

April 9, 2022

2022.04.09 Bloomberg reported on Thursday that inventories across London Metal Exchange warehouses have […]

Do you like it?

April 8, 2022

April 8, 2022

2022.04.08 As the oldest metal known to man, copper has been an essential […]

Do you like it?

April 7, 2022

April 7, 2022

2022.04.07 Moving further towards its goal of becoming America’s first fully integrated graphite […]

Do you like it?

April 6, 2022

April 6, 2022

2022.04.06 The subject of multiple exploration campaigns, with nearly 50,000m of drilling completed, Getchell […]

Do you like it?

April 2, 2022

April 2, 2022

2022.04.02 The supply chain for batteries, wind turbines, solar panels, electric motors, transmission […]

Do you like it?

April 2, 2022

April 2, 2022

2022.04.02 High fuel prices may have a lot of motorists thinking about how […]

Do you like it?

March 31, 2022

March 31, 2022

2022.03.31 Meeting new emissions targets being set by countries like Canada, the US, […]

Do you like it?

March 30, 2022

March 30, 2022

2022.03.30 Rick Mills: Joining me today is Brad Aelicks. Brad is a geologist, […]

Do you like it?

March 29, 2022

March 29, 2022

2022.03.29 As a follow-up to its major announcement earlier in the month, Max […]

Do you like it?

March 26, 2022

March 26, 2022

2022.03.26 Rick Mills, Editor/ Publisher, Ahead of the Herd: Today I’m here with […]

Do you like it?

March 25, 2022

March 25, 2022

2022.03.25 “Every gun that is made, every warship launched, every rocket fired signifies, […]

Do you like it?

March 24, 2022

March 24, 2022

2022.03.24 Gold is often criticized by Wall Street as kind of a useless […]

Do you like it?

March 22, 2022

March 22, 2022

2022.03.22 Emerging BC-focused explorer Core Assets Corp. (CSE: CC) (FSE: 5RJ) (OTCQB: CCOOF), […]

Do you like it?

March 21, 2022

March 21, 2022

2022.03.21 The current commodity price surge puts Palladium One Mining (TSXV:PDM, OTC:NKORF, FSE:7N11) […]

Do you like it?

March 18, 2022

March 18, 2022

2022.03.18 Rick Mills: This morning we’re talking to Dr. Chris Wilson of Roogold […]

Do you like it?

March 17, 2022

March 17, 2022

2022.03.17 In another major step towards becoming America’s first vertically integrated graphite producer, […]

Do you like it?

March 15, 2022

March 15, 2022

2022.03.15 Rick Mills: I’m talking to Nicole Brewster, CEO of Renforth Resources (CSE:RFR, […]

Do you like it?

March 12, 2022

March 12, 2022

2022.03.12 For years, North America’s supply of critical minerals — the very foundational […]

Do you like it?

March 12, 2022

March 12, 2022

2022.03.12 多年来,北美关键矿产的供应,即清洁能源转型的基础部分,一直是决策者和企业关注的焦点。 一方面,未来几年对用于制造电动汽车和储能应用的原材料的需求将激增。 彭博社新能源金融公司(Bloomberg New Energy Finance)估计,到2030年,锂和镍等矿物的消费量将至少是当前水平的五倍(参见下图)。 这种预测对这些材料的供应提出了巨大的疑问。标准普尔全球(S&P Global)12月的一份报告预计,由于使用量超过了产量,消耗了库存,锂材料将在2022年出现短缺。 虽然锂等金属的供应正在增长,但即使是两位数的增长率(如去年所见),也可能不足以满足我们的汽车电气化需求。 在北美,情况更为严峻,因为美国和加拿大的大部分电动汽车原材料都依赖进口。两国多年来一直忽视着针对电池矿产的勘探与矿山的建造。而考虑到世界政治的动荡程度,这是一种冒险的赌注。 在最终意识到美国供应链的脆弱性后,美国政府于2018年制定了一份清单,列出了35种被认为对其国家和经济安全至关重要的矿物。而如今,这一名单已增至近50种矿物,其中70%仍由其两个主要竞争对手 (俄罗斯和中国)供应。 […]

Do you like it?

March 10, 2022

March 10, 2022

2022.03.10 Lithium is without question one of the most sought-after commodities right now, […]

Do you like it?

March 9, 2022

March 9, 2022

2022.03.09 The war in Ukraine has lit a fire under commodities and none […]

Do you like it?

March 7, 2022

March 7, 2022

2022.03.07 Rick Mills: Joining me today is Brad Aelicks. Brad is a geologist, […]

Do you like it?

March 5, 2022

March 5, 2022

2022.03.05 Rick Mills: Joining me today is Bob Moriarty from 321gold. We’re going […]

Do you like it?

March 4, 2022

March 4, 2022

2022.03.04 The global copper supply crisis is getting deeper with each passing day. […]

Do you like it?

March 3, 2022

March 3, 2022

2022.03.03 The global race to secure more EV battery materials is well and […]

Do you like it?

March 2, 2022

March 2, 2022

2022.03.02 North America relies heavily on foreign supplies of critical minerals — the […]

Do you like it?

March 1, 2022

March 1, 2022

2022.03.01 Max Resource Corp (TSXV:MXR; OTC:MXROF; Frankfurt:M1D2) came out with major news on […]

Do you like it?

February 23, 2022

February 23, 2022

2022.02.23 Weeks of failed diplomacy over a potential invasion of Ukraine resulted in […]

Do you like it?

February 23, 2022

February 23, 2022

20.02.23 The recent geopolitical tensions in Ukraine tell us that during troubled times, […]

Do you like it?

February 21, 2022

February 21, 2022

2022.02.21 While it’s too early to declare lithium as the winning commodity of […]

Do you like it?

February 18, 2022

February 18, 2022

2022.02.18 Driven by the need to decarbonize due to increasingly apparent climate change, […]

Do you like it?

February 17, 2022

February 17, 2022

2022.02.17 Geopolitical tensions on the Russia-Ukraine border pushed gold to its highest in […]

Do you like it?

February 16, 2022

February 16, 2022

2022.02.16 “I’ve been doing this 30 years and I’ve never seen markets like […]

Do you like it?

February 16, 2022

February 16, 2022

2022.02.16 In exploration, a number of techniques are employed to gather information about […]

Do you like it?

February 15, 2022

February 15, 2022

2022.02.15 The nickel market is currently experiencing its biggest squeeze in recent memory. […]

Do you like it?

February 15, 2022

February 15, 2022

2022.02.15 The copper industry is threatened by a looming global supply crisis, as […]

Do you like it?