Top 5 reasons to consider gold in inflationary period

2022.04.12

Gold has always been the prized metal of mankind for its artistic and cultural value, with a rich history dating back to Ancient Egypt.

In many parts of the world, it serves as a symbol of wealth and the centerpiece in almost every special social gathering. Each year, more than 1,400 metric tons of the metal are consumed for jewelry and other decors.

But the reason to buy gold goes beyond the customary yearly celebrations or the need to display affluence; people can also view the metal as a form of investment and growing their wealth. This is especially true during times of high inflation, where the cost of living rises and the value of currency depreciates.

The US economy is currently going through an extreme inflationary period, with its annual inflation rate reaching 7.9%, the highest on record in 40 years.

Since the start of 2022, inflation concerns have jump-started a fresh wave of gold buying, which nearly took the precious metal past its all-time high of $2,070/oz set in August 2020.

Demand for gold-backed investment products also surged, with gold ETFs seeing net inflows of 187.3 tonnes (US$11.8 billion) in March, taking total holdings just below the record US$240.3 billion of August 2020.

Below are some of the factors behind gold’s enhanced appeal during an inflationary period:

- Store of Value

The notion that gold carries monetary value has been widely accepted even in ancient times, and for the most part, this principle has worked in practice. During Roman times, for example, one ounce of gold was enough to buy one toga and accessories. Today, the same amount of gold can buy a tailored suit or a wedding dress.

The prospective value placed on gold is what draws investors into the metal. Throughout history, people tend to hoard gold when their traditional “money”, or currencies, are losing value, because they realized that metal is much more durable and can be exchanged for more value later on.

- Inflation Hedge

As mentioned, gold is viewed as the ideal hedge against inflation, as its value tends to rise with the price of goods. This is because our fiat currency (i.e. a US$100 dollar bill) loses its purchasing power when things become more expensive, and gold tends to be priced in those currency units.

Indeed, looking back at the past 50 years, gold prices have kept up with inflation, and the metal’s purchasing power has increased accordingly, while the US dollar has lost value and purchasing power.

For example, in 1930, 1/100 oz of gold could buy 2.3 loaves of bread, and US$1 could buy 11 loaves of bread. Fast forward to 2021, 1/100 oz of gold can buy 8.6 loaves of bread, but US$1 can buy just one-half a loaf of bread. This means gold has more or less kept pace with the price of bread over that period, while the US dollar has eroded.

- Diversification

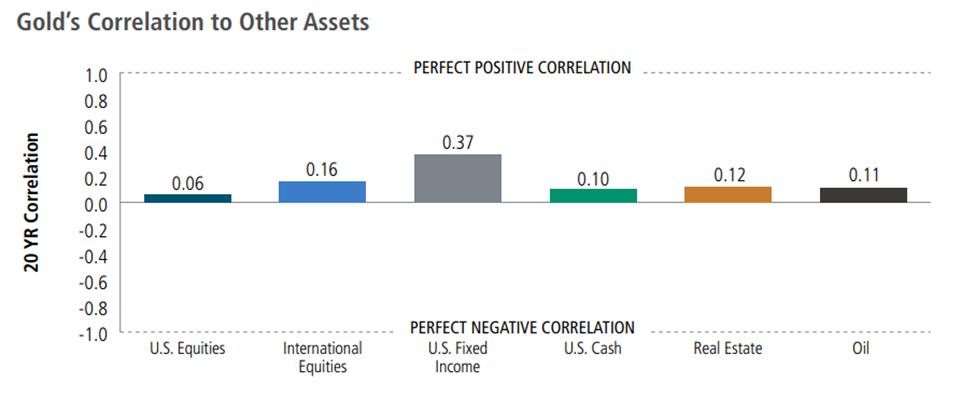

Many of the major asset classes today — stocks, real estate and commodities — are correlated and tend to move in the same direction at the same time. Gold, however, is driven by a completely different set of factors and has low correlation with those other assets.

In other words, gold’s performance moves independently and may help serve as a return diversifier within a broader multi-asset portfolio. It aligns perfectly with the investment mantra of “not putting all your eggs in one basket” — providing a safety net against events that may plummet the value of popular investments like stocks.

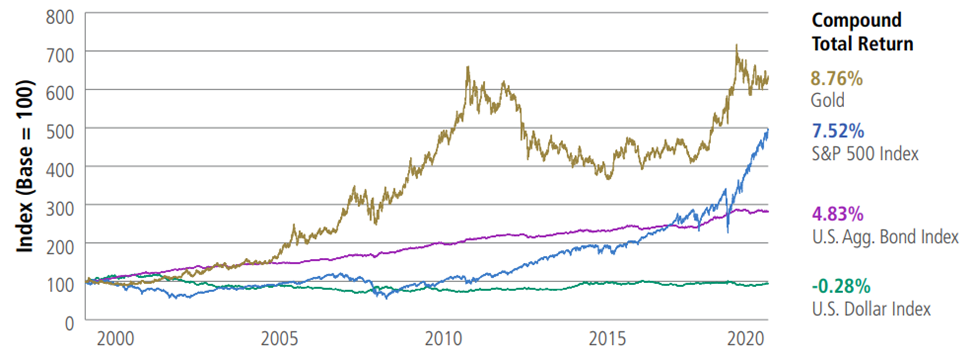

More importantly, gold has outperformed the major asset classes over the past 22 years, historically enhancing returns and increasing diversification. It is also significantly undervalued compared to equities, as the gold-stock price ratio is currently sitting at just 38%.

- Economic & Political Instability

Gold also provides investors with a safe haven during periods of economic and political instability. During the height of the Covid pandemic in 2020, gold managed to outperform both stocks and bonds while setting a record high. According to the World Gold Council, its performance during periods of crisis has risen to become the “top reason for central banks to hold gold.”

This year, gold is once again garnering investors’ attention following Russia’s invasion of Ukraine. Sanctions against Russia have already taken the commodities market for a wild ride, fueling concerns of stagflation — a combination of slow economic growth and high inflation — both of which is positive for gold.

- Rising Government Debts

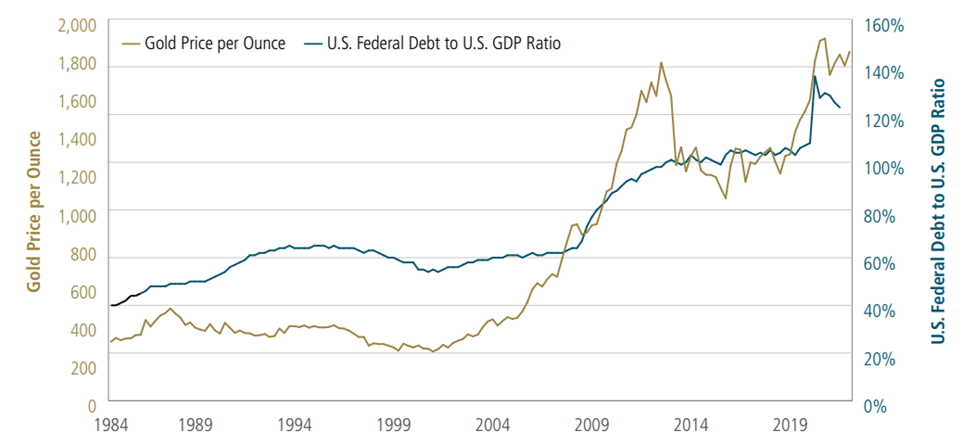

Offering more support for gold is the massive public spending spree, especially during disruptive periods like the Covid crisis, that have led to excessive government debt.

While increased spending may help support economic recovery in the near-term, major economies like the US are actually accumulating debt at a faster pace than their economic growth.

The crushing global debt burden is likely to weaken major fiat currencies (like the US dollar) and gold can help protect investor wealth. Historically speaking, gold has appreciated as US federal debt levels rise.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Norden Crown (TSX.V:NOCR). NOCR is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.