5 reasons to prioritize graphite in EV push

2022.04.19

With the electric vehicle revolution taking off at full throttle, automakers worldwide are faced with the challenge of securing their supply of minerals like lithium, nickel and cobalt to build car batteries. Lithium prices in China have already reached all-time highs this year amid the global scramble for battery metals.

There is one key battery mineral, though, that has been largely overlooked by the market and should be prioritized: graphite.

An allotrope (or different physical form) of carbon, graphite is one of the hardest and most durable materials on Earth, and has been used by mankind for thousands of years. Today, it is mostly used as the “lead” in pencils and as an additive to lubricating grease. But with the pivot to vehicle electrification, graphite’s importance has grown even further.

The Canadian and US governments have already included graphite, along with other battery metals, in their respective list of minerals considered “critical” to economic and natural security.

In fact, graphite is one of only four “critical minerals” recognized by the US Geological Survey that is essential to all six industrial sectors.

There is every reason to believe that, somewhere down the road, graphite could very well match up with the likes of lithium, perhaps achieving the status of “most critical mineral” during the global EV push. Consider below:

- Graphite as Anode Material

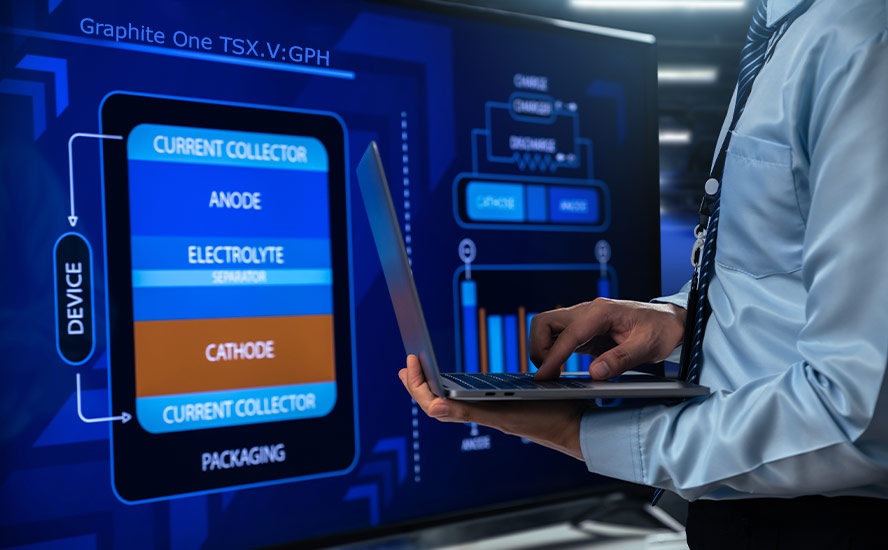

The lithium-ion battery used to power electric vehicles is made of two electrodes — an anode (negative) on one side and a cathode (positive) on the other. At the moment, graphite is the only material that can be used in the anode, and there are no substitutes.

This is due to the fact that, with high natural strength and stiffness, graphite is an excellent conductor of heat and electricity. Being the only other natural form of carbon besides diamonds, it is also stable over a wide range of temperatures, with a temperature resistance that goes above 3,500 degrees Celsius — same as the outer atmosphere of the sun!

The cathode is where metals like lithium, nickel, manganese and cobalt are being used, and depending on the battery chemistry, there are different options available to battery makers (see below).

Hence, graphite can be considered indispensable to the global shift towards electric vehicles. It is also the largest component in batteries by weight, with each battery containing 20-30% graphite.

But due to losses in the manufacturing process, it could take 30 times more graphite than lithium to build a battery.

- Material Requirement

However, not all graphite mined naturally in open-pit and underground mines be used in EV batteries.

Natural graphite exists in three forms, flake, amorphous, and vein or lump graphite. Only flake graphite, upgraded to 99.95% purity, can be used in batteries.

Flake graphite is made up of layers of graphene, which is the minerals’ base structural element, and is preferred by most manufacturers of refractories, batteries, crucibles, pencils, powder metallurgy, on top of lithium-ion batteries. About 40% of the world’s production is flake graphite.

The anode material — called spherical graphite — can also be manufactured from synthetic/artificial graphite, which is produced from heating petroleum coke feedstock in a special furnace, but this method is super energy-intensive.

Moving forward, the significance of natural flake graphite will rise given the stricter environmental concerns in top producer China. Due to power disruptions, the average Chinese flake graphite prices increased by 25% between May and December last year.

- Scorching Demand

According to Fastmarkets, a UK-based commodity price reporting agency, the current rate of EV production indicates demand for battery-grade graphite could rise by a jaw-dropping 36% this year.

“Such large growth will allow room for significant rises in both natural and synthetic graphite,” analysts at consultancy Wood Mackenzie said.

An average plug-in EV has 70 kg of graphite, or 10 kg for a hybrid. Every 1 million EVs requires about 75,000 tonnes of natural graphite, equivalent to a 10% increase in flake graphite demand.

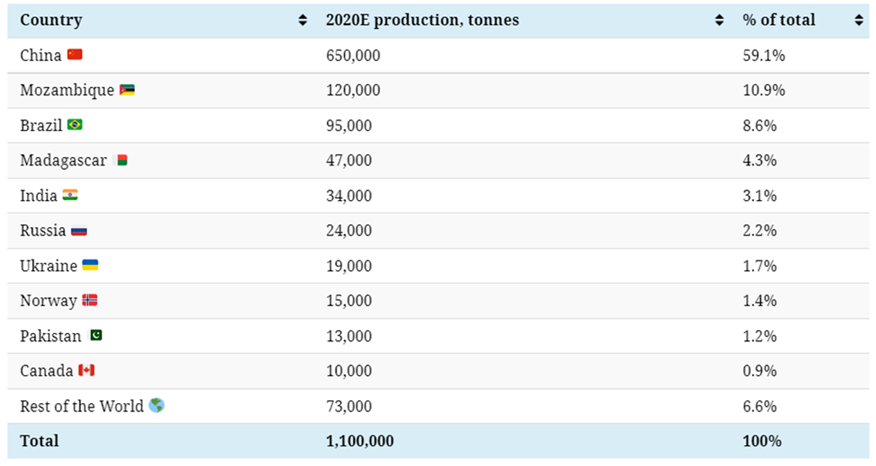

By estimates, at least 125 million EVs are expected to be mobile by 2030. That’s more than 8 million tonnes of additional battery-ready graphite needed this decade, considering the mining industry is able to supply 1.1 million tonnes.

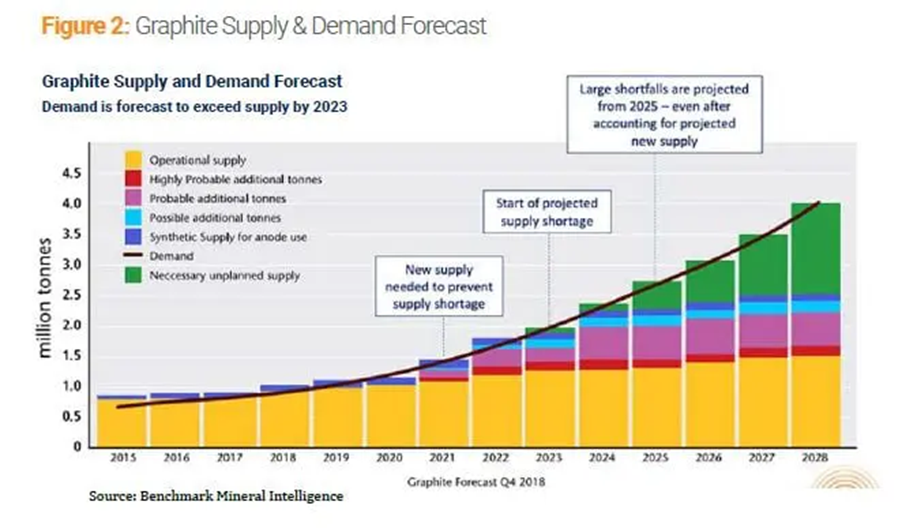

According to Benchmark Mineral Intelligence, another UK-based price reporting agency, the flake graphite feedstock required to satisfy the world’s lithium-ion anode market is projected to reach 1.25 million tonnes per annum by 2025. At this rate, demand could easily outstrip supply in a few years.

- Concentrated Supply

Almost all graphite processing today takes place in China because of the ready availability of graphite there, weak environmental standards and low costs.

Nearly 60% of the world’s mined graphite also comes from China, making it a dominant player in every stage of the EV battery supply chain. After China, the next leading graphite producers are Mozambique, Brazil, Madagascar, Canada and India — each contributing to 10% or less of the global supply.

Given the distribution of supply, many of the major auto markets that have no graphite output are heavily dependent on China’s exports. The US, for example, imported 42,000 tonnes of the material in 2020, 33% of which came from China.

But considering that all of the spherical graphite processing is controlled by China, every nation is technically 100% reliant on China.

- Geopolitical Risks

Of course, this also means that the global graphite market is the most vulnerable to disruptions, as it is essentially held hostage by China.

Given what happened recently with nickel following the economic sanctions against Russia, which supplies 20% of the world’s Class 1 nickel, graphite could easily skyrocket out of control.

As we’ve discussed before, China could use its stranglehold on graphite processing as a cudgel in trade talks with the United States, or it could freeze shipments of them during a war. The possible threat of China cutting off supply presents a ticking time bomb for the EV industry, as the cost of graphite could drive many battery makers out of business.

Moreover, most of the other major natural graphite producers like Mozambique and Brazil have their own risk factors that could derail supply growth.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.