Palladium: 5 reasons stronger for longer

2022.04.13

One of the clearcut winners of the 2022 commodity rally has to be palladium.

The metal commonly used in catalytic converters recently saw its price catapult to record highs following Russia’s invasion of Ukraine, and is now trading 30% higher since the start of the year. However, things may only be getting started, as those in the industry believe this precious metal could shine even brighter.

Due to strong demand from the auto sector, which uses 85% of the world’s palladium, Citigroup analysts recently raised their price forecast to $2,800/oz for Q1 2022, and to $2,700/oz for the end of Q2 2022.

According to Impala Platinum, the world’s largest producer of platinum group metals, the global palladium rally could last many years given the various market dynamics that are currently in play.

The reasons for palladium to stay stronger, for longer, are as follows:

- Supply Uncertainty

About 40% of the world’s palladium is mined by Russia, which means any ongoing supply concerns are definitely warranted as long as the war in Ukraine continues.

While palladium has been left out of the government sanctions so far, it remains to be seen whether the precious metal will be free of any supply disruptions given everything that is going on.

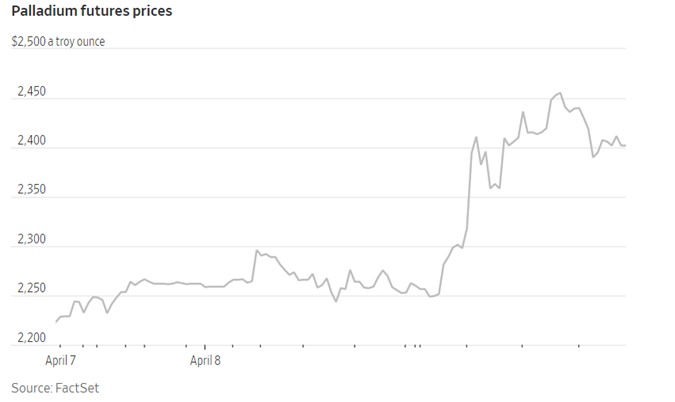

The first targeted move against Russian palladium was made last week, when the London Platinum and Palladium Market suspended the only two accredited Russian refiners whose metal can be traded in the London and Zurich markets.

This gave the palladium (and also platinum) market another jolt, sending palladium futures 8.3% higher to about $2,407/ounce, and since then, the metal has continued to surge.

“The suspension of the Russian refiners certainly increases the concerns among market participants that the palladium market will be severely undersupplied going forward,” Commerzbank analyst Daniel Briesemann told Reuters on Monday.

- Soaring Demand

The latest development comes at a time when the palladium is already under significant pressure globally due to demand from the auto sector.

The biggest reason behind palladium’s soaring demand is the significant role the metal plays in reducing carbon emissions and meeting our climate goals.

Palladium is the key ingredient that goes into catalytic converters, which reduce noxious substances in exhaust fumes from gas-powered cars. It is also used in hybrid vehicles, considered the stop-gap between gas-powered cars and pure electrics.

Moreover, palladium is also said to be the key to unlocking fuel cell vehicles powered by hydrogen, which some believe are the future of transportation given that hydrogen fuel cells can offer much higher energy density than the contemporary lithium-ions.

Such promise makes palladium, which is already in a market deficit for the past decade, a hot commodity in the growing automotive sector. In 2021, there was even a trend where thieves were stealing car mufflers to sell the metals back into the recycling market.

“For palladium, it is because of strong pent-up consumer demand for vehicles. We have seen the prices of used vehicles go up as much as 45% in North America. In the automotive industry, there seems to be signs of green shoots on managing its supply chain issues,” Trevor Raymond, director of research at the World Platinum Investment Council (WPIC), told Kitco News earlier this year.

Russia’s Nornickel, the biggest producer in the world, is expecting another deficit of 300,000 oz in 2022, with the auto market resuming to normal in 2023. In the future, palladium sourcing will continue to be a major challenge for automakers.

- Dormant Mine Supply

Contributing to the palladium shortage is the dearth of mine investments that has led to supply slowing down.

The lack of “major investment in new supply” may help support the palladium rally in the coming years, said Nico Muller, chief executive officer at Impala Platinum. “I believe that the fundamental market dynamics are going to provide strong price support for our metals for at least the next four or five years, potentially even longer,” he emphasized.

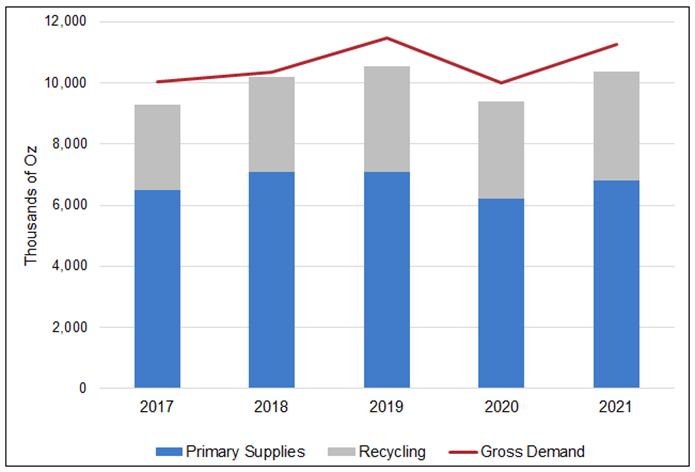

According to a special report by Sprott Asset Management, a “primary driver of higher palladium prices remains the structural deficit, in which demand continues to greatly exceed combined primary and secondary supplies.”

Johnson Matthey’s May 2021 PGM market report confirmed that global palladium supply continues to lag behind demand.

- Jurisdiction Risks

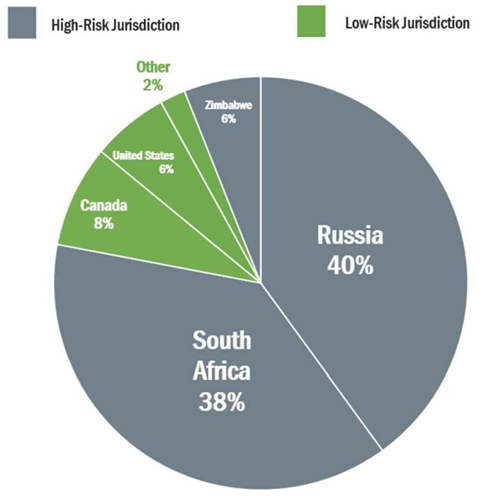

Tying into the supply uncertainty is the jurisdiction risks posed by the major producers of palladium. Nearly 80% of the world’s palladium is mined in South Africa and Russia (see below), both of which have high degrees of political risk.

Few other nations are considered major contributors to the world supply, which goes back to the lack of mine investment over recent years. For the low-risk jurisdictions, the only notable names are Canada and USA.

Following the recent events in Europe, palladium buyers have been increasingly looking to South Africa for supplies, as many have dropped their business ties with Russia. However, any significant shift would add further pressure to the palladium market given Russia’s sizable contribution to supply, thus keeping prices elevated.

“In time you are going to see, as soon as a company has defined an alternative supply source, that you may start seeing shifts in supply contracts,” Impala’s Muller predicted.

- Inflation Concerns

One other thing that palladium has going its way is the inflation concerns reverberating around the global economy. The US, for example, is already experiencing its highest inflation in 40 years.

While palladium is mostly used for industrial purposes, it is still considered to be a precious metal, and hence, it can act as a hedge against inflation like gold and silver.

“Inflation concerns are particularly high among retail investors in North America, so they look to platinum (and palladium) as a diversifier and a hedge against inflation,” WPIC”s Trevor Raymond said.

Since palladium is only mined in a few places on Earth, and is already highly demanded by the auto industry, the metal may offer a higher return than gold, which has little to no industrial uses. A study using OECD data showed that palladium could even offer superior hedging performance than gold after the global financial crisis.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Norden Crown (TSX.V:NOCR). NOCR is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.