Palladium One boosts LK project indicated resources by nearly 250%

- Home

- Articles

- Environment Clean Energy

- Palladium One boosts LK project indicated resources by nearly 250%

2022.05.01

One of the most important pieces of news that mining investors usually look for is how months of successful drilling can lead to significant resource upgrades. This week, “green metals” explorer Palladium One Mining Inc. (TSXV: PDM)(OTCQB: NKORF)(FSE: 7N11) delivered exactly that for its shareholders with the release of a much-anticipated resource estimate for its flagship Läntinen Koillismaa (LK) PGE-copper-nickel project in north-central Finland.

LK Project Resource Estimate

For over two years, PDM has been continuously exploring and growing the LK project, and the fruits of its labour can now be finally authenticated by this NI 43-101 compliant resource estimate to confirm the project’s potential scale.

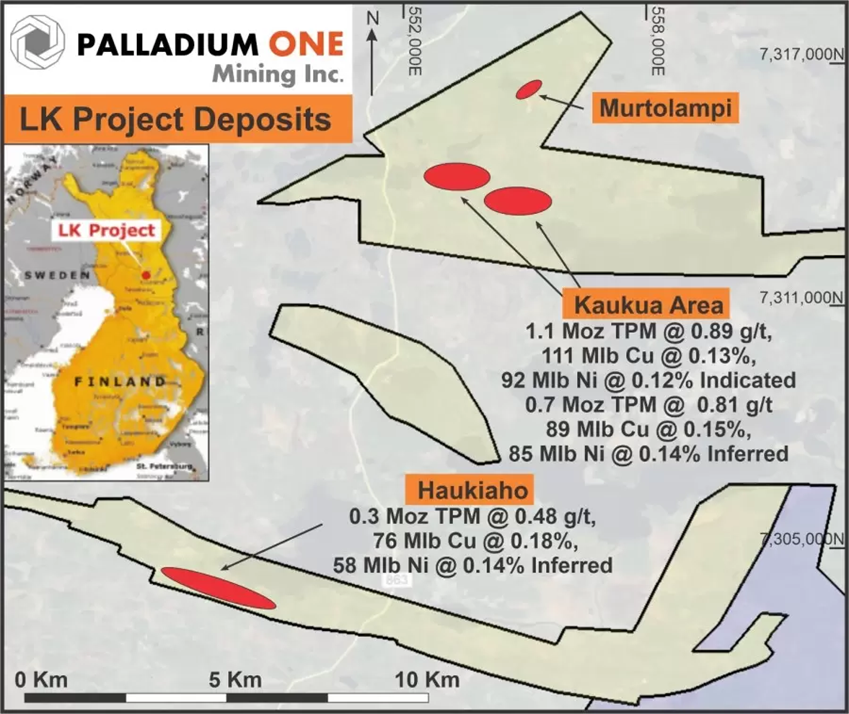

The LK property represents a disseminated, palladium-rich open-pit sulphide deposit hosted within a large, approximately 38 km long mineralized system.

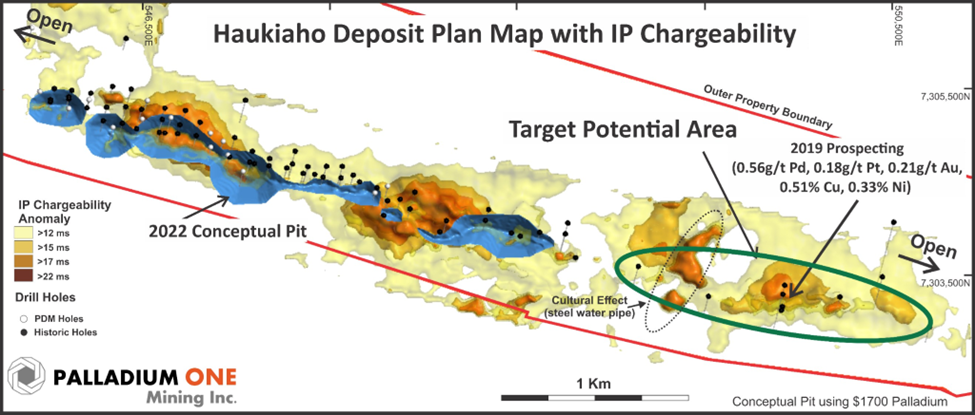

The exploration permits are divided into two groups, the Kaukua group consisting of the Kaukua and Murtolampi targets, and the Haukiaho group covering the Lipeävaara and Haukiaho targets. There is also the Salmivaara permit, which represents the eastern and western extension of Haukiaho.

In its last resource update in September, the company only included additions from the base metals-dominant Haukiaho zone, which more than doubled the company’s mineral resource endowment. Resource definition drilling for the PGE-dominant Kaukua area was just completed at the time.

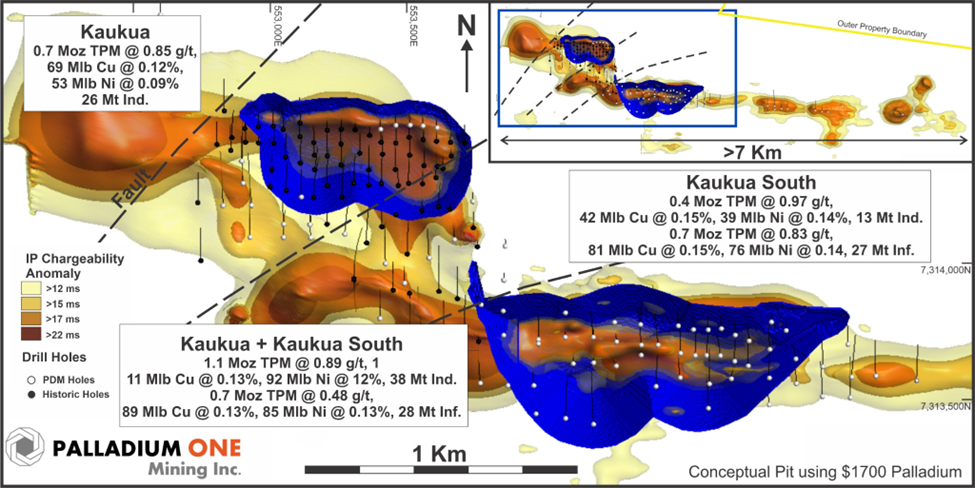

The April 2022 estimate covers three open pits in the Kaukua area, including a maiden resource for Kaukua South and Murtolampi (altogether 210 drill holes totalling 44 km), and one at Haukiaho (84 drill holes totalling about 13,400 metres), located 10 km south of Kaukua.

Indicated resources covering the Kaukua area totalled 38.2 million tonnes grading 0.61 g/t Pd, 0.22 g/t Pt, 0.07 g/t Au, 0.13% Cu, 0.11% Ni and 64.56 g/t Co. This represents an increase of 248% (a near 3.5x increase) over the previous estimate in September.

Importantly, nearly half (44%) of the total resource at the LK project is now in the indicated category (compared to 20% previously). Essentially all of its indicated tonnes are found in the Kaukua area.

Inferred resources, contained in both the Kaukua and Murtolampi pit area and the Haukiaho zone, totalled 49.7 million tonnes grading 0.43 g/t Pd, 0.17 g/t Pt, 0.09 g/t Au, 0.16% Cu, 0.14% Ni and 73.98 g/t Co, for a moderate increase of 14%.

Total contained metal, therefore, amounts to 740,000 oz palladium, 260,000 oz platinum, 80,000 oz gold (for >1 million oz of total precious metals), 110.7 million lb copper, 91.6 million lb nickel and 5.4 million lb cobalt in the indicated category, plus 680,000 oz palladium, 260,000 oz platinum, 140,000 oz gold ( >1 million oz total precious metals), 172.9 million lb copper, 151.5 million lb nickel and 8.1 million lb cobalt in the inferred category.

The mineral resources were based on a preliminary open-pit plan using a net smelter return pit discard cut-off of $12.5/tonne. Long-term metal prices of $1,700/oz palladium, $1,100/oz platinum, $1,800/oz gold, $4.25/lb copper, $8.50/lb nickel and $25/lb cobalt were assumed.

Waste-to-ore ratios were 1.48:1 for the Kaukua area (including Murtolampi) and 0.58:1 at Haukiaho, respectively.

It’s important to note that this new resource provides only a “conservative” view of the LK project’s economic potential, since metal prices are now higher than those used in the estimate.

As detailed in PDM’s sensitivity analysis, at $2,000/oz palladium — which is the closest to its current price — the LK project would have a higher indicated resource at 46.5 million tonnes (0.58 g/t Pd, 0.21 g/t Pt, 0.06 g/t Au, 0.12% Cu, 0.11% Ni and 65.6 g/t Co) and inferred resource at 56.6 million tonnes (0.42 g/t Pd, 0.16 g/t Pt, 0.08 g/t Au, 0.15% Cu, 0.14% Ni and 73.7 g/t Co).

Phase II Metallurgical Testing Program

The recovered and payable metal assumptions in the resource estimate were based on the Phase II metallurgical testing program carried out by Palladium One in 2022, which demonstrated the ability to produce both high-value copper and nickel concentrates using conventional three-stage flotation.

The floatation metallurgical program was conducted on the Kaukua and Kaukua South deposits, which share very similar geology and mineralization. A bulk sample of approximately 1 tonne from 22 holes from two mineralized zones was blended to produce a representative composite sample with grades of 1.66 g/t PdEq (0.63 g/t Pd, 0.22 g/t Pt, 0.10 g/t Au, 0.13% Cu, 0.14% Ni, 88 g/t Co).

These results were consistent with the company’s historical test work in 2011 on the Kaukua deposit, which produced a similar bulk composition to the current metallurgical sample but was higher grade 2.38 g/t PdEq (0.94 g/t Pd, 0.31 g/t Pt, 0.08 g/t Au, 0.22% Cu and 0.20% Ni).

Overall, the current metallurgical program highlighted very consistently reproducible recovery rates from the Kaukua/Kaukua South mineralization. Copper and PGE recovery was only slightly affected by changes in grade; nickel recovery is significantly affected by grade, as the percentage of silicate nickel increases as grade decreases.

In addition to the bulk concentrate, a split copper and nickel concentrate was produced, both of which are highly saleable. The copper concentrate was particularly high grade with 30% Cu and high PGEs. It represents 30% of the bulk concentrate by weight, with the nickel concentrate comprising 70%.

Both Cu and Ni concentrates were high in iron and sulfur and low in MgO (<6%), making them highly attractive to smelters. A low mass pull of 1.2% was achieved, thereby suggestive of low transportation charges.

Commenting on the significant resource boost at LK and the promising metallurgical testing results, PDM president and CEO Derrick Weyrauch stated: “These milestones substantially improve the economic potential by confirming scale and by delivering clarity of recovery rates for various rock types.

“With a grade of 30% copper in the copper concentrate and a value of approximately US$4,200 per tonne for the nickel concentrate, both are highly marketable, which bodes well for future concentrate marketing negotiations.”

As the LK project is located 160 northeast of the Port City of Oulu, there is potential for significant cost reductions when it comes to shipping. In addition, Finland has domestic copper and nickel smelting capacity, which could further reduce transportation costs.

LK Project: Next Steps

Of course, Palladium One’s exploration on the LK property is far from finished, as the project remains open for additional resource expansion both along strike and at depth.

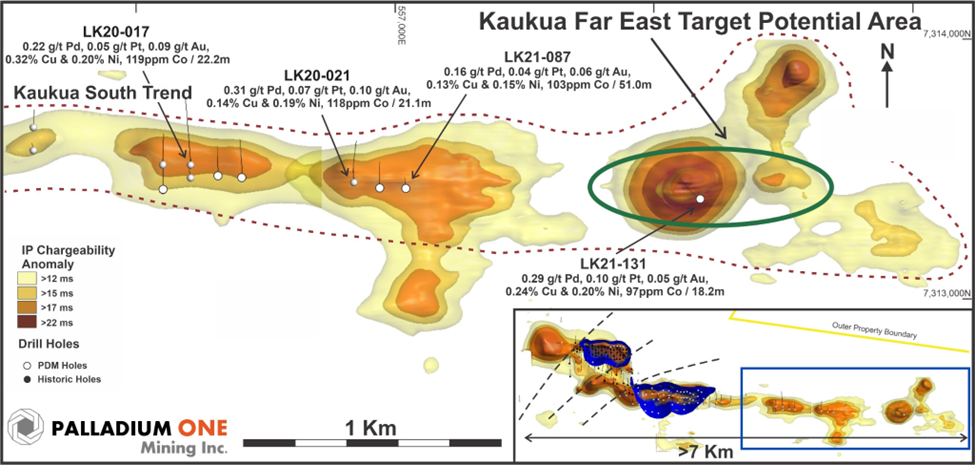

The current mineral resource covers only 5 km of the 38-km marginal series contact zone, for which historical reconnaissance drilling indicated mineralization along nearly its entire length. The company’s near-term plans include two additional open-pit targets in the Kaukua area, and possibly multiple open-pit targets along the 17-km Haukiaho trend.

Three areas of target potential have been defined for near-term resource expansion representing an additional 2.4 km of strike length along the favourable marginal series. These could add between 21.6Mt and 36Mt to the existing resource (Kaukua Far East & Haukiaho East – see figures below).

PDM chief executive Derrick Weyrauch recently told AOTH that growing the resource base to well over 100 million tonnes should be “rather straightforward.”

Right now, the company has 38 million tonnes of indicated and 50 million tonnes of inferred resources, which already represents an opportunity for a large-tonnage long-life mine to be developed by a major.

Tyko Project Update

The LK project isn’t the only thing keeping Palladium One investors alert. The bulk of the company’s exploration efforts in 2022 will still be at the Tyko nickel-copper project in Ontario, where it plans to drill test several areas.

Located 25 km north of the Hemlo mining complex, the ~250 km2 Tyko property is host to a large, Ni-Cu-PGE mineralization system that is similar in style to Vale’s Voisey Bay. A high-grade discovery was discovered at Smoke Lake in November 2020, where drilling returned grades up to 9.9% NiEq over 3.8m.

The Smoke Lake discovery was later awarded the 2020 Bernie Schnieders Discovery of the Year Award by the Northwestern Ontario Prospectors Association (NWOPA) as a recognition for this “outstanding mineral discovery”.

Building off this success, the PDM team continued exploration at the Smoke Lake zone in 2021 with a Phase 2 drilling program (nine holes totalling ~2,000m), which produced a number of high-grade intersections, all near surface. The most recent results were highlighted by 5.0% NiEq over 1.4m.

This year, the company is targeting an even bigger drill campaign of up to 14,000m on several drill-ready targets, with exploration funding already secured through a $4.35 million private placement completed in December.

Conclusion

In just a few months, Palladium One has managed to bolster its resource base in Finland by almost 250% – such a feat is rarely accomplished in the mining industry and is a complete “game changer” for the company; this signals to its peers that the LK project can, in my opinion, one day be developed into a large-tonnage, long-life mine operation.

And make no mistake, the mineral resources at LK will grow even further with continued exploration, and it’s only a matter of time until it reaches 100+ million tonnes. The near-term plan is to accelerate the project’s baseline environmental studies and complete a preliminary economic assessment to confirm its potential scale.

This also doesn’t mean the company’s exploration focus will be diverted away from the award-winning Tyko project in Canada; an even bigger drill campaign than last year’s is being planned, testing several targets with highly anomalous soil sample values of copper, nickel and cobalt.

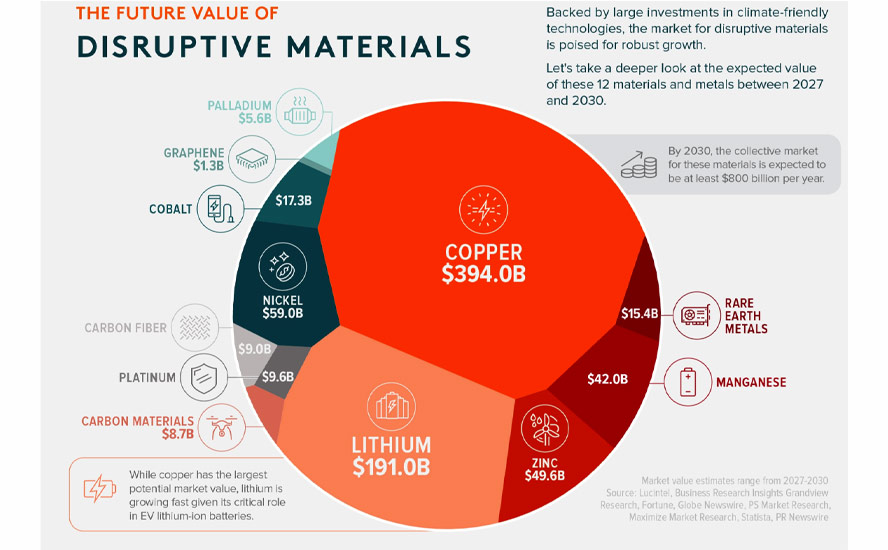

Given that all these metals being targeted are crucial to the new “green economy”, many of which are facing severe supply challenges in the future, Palladium One and both its projects could be of interest to the major miners and even automakers that are looking to secure raw materials.

More importantly, the company’s LK project is situated right in the neighborhood of Europe’s biggest carmakers, making it an intriguing option down the road.

Palladium One Mining

TSXV:PDM, OTC:NKORF, FSE:7N11

Cdn$0.21, 2022.04.28

Shares Outstanding 256.5m

Market cap Cdn$53.8m

PDM website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Palladium One Mining (TSXV: PDM). PDM is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.