Top 5 reasons copper is heading higher

2022.05.06

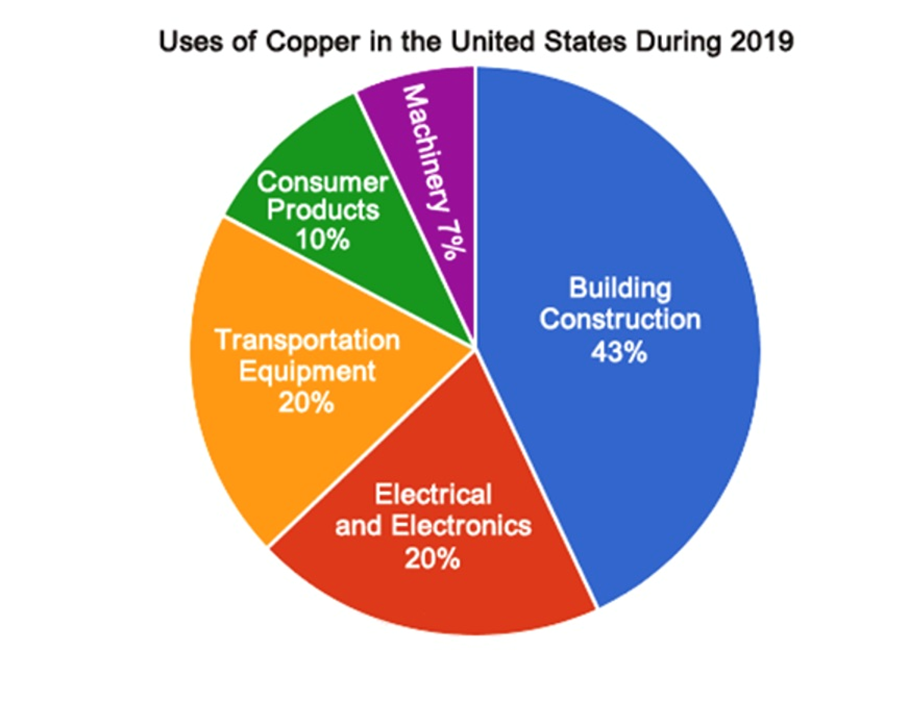

Copper is one of our most important metals with more than 20 million tonnes being consumed each year across a variety of industries, including building construction (wiring & piping,) power generation/ transmission, and electronic product manufacturing.

Roskill forecasts total copper consumption will more than double and exceed 43 million tonnes by 2035, driven by population and GDP growth, urbanization and electricity demand.

In recent years, the global transition towards clean energy has stretched the need for the tawny-colored metal even further. More copper will be required to feed our renewable energy infrastructure, such as photovoltaic cells used for solar power and wind turbines.

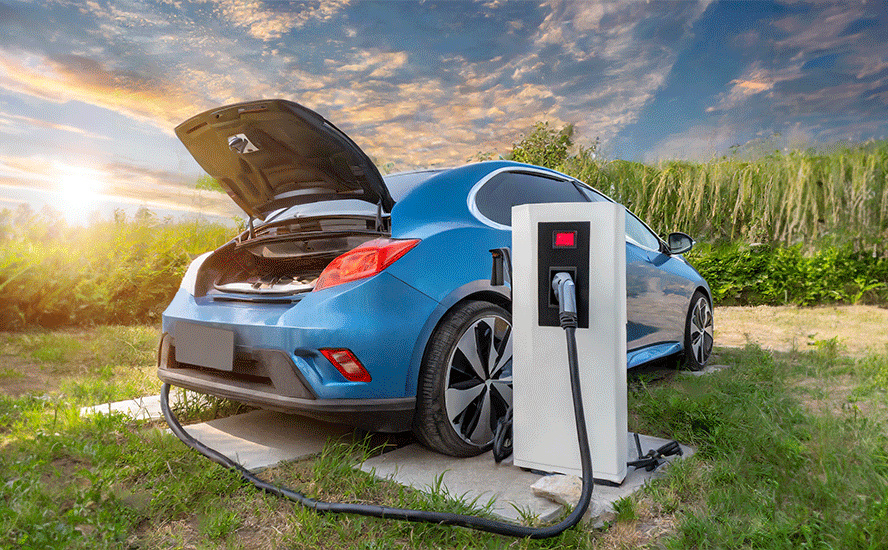

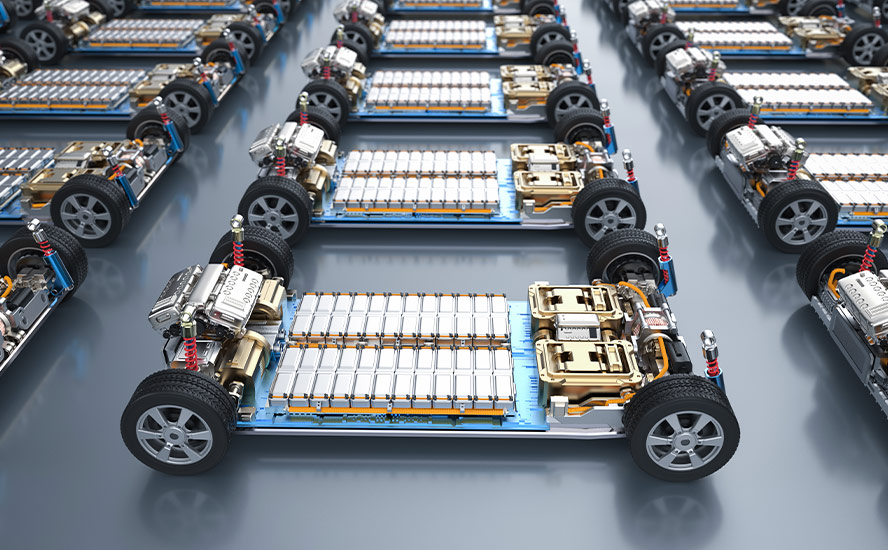

The metal is also a key component in transportation, and with increasing emphasis on electrification, demand is only going to increase, as EVs use about four times as much copper as regular internal combustion engine vehicles.

In fact, copper is so critical to electric vehicle and clean energy technologies, analysts at Goldman Sachs are calling it “the new oil”.

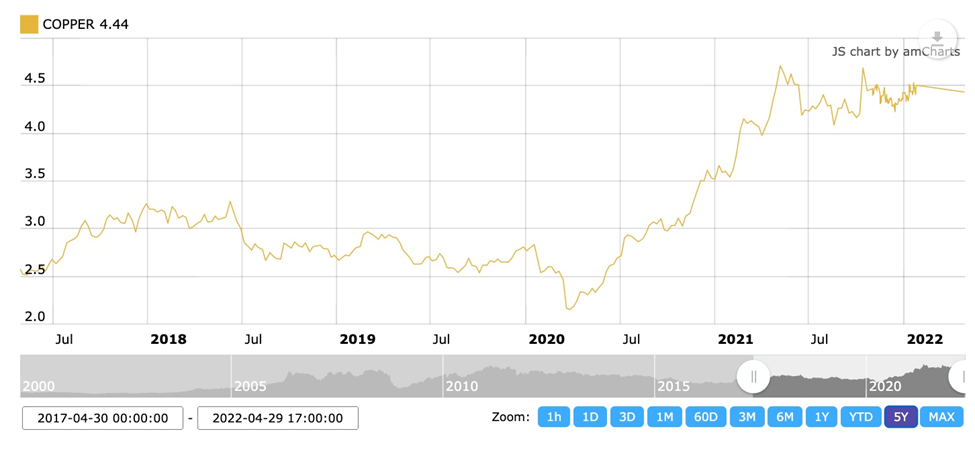

During the first half of 2021, copper rallied on the back of a sharp recovery in economic activity after a year of pandemic-related malaise, led by top consumer China. At the end of last April the spot price broke through the $10,000/t level, the first time that has happened in a decade, and eventually hit a new high the week after.

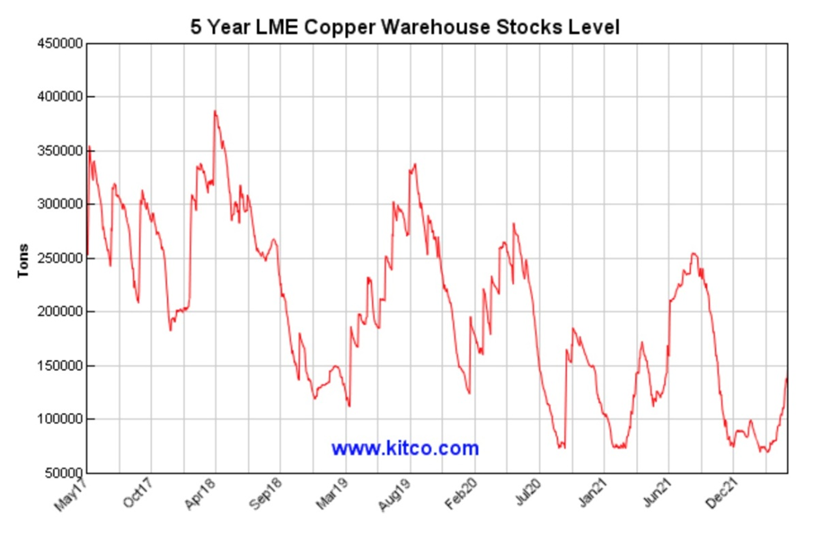

In H2, copper received another boost amid an energy crisis that affected several major producers and threatened global supply. A surge in metal orders from warehouses in Europe saw LME inventories plunge by as much as 89%, to their lowest in 47 years.

All these events factored into copper’s record-breaking year, but the run wasn’t over.

A combination of supply disruptions, historically low copper stockpiles and higher energy costs, propelled the base metal to a new all-time high of $4.94/lb on Friday, March 4.

Despite a number of headwinds, including the repercussions from the war in Ukraine on global growth, rising interest rates, and a slowdown in the Chinese economy, copper is showing remarkable resilience.

Below are the top 5 reasons we think copper prices will stay elevated and potentially move beyond $5 per pound.

- Electrification & decarbonization

The continued move towards electric vehicles is a huge copper driver. In EVs, copper is a major component used in the electric motor, batteries, inverters, wiring and in charging stations. An average electric vehicle contains about 4X as much copper as regular vehicles. Electrification includes not only cars, but trucks, trains, delivery vans, construction equipment and two-wheeled vehicles like e-bikes and scooters.

The latest use for copper is in renewable energy, particularly in photovoltaic cells used for solar power, and wind turbines. The base metal is also a key component of the global 5G buildout. Even though 5G is wireless, its deployment involves a lot more fiber and copper cable to connect equipment.

The big question is, will there be enough copper for future electrification needs, globally? And remember, in addition to electrification, copper will still be required for all the standard uses, including copper wiring used in construction and telecommunications, copper piping, and copper needed for the core components of airplanes, trains, cars, trucks and boats.

The short answer is no, not without a massive acceleration of copper production worldwide.

According to a joint report from Ernst & Young (EY) and Eurelectric, Europe will have 130 million EVs by 2025.

The report’s projections, cited by BNN Bloomberg, show Europe’s EV fleet growing from its current <5 million to 65 million by 2030, then doubling over the following five years. This number of EVS will require 65 million chargers.

EVs take about 85 kg of copper per vehicle.

An EY leader notes it took 10 years to install 400,000 chargers, now we will need about 500,000 per year until 2030, and 1 million every year between 2030 and 2035. Where is all the copper going to come from?

- Infrastructure buildouts

Copper’s widespread use in construction makes it a key metal for civil infrastructure renewal. Last November the United States Congress passed a $1 trillion piece of legislation aimed at addressing the country’s glaring “infrastructure deficit”. Repairing and improving the country’s roads and bridges, public buildings, ports, airports, etc. will require copious amounts of metal, including copper.

China recently announced a $2.3 trillion infrastructure program based on developing high-tech manufacturing. Local governments are being tasked with identifying and financing hundreds of new projects.

According to the USGS Mineral Commodity Summary, nearly half of the world’s copper makes its way into buildings, from downtown skyscrapers to suburban homes. The average single-family home today contains about 200 kilograms (439 pounds) of copper metal.

With physical properties that few metals can match, copper can be used in a wide range of building applications, from heating and plumbing to roofing and electrical wiring.

Furthermore, copper is a sustainable metal for use in building construction, as it can be recycled time and time again without losing durability or conductivity, which means it has low life cycle impacts.

- Production snafus

Copper’s current price strength is underpinned by how tight the copper market is, and is expected to be in future.

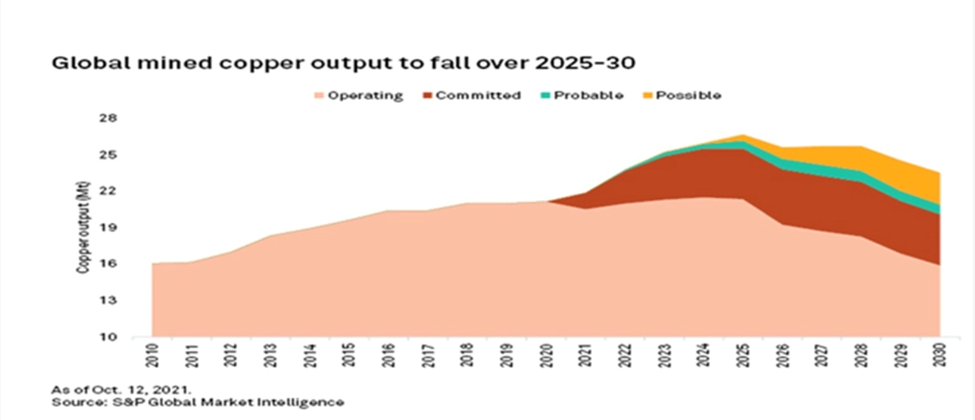

Much more copper is required for the mining industry to avoid a supply crisis that is all but guaranteed within a few years.

In March, the head of base metals supply at CRU, a leading authority on copper, said the global copper industry needs to spend more than $100 billion to build mines able to close a projected annual deficit of 4.5 million tonnes by 2030. The next decade, the supply gap widens to 6Mt.

Other analysts think the supply crunch will come much sooner.

S&P Global Market Intelligence predicts that due to a shortage of projects, copper supply will lag demand starting as early as 2025, with global mine production dropping from last year’s 21Mt to roughly 15.9Mt in 2030.

In fact, the coming supply crisis is manifesting as we write, with some of the world’s largest copper miners proving unable to produce as much as they said they would. BHP, Rio Tinto, Anglo American, First Quantum Minerals and Glencore have all pared back production forecasts, blaming higher costs for their lower output figures.

Following a 14% drop in copper production in Q1, Glencore cut its 2022 guidance by 3% or 40,000 tonnes.

“Supply disruptions in various locations are putting production at risk,” Morgan Stanley analyst Amy Sergeant told Bloomberg earlier this week. “Risks to supply are rising in the near term, which could keep the copper market tighter in the second quarter.”

Inventories across London Metal Exchange warehouses of copper, lead, nickel, zinc and tin haven’t been this low for 20 years, with the total amount of registered metal in the LME’s global warehouse network falling below 1 million tonnes in March.

An even bigger draw-down is occurring within LME shadow inventories, referring to metal that is stored off-market but is under a warehousing contract allowing for exchange delivery.

The result is higher prices and increased volatility.

- Lack of new mines

The Fraser Institute thinks Canada is not doing enough to make the country an attractive jurisdiction for mining investment.

Bill C-69 is an example of legislation passed by a government that has the ear of special interests. The new legislation broadens the scope of the assessment process and adds more consultation with the public and particularly indigenous groups.

Such anti-mining legislation can present a significant obstacle to companies trying to move a project forward to production, and in the worst of cases, drags the process out so many years that the economics no longer work and the mine is shelved.

This often happens in North America, where it can take up to 20 years to move a project from discovery to commercial production. A preliminary economic assessment done in year 3 is of little use if the minerals aren’t produced until year 20.

According to Goehring & Rozencwajg Associates, the number of new world-class copper discoveries coming online this decade “will decline substantially and depletion problems at existing mines will accelerate.”

According to the Wall Street firm’s model, the industry is “approaching the lower limits of cut-off grades,” and brownfield expansions are no longer a viable solution.

“If this is correct, then we are rapidly approaching the point where reserves cannot be grown at all,” the report concluded.

It also shines a light on the importance of making new discoveries in establishing a sustainable copper supply chain.

Over the past 10 years, greenfield additions to copper reserves have slowed dramatically. S&P Global estimates that new discoveries averaged nearly 50Mt annually between 1990 and 2010. Since then, new discoveries have fallen by 80% to only 8Mt per year.

And while S&P Global has identified 14 probable and 26 possible projects in the copper pipeline, the firm admits it’s unlikely that all of those will come to fruition.

- Resource nationalism

Along with technical issues such as falling grades and geological constraints concerning copper porphyry deposits, there is also supply pressure from growing resource nationalism.

The industry is running out of copper at precisely the wrong time, as demand is accelerating rapidly not only for traditional uses, i.e. construction, transportation and telecommunications, but for the green economy which includes vehicle electrification and renewable energy.

Yet all the low-hanging fruit, so to speak, has been picked.

There is a need to go further afield and dig deeper to find copper at the grades needed to economically produce copper products for end users. This usually means riskier jurisdictions that are often ruled by shaky governments, with an itchy trigger finger on the resource nationalism button. Combine that with production problems and you have all the makings of a structural supply shortage, meaning higher copper prices will likely be with us for the foreseeable future.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.