5 reasons to consider gold over crypto

2022.04.20

The mainstreaming of cryptocurrency has made many of us wonder whether it could actually replace gold’s role as a portfolio diversifier.

Some believe that the likes of bitcoin have proven its worth as an asset that can offer superior returns during economic downturns, an environment under which gold has traditionally thrived.

As Tyler Winklevoss, a tech entrepreneur, once put it: “Our basic thesis for bitcoin is that it is better than gold.”

Indeed, the crypto market performed very well in 2021, enjoying high returns and growing its infrastructure further. Bitcoin outpaced not only equities but also gold, solidifying the widely held view that both the digital currency and safe-haven metal could co-exist, with the former dubbed the “new gold”.

Billionaire hedge fund manager Paul Tudor Jones, who is super high on crypto, even stated that he is willing to give this asset class the same 5% weighting as gold, commodities and cash. Ray Dalio, another hedge fund guru, once said he’d rather own bitcoin than government bonds.

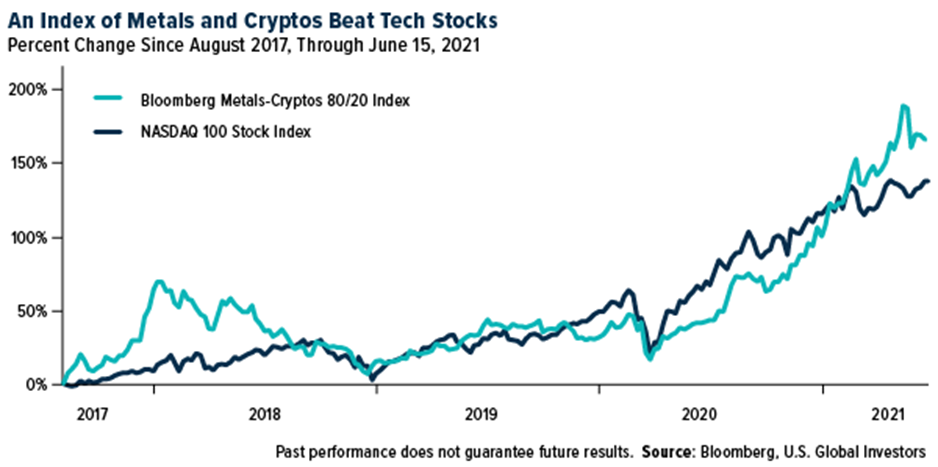

A Blloomberg index tracking metals and cryptos (80/20 basis) has beaten the tech-heavy Nasdaq-100 since August 2017, adding credence to the returns offered by this budding sector.

However, when presented with the choice between gold and crypto (i.e. bitcoin), the decision may not be as close as we think, at least not yet. For many reasons, gold is stiff the preferred option given its various advantages over crypto:

- Volatility

The idea of investing in stock alternatives is to protect your investment against market volatility with a stable asset. Ironically enough, most cryptocurrencies are extremely volatile, and even a “safe” one like bitcoin is more of a risk-on asset like stocks. This is because cryptos are oftentimes subjected to the “media effect” — meaning their values are heavily influenced by investor sentiment and media hype.

On the other hand, gold is a known commodity that has been fundamentally embedded in the financial system for decades, so no amount of media hype could sway public perception of the metal. It has no positive correlation with the stock market, and therefore is less vulnerable to its ups and downs.

Unlike many risky assets, gold has been able to reliably hold value over time despite episodes of fluctuations. During inflationary periods, it even outperforms the market as investors turn to gold as a hedge; this trend has held true for over 50 years. Major cryptos like bitcoin, though, remain unproven in this regard.

Case in point: concerns of stagflation in the US have driven gold up by 9% this year, while bitcoin is now down 15%, indicating that investors still prefer the more traditional asset during uncertain times.

- Liquidity

Another factor that comes into the gold vs. crypto debate is liquidity: how easily the asset can be converted into cash. Although bitcoin and many other cryptocurrencies trade 24 hours a day around the globe, they are less liquid than other asset classes. Transactions involving bitcoin et al. generally come with a cost and/or time delay, which is also a contributing factor to its price volatility.

While the increased number of trusted bitcoin exchanges has greatly improved the liquidity problem over the years, crypto’s liquidity remains largely dependent on the platform, the time of the day, and the amount being cashed out.

Meanwhile, gold has always been an extremely liquid asset; most of the time, bullion can be easily exchanged for cash, as it’s universally recognized around the world. Nearly 90% of the world’s annual gold production changes hands each day.

In fact, data from the World Gold Council (WGC) shows that the precious metal is actually the second most liquid asset after S&P 500 stocks.

- Regulations

Because gold already has an established system for trading, weighing and tracking, the regulations that govern this market are generally very clear and rigid. Unlike stocks and currency, gold cannot be manufactured on the spot and must be mined from the ground. This also makes forgery or fraud extremely difficult, thus protecting gold owners.

Crypto, however, does not offer investors the same degree of protection. Since this market is still in its infancy stage, the regulatory infrastructure to ensure that users are safe is not yet in place. While it’s true that a major cryptocurrency like bitcoin is much less vulnerable to theft thanks to its encrypted and decentralized system, it is not immune to its own regulatory risks.

For example, in some countries, the central bank may worry that crypto could undermine the stability of the monetary system, and therefore would take certain measures to control this emerging market, including creating an uneven playing field to put crypto at a disadvantage.

Taking the most extreme measure to date was China, which outright banned all crypto activity in September 2021 and is now promoting its own digital currency. The threat of regulatory action in other parts of the world will continue to pose a great risk for crypto investors, something that the more “legal” gold market is immune to.

- Utility

Unlike crypto, which mostly serves as a medium of exchange in the form of a digital currency, gold has a variety of uses across many industries, such as fashion, arts, electronics, and many more. Gold’s place in human history is also much richer, dating as far back as some 5,000 years ago; today, the precious metal is still deeply worshiped by cultures all over the world.

Given its multi-functional utility and revered status as a symbol of wealth, gold has been able to withstand the ravages of time and maintain its prominence through every era of human civilization.

In the future, gold is expected to continue to hold value from generation to generation, as no other metal will ever replace it.

- Rarity

What’s really underpinning gold’s value is simply how rare this yellow-colored metal is. For every billion kg of the Earth’s crust, there is about 4 kg of gold (hence the “precious metals” label) — this fraction is even less than other precious metals like silver and platinum. And once the ore is mined, the extraction process of gold is also very complex and costly.

It is estimated that all the gold metal mined throughout history would fit into a square box with sides of around 20 meters in length, demonstrating just how scarce the metal is.

Although some cryptocurrencies like bitcoin are also rare given the limited supply, investors could always have a wide selection of digital assets to choose from, and in a sense, the investment possibilities in crypto are unlimited.

Gold investors, meanwhile, have only a limited number of options aside from buying the physical metal; they can either place money into funds that replicate the value of gold (i.e. gold-backed ETFs), or consider contracts that give them the right to buy the asset later on (options and futures).

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.