Max closes $17.7M financing, setting up a busy summer at CESAR

2022.06.15

Max Resource (TSXV:MAX; OTC:MXROF; Frankfurt:M1D2) has just closed the final CAD$2.4 million of its $17.7 million financing, putting the Vancouver-based junior resource company in an excellent position to drill and continue exploring its flagship CESAR copper-silver project in northeastern Colombia, this summer.

The brokered private placement led by Cormark Securities, which took 2.5 million units @ $0.60, brought in $1.5 million. Combined with a non-brokered offering of 1.5 million units, also at 60 cents, that secured $900,000, and Cormark placed $1,040,000 of the $15.3 million financing which closed on May 18, Max’s aggregate proceeds total $17.7 million.

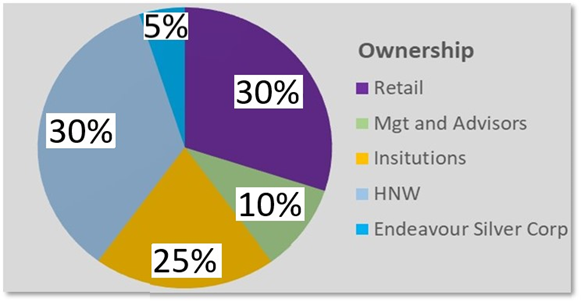

Institutions now hold 25% of the company (see pie chart).

In connection with their earlier agreement with Max, Endeavour Silver subscribed for 1.6 million units at $0.60 for total holding of 8.2 million units to keep their 5% ownership position.

Right now, Max has roughly $21M from the last two financings in the treasury (Max also has 14.8 million warrants at $0.36 from the March financing that are well in the money and should add another $5.3m).

Enough to do all the IP (induced polarization geophysical survey), drilling, etc. they need to do.

Those involved in this second financing, $0.60 common share/ $0.85 warrant, were given a full warrant, good for a year.

In a year, if all goes well, the 28 million $0.85 warrants will get exercised (allowing the two cornerstone institutions participating in the financing to each increase to 10% of the company and not dilute their position further), raising another $23.8M to continue working.

CESAR

In my opinion Max’s CESAR property has real potential to be one of the largest copper-silver systems ever discovered.

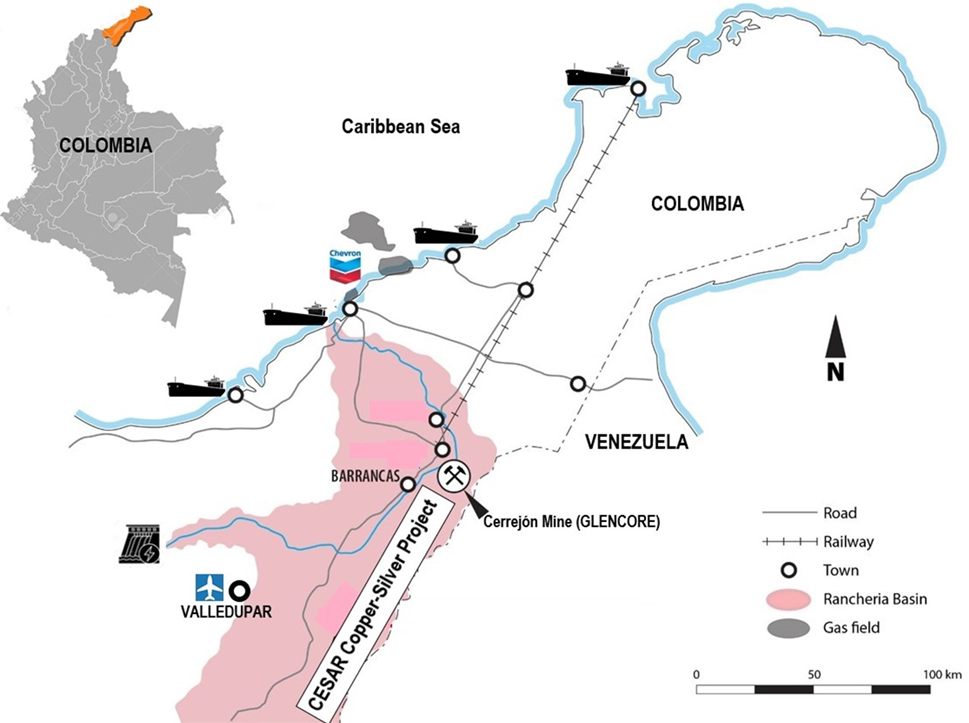

The project sits on a massive sedimentary system covering a significant portion of the 200-km-long Cesar Basin, a geological feature that extends for over 1,000 km from the northern tip of Colombia southwards through Ecuador and Peru.

The Max exploration team interprets the sediment-hosted stratabound mineralization, to be analogous to both the Central African Copper Belt (CABC) and the Polish Kupferschiefer in terms of grade, scale and mineralogy.

Almost half of the copper known to exist in sediment-hosted deposits is contained in the CACB, including Ivanhoe Mines’ 95-billion-pound Kamoa-Kakula copper deposits in the DRC.

Poland’s Kupferschiefer deposits are considered to be the world’s biggest silver producer and Europe’s largest copper source. In fact, Kupferschiefer’s silver yield is almost twice the production of the second-largest silver mine.

Therefore, Max believes CESAR has the makings of a district-scale copper-silver system comparable to the world’s best.

Exploration success

For the past two and a half years, Max has not only been discovering high-grade copper zones on its flagship CESAR property, but is expanding these areas, moving ever closer to confirming the existence of a huge sediment-hosted system.

Max has so far received 19 mining concessions covering a total area of 186 km² (additional concessions are pending) — more than any other company has ever received in Colombia.

This significant milestone paves the way for Max to initiate drill permitting on its URU concessions.

URU represents a new discovery that spans a major structural corridor and remains open in all directions. Geologically, Max compares the sediment-hosted copper-silver mineralization at URU to that found in the Central African Copper Belt.

The 20-km-long URU zone returned 7.0 meters @ 8.5% copper + 143 g/t silver and 16.8m @ 8.3% copper + 146 g/t silver.

Rock chip channel sampling featured the following assay highlights:

- at the valley bottom 7.0m @ 8.5% copper + 143 g/t silver (true thickness);

- 6.0m higher in elevation, 16.8m @ 8.3% copper + 146 g/t silver (true thickness); and

- 190m above the valley bottom and 290m NNE, 48.0m at 5.3% copper + 44 g/t silver (along a ridge).

Recently Max discovered another copper-silver outcrop (chalcocite-bearing) located 750 meters east, and on trend, with the URU discovery. In a news release this week, the company said the copper-silver outcrop is over 15 meters thick, and that it has been chip-channel sampled over 1-meter increments, with assay results pending. According to Max, Field crews are following-up along the new 750m mineralized trend. It appears the URU discovery and the new outcrop represent the same copper-silver mineralized structure that dips to the south and extends east-west.

Click here for Youtube video of a drone flight

URU now extends north-northeast over 290m and 750m east, with a combined elevation of 322m.

Drill targets are also being delineated at the Conejo and AM targets to the north. The AM discovery features Kupferschiefer-type mineralization with highlight values of 34.4% copper and 305 g/t silver.

Conejo has high-grade copper-silver over 3.7 km, averaging 4.9% Cu (2% cutoff) and open in all directions.

Geophysical surveys

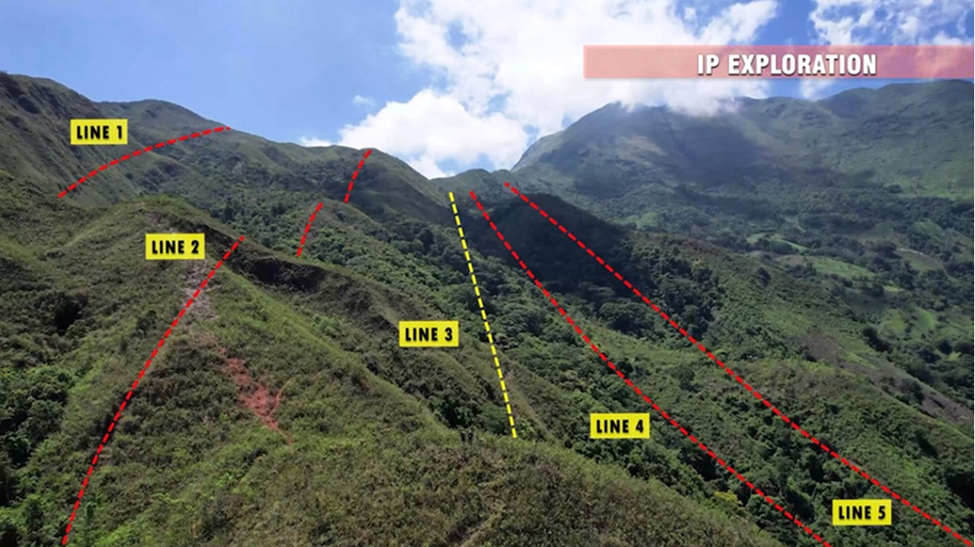

To follow Max’s progress at CESAR, it’s important to understand the sequence of events. First, the Max field team will conduct an induced polarization (IP) survey at URU so that they can see in three dimensions what the mineralization looks like before they start drilling it. Because the primary copper mineral is highly conductive chalcocite, it lights up nicely on an IP geophysical survey.

IP will be beneficial not only for helping to guide the drilling, but in showing the market the size and magnitude of the deep-seated structures Max is expecting to find with the drill bit.

“The objective of the field work and the geophysical survey is to expand the URU Discovery footprint and prepare for drilling, which will be conducted by Kluane Drilling of Colombia, as we have now finalized the contract,” said Max’s CEO, Brett Matich, in the June 13 news release.

To perform an IP survey, technicians place electrodes into the ground. A current is injected into the transmitting electrodes and the potential is measured at the receiving electrodes. The survey grid is typically composed of lines 100 meters apart, and is normally perpendicular to the strike. Chargeability and resistivity data is collected, then processed into maps and models for interpretation.

The crew then moves on to the next target.

The company has already conducted a 290 km² LiDAR survey over the five drill target areas spread along 15 km of strike at URU. LiDAR is a geophysical technique that provides detailed information on an area’s topography. It can also help to pinpoint mineralized structures.

For Max, the goal of LiDAR was to hone in on drill targets within the URU zone and to maximize the success of what will be the first drill campaign targeting copper-silver deposits in the Cesar Basin.

Indeed it is important to emphasize, that within the basin, there has never been any modern exploration, other than seismic surveys done by the oil and gas industry. In other words, no geophysical surveys (eg. LiDAR, IP) and no drill hole has ever been sunk seeking copper, on Max’s 186 square kilometers of mining concessions. This is pure greenfield exploration, with significant discoveries coming on a regular basis.

Visualizing CESAR

Max is not only planning IP across the five target areas at URU; the company as mentioned has already completed a LiDAR survey, and it will also be incorporating data from the above-mentioned seismic regional surveys, done within the Cesar Basin.

Geophysics then, for Max is a two-pronged approach: at a regional level, which includes not only the mineralization but the structures; and at individual targets, such as the first target to be drilled at URU. (seismic provides useful information on the area’s stratigraphy/ rock layers)

The company plans to compile all of this survey data (seismic, LiDAR, IP, and other geophysical techniques, land- and air-based) into a three-dimensional model, using LeapFrog and Micromine, two specialized geological modeling software programs. The idea is for the 3D geological model to be used both for interpretation and marketing purposes. Drone footage of the project will also be included, as will drill results, when they become available.

The constantly evolving model will essentially have three parts: one focused on existing drill targets; the second will look for new drill locations; and the third will build a geological model for the basin.

“It’s like a jigsaw puzzle, and at the same time it helps in conjunction with the work you’re doing on the ground.” Matich told me over the phone, Monday, in explaining Max’s 2022 exploration strategy.

The company understands the importance of visuals in communicating its story to investors. It plans on being very transparent with the data it receives, and will be showcasing its increasingly sophisticated 3D models on it’s website. Max also wants to talk with analysts who can help share the narrative with retail and institutional investors. Ideally, analysts would come to the property and see the drilling for themselves.

They can also visit the numerous mineralized outcrops, across the 90-km-long property, to get an indication of CESAR’s scale.

“Because it’s so visual we encourage analysts to come on site. We can’t really pitch them the enormity of it until they get here,” says Matich.

The next step for Max after doing IP at URU, is to secure drill permits. Obviously if Max is to drill this summer, it needs to obtain drill permits within a relatively short window. We are confident the environmental baseline studies that have preceded the permit applications will be favorable, that the IP surveys will enlighten the drill targeting process, and that the drill permits will be granted in good time.

Note that each permit is for an entire area, not just one drill pad. I’m expecting the first drill permit to be an important signal to the market. As IP is completed at the various targets, more drill permits will be applied for, and hopefully, granted, setting Max up for continued exploration success at URU to begin with, and later, at Conejo and AM.

Conclusion

It’s full steam ahead for Max as the company, flush from a $17.7M financing, is poised to drill CESAR for the first time after completing the all-important IP survey at URU.

The CESAR project is in a great mining location with plenty of existing infrastructure thanks to its proximity to Glencore’s Cerrejon coal mine and associated rail, road, power and port facilities.

A recent poll shows the number of Colombians who believe mining has a positive impact on the country’s economy continues to increase. This includes the northern Cesar region where Max is developing its project.

As a testament to the country’s stability, among the major mining companies working in Colombia presently are BHP, Barrick, Newmont, Anglo American, Yamana, Glencore and Agnico Eagle.

“The financing’s now complete, meaning we will soon have more news,” Matich told AOTH, noting Max is significantly expanding the exploration side and will be talking about it. “Keep in mind we’re waiting for the drill permits, and in the meantime there’s a huge amount of work that we’re doing.”

The last point is important. Remember: despite all of the developments that have occurred over the past six months, including the completion of some major financings, and reaching a deal with Endeavour Silver, Max remains true to its original strategy: run geophysics and work through the process of obtaining drill permits for drilling CESAR for the first time; and continue prospecting and mapping to pick up more mineralization at surface to extend the footprint.

To us at AOTH, what’s really enticing about the CESAR project is its extremely unique geological model and the potential of building out a large resource. I’m expecting plenty of news flow from Max this summer as exploration shifts into high gear.

Max Resource Corp.

TSXV:MAX; OTC:MXROF; Frankfurt:M1D2

Cdn$0.63 2022.06.14

Shares Outstanding 160.2m

Market cap Cdn$101.9m

MAX website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Max Resource Corp. (TSXV:MAX). MAX is a paid sponsor on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.