Copper market update

2022.02.15

The copper industry is threatened by a looming global supply crisis, as the world needs more of the metal to accelerate its transition towards cleaner energy sources.

Green-related demand will gather pace in the second half of this decade, ultimately generating nearly 5 million tonnes of additional demand, Goldman Sachs recently said.

BloombergNEF estimates that in 20 years, copper miners will need to double the amount of global production — from the current 20 million tonnes annually to 40 million tonnes — just to meet the demand for a 30% penetration rate of electric vehicles.

This is a tough ask considering some of the world’s largest mines are seeing depleted copper reserves and lower ore grades, so it would be difficult for global production to even maintain a 20Mtpa pace.

Mining and metals consultancy CRU Group estimates that, without new capital investments, global copper mined production will drop below 12Mt by 2034, leading to a supply shortfall of more than 15 million tonnes.

According to CRU, there are over 200 copper mines that are expected to run out of ore before 2035, with not enough new mines in the pipeline to take their place.

S&P Global Market Intelligence predicts that a production shortfall of 3.85 million tonnes could happen as early as 2025, due to diminishing supply from existing mines and rising demand for copper concentrates globally.

The solution, as simple as it sounds, is to have more copper projects that can be developed into producing mines.

S&P Global has identified 14 probable and 26 possible projects in the copper pipeline, though the firm admits it’s unlikely that all will come to fruition.

Even should many of these projects come online, they would likely just replace existing copper output and not contribute to supply growth. Therefore, a sustainable copper supply chain to meet future demand requires more discoveries than we’ve seen in recent years.

As of now, the global copper cupboard is quite bare. Over the past decade, greenfield additions to copper reserves have slowed dramatically around the globe, with tonnage from new discoveries falling by 80% since 2010, according to S&P Global.

For 20 million tonnes of additional copper to be delivered by 2040, the world needs the equivalent of one new Escondida mine (1 million tonnes annual production) each year for the next 20 years.

And this task is only going to get more difficult when factoring in events beyond miners’ control. Increasing copper supply is only getting harder as environmental groups and local communities refuse to grant miners “social licence” to operate, and politicians seek a bigger share of industry profits.

More positively, industry analysts are becoming more bullish on commodities, in this era of high inflation, especially metals. (commodities are considered a good hedge against inflation)

The stock market has been volatile lately on an expected interest rate hike from the US Federal Reserve, likely in March. On Thursday it was reported that US consumer prices surged more than expected in January, lifting US CPI to 7.5%, higher than December’s 7% and hitting a fresh 40-year record.

Bloomberg has Jeff Currie, global head of commodities research for Goldman Sachs, declaring copper as “the new oil”, noting it’s absolutely indispensable in global decarbonization strategies with copper shortages already being felt.

Referring to the Bloomberg Commodity Spot Index, which reached a new record earlier this year, driven in part by surging oil prices, Currie said this week he’s never seen commodity markets pricing in the shortages they are right now.

“I’ve been doing this 30 years and I’ve never seen markets like this,” the commodity expert said in a Bloomberg TV interview. “This is a molecule crisis. We’re out of everything, I don’t care if it’s oil, gas, coal, copper, aluminum, you name it we’re out of it.”

As evidence, Currie points to the futures curves in several markets that are trading in “super-backwardation”. Bloomberg points out, All six of the main industrial metals traded on the London Metal Exchange moved into backwardation late last year, in a rare synchronized bout of tightness last seen in 2007.

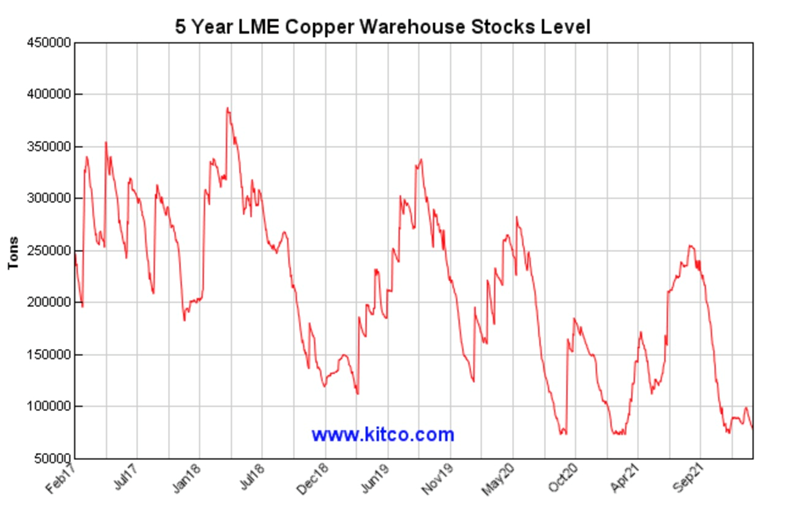

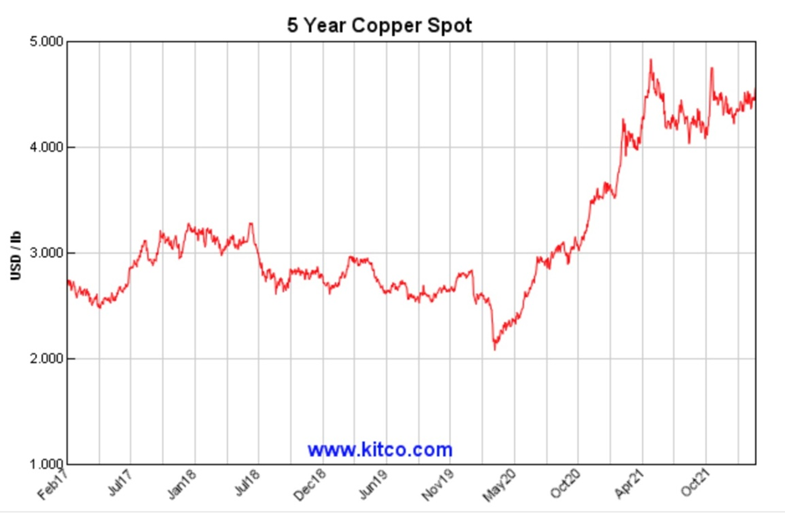

Copper stored in LME, New York and Shanghai Metal Exchange warehouses are once again approaching historically low levels, causing copper prices to spike, in a repeat of the same trend last October, which sent the bellwether metal into record territory. Only about 200,000 tonnes were available Wednesday, not even enough for three days global consumption, as March copper futures hit $4.58 a pound.

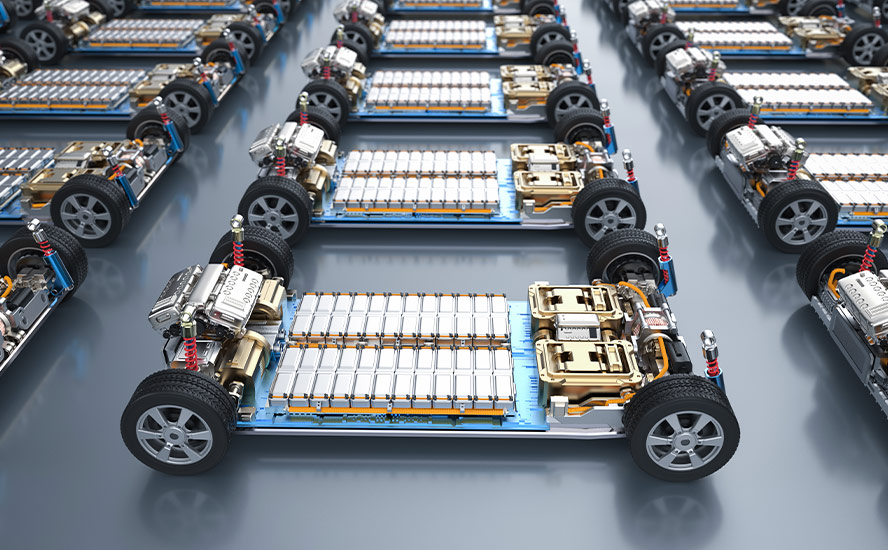

Meanwhile the demand side of the equation is strengthening, helped by increased electric-vehicle penetration. According to a joint report from Ernst & Young and Eurelectric, Europe will have 130 million EVs by 2025.

The report’s projections, cited by BNN Bloomberg, show Europe’s EV fleet growing from its current <5 million to 65 million by 2030, then doubling over the following five years. This number of EVS will require 65 million chargers.

EVs take about 85 kg of copper per vehicle.

An EY leader notes it took 10 years to install 400,000 chargers, now we will need about 500,000 per year until 2030, and 1 million every year between 2030 and 2035. Where is all the copper going to come from?

Meanwhile the Biden administration is planning on spending $5 billion over five years to install EV chargers, mostly along interstate highways, with another $2.5B given to rural and under-served communities. The funds are coming from the trillion-dollar infrastructure bill passed by Congress in November.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.