Governments ignore mining in electrification push

2022.04.02

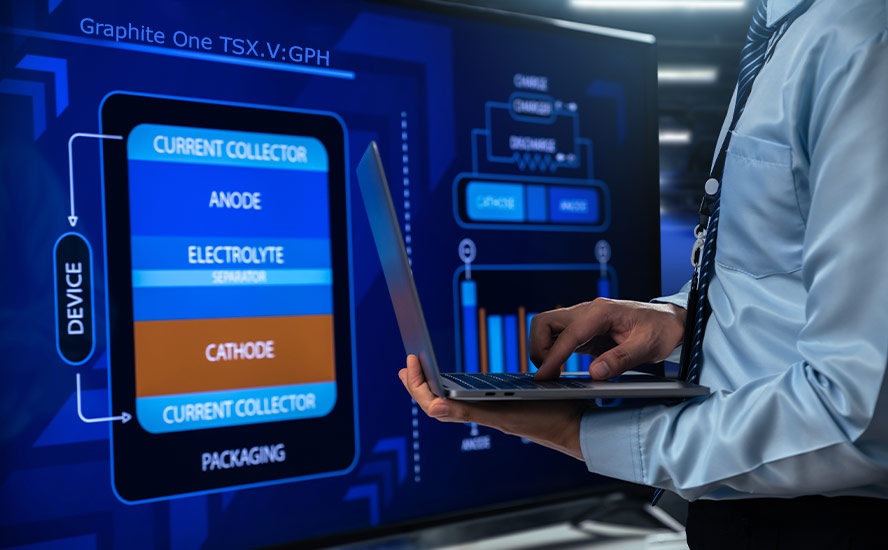

The supply chain for batteries, wind turbines, solar panels, electric motors, transmission lines, 5G — everything regarding electrification and decarbonization that is needed for a green economy — starts with metals and mining.

A green infrastructure and transportation spending push will mean a lot more metals will need to be mined, including lithium, nickel, and graphite for EV batteries; copper for electric vehicle wiring, charging stations and renewable energy projects; silver for solar panels; rare earths for permanent magnets that go into EV motors and wind turbines; and silver/ tin for the hundreds of millions of solder points necessary in making the new electrified economy a reality.

In fact, battery/ energy metals demand is moving at such a break-neck speed, that supply will be extremely challenged to keep up. Without a major thrust by producers and junior miners to find and develop new mineral deposits, glaring supply deficits are going to beset the industry for some time.

According to research by Fastmarkets, the lithium market is facing a growing deficit through 2023, with a deficit of 60,000 tonnes of lithium carbonate equivalent (LCE) in 2022 and a deficit of 89,000 tonnes of LCE in 2023.

Like lithium, the increased uptake in nickel use is raising concerns over nickel supply. According to CNBC, Analysts at Rystad Energy warned last fall that global demand for the high-grade nickel required for EV batteries is likely to outstrip supply by 2024, a message that has since been echoed by other commodity analysts, including Jonas’s counterparts at Morgan Stanley.

BloombergNEF estimates that in 20 years, the world’s copper miners must double the amount of global production — from the current 20 million tonnes annually to 40 million tonnes — just to match the demand for a 30% penetration rate of electric vehicles.

These supply deficits are only going to increase our dependence on foreign suppliers, unless the West, meaning Europe and North America, make a major departure from the way we’ve been doing things and start mining and refining minerals.

Mining gets short shrift

The US and Canadian governments have been good about providing incentives for electric vehicle buyers and manufacturers. When it comes to mining, however, little support has been offered.

Last year in the United States for example, governments spent $2 billion in public subsidies for the construction of battery and electric vehicle plants.

Contained within the Biden administration’s $1.75 trillion Build Back Better Act, narrowly passed by the House of Representatives but still awaiting a vote in the Senate, is a measure to boost the federal subsidy for an EV purchase to $12,500. This would erase the approximately $10,000 price premium that has kept many buyers from considering buying an electric car or truck.

The Canadian government recently extended, and funded, an incentive plan for would-be EV buyers that provides rebates up to $5,000 for cars valued at under $45,000. (which in Canada, isn’t many…)

But it’s funny. Most public officials appear to have no concept of how important mining is to developing a North American EV supply chain, one that encompasses everything “from mine to battery to showroom”.

In fact, as US automakers like Ford and GM prepare to break ground on a number of electric-vehicle manufacturing facilities in 2022, they will be competing with international rivals, and US based start-ups, for the supply of metals required for the so-called greening of the economy.

That’s because the Biden administration has come out against domestic mining through a number of anti-extractive industry decisions, while it supports cleaner EV manufacturing and auto-assembly.

The White House is working to enlist labor support (presumably not mining labor unions though) as it tries to build a case that its green policies are creating jobs, ahead of the 2022 midterm elections.

Biden officials have reached out to unions across the country asking for specific job-boosting projects the administration can take credit for, labor sources have said.

Obstacles to mining

The Democratic Party’s aversion to mining is, at least partially, a reflection of the American public’s reluctance to accept the extractive industry as part of the country’s future.

Mining rare earths? Too complicated. Too polluting. Let China do it. Let anybody do it but us. It’s classic NIMBYism. The same goes for cobalt, lithium, sulfide nickel, or most of the other 35 minerals the US deems critical to its economic and national security.

So, instead of building a “mine to EV” supply chain, Biden and his Democrats want to skip the mining and go straight to the cleaner, manufacturing-intensive electric vehicle-building, that will supposedly bring plenty of jobs.

A Reuters story claims the United States has enough reserves of lithium, copper and other metals to build millions of its own vehicles, but opposition to new mines may force the country to rely on imports that could delay efforts to electrify its roughly 275 million cars and trucks.

Last year Biden issued an executive order aimed at making 50% of all new vehicles sold in 2030 electric.

Arguably, if electrification is delayed due to metals supply problems, his administration have only themselves to blame.

The United States has plenty of EV metals but the White House and Congress have chosen not to tap them.

“If we don’t start getting some mining projects under construction this coming year, then we will not have the raw materials domestically to support EV manufacturing,” said Reuters quoting an executive at a company developing a US lithium-boron deposit.

Among the mining projects facing opposition from indigenous groups, ranchers or environmentalists, are:

- The Thacker Pass lithium project in Nevada. A judge last September denied a request by native Americans to halt excavation at the mine site over concerns it may host ancestral bones and artifacts. This year, federal judges will rule in separate cases whether mine approvals granted by former President Trump should be reversed.

- Another lithium project, in North Carolina, is facing pushback from local landowners that could cost Piedmont Lithium necessary local zoning approvals.

- State regulators in Minnesota are weighing whether permits issued to Polymet Mining, controlled by Glencore, should be revoked or re-issued. The North-Met project would be Minnesota’s first copper-nickel mine.

- Biden himself took steps to block Antofagasta’s Twin Metals copper and nickel project in Minnesota, with the US Forest Service in October proposing a 20-year ban on mining in the Boundary Waters region. The Chile-based company appealed the decision which it called politically motivated, since Biden aimed to shore up support with environmentalists and counter his earlier commitments to allow more domestic mining. Earlier this year the Biden administration effectively canceled two long-standing mineral leases at the Twin Metals mine.

- The massive Pebble deposit of Northern Dynasty has been halted because of environmental concerns.

Along with siding with, or not going against, mining opponents, the Biden administration is also practising resource nationalism by trying to exact a larger piece of the metals pie.

Last September a congressional committee added language that would set an 8% gross royalty on existing mines and 4% on new ones.

There would also be a 7-cent fee on every ton of rock moved. According to a Reuters story the proposal would mark one of the most-substantial changes to the law that has governed U.S. mining since 1872 and could raise about $2 billion over 10 years for federal coffers…

Executives say Biden’s goal to have 35% of U.S. electricity generated by solar panels – up from 3% today – would be all but impossible without new mines.

Mining is seen by some as a necessary evil whose environmentally destructive practices should be stopped, or at least, shouldn’t take place anywhere near them. They don’t realize, or care, that without mining there would be no modern society: no steel to make bridges, no copper wiring that powers homes and businesses, no uranium to fuel nuclear reactors, no jewelry, no rare earths to make smart phones, solar panels, color monitors and TVs. Usually they want resource extraction halted, at all costs — the minerals or the oil kept in the ground.

Note: the United States already has very strong environmental protections through the National Environmental Policy Act (NEPA). Infamously, the act can require seven to 10 years to secure a US mine permit, compared to two years in countries with similar regulations like Australia. Thus it is no surprise that mining companies with a choice to mine domestically or abroad, would choose the latter.

In Canada, Bill C-69 is an example of legislation passed by a government that has the ear of special interests. In summary, Bill C-69 broadens the scope of the assessment process and adds more consultation with the public and particularly indigenous groups.

Such anti-mining legislation can present a significant obstacle to companies trying to move a project forward to production, and in the worst of cases, drags the process out so many years that the economics no longer work and the mine is shelved.

This often happens in North America, where it can take up to 20 years to move a project from discovery to commercial production. A preliminary economic assessment done in year 3 is of little use if the minerals aren’t produced until year 20.

A Fraser Institute report found that Canadian mining jurisdictions lagged their international competitors for increases in the time for permit approval, transparency and confidence that permits will be granted.

Special interest groups tend to treat all mining as having the same destructive effect on the environment. They don’t differentiate between mining for metals that are on the way out (like coal) and say, copper and nickel, metals that are highly in demand, where the benefits of extraction could, depending on location, outweigh the effects of some ground disturbance.

In response to anti-mining sentiment among some sectors of the population, resource companies are trying harder to make their operations less carbon-intensive and are ensuring that they adhere to more stringent environmental, social and governance (ESG) criteria.

Miners are finding that institutional investors are pressuring them to show they are investing in solutions, not problems.

Companies that proactively address the issues that investors want them to look at may see a lower cost of capital, but this must be weighed against the implementation of ESG solutions which add to a miner’s cost per tonne or ounce.

Positive developments

To be fair, the Canadian and US governments have made some good decisions regarding the electrification and decarbonization shift.

The Biden administration allocated $6 billion as part of a huge infrastructure bill aimed at developing a US battery supply chain and weaning the auto industry off its reliance on China. In a July 2021 report, the White House said the number of mineral commodities for which the US is reliant on imports for more than a quarter of demand, has jumped to 58 from 21 in 1954.

Biden is reportedly invoking War powers to encourage domestic production of critical minerals for batteries. White House discussions involve adding battery materials to the 1950 Defense Production Act, previously used by President Harry Truman to make steel for the Korean War, and by President Trump to spur production of masks during the pandemic.

An un-named source told Bloomberg that adding minerals like graphite, lithium, nickel, cobalt and manganese to the list could help mining companies access $750 million under the act. The presidential directive would fund production at current mining operations, productivity and safety upgrades, and feasibility studies.

$750 million is a good start, but it’s not nearly enough to accomplish the domestic mine-building of the scale needed to reduce our dependence on foreign suppliers, and to lessen the above-mentioned deficits of key battery/ energy metals such as graphite, lithium, nickel and copper. Three quarters of a billion might pay for one or two mines; we need dozens of mines.

The National Mining Association followed up the Defense Production Act news by stating that changes to the act will do nothing to ease mining permit bottlenecks. The NMA also said it takes seven to 10 years to permit a mine in the US versus two to three years in Canada. (Both are seriously flawed estimates. In regulation-happy jurisdictions like Canada and the US, the time frame is more like 20 years.)

“Unless we continue to build on this action, and get serious about re-shoring these supply chains and bringing new mines and mineral processing online, we risk feeding the minerals dominance of geopolitical rivals,” association President Rich Nolan wrote in an email to Bloomberg. “We have abundant mineral resources here. What we need is policy to ensure we can produce them and build the secure, reliable supply chains we know we must have.”

The mining association said the country should take steps to streamline the process and put it on par with Canada, including reducing duplication between state and federal government for approvals and setting specific deadlines.

North of the border, the Canadian government under Justin Trudeau recently said it is planning on spending CAD$400 million to build 50,000 electric vehicle charging stations, on top of half a billion Canadian dollars for charging infrastructure through the Canada Investment Bank and CAD$1.7 billion to extend an incentive program for EV purchasers.

The large spending package is part of the government’s plan to require that 20% of new light-vehicle sales in Canada be zero-emissions by 2026. Prime Minister Trudeau’s stated goal is to phase out gasoline-powered cars by 2040.

Three of the world’s largest car companies have announced they are investing in Ontario, Canada’s auto sector hub.

General Motors said it will spend close to $1 billion to produce electric commercial vans in Ingersoll, while Ford will invest C$1.2 billion to start building five battery-powered car models in Oakville from 2025. In 2020, the governments of Ontario and Canada announced they would each spend $295 million to help Ford upgrade its Oakville assembly plant in its transition to EV production. The company thinks electrics will out-sell its traditional models within the next decade.

Not to be outdone, Fiat Chrysler expects to shell out as much as $1.5 billion in creating its electric vehicle platform in Ontario.

The next-door province of Quebec has also attracted EV investment. Quebec-based Lion Electric announced it will build a battery pack manufacturing plant in its home province. The $185 million factory, funded by the Quebec and federal governments who each committed $50 million, will build lithium-ion battery packs capable of electrifying 14,000 medium and heavy-duty vehicles annually.

Earlier this month General Motors and South Korea’s Posco Chemical announced an agreement to build a plant in Becancour, QC, to produce cathode active materials (CAM) for GM’s Ultium batteries.

CAM consisting of processed nickel, lithium and other materials will help to power EVs including Chevy’s Silverado and GMC’s Hummer.

According to GM Canada’s David Peterson, via Global News, the company chose Quebec as the location for the new US$400 million facility due to its low-cost hydroelectricity, along with “great logistics links and a well-educated workforce.”

Also this month, and also in Becancour, German company BASF SE announced it has secured land for a planned battery materials facility, that would produce and recycle CAM starting in 2025.

BASF already has a partnership with Japan’s Toda Kogyo Corp to produce CAM at plants in Ohio and Michigan, including nickel cobalt aluminum oxide and nickel cobalt manganese oxide.

A media report says Quebec government officials have been talking to electric car companies including market leader Tesla to facilitate building battery cells in the province.

“Quebec has a lot to offer for the supply chain for [electric vehicles]. We’ll start with the minerals – we have lithium, nickel, graphite,” Quebec’s Economy Minister Pierre Fitzgibbon said in an interview with BNN Bloomberg, last November.

The minister confirmed he has had discussions with Tesla executives about potentially supporting the automaker’s battery production.

In summary, there have been some positive developments by officials at the highest levels of government in Canada and the United States, to facilitate the building of battery cells, electric vehicles and charging infrastructure, and to incentivize EV purchases with generous subsidies.

What’s missing is any concerted effort to support the mining of minerals deemed necessary for the electrification and decarbonization agendas being vigorously pursued by both countries.

Graphite One template

One exception is what we see happening in Alaska, with Graphite One’s (TSXV:GPH, OTCQX:GPHOF) enormous Graphite Creek project.

Graphite Creek was granted High-Priority Infrastructure Project (HPIP) status last year by the Federal Permitting Improvement Steering Committee (FPISC), which would allow its approval process to be streamlined.

This week Graphite One’s CEO, Anthony Huston, reacted to President Joe Biden’s April 1 announcement that graphite and other critical battery materials are designated as “essential to national defense” under the above-mentioned Defense Production Act, by noting that unlike presidential orders, designations under the DPA carry the full force of law.

“With this new defense designation under U.S. law, graphite joins a select group of ‘super-critical minerals’ that are essential to commercial technology and national security applications,” said Huston. “This action by President Biden validates Graphite One’s strategy of creating a full supply chain for advanced graphite materials located in the United States.”

The DPA “provides the President a broad set of authorities to ensure the timely availability of essential domestic industrial resources to support national defense and homeland security requirements.”

According to the White House statement, President Biden “…issue[d] a directive, authorizing the use of the Defense Production Act to secure American production of critical materials to bolster our clean energy economy by reducing our reliance on China and other countries for the minerals and materials that will power our clean energy future. Specifically, the DPA will be authorized to support the production and processing of minerals and materials used for large capacity batteries — such as lithium, nickel, cobalt, graphite, and manganese — and the Department of Defense will implement this authority using strong environmental, labor, community, and tribal consultation standards. The sectors supported by these large capacity batteries — transportation and the power sector — account for more than half of our nation’s carbon emissions. The President is also reviewing potential further uses of DPA — in addition to minerals and materials — to secure safer, cleaner, and more resilient energy for America.”

Earlier this month, US Senators Lisa Murkowski (R-AK) and Joe Manchin (D-WV), former and current chairs of the Senate Energy and Natural Resource Committee, sent a letter to President Biden urging him to make a DPA Title III designation to “invoke the Defense Production Act to accelerate domestic production of lithium-ion battery materials, in particular graphite, manganese, cobalt, nickel, and lithium.”

In a press release, Sen. Murkowski stated: “This is an overdue step that will help address one of our nation’s most significant vulnerabilities, our increasing dependence on foreign supply of critical minerals. While there are a range of actions we should be taking to address this challenge, including further federal permitting reforms, the Defense Production Act is an important complement to them.

“My hope is that this decision marks the start of a much more serious emphasis on our nation’s mineral security, and that real projects, especially mines, in states like Alaska, result from it. It is also critical that the five minerals addressed under this decision are just the start, not the end, of federal efforts to rebuild our domestic supply chains.”

Huston commented: “All of us at Graphite One want to thank Senator Murkowski, the Senate’s undisputed expert on critical minerals, and Chairman of the Senate ENR Committee, Joe Manchin who made such a compelling case for President Biden to take this step. Giving graphite and the battery materials the DPA Title III designation — as ‘essential to national defense’ — is a strong signal that the full force of the U.S. federal government will now be behind domestic development of these ‘super-critical minerals’.

“With the USGS recognizing Graphite One’s Alaska deposit just last month as being America’s largest known graphite deposit, and adding to that our plan to produce battery-ready anode material, Graphite One is ready to answer the call, and create a complete advanced graphite supply chain solution for the U.S.”

Graphite One’s project plan includes an advanced graphite material and battery anode manufacturing plant to be sited in Washington State.

The Washington facility represents the second link in Graphite One’s 100% US-based graphite supply chain strategy, anchored by its development of the Graphite Creek resource in Alaska, recently identified by the US Geological Survey as the largest known graphite deposit in the country.

The Graphite Creek deposit is situated along the northern flank of the Kigluaik Mountains, spanning a total of 18 km (see map below). According to the USGS, this particular area of Alaska contains an abundance of graphite minerals, much of which remains underexplored to this day.

The latest resource estimate (March 2019) — derived from exploration drilling of only less than 30% of the Graphite Creek mineralization — showed 10.95 million tonnes of measured and indicated resources at a graphite grade of 7.8% Cg (graphitic carbon), for some 850,000 tonnes of contained graphite. Another 91.9 million tonnes were tagged as inferred resources, with an average grade of 8.0% Cg containing 7.3 million tonnes.

A Preliminary Economic Assessment (PEA) on Graphite Creek supported a 40-year operation with a mineral processing plant capable of producing 60,000 tonnes of graphite concentrate (at 95% purity) per year.

Once in full production, Graphite One’s proposed graphite products manufacturing plant is expected to turn graphite concentrates into 41,850 tonnes of battery-grade coated spherical graphite and 13,500 tonnes of graphite powders per year.

This level of prospective production cannot be ignored, given it would cover the amount of US graphite imports in most years.

The next steps for Graphite Creek will include an updated resource model and new technical data for a preliminary feasibility study, anticipated to be released in April, which will incorporate results of the 2021 drill program.

Conclusion

Graphite Creek represents the ideal when it comes to industry-government collaboration to reach a shared goal — in this case, domestic mining and processing of EV raw materials, a process that up until now has been dominated by China.

We have the metals! We do not need to purchase them from China, the DRC, Russia or any other foreign producer, we can mine and refine them right here.

We should be building more mines in North America, not closing them, as the hunt for critical minerals and less rare industrial metals like copper, a key ingredient of electrification/ decarbonization, intensifies.

And nobody is better at it than Canadian junior resource companies as witnessed by Graphite One and all that it has accomplished — so that we can find and develop the deposits that will become the world’s next mines, to supply the new electrified, decarbonized global economy.

Graphite One Inc.

TSXV:GPH, OTCQX:GPHOF

Cdn$1.82, 2022.04.01

Shares Outstanding 85.5m

Market cap Cdn$155.6m

GPH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Graphite One (TSX.V:GPH). GPH is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.