Core Assets: Drilling at Laverdiere intersects extensive iron-copper skarn and copper-porphyry mineralization; assay results pending

2022.06.25

Only two weeks into drilling its Laverdiere Skarn-Porphyry Project, Core Assets (CSE:CC) (FSE:5RJ) (OTC.QB:CCOOF) is chalking up a win.

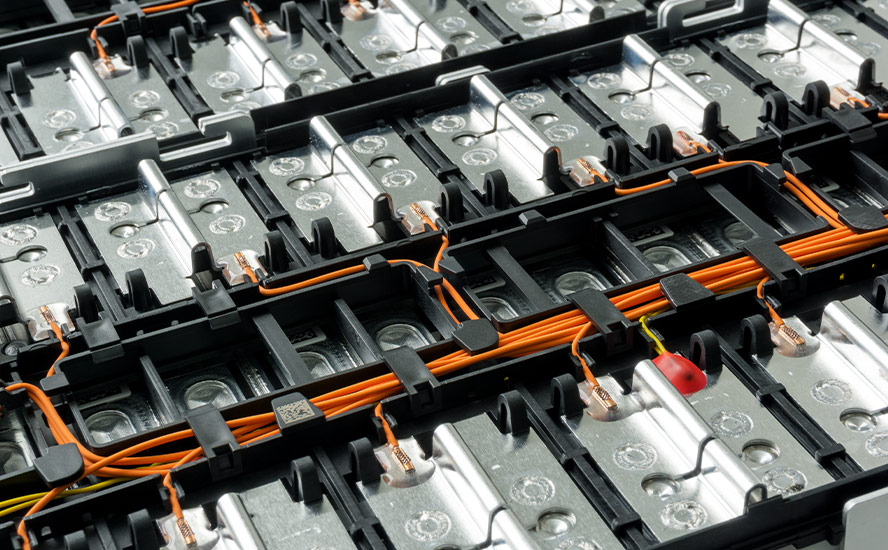

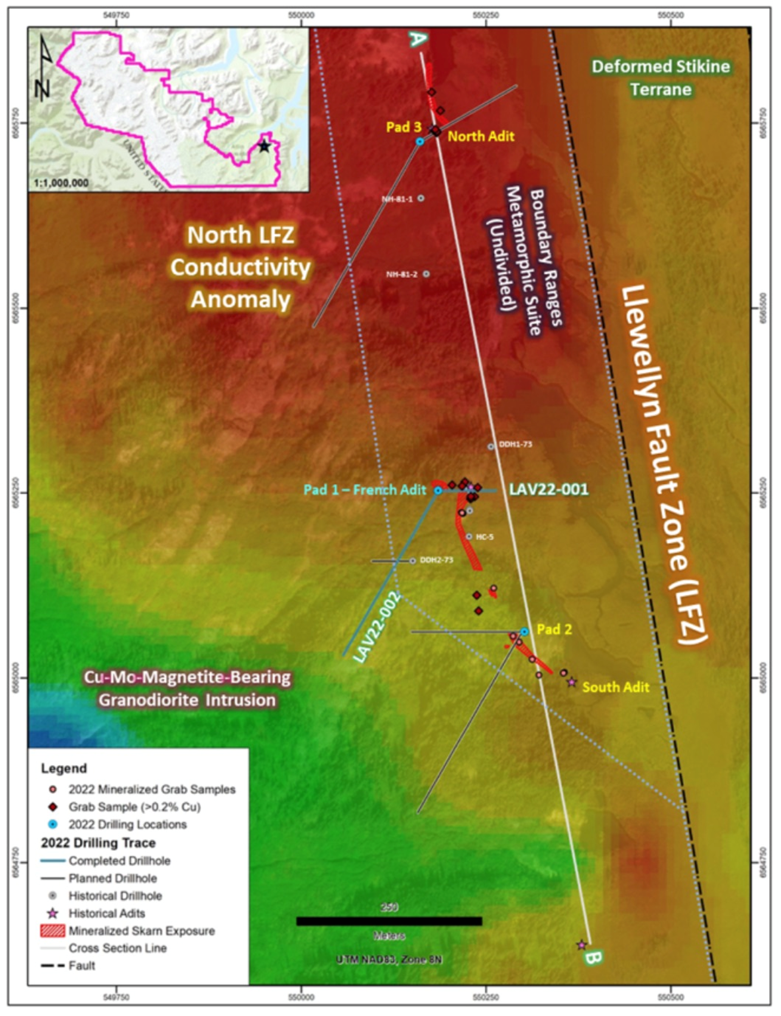

The first two holes of the 2022 exploration campaign at the Laverdiere Skarn-Porphyry Project, part of Core’s Blue property within the Atlin mining district of northwestern British Columbia, successfully confirmed massive to semi-massive iron-copper skarn mineralization, and extended porphyry-style copper mineralization to just over 400 meters depth, while remaining open for exploration.

So far 671 meters of diamond drilling have been completed at the French Adit part of Laverdiere.

Core advises that any inference of potential copper, gold, silver and molybdenum grades from the geological descriptions provided in the June 17 news release are speculative and based on preliminary visual observations only. Drill core assays on holes LAV22-001 and LAV22-002 are pending.

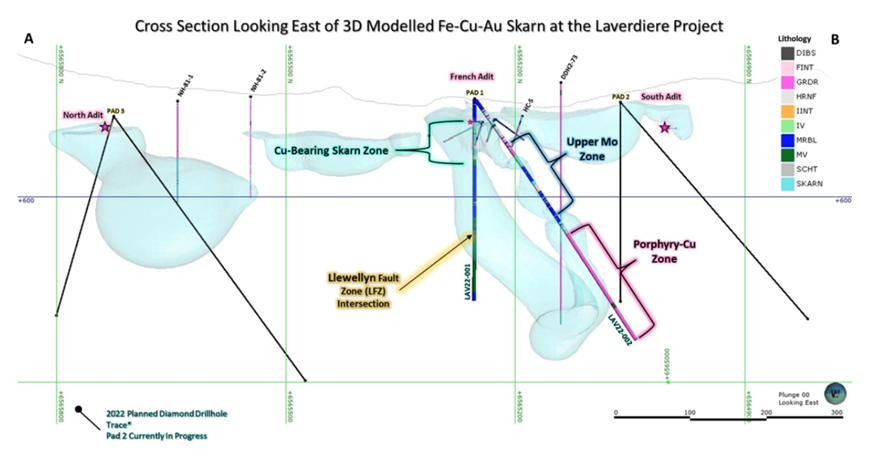

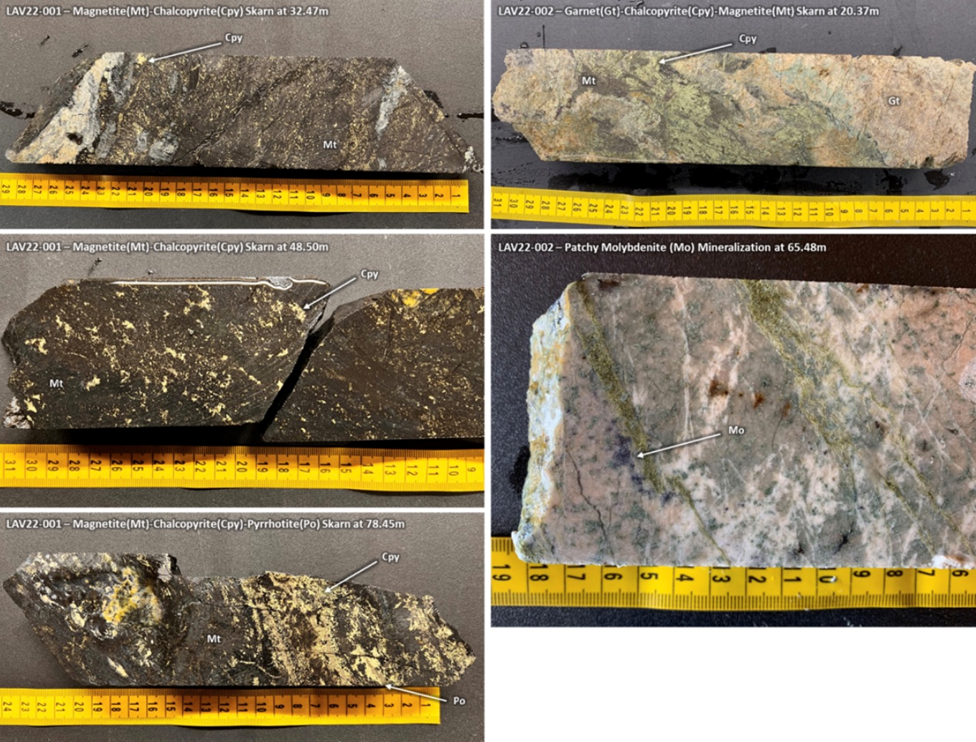

LAV22-001 was drilled steeply to the east for a 268-meter core depth and intersected what Core describes as Alternating intervals of marble-hosted and locally massive magnetite (Fe)-chalcopyrite (Cu)-dominant skarn — containing up to 10% visual coarse-grained chalcopyrite; and zones of deformed, chlorite altered felsic intrusive that extended from surface to 78 metres depth. (Figure 3).

LAV22-002, the deepest drill hole completed on the property to date, was collared from the same location as LAV22-001 and oriented southwest. It intersected Alternating intervals of marble-hosted magnetite (Fe)±chalcopyrite (Cu) skarn, garnet-chalcopyrite endoskarn (>10 % visual chalcopyrite locally), and intensely altered felsic intrusive to 224 meters depth (Figure 3).

Other highlights of Laverdiere Skarn-Porphyry Project drilling:

- The Llewellyn Fault Zone (LFZ) was intersected near 180 meters depth in LAV22-001 and consisted of fault-bound, marble, intrusive, and intensely sheared mafic volcanics hosting finely disseminated and locally pervasive magnetite-pyrite-pyrrhotite mineralization that persisted to the end of the hole;

- An upper molybdenite (Mo) zone characterized by patchy to finely disseminated molybdenite hosted in chlorite-epidote-garnet±potassium feldspar altered felsic intrusive was intersected at 63 meters depth and was observed intermittently to 189 meters (Figure 3).

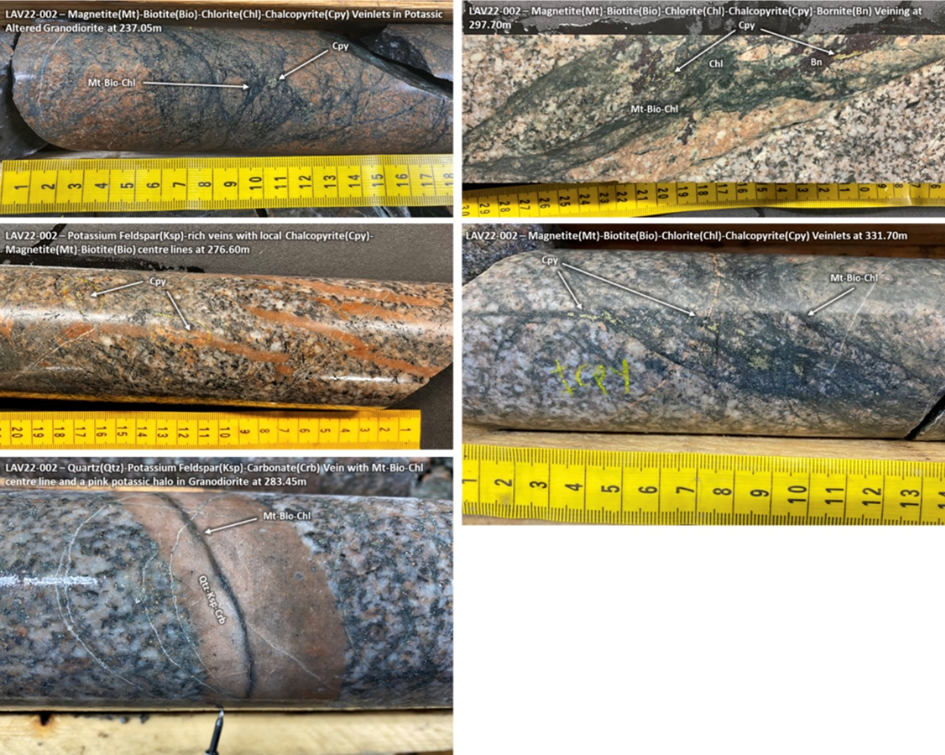

- A 179-meter interval that remains open at depth consists of chalcopyrite±bornite porphyry mineralization and potassic alteration from 224m to 403m. The porphyry is granodiorite in composition and contains disseminated magnetite and chalcopyrite with locally abundant magnetite-biotite-chlorite-chalcopyrite±bornite veinlets, and minor intervals of quartz-potassium feldspar-biotite±carbonate ±chalcopyrite±magnetite veining (Figure 4).

“Drilling at the French Adit has confirmed the presence of skarn mineralization and intersected mineralized porphyry earlier than anticipated. Preliminary observations from the first two holes indicate that we are situated within the potassic zone of a mineralized Cu-bearing porphyry core,” said Core Assets’ VP, Exploration Monica Barrington. She added, “We are eagerly awaiting assay results and are excited to further investigate the geometry and extent of porphyry-skarn mineralization at Laverdiere through additional field work and diamond drilling.”

and veining.

2022 exploration

Crews were mobilized at the start of June for Core’s inaugural 5,000-meter drill program, targeting high-grade mineralization at Laverdiere, and the Silver Lime Carbonate Replacement-Porphyry Project (Silver Lime). Both are located on Core Assets’ Blue property.

Notably, this is the first-ever diamond drilling in the area.

The priority is Laverdiere, where 1,500 meters are planned at three separate drill locations.

According to the company, High-grade Fe-Cu-Au skarn mineralization delineated from prospecting and historic drilling between the South and North Adits at Laverdiere is traceable for 800m along surface, to 300m at depth, and remains open in all directions.

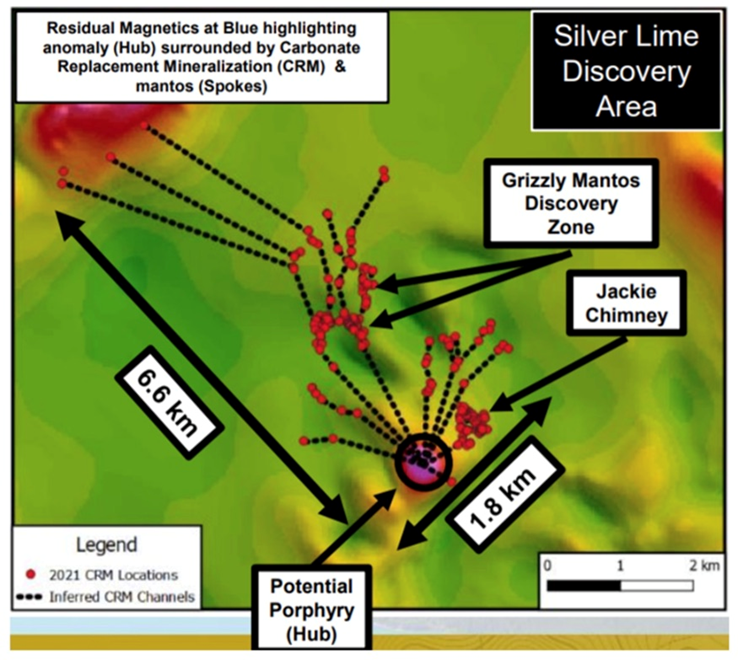

Next, the drill crew will move onto Silver Lime, to complete the remaining 3,500 meters. Core says the project boasts an average surface grade of 4.9% Zn, 2% Pb, 0.33% Cu, and 92 g/t Ag, within the extensive 6.6 x 1.8-km mineralized corridor, making it the largest known, untested exposure of carbonate replacement mineralization globally.

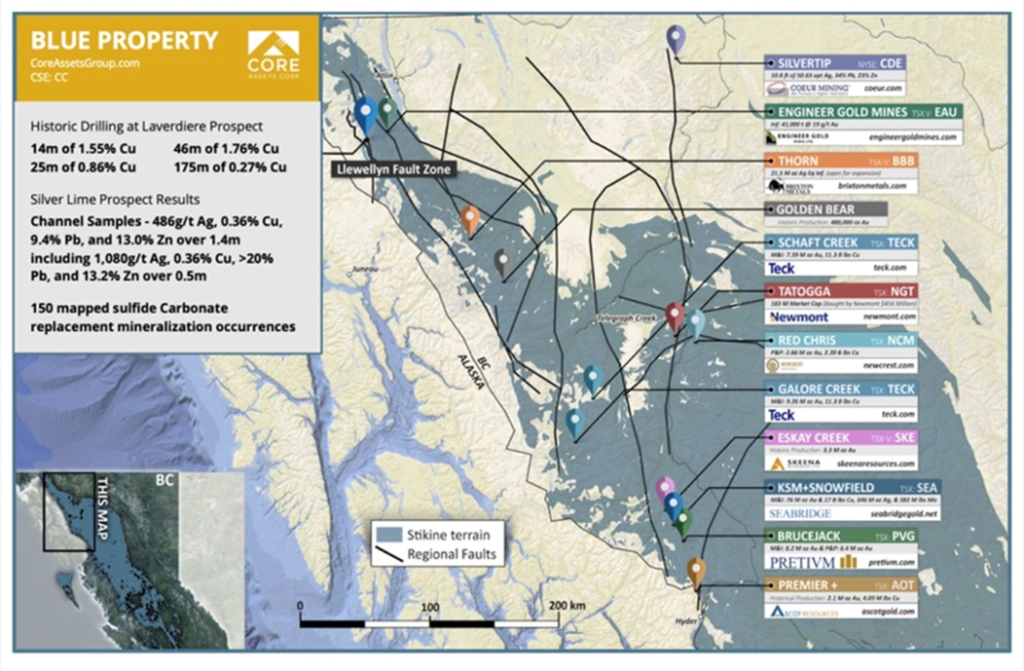

Blue property

Core Assets’ Blue property commands 1,116 km² in British Columbia’s prolific Atlin mining district. It is located 48 km southwest of Atlin, on the eastern shore of Atlin Lake, providing cost-effective exploration mobilization and potential low-cost ore transportation.

The project geologically is in the Stikine Terrane, host to some of the province’s most significant projects such as Teck Resources’ Schaft Creek and Galore Creek, and Newmont’s Tatogga (see map below).

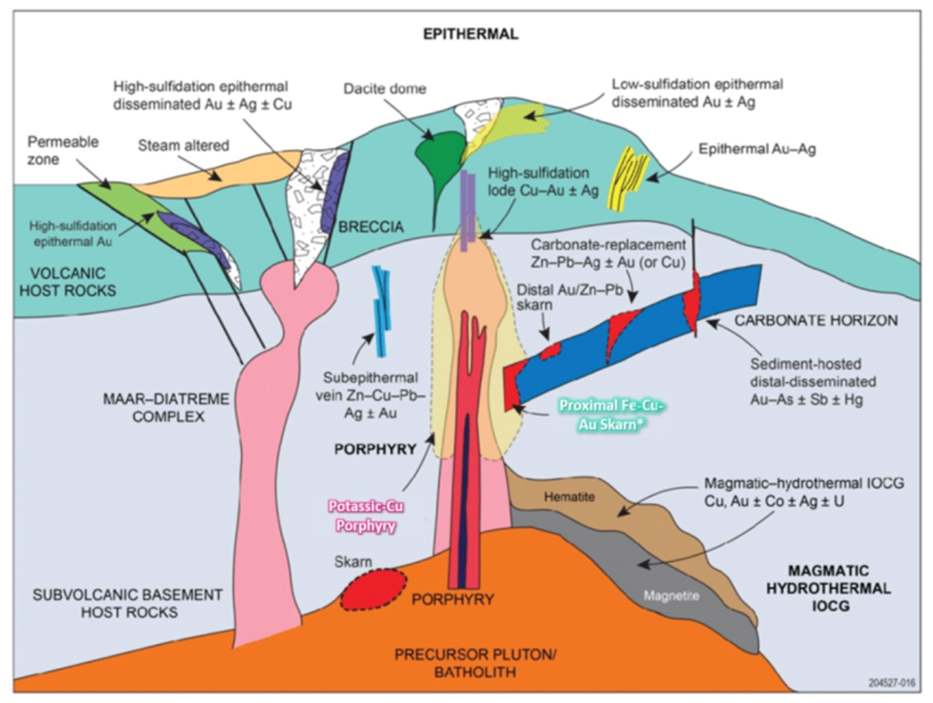

Carbonate replacement deposits (CRD) feature prominently in this region, including Core Assets’ Blue property.

These deposits are polymetallic, meaning they have various metals in them such as copper, gold, silver, lead, manganese and zinc. The mineralogy depends on the distance from the intrusive rock.

CRDs are also epigenetic, meaning they are produced on or near surface, usually through a “replacement process”, hence the name. They are characterized by high grades (up to 1,500 g/t Ag, 25% Pb and Zn, and 5% Cu), bulk tonnage (up to 150 million tonnes), low mining costs and minimal environmental footprint.

The Blue project is considered to be the most northerly, district-scale CRD-porphyry asset in the province. In fact the only two CRD deposits in BC more established than Blue, are Coeur Mining’s Silvertip, one of the highest-grade silver-lead-zinc operations in the world; and NorthWest Copper’s Stardust project, which has a National Instrument 43-101 mineral resource.

It is characterized by a major structural feature known as the Llewellyn Fault Zone (LFZ), which is approximately 140 km long and runs from the Tally-Ho shear zone in the Yukon, south through the property to the Alaskan Panhandle Juneau Ice Sheet in the United States.

Often with CRDs, the surface expressions are few and far between, and maybe a cm or two thick. This one appears to be different. Blue has one manto, the Grizzly, that is 500 meters of massive sulfide outcropping in an area extending 6.6 km from the potential porphyry hub (the spokes are seen below as dotted black lines to the red dots). This area is almost two kilometers (1.8 km) wide. Extraordinary.

The main point of this whole project and the reason for the dotted lines and the massive sulfide occurrences, is that unlike vein-hosted deposits, CRDs typically manifest as continuous sulfide bodies over multi-kilometer scales that broaden with depth and demonstrate continuity back to the source. All dots should be connected in the sub-surface and that is what Core Assets aims to test this summer.

According to the company, the newly defined, high-grade district-scale (6.6 km x 1.8 km) CRD Ag-Pb-Zn-Au alternation assemblages, indicate the potential for a nearby Cu-Mo porphyry discovery using a proven exploration deposit model.

Within this area, the first surface channel assays from a maiden sampling campaign at Silver Lime, have confirmed high-grade carbonate replacement mineralization (CRM).

Rock sampling results (February 2022) from several carbonate replacement and skarn, massive to semi-massive sulfide occurrences at the Sulphide City and Grizzly targets contained values up to 406 g/t Ag, 11.8% Cu, >20% Pb and 15.45% Zn.

Results from 2021 backpack drilling further strengthened the company’s belief that these occurrences exhibit grade consistency and continuity over shallow depths as well as along surface.

More good news came in April, when CC discovered a new copper occurrence exposed at surface, observed during a property accessibility assessment carried out in late March at the Laverdiere project. Located on the eastern end of the Blue property, the historical copper-iron skarn-porphyry target is about a 45-minute snowmobile ride from Atlin.

Core Assets confirmed the existence of outcropping copper-iron mineralization between historical adits (entrances to old mines) during a visit to the Laverdiere project in late March.

Multiple unsampled exposures of magnetic, copper-stained lithologies were identified along a 3.9-kilometer mineralized corridor coinciding with the Llewellyn Fault.

Most recently, Core Assets received results from a geophysical survey carried out last year on the property, which identified numerous large-scale anomalies that may well point the company towards a major discovery as soon as this year.

The newly detected anomalies are all located along the Llewellyn Fault. They will be tested as part of the company’s 2022 drill campaign.

Conclusion

With nearly $4 million in the treasury, Core Assets is fully cashed up for the 2022 exploration season. It doesn’t have to go to the market to raise funds, and it has already started putting out news, just two weeks into its drill campaign. I’m eager to see the assays at Laverdiere and what Core delivers at the next drill target, Silver Lime, home to the 2021 Discovery Zone (Grizzly Manto, Jackie, and Sulphide City targets).

This company is one of only a few junior resource sector that is putting money into the ground. Shareholders are being rewarded for their patience. Over the past year, CC is a 6-timer, rocketing from $0.14/sh last June to 83 cents in April. While the stock has slipped back recently, I am confident that additional positive drill results will result in a healthy correction.

Core Assets Corp.

(CSE:CC) (FSE:5RJ) (OTC.QB:CCOOF)

Cdn.$0.51, 2022.06.23

Shares Outstanding 73.86m

Market cap Cdn$37.7m

CC website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Core Assets Corp. (CSE:CC). CC is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.