Max Resource seals cooperation agreement with Endeavour Silver

2022.03.29

As a follow-up to its major announcement earlier in the month, Max Resource Corp (TSXV: MAX) (OTC: MXROF) (Frankfurt: M1D2) has now executed a definitive agreement with Endeavour Silver Corp. (TSX: EDR) (NYSE: EXK), which will see the companies work closely together with the aim of expanding Max’s flagship CESAR copper-silver property in northeastern Colombia.

A mid-tier precious metals miner, Endeavour currently operates two high-grade underground silver-gold mines in Mexico, and is advancing another mine project towards a development decision.

Under the cooperation agreement, Endeavour will provide certain financial capabilities required of Max by the National Mining Agency (ANM) of Colombia for the benefit of securing mineral tenures within the entire Cesar copper-silver basin.

Max will own such new mineral tenures, with Endeavour obtaining an underlying 0.5% net smelter returns royalty. Endeavour’s royalty will not cover Max’s existing mineral tenures on the CESAR property.

As part of the agreement, Endeavour has purchased 6.6 million units of Max’s private placement, which will result in the mid-tier owning approximately 5% of Max’s shares post-financing. Endeavour has also agreed to maintain its 5% ownership moving forward, and has the right to participate in future equity placements to maintain this position.

As for Max, the company just closed its non-brokered private placement of 29.6 million units for gross proceeds of $7.7 million. Each unit is being offered at CAD$0.26, comprising one common share and one-half of a share purchase warrant (Max’s shares are currently trading at $0.50).

“Max is thrilled to have the strategic support of enduring miner Endeavour Silver, both their financial and technical expertise. This partnership will significantly enhance Max’s goal of delivering long-term value to Max shareholders,” Max CEO Brett Matich commented in the March 21 press release.

“As a major shareholder of Max Resource, Endeavour Silver looks forward to this endeavouring partnership with the objective of unlocking the true value of the Cesar project, which we believe may be the world’s largest undeveloped copper-silver district,” Endeavour CEO Dan Dickson added.

About CESAR Property

At AOTH we also believe Max’s CESAR property has real potential to be one of the largest copper-silver systems ever discovered.

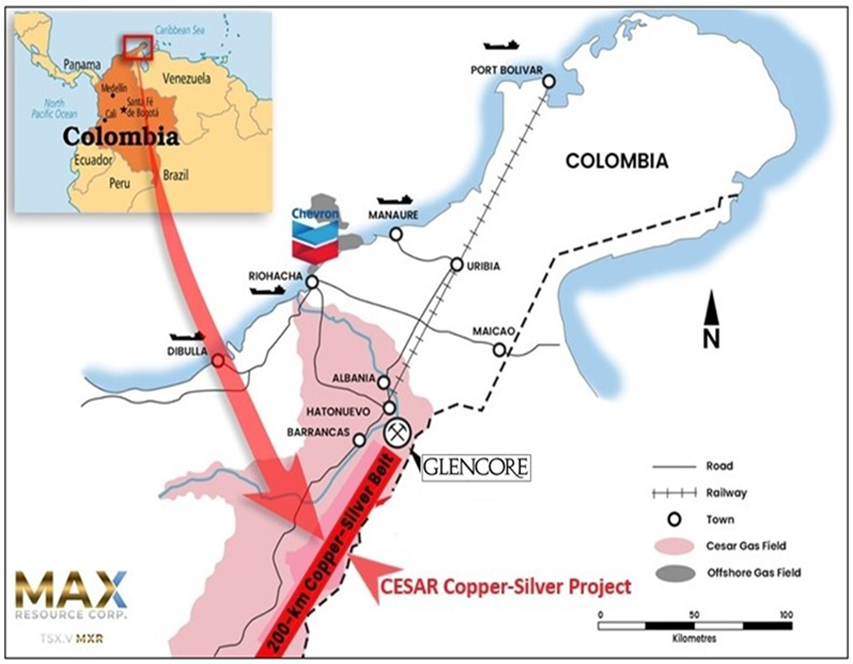

This district-scale project is situated along the Andean Copper Belt, the world’s leading copper-producing area, within a region that enjoys major infrastructure from existing mining operations including Cerrejon, the largest open-pit coal mine in South America. (see map below).

This includes roads, railways, hydroelectric power, and nearby port facilities from where coal is already being shipped.

The entire project area lies on a massive sedimentary system covering a significant portion of the 200 km long Cesar Basin, a massive geological feature that extends for over 1,000 km from the northern tip of Colombia southwards through Ecuador and Peru.

The basin was a seabed trapped behind the uplifting Cordillera mountain ranges, and the model suggests that rich copper and silver-bearing fluids flooded up into the basin and deposited as they encountered organic matter on the seafloor.

As such, CESAR represents a type of sediment-hosted copper mineralization that is known to be extensive in only certain parts of the world, namely Africa, Poland and Colombia.

The Max exploration team interprets the sediment-hosted stratabound mineralization of the Cesar Basin to be analogous to both the Central African Copper Belt (CABC) and the Polish Kupferschiefer in terms of grade, scale and mineralogy.

Almost half of the copper known to exist in sediment-hosted deposits is contained in the CACB, including Ivanhoe Mines’ 95-billion-pound Kamoa-Kakula copper deposits in the Congo.

Poland’s Kupferschiefer deposits are considered to be the world’s biggest silver producer and Europe’s largest copper source. In fact, Kupferschiefer’s silver yield is almost twice the production of the second-largest silver mine.

Therefore, Max believes CESAR has the makings of a district-scale copper-silver system comparable to the world’s best.

CESAR Exploration Progress

For over the past two years, Max has not only been discovering high-grade copper zones on its flagship CESAR property but is expanding these areas moving ever closer and closer to confirming the existence of a massive sediment-hosted system.

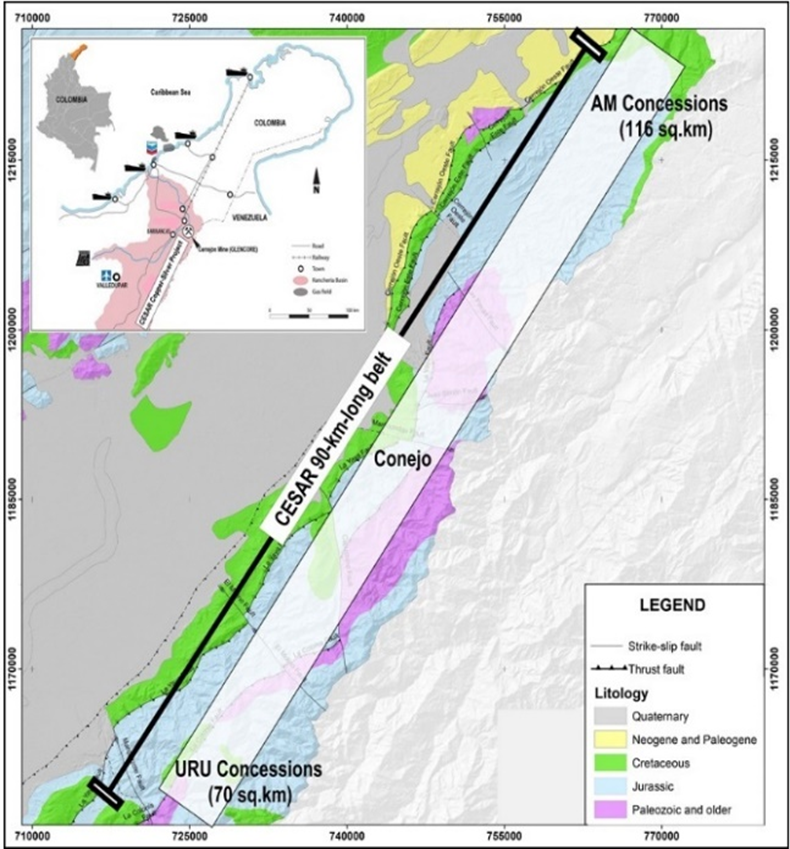

Max has, so far, received 19 mining concessions covering a total area of 186 km² (additional concessions are pending). This is more than any other company has ever received in Colombia.

This significant milestone paves the way for Max to initiate drill permitting on its URU concessions.

URU represents a new discovery that spans 48 km² over a major structural corridor and remains open in all directions. Geologically, Max compares the sediment-hosted copper-silver mineralization at URU to that found in the Central African Copper Belt.

Commenting on the company’s upcoming URU drilling, Max CEO Brett Matich said: “URU is to be the first significant drilling event on this previously unrecognized copper-silver belt, since the discovery of Cerrejón, the largest coal mine in South America and the reasons for much of the critical infrastructure in the Cesar basin.”

To assist the drill design and exploration at URU, the company is conducting a 290 km² LiDAR survey over the five drill target zones spread along 15 km of strike. The goal is to determine high-probability drill targets within the URU zone and maximize the success of what would be the first drill campaign targeting copper-silver deposits in the Cesar basin.

Watch a video of Dr. Chris Grainger, an expert on Colombian geology and member of Max’s advisory board, showing sub-vertical structures rising hundreds of meters from the river valley floor. Grainger also identifies chunks of primary chalcocite on surface that are 80% copper by weight.

“We’re sampling here now, we hope to get 20m true width, hopefully at 4-5% copper, with silver credits. This what it’s all about,” he says, pointing to the rock, tinted green from oxidized copper.

Regarding the ~20m true width structure, Grainger says “From the riverbed, up to where we followed and mapped and sampled the old adits, they go up about 340 meters vertical. And that’s the topographic high so we know they’re going to go vertically down below us, and they continue to our next prospect which is about 1.6 km along the strike.”

Copper Opportunity

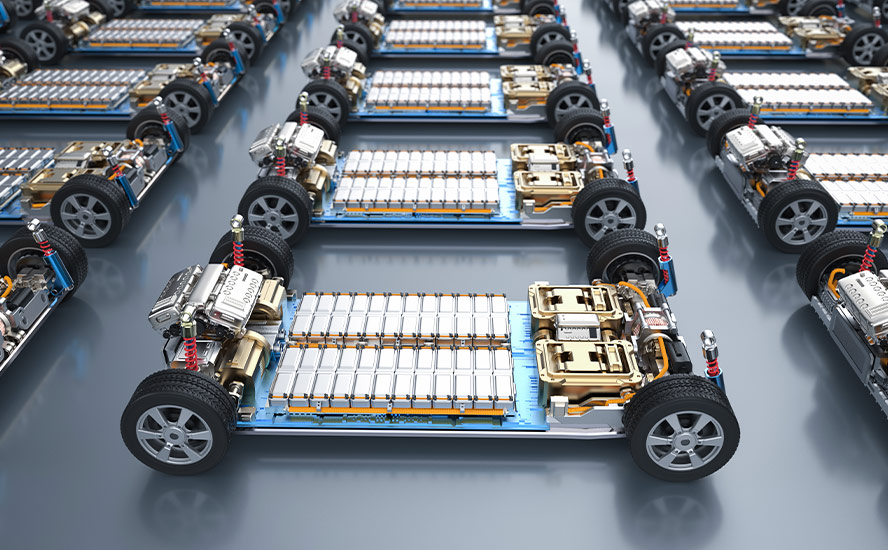

The discoveries made on the CESAR property come at a time when the copper industry is threatened by a looming global supply crisis, as the world needs more of the metal to accelerate its transition towards cleaner energy sources.

Green-related demand will gather pace in the second half of this decade, ultimately generating nearly 5 million tonnes of additional demand, Goldman Sachs recently said.

BloombergNEF estimates that over the next 20 years copper miners will need to double the amount of global production — from the current 20 million tonnes annually to 40 million tonnes — just to meet the demand for a 30% penetration rate of electric vehicles.

This is a tough ask considering some of the world’s largest mines are already seeing depleted copper reserves and lower ore grades, so it would be difficult for global production to even maintain the required 1Mtpa pace over the next 20 years.

Mining and metals consultancy CRU Group estimates that, without new capital investments, global copper mined production will eventually drop from the current 20Mt level below 12Mt by 2034, leading to a supply shortfall of more than 15Mt.

According to CRU, there are over 200 copper mines that are expected to run out of ore before 2035, with not enough new mines in the pipeline to take their place and keep pace with rising demand.

According to the New York-based research firm, the number of new world-class discoveries coming online this decade “will decline substantially and depletion problems at existing mines will accelerate.”

To avoid a global copper crisis heading into the latter half of this decade, the mining industry has to step up its efforts in making new, significant discoveries. According to CRU, the industry needs to spend upwards of $100 billion to erase what it estimates to be a 4.7Mt deficit by 2030.

It’s expected that over the next 3-5 years, global mining companies will all be “splashing the cash” on the next batch of projects in hopes of keeping supply afloat. Given the current market environment where commodities are all racing against one another, the incentive to do so has never been greater.

Reaping the rewards of this investment will be the junior miners, especially those with copper projects capable of matching the production of some of the world’s best deposits.

Your author believes a company like Max Resource has a lot of appeal, as its CESAR property has geological similarities to both Poland’s world-class Kupferschiefer deposits and the Central African Copper Belt, which hosts Ivanhoe’s Kamoa-Kakula discovery — the world’s biggest copper project with nearly 38Mt of contained metal.

Conclusion

So far with Max’s discovery in the Cesar basin of northern Colombia, we are seeing extensive evidence of this style of mineralization. Exploration to date has demonstrated that CESAR has both the potential size and grades for a multi-decade copper operation.

What’s really enticing about this project is its extremely unique geological model and the high probability of building out a large resource.

“There’s only three to five of these things in the world, and the ones that have proven to be productive, and find critical mass, that have gone to production or are going to production, are literally some of the largest deposits in the world,” Brad Aelicks of Pyfera Capital recently told us in an interview.

“You find one of these things, the value isn’t can we find enough tonnage for a 10-year mining operation, which is kind of the minimum threshold out there, you’re looking at, if you find one of these things that Max is working on, which is a sediment-hosted copper-silver deposit, you’re looking at mine life potential of a hundred years,” he added.

What’s unique about CESAR’s geological model is that unlike a porphyry deposit, where you have this huge bulk tonnage of low-grade material, the mineralization is blanketed in nature and it has extensive lateral continuity. As seen with the Kupferschiefer system, it can be thousands of square kilometers.

“They’re not just company makers, they’re big enough to make two, three, four companies all at once. They’re the things that the majors are looking for, they have long-duration mine cycles,” Aelicks said.

Of course, developing a mine is about more than the minerals. You also need to have community buy-in and mining must be done in a way that respects local communities and the environment. Max is helped in this respect by the fact that northeastern Colombia is already a region with extensive coal-mining and oil and gas infrastructure, whose population is generally supportive of natural resource extraction.

A recent poll shows the number of Colombians who believe mining has a positive impact on the country’s economy continues to increase. According to the report by the National Association of Colombian Entrepreneurs, 74% of residents in municipalities where there are mining operations, and 64% of those living in non-mining towns, believe that mining benefits Colombia.

The poll based on consultations with 2,600 citizens also showed that the greatest improvement occurred in areas where thermal coal and construction materials are produced. This includes the northern Cesar region where Max is developing its project, along with the Atlántico, Bolívar and Córdoba departments, and the northwestern part of Antioquia.

“The overall improvement in the public opinion around mining is associated with three factors: first, people perceive that the sector’s environmental performance has improved; second, they seem to see that royalties are being put to good use; and third, they identify that mining is necessary not only for modern life but for the energy transition,” Jaime Arteaga, director of Mining Compass, said.

It’s true that Colombia has, in the past, had its difficulties, but things have improved immensely.

In 2018 a pro-mining President Ivan Duque was elected. And unlike neighboring Venezuela, a failed state that has gone off the rails economically, or Bolivia, where former President Evo Morales became known for resource nationalism decisions, in Colombia, the government has never repatriated any mineral titles.

A tax bill introduced in 2018 that includes a 5% corporate tax cut was lauded by the Colombian Mining Association for helping to make Colombia more competitive with Peru and Chile.

In fact the latest (2020) Fraser Institute survey of mining and exploration companies ranked Colombia first among all other Latin American nations. The annual Investment Attractiveness Index placed Colombia ahead of, in order, Chile Peru, Brazil, Mexico, Ecuador, Dominican Republic, Rio Negro, Guyana, Bolivia and Venezuela.

“Colombia has gone from one of the worst places to do business decades ago, and it now ranks as number one in South America. It’s a real testament to the evolution of the country and the good work that’s been done to try to establish proper regulation for mine opportunities to be moved forward, good changes in safety perspectives that are there, and the mineral wealth,” Aelicks told me during our talk. He added: “I think we’re going to see a lot of good things coming for Colombian mining and it’s likely going to be led by the development of the copper industry. Max is in a prime position to be a major contributor to that.”

The cooperation with Endeavour Silver is just another seal of approval for CESAR and its district-scale copper-silver system.

Max Resource Corp.

TSXV:MAX; OTC:MXROF; Frankfurt:M1D2

Cdn$0.50 2022.03.28

Shares Outstanding 98.1m

Market cap Cdn$49.0m

MXR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Max Resource Corp. (TSXV:MAX). MAX is a paid advertiser on his site aheadoftheherd.com.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.