Articles

November 10, 2022

2022.11.10 At Ahead of the Herd, we pride ourselves on being right, when […]

November 10, 2022

November 9, 2022

2022.11.09 Copper is one of the most important metals with more than 20 […]

November 9, 2022

By Schiffgold 2022.11.09 Gold rallied by over $50 an ounce last Friday and the […]

November 8, 2022

By Theo Normanton 2022.11.08 Representatives of more than 190 countries (including 100 heads of […]

November 7, 2022

By MN Gordon 2022.11.07 The vast herd of investors are a deluded crowd. Following […]

November 7, 2022

By Swansy Afonso and Sing Yee Ong 2022.11.07 Indian silver consumption is forecast to […]

November 6, 2022

By James Rickards 2022.11.06 The all-important midterm elections are just one week away. I’ve […]

November 5, 2022

2022.11.15 In 2021 the world’s militaries spent USD$2.1 trillion, marking the seventh straight […]

November 4, 2022

By Adam Hamilton, CPA 2022.11.04 The Fed continued its extreme tightening this week […]

November 4, 2022

By Andy Home 2022.11.04 Lead will become the 24th commodity to be included […]

November 3, 2022

2022.11.03 The US Federal Reserve is grappling with how to reduce inflation, which […]

November 3, 2022

By Martin Armstrong 2022.11.03 This is one of the oldest methods to brainwash […]

November 3, 2022

By Nouriel Roubini 2022.11.03 Global warming, war and inflation: The world seems to […]

November 2, 2022

By Neils Christensen Despite persistent bearish sentiment in future markets and outflows in […]

November 2, 2022

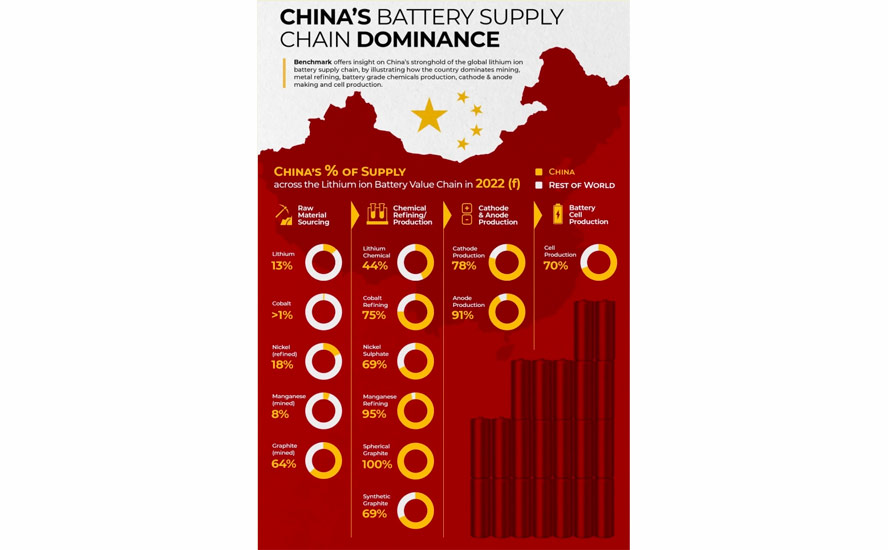

2022.11.02 Dozens of metals and minerals used in high-tech applications have a special […]

November 1, 2022

By Priyamvada C 2022.11.01 A fragile supply chain marred by geopolitical tensions could […]

November 1, 2022

2022.11.01 According to data collected by The Book of Deals, via cargroup.org, in 2021 […]

October 31, 2022

By Sandra Wirtz It’s Halloween – time for trick or treating, spooky storytelling and […]

October 30, 2022

By Egon von Greyerz 2022.10.30 A Lehman squared moment is approaching with Swiss banks […]

October 28, 2022

2022.10.28 European Union lawmakers and member countries reached a deal to ban the […]

October 28, 2022

2022.10.28 You may not have noticed, but our planet is becoming increasingly unstable. […]

October 27, 2022

By Goehring & Rozencwajg 2022.10.27 Ever since silver staged a furious catch-up rally […]

October 26, 2022

By Govind Bhutada 2022.10.26 This was originally posted on Elements. Sign up to the free […]

October 26, 2022

BY SCHIFFGOLD 2022.10.26 Economist Nouriel Roubini says Federal Reserve is going to “wimp out” […]

October 24, 2022

2022.10.24 Chrystia Freeland is Canada’s Deputy Prime Minister and the Minister of Finance. […]

October 21, 2022

By Neils Christensen 2022.10.21 (Kitco News) – Persistent inflation will force the Federal Reserve […]

October 21, 2022

By James Turk 2022.10.21 Every natural element with which the earth has been […]

October 21, 2022

2022.10.21 A new report by Wood Mackenzie estimates that 9.7 million tonnes of new copper […]

October 19, 2022

By Pete Evans 2022.10.19 Canada’s official inflation rate slowed for the third month […]

October 19, 2022

2022.10.19 For more than a year, the US dollar has been gaining strength […]

October 19, 2022

By Don Pittis 2022.10.19 After the Canadian deputy prime minister’s declaration in Washington, D.C., […]

October 18, 2022

2022.10.18 Although British Columbia experienced an unusually cold and wet spring, delaying the […]

October 17, 2022

By Gabrielle Coppola, with assistance from Sean O’Kane, Mark Niquette, Keith Naughton and Rob […]

October 14, 2022

By Jesse Felder 2022.11.14 Even after their correction over the past few months, […]

October 14, 2022

By Adam Hamilton, CPA 2022.10.14 The notorious gold-futures speculators just struck again, selling […]

October 11, 2022

By Money Metals 2022.10.11 Washington, DC – America’s currency would regain stable footing for […]

October 9, 2022

By Adam Hamilton 2022.10.09 Though still battered, the gold stocks are starting to […]

October 9, 2022

By Shane Lasley 2022.10.09 A shortage of the graphite required for the lithium-ion batteries […]

October 7, 2022

2022.10.07 Unusually warm weather and forest fires burning into October are two signs […]

October 7, 2022

By Theophilos Argitis 2022.10.06 Macklem says economy is still ‘clearly’ in excess demand […]

October 6, 2022

2022.10.06 ‘The Six Million Dollar Man’ Steve Austin, played by Lee Majors, is […]

October 5, 2022

2022.10.05 A new research paper by the International Monetary Fund estimates that the […]

September 29, 2022

By Michael Maharrey September 29, 2022 Given historically high inflation, why haven’t we seen a […]

September 29, 2022

By Daniel Lacalle 2022.09.29 The main issue in the economy is that there […]

September 28, 2022

2022.09.28 Max Resource Corp. (“Max” or the “Company”) (TSX.V: MAX; OTC: MXROF; Frankfurt: M1D2) is pleased to […]

September 27, 2022

By Ryan McMaken 2022.09.26 When asked about price inflation in his Sunday interview […]

September 27, 2022

By Felicity Bradstock 2022.09.28 Water is growing more scarce due to climate change. Water […]

September 26, 2022

2022.09.26 It appears the days of being a “one trick pony” mining company […]

September 26, 2022

By Bob Moriarty 2022.09.26 Regular readers are well aware of how much respect […]

September 23, 2022

By Adam Hamilton, CPA 2022.09.23 The left-for-dead gold miners’ stocks are literally trading […]

September 22, 2022

2022.09.22 At the Federal Reserve’s annual retreat in Jackson Hole, Wyoming, Chairman Jerome […]

September 22, 2022

By Andy Home 2022.09.22 London Metal Exchange (LME) warehouses saw 11,200 tonnes of […]

September 20, 2022

By Frik Els 2022.09.20 Copper prices have been hovering either side of $3.50 […]

September 20, 2022

By Lance Roberts 2022.09.20 “The ‘Buffett Indicator’ says the stock market will crash.“ Such was an […]

September 17, 2022

2022.09.17 This year has seen a correction in the gold price, commensurate with […]

September 13, 2022

By Nia Williams and Ismail Shakil 2022.09.13 Sept 12 (Reuters) – Growing wildfires in Canada’s westernmost […]

September 13, 2022

By Anna Golubova 2022.09.13 (Kitco News) To achieve a “soft landing” for the U.S. […]

September 12, 2022

By Archie Hunter 2022.09.12 Copper spreads are spiking in a signal that physical supplies […]

September 12, 2022

By David Brady 2022.09.12 Back in December 2017, I did a podcast with […]

September 9, 2022

September 8, 2022

2022.09.08 By Siyi Liu and Dominique Patton China imported 26% more copper in […]

September 8, 2022

2022.09.08 By MINING.COM Staff Writer The copper price rose on Thursday as potential […]

September 6, 2022

2022.09.06 At the start of August, British homeowners saw an 80% increase in […]

September 5, 2022

By Frik Els 2022.09.04 After an early jobs-report bump on Friday in New […]

September 3, 2022

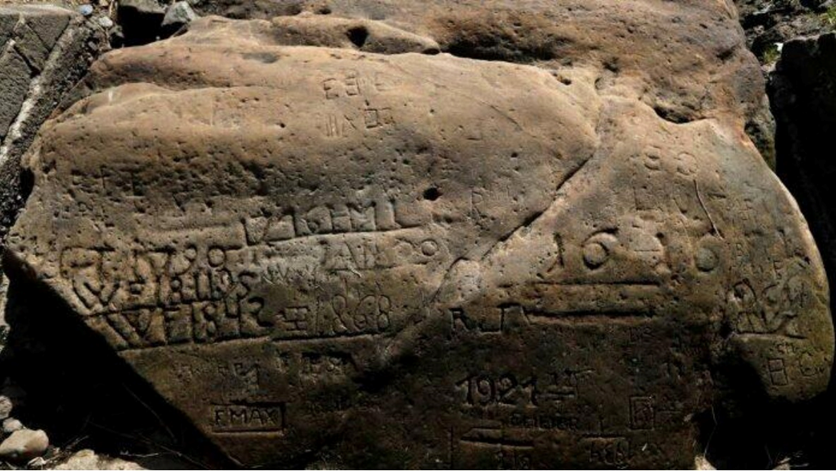

2022.09.03 Hundreds of years ago, early Europeans hit with a devastating drought thought […]

September 2, 2022

2022.09.02 By Nat Bullard Copper is one of the essential elements of today’s […]

September 2, 2022

2022.09.02 Russia’s invasion of Ukraine may have the unforeseen consequence of weakening the […]

August 31, 2022

2022.08.31 Arranged by the Quintil Valley innovation agency, and led by AngloGold Ashanti […]