5 reasons the West needs a secure supply of critical minerals – Richard Mills

2022.11.10

Critical minerals are defined as non-fuel materials that are vital to the economic and national security of a country. To be considered a critical mineral, it must have supply concerns tied to geological scarcity, geopolitical issues, trade policy or other factors.

In 2018, the US Department of the Interior released a list of 35 critical minerals, which was later updated this year to contain 15 more commodities. Many of these minerals are deemed integral to the infrastructure requirements of decarbonization and vehicle electrification.

At an important juncture of the global energy transition, this “critical minerals” list represents a huge step for the US and other Western powers to deliver on their climate goals. However, there’s more to it than simply shifting toward renewables; below we have five reasons why the West wants to secure its critical minerals ASAP:

- The Next Oil?

The importance of critical minerals mirrors that of fossil fuels, in the sense that both are key to a nation’s energy security. As a matter of fact, some consider metals like lithium as the “new oil”, for the simple reason that it will be needed to power most of our vehicles and energy storage systems in the future.

Thus, for Western nations, critical minerals represent the next frontier of the global energy ecosystem, and importantly, a means to finally achieve energy independence after decades of relying on developed nations’ fossil fuels.

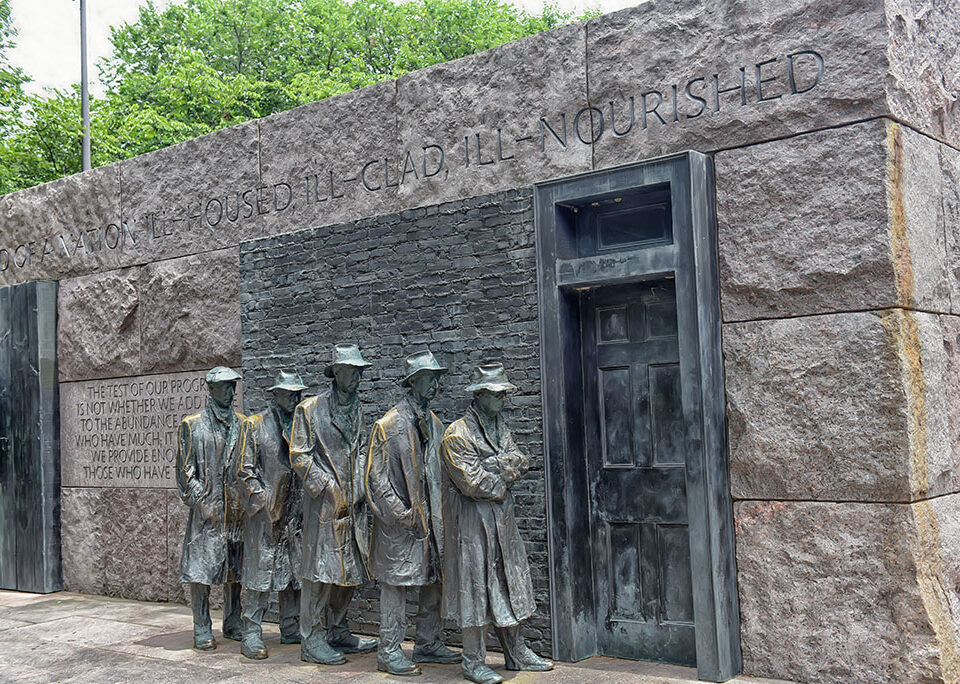

For decades, fossil fuels (i.e. oil and gas) have dictated the dynamics of global relations, where those who control the resource could wield a degree of power over those who don’t; to this day, the geopolitics of oil remain a major contributing factor to international conflicts.

Jeff Colgan, Assistant Professor in the School of International Service at American University in Washington, DC, previously wrote that “although the threat of ‘resource wars’ over possession of oil reserves is often exaggerated, the sum total of the political effects generated by the oil industry makes oil a leading cause of war.”

Between one-quarter and one-half of the interstate wars since 1973 have been linked to oil, Colgan noted, adding that “no other commodity has had such an impact on international security.”

However, we may say the same about critical minerals one day, especially if the West allows history to repeat itself as it had done with oil and gas. Failure to attain a secure supply of lithium, cobalt, nickel, etc. will likely exacerbate the geopolitical issues at hand, especially when countries like China and Russia are major producers of these minerals.

- Energy Independence

Amongst the incentives to develop a sustainable supply of critical metals, the biggest is arguably energy independence.

For a long time, the West has sought to reduce its dependence on oil resources from Russia and the OPEC members, and the global transition away from fossil fuels provides the perfect opportunity to do so.

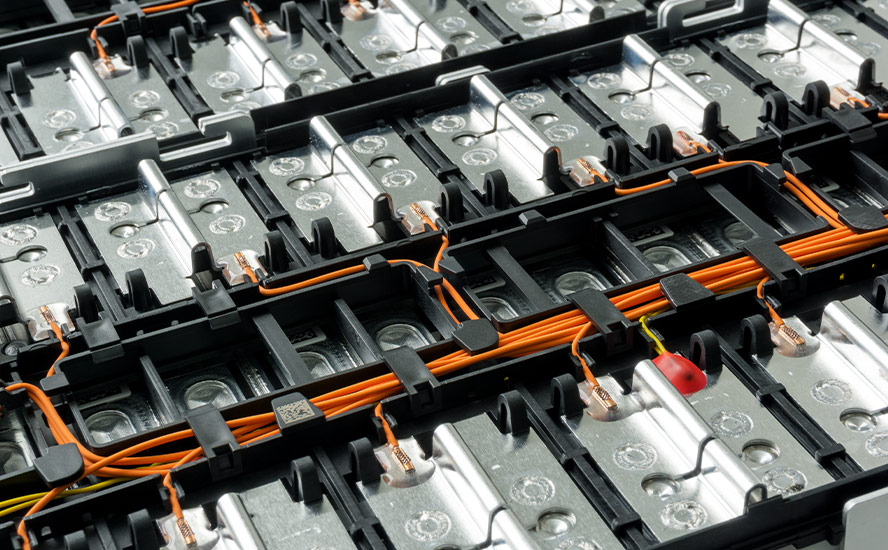

But first and foremost, developed nations must have enough raw materials to build the necessary infrastructure envisioned under a “green economy”, namely batteries, wind turbines, solar panels, electric motors and transmission lines.

“The quicker we switch to renewables and hydrogen, combined with more energy efficiency, the quicker we will be truly independent and master our energy system,” European Commission President Ursula von der Leyen recently said, adding that the goal is to reduce EU demand for Russian gas by two-thirds before the end of this year.

“We must become independent from Russian oil, coal and gas. We simply cannot rely on a supplier who explicitly threatens us,” she emphasized.

“Renewables give us the freedom to choose an energy source that is clean, cheap, reliable, and ours,” Frans Timmermans, European Commission Executive Vice-President for the European Green Deal, said in the EU proposal.

- Green Economy Requirements

As we know, the world is in the midst of an energy transition that requires unprecedented amounts of raw materials to realize.

These include lithium, nickel, and graphite for EV batteries; copper for electric vehicle wiring, charging stations and renewable energy projects; silver for solar panels; rare earths for permanent magnets that go into EV motors and wind turbines; and silver/ tin for the hundreds of millions of solder points necessary in making the new electrified economy a reality.

In fact, battery/energy metals demand is moving at such a break-neck speed that the world’s supply will be extremely challenged to keep up.

According to research by Fastmarkets, the lithium market is already facing a growing supply shortage through 2023, with deficits of 60,000 tonnes of lithium carbonate equivalent (LCE) in 2022 and 89,000 tonnes of LCE in 2023.

Like lithium, the increased uptake in nickel use is raising concerns over nickel supply. According to CNBC, Analysts at Rystad Energy warned last fall that global demand for the high-grade nickel required for EV batteries is likely to outstrip supply by 2024, a message that has since been echoed by other commodity analysts, including Jonas’s counterparts at Morgan Stanley.

BloombergNEF estimates that in 20 years, the world’s copper miners must double the amount of global production — from the current 20 million tonnes annually to 40 million tonnes — just to match the demand for a 30% penetration rate of electric vehicles.

These supply deficits are only going to increase our dependence on foreign suppliers, unless the West makes a major departure from the way we’ve been doing things and starts mining and refining these minerals.

- Jurisdictional Risks

Often intertwined with the import dependence are the jurisdictional risks associated with many of the global supply sources. Countries like China and Russia with vast resources currently produce an insane amount of our critical minerals, but does the West want to keep it that way? Certainly not.

Recently, both the US and Canadian governments announced billion-dollar budgets to accelerate their domestic production and processing of these minerals, citing the supply advantage held by competing nations.

Aside from the world powers, nations like the Democratic Republic of Congo, which supplies over 70% of the world’s cobalt, and Indonesia, the top nickel producer, are also considered major players in the critical mineral supply chain, but neither of them are emblematic of “long-term reliability” since they’re less-than-ideal regions to conduct business in.

The DRC mining industry is also lambasted for its human rights issues, so developed nations have a moral duty to find alternative supply. In early 2022, Indonesia announced an export ban on its raw nickel, years after it tried banning mineral exports altogether.

Therefore, to avoid falling behind the global energy transition and their ambitious climate targets, the West has to develop its own supply of critical minerals before another “resource war” emerges.

- “World Peace”

While whether world peace is ever attainable is an entirely different topic, the important thing is that having critical minerals helps the West to alleviate some of the geopolitical tensions carried over from the 20th Century.

Russia’s invasion of Ukraine this year has more or less highlighted the vulnerability of the global resource market, one which extends beyond fossil fuels and into clean energy metals. Russia is currently the world’s third-largest producer of nickel and second-largest of cobalt, both key ingredients in lithium-ion batteries.

The war, followed by Western sanctions against Russia, has been wreaking havoc on the global commodities markets, in particular nickel, while also jacking up oil and natural gas prices as expected.

“Russia’s invasion of Ukraine has aggravated the security of supply situation and driven energy prices to unprecedented levels,” according to the European Commissioner for Energy, Kadri Simson.

This is why energy independence for the West is important, as it would minimize the economic repercussions of geopolitical events by leveling the playing field with rivals.

US energy secretary Jennifer Granholm recently referred to the Biden Administration’s plan to support the mining, processing and recycling of critical materials as “the greatest peace plan this world will ever know.”

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.