Diversification is the new mining buzzword – Richard Mills

2022.09.26

It appears the days of being a “one trick pony” mining company are numbered. As global growth slows and talk of a recession becomes louder, falling metal prices, including gold, which recently scraped a two-year low, are forcing companies to play defence, as they seek to maintain profit margins during what could be a prolonged downturn.

The defensive strategy involves diversification, and while that is nothing new — BHP, traditionally an iron ore miner, branched out to copper as far back as 1996, with the $3.2 billion purchase of Magma Copper and its San Manual copper smelter in Arizona, while Barrick Gold’s CEO Mark Bristow in 2020 mulled purchasing the second-largest copper mine in the world, Indonesia’s Grasberg — the current economic conditions are accelerating the trend.

According to Newmont’s CEO Tom Palmer, along with “a very volatile economic environment” including inflation, interest rate hikes and the war in Ukraine, gold miners are facing cost inflation in labor, fuel and energy, as well as materials and consumables, “continuing into the better part of 2023.”

Shaun Usmar, CEO of Triple Flag Precious Metals Corp, was quoted by Bloomberg saying that current hawkish measures being pursued by central banks, i.e., aggressive monetary tightening to bring down inflation, which has lifted bond yields and the dollar, pushing gold prices down, could make it challenging for single-asset producers and development companies that may not have the financing means to absorb costs and increase capital.

For these companies, the equity markets aren’t accessible, and if they are, it’s very expensive and dilutive. Such an environment leaves room for mergers and consolidations, especially for miners with cash and a need to grow, said Usmar, who was Barrick’s CFO from 2014-16.

Last week, the Globe and Mail reported Agnico Eagle Mines is teaming up with Teck Resources to buy a copper-zinc project in Mexico, in what would be a major departure from precious metals for Agnico.

The Toronto-based company, with stock symbol AEM, has gold and silver operations in Canada, Australia, Finland and Mexico, including Canada’s largest gold mine, Canadian Malartic, and the Meadowbank Complex, located in Canada’s far northern Nunavut territory.

Agnico Eagle said last Friday it will pay USD$580 million for a 50% share in Teck’s San Nicolas copper-zinc mine in Zacatecas, Mexico.

The Globe notes that AEM, Canada’s second-biggest gold producer, is currently heavily weighted to precious metals production (about 99%), but once San Nicolas starts up, precious metals would fall to 87% of the company’s output.

Agnico is not alone in increasing its exposure to copper and other green-economy metals, including lithium, graphite and nickel. The latter, seen by investors as ESG-friendly, fit with another decision many mining companies are making, i.e., distancing themselves from “dirty”, old-economy materials like coal and oil.

Even the so-called experts are wrong about critical metals supply

Teck, for example, has said it is open to selling its stake in the Fort Hills heavy oil project in Alberta, and is actively looking at either unloading or spinning off its metallurgical coal unit. Meanwhile, the Vancouver-based firm is moving its business towards copper by building a major new copper mine in Chile, called Quebrada Blanca, or QB2.

About 20% of Barrick Gold’s production now comes from copper, and as mentioned, in 2020 CEO Mark Bristow indicated his interest in Grasberg, then US copper mining giant Freeport McMoRan’s flagship asset (the mine is now co-owned by Freeport and Inalum; the latter, a state-owned miner, becoming a 51% majority owner in 2018 through a $3.9B payment to Freeport and Rio Tinto).

At the time, Bristow said he believes copper will be “the most strategic metal on this planet” in a decade, due to its use in electric vehicles and other clean-energy applications.

The Financial Post reported in its Tuesday edition that Bristow several years ago engaged in unsuccessful merger discussions with Freeport-McMoran. The CEO reiterated his interest in the base metal. “Copper is probably the most strategic metal, and it’s geologically related to gold,” he said. “So if you want to become a world-leading gold company in the fullness of time, you are going to end up producing [copper].”

The Financial Post notes that if gold prices continue to slide, other gold miners may also look to make copper, zinc and other metals part of their portfolio.

While not a gold company, earlier this month Rio Tinto said it is willing to pay $4.2 billion to buy the 49% of Canadian producer Turquoise Hill Resources it doesn’t already own, effectively giving the Anglo-Australian multinational control of the massive Oyu Tolgoi copper-gold mine in Mongolia (Turquoise Hill owns 66% of Oyu Tolgoi, with the Mongolian government holding the remaining 34% interest).

Diversification hasn’t always been as important to mining companies. Miners in the mid-2010s basically ate each other and by shutting down exploration there was no accretive increase in reserves. After years of selling “non-core” assets, mining firms are coming around to realizing that diversification is good.

In a 2021 article, Investors Chronicle writes that, while companies that consolidated into one or two commodities took advantage of higher prices last year, any supply increase or demand deterioration in these markets could sink profits quickly.

To help guard against this, BHP (BHP) and Rio Tinto (RIO) have recently approved massive new projects outside their traditional areas. This marks a turning point in the sector.

BHP greenlit the Jansen potash mine in Saskatchewan, and Rio committed to building the Jadar lithium-borate mine in Serbia.

Smaller companies are also getting on board the diversification train. For example Hochschild Mining, a Peru-based gold and silver miner, in 2019 purchased a rare earths element project for $56 million.

Investors Chronicle said the latest round of diversification among major miners differs from the last mining boom, when the majors tried building non-iron ore projects that would address short and medium-term market conditions, such as oil and gas.

This time it’s different: BHP and Anglo are looking at population growth and more hungry mouths as drivers, while the lithium plan from Rio is largely based on forecast battery manufacturing capacity in Europe.

A report earlier this year from Fitch Solutions confirms that the mining majors are ramping up their diversification policies to capitalize on decarbonization trends.

For example, copper. It’s not an exaggeration to say that copper is essential to decarbonization; nothing happens without it. The continued movement towards electric vehicles is a huge copper driver. EVs use about 4X as much copper as regular internal combustion engine vehicles. It’s in the motor, the wiring, and the charging stations. Copper is also in the “smart grid” to get renewable energy to where it’s needed. The latest use for copper is in renewable energy, particularly in photovoltaic cells used for solar power, and wind turbines.

When it comes to diversification, however, Fitch Solutions says copper is “a particularly troublesome commodity” because of the combined effects of historically high prices (copper reached a record $5.02 a pound on March 6, though it has since fallen back to $3.14), expectations of strong demand growth (due to the electrification & decarbonization trend) and geographic concentration of production in countries that pose a significant risk for mining companies.

The top two copper producers, Chile and Peru, are both seeing a wave of resource nationalism, where governments try to exact a greater share of resource revenues through various means, such as higher royalties and export bans of raw ores, in favor of in-country processing.

In December, leftist candidate Gabriel Boric was elected president of Chile, on a mandate to impose higher taxes, sending a chill through the mining industry which argues the change will impede competitiveness. A vote is scheduled in Congress in the coming weeks.

Peru’s President Pedro Castillo has also proposed to raise taxes on the mining sector by at least 3%, which the country’s mining chamber says could cost USD$50 billion in future investments.

“We, therefore, expect most major miners will face significant impediments to pursuing diversification strategies focused on the acquisition of copper assets in the short- to medium-term unless they become less risk averse financially,” Fitch Solutions said.

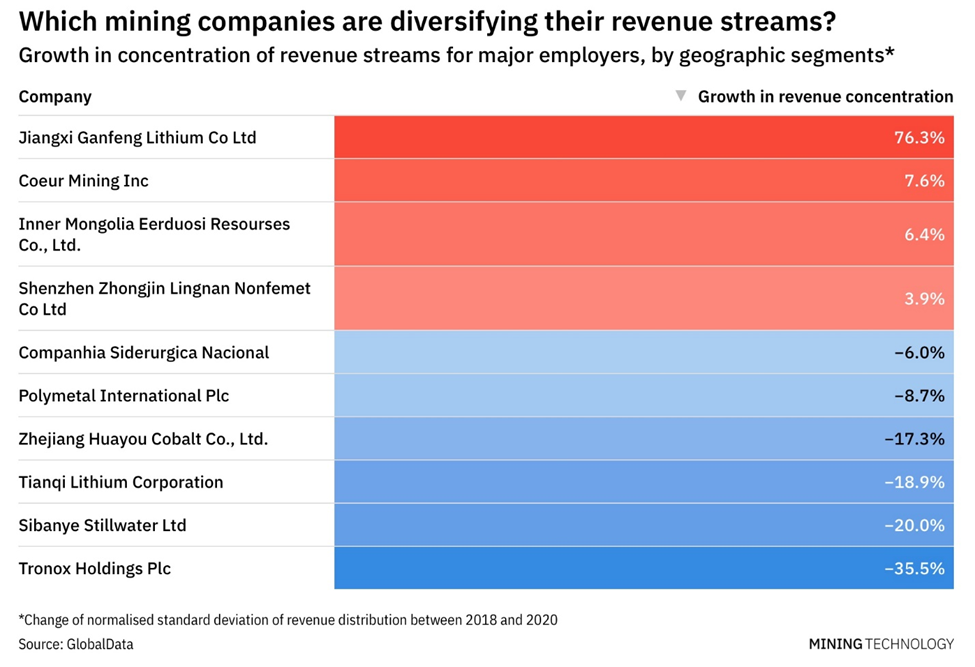

A GlobalData analysis of the extent to which mining companies are diversifying their revenue streams, found that supply chain disruptions caused by the covid-19 pandemic have shown the importance of geographic diversification of revenues. Lockdowns targeting specific sectors similarly demonstrated the value of maintaining a diverse product offering, says the analysis, via Mining Technology.

Out of Mexico, into Colombia

One example of geographic diversification caused not by covid, but resource nationalism, is the flight from Mexico, a major mining country that ranks as the world’s top silver producer, and Latin America’s biggest gold miner.

But government policies are scaring mining companies off. The Mexican government has stopped awarding new mineral concessions, nationalized lithium projects and restricted permitting to extensions of existing mines, Mining Weekly said.

BN Americas reports that mining companies are diversifying away from Mexico in a period of heightened political risk under leftist President Obrador. Two mining and exploration firms have exited the country while a further three mid-tier players have sold off significant assets. Four Mexico-focused companies have made acquisitions overseas, with many targeting Nevada, ranked by The Fraser Institute as the world’s third most attractive mining jurisdiction.

BN Americas points to Orla Mining’s acquisition of Gold Standard Ventures as the latest example of diversification away from Mexico. Orla, whose first mine Camino Rojo in Mexico began production last year, expects to build an open-pit heap leach operation at Gold Standard’s South Railroad gold project in Nevada.

Other Mexico exits include SSR Mining with its sale of the Pitarilla project to Endeavour Silver for USD$70 million in cash and shares; and ASX-listed Azure Minerals, which announced a deal to sell its Mexican assets to Bendito Resources for AUD$20 million.

Some firms took advantage of strong prices to sell their Mexican projects while retaining a strong presence in the country. They include Equinox Gold selling its Mercedes gold mine to Bear Creek Mining for $125M; Alamos Gold divesting its Esperanza gold project to Zacatecas Silver for about $60M; and US-based Coeur Mining’s sale of its La Preciosa primary silver project to Avino Silver & Gold Mines for up to $93.4M.

Also this year, First Majestic Silver announced a $35M deal to sell its La Guitarra primary silver mine to Sierra Madre Gold and Silver; following up on the April 2021 divestiture of Endeavour Silver’s El Cubo primary silver asset to Guanajuato Silver.

Like Orla Mining, First Majestic and Endeavour Silver are also viewing Nevada as a wise pivot from Mexico. The former closed its acquisition of the Jerritt Canyon mine in Nevada in April, 2021; the latter took over the Bruner gold project last September. Gold Resource acquired the Back Forty project in Michigan through its takeover of Aquila Resources, while Santacruz Silver closed the acquisition of a number of Bolivian assets in March.

When it comes to exploration and mining, the loss of confidence in Chile, Peru and Mexico is proving to be Colombia’s gain.

Another BN Americas article said that while coal remains Colombia’s largest mineral export, the country aims to boost gold production and become the world’s third largest copper producer after Chile and Peru.

In an interview, the president of national mining agency ANM, Juan Miguel Duran, told the publication that To increase competitiveness, efforts focus on promoting minerals that can support diversification policies, especially those demanded for the development of new technologies and alternative energy sources.

According to Colombia’s geological service, the best potential for finding new gold deposits is within metallogenic belt districts located in the departments (states) of Antioquia, Santander, Tolima, Huila, Caldas, Nariño, Cauca and Bolívar, along the Andes mountain chain.

To date, 142 copper deposits, occurrences and prospects have been identified, including porphyries, volcanogenic massive sulfides (VMS), skarn, iron-copper-gold oxide deposits, and deposits hosted in sediments or stratabound ones. The most favorable environments for copper deposits are in Córdoba, Chocó, Narino, Antioquia, and the country’s northeast, in the departments of La Guajira and Cesar.

According to Duran, there is tremendous potential for growth in the mining sector. Only 2.8% of Colombia’s territory is dedicated to mining, of which about 2 million hectares have mining titles related to gold, precious metals and copper.

How much longer can the dollar trade last?

Asked to comment on the status of copper mining, crucial for the energy transition, Duran responded that little copper exploration is currently being done, however, there are important reserves along the mountain ranges.

“Ore is produced in polymetallic concentrates, mainly at El Roble, which reported production of 9,373t in 2020 and 8,194t in 2021, in addition to 1,000t of copper reported by Carbomás,” he said.

“Additionally, flotation processes were implemented at the Buriticá project for the production of polymetallic copper and zinc concentrates in 2021.

The country’s copper potential has encouraged major exploration campaigns, mainly in the departments of Córdoba, Chocó and Antioquia, highlighting the advances in exploration at the Quebradona and San Matías projects.

With the start of new operations in the coming years, Colombia is expected to increase its copper production.”

Conclusion

Portfolio diversification is one of the most important strategies recommended to retail investors, for mitigating risk (eg. a 60-40 split, equities to bonds). It’s no different for mining companies. Too much of a concentration in one metal risks exposure to a decline in the price of that metal. Geographical concentration opens a company up to resource nationalism policies that can cost it more in royalties and other taxes, or even outright expropriation.

Diversification is a way for mining firms to spread the risk, and is seen as a defensive strategy in the current challenging operating environment, where companies are seeking to maintain profit margins during what could be a prolonged downturn, brought on by lower metal prices and persistent mining cost inflation.

One game plan is for mining companies to diversify from gold, to copper and other green-economy metals that are expected to benefit from the energy transition. The copper price has fallen by nearly a third since its March record high, but according to Bloomberg, some of the largest miners and metals traders are warning that in just a couple of years’ time, a massive shortfall will emerge for the world’s most critical metal — one that could itself hold back global growth, stoke inflation by raising manufacturing costs and throw global climate goals off course.

Commodities are the trade for riding out the Fed-caused recession

Companies that diversity into copper now, would be well-positioned to benefit from this shortfall, that should result in a much higher realized copper price. Barrick Gold and Agnico-Eagle are two recent examples. Agnico Eagle will pay USD$580 million for a 50% share in Teck’s San Nicolas copper-zinc mine in Zacatecas, Mexico. About 20% of Barrick Gold’s production now comes from copper.

Another diversification strategy is to spread risk among jurisdictions. This is largely to mitigate the negative impacts of resource nationalism, but it could also be done to take advantage of lower labor costs, better infrastructure, communities friendlier to mining, etc. We are seeing this in a number of mining companies selling assets in Mexico and investing instead in Nevada. The same thing is happening in Colombia, where the government has been trying to diversity its mining sector away from thermal coal, towards copper and gold. In early 2021 the government launched copper and phosphate “strategic mining areas”, with the first areas for gold announced at the PDAC mining conference in March — four blocks of claims in Antioquia for bidding.

The country’s copper potential has encouraged major exploration campaigns. The most favorable environments for copper deposits are in Córdoba, Chocó, Narino, Antioquia, and the country’s northeast, in the departments of La Guajira and Cesar. Some of the world’s leading gold companies are in Colombia, including Newmont, AngloGold Ashanti and Agnico Eagle Mines. Remember, at least one of them, Agnico Eagle, is diversifying from gold into copper. Since they are there already, exploring the Anza project in a joint venture with Newmont, could Agnico Eagle also be interested in developing copper mines in Colombia?

The CEO of Anglo American, another major diversified miner, has indicated that South Africa would be a good jurisdiction to explore for base metals. “We will explore base metals across South Africa… We are already in Zambia and other places, we want to do more in South Africa so we are looking for adjustments in legislation there,” Mark Cutifani said during the 2020 Joburg Mining Indaba conference.

Copper, nickel, lead and zinc are among the base metals Anglo American is focusing its global discovery strategy in greenfield and brownfield projects.

Going forward, it will be very interesting to see companies moving outside of their comfort zones, as they explore for and mine new metals in new jurisdictions.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Follow me on Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.