US battery and EV plants galore – Richard Mills

2022.11.01

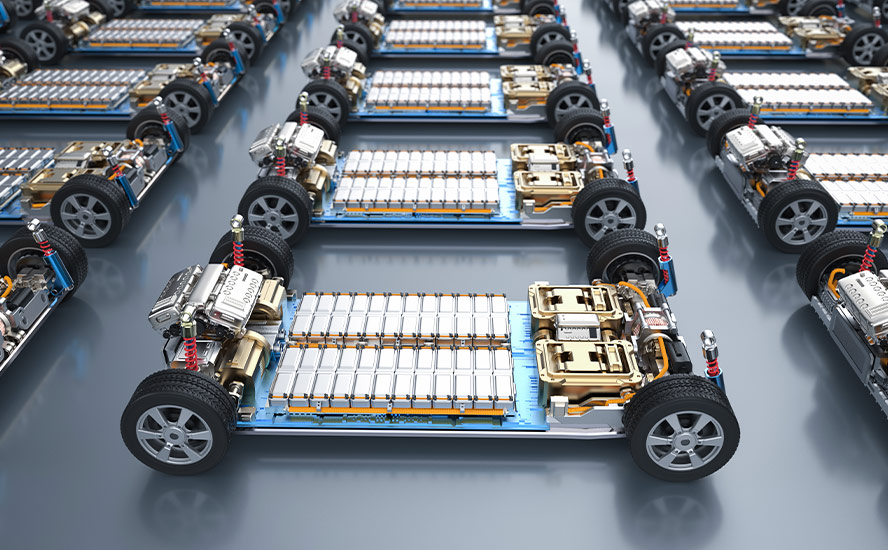

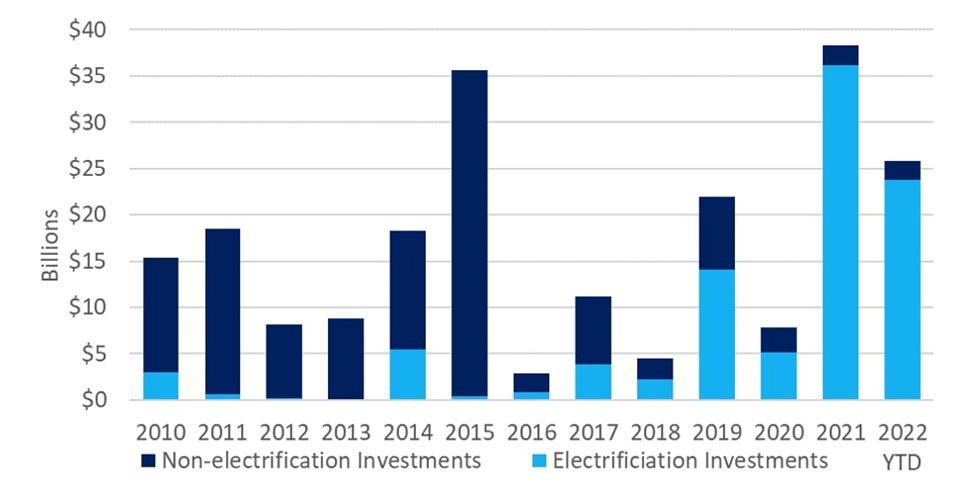

According to data collected by The Book of Deals, via cargroup.org, in 2021 automakers announced $36 billion of investments to build facilities dedicated to manufacturing EVs and batteries. In the first five months of 2022, automakers announced $24 billion in EV-related investments, almost double the investments announced by the same time last year. Recent automaker announcements on EV and battery manufacturing investments demonstrate an acceleration of growth in the EV market driven by new government EV targets and increasing consumer demand.

State-directed funding for vehicle electrification has been made available through President Biden’s American Rescue Plan, a $1.9 trillion funding package to help US states, territories, cities and tribal governments replace tax revenue lost during the pandemic. According to a recent Bloomberg piece, hundreds of billions in federal aid was made available to states but never spent.

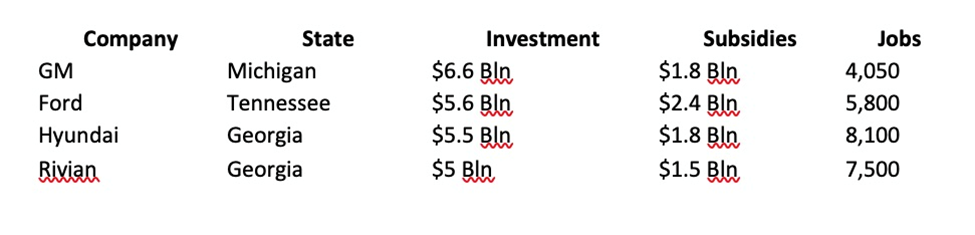

Michigan took advantage by announcing a $6.6 billion electric-truck factory and battery plant from General Motors, along with a billion in corporate subsidies. The announcement came soon after rival Ford made public that it had chosen two southern states, Tennessee and Kentucky, as sites for an $11 billion electric-vehicle project.

The Bloomberg article quotes an expert saying that, while states have long competed against one another to lure companies, the scale and the ferocity of it now — for EV plants, semiconductor factories and other megaprojects — are unprecedented.

“I have never seen the same kind of surge in subsidies all across the US all happening at the same time,” said Michael Farren, a senior researcher at the Mercatus Center at George Mason University and a critic of corporate incentives. “It’s pretty clear that there’s an external motivating factor, and that is the American Rescue Plan relief funds.”…

The $350 billion that Congress set aside for states and municipalities in May 2021 is coinciding with a once-in-a-century transformation of the auto industry, as carmakers prepare to retire the combustion engine in favor of battery power…

What is known is that global carmakers and established battery manufacturers have announced plans to invest at least $50 billion into at least 10 states to build EV assembly and battery plants since the start of 2021, and states have made commitments totaling at least $10.8 billion to lure those investments, according to a tally of publicly disclosed incentives by Bloomberg and Good Jobs First. That figure almost certainly underestimates the actual number.

Arun Kumar, a managing director at consulting firm AlixPartners, forecasts a 54% EV market share globally by 2035, and suggests that at such volumes, more EV plants will be coming to the United States.

Tennessee and Georgia exemplify how state-corporate collaboration is working to create the downstream part of a critical minerals supply chain. At Blue Oval City, a six-square-mile site an hour’s drive from Memphis, an assembly plant is being built to produce Ford’s new electric F-150 pickup, and a battery plant that together promise to create nearly 6,000 jobs. State officials say the $5.6B project will add $3.5B annually to Tennessee’s economy. A cash grant from the state legislature totals at least $2.4 billion, which includes tax breaks, donated land, infrastructure improvements and short-term wage subsidies from the federal government, according to contract documents obtained by Bloomberg.

In June, Volkswagen America opened a $22 million Battery Engineering Lab, a 32,000-square-foot facility located next to its Chattanooga, TN plant. ABC News said the company’s compact ID.4 SUV, currently imported from Germany, will roll off assembly lines for US consumers later this year. VW has reportedly invested more than $800 million to prepare its Chattanooga plant for the local assembly of the ID.4 SUV in 2022.

Georgia, meanwhile, has landed two $5B EV deals from Rivian and Hyundai. The state offered incentives worth $3.3B to win the projects, which promise to create over 15,000 jobs.

Mercedes-Benz’s Bibb County, Alabama plant joins the carmaker’s global battery production network with factories on three continents. The German company has said it will go all-electric by 2030, with plans invest 40 billion euros into BEVs from 2022-30.

Rival BMW in 2019 expanded its battery facility at Plant Spartanburg, South Carolina, more than doubling capacity. According to ABC News, Higher performing, fourth-generation batteries are assembled on-site for the BMW X5 and BMW X3 plug-in hybrid electric variants and 120 employees were specially trained to work the new line, having completed an extensive program in battery production, robotics and electrical inline quality inspection along with end-of-line testing, BMW said.

Of course we can’t forget about Tesla, the country’s top seller of EVs. The company produces batteries and electric motors for the Model 3, at is Sparks, Nevada plant, which broke ground in 2014. The company says the site currently produces more batteries in terms of kilowatt-hours than all other carmakers combined.

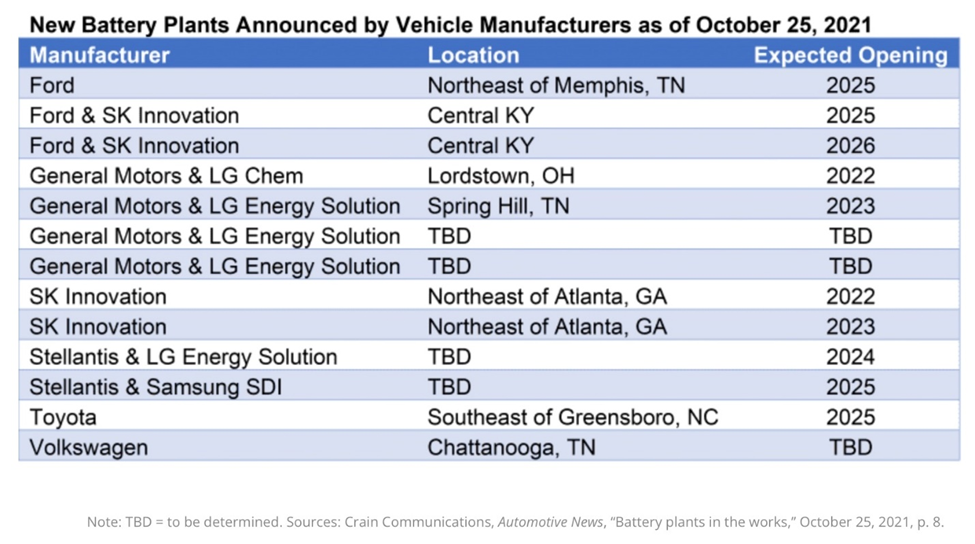

As for future developments, 13 electric-vehicle battery factories are planned in the United States between 2021 and 2026, according to the table below by the Department of Energy. This is in addition to battery plants that are already in operation. Of the 13 new plants, eight are joint ventures between automakers and battery manufacturers. Many will be located in the US Southeast or Midwest.

Fourth down on the list, General Motors and Korean battery-maker LG Chem are teaming up to build three US EV battery factories with a $2.5 billion loan from the US Department of Energy. Known as Ultium Cells, the joint venture will open a new 2.8 million-square-foot facility in Lansing, Michigan, its third battery cell manufacturing plant in the country. Workers will supply battery cells to Orion Assembly in Michigan and other GM EV assembly plants. Production at the Ohio plant was to begin in August, with the Tennessee plant expected to open in late 2023 and the Michigan plant in 2024.

Another JV, between Stellantis and Samsung SDI, plans to build an EV battery plant in Kokomo, Indiana, targeting a 2025 launch with a total investment of $2.5B.

Stellantis also announced a $4 billion investment with LG Energy Solution to build an EV battery plant in Windsor, Ontario.

Tesla supplier Panasonic earlier this year announced it will build a new lithium-ion battery factory in De Soto, Kansas. Reuters said the $4 billion plant will mostly supply batteries to Tesla, but not exclusively.

Hyundai recently said it plans to spend $5.5 billion to build facilities for manufacturing EVs and batteries in Savannah, Georgia, making it the automaker’s first EV-only plant in the United States.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.