Markets

December 1, 2022

2022.12.01 The US Federal Reserve continues to grapple with inflation, which at 7.7% […]

November 16, 2022

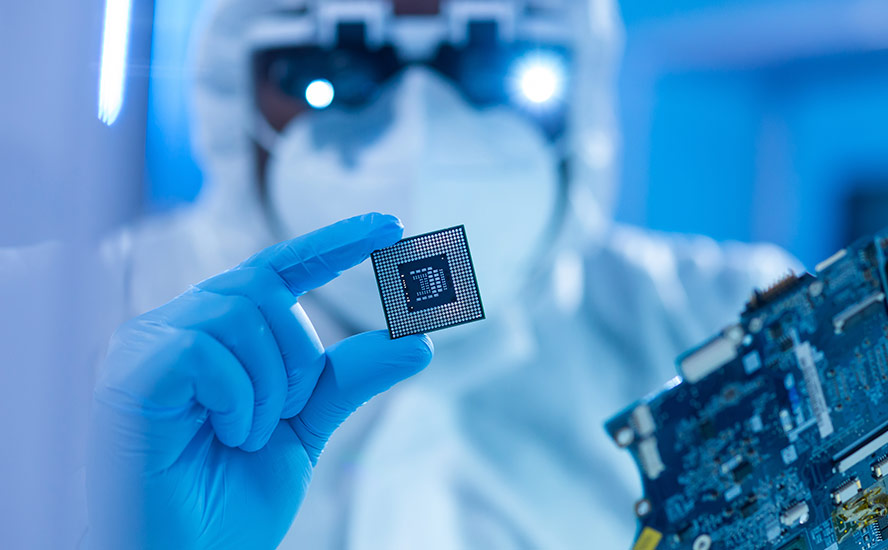

2022.11.16 Canada and the United States are finally getting serious about protecting their […]

November 11, 2022

2022.11.11 Gold and silver prices jumped on Thursday following the release of October’s […]

November 5, 2022

2022.11.15 In 2021 the world’s militaries spent USD$2.1 trillion, marking the seventh straight […]

November 3, 2022

2022.11.03 The US Federal Reserve is grappling with how to reduce inflation, which […]

October 24, 2022

2022.10.24 Chrystia Freeland is Canada’s Deputy Prime Minister and the Minister of Finance. […]

October 19, 2022

2022.10.19 For more than a year, the US dollar has been gaining strength […]

September 26, 2022

2022.09.26 It appears the days of being a “one trick pony” mining company […]

September 22, 2022

2022.09.22 At the Federal Reserve’s annual retreat in Jackson Hole, Wyoming, Chairman Jerome […]

September 17, 2022

2022.09.17 This year has seen a correction in the gold price, commensurate with […]

September 6, 2022

2022.09.06 At the start of August, British homeowners saw an 80% increase in […]

September 2, 2022

2022.09.02 Russia’s invasion of Ukraine may have the unforeseen consequence of weakening the […]

August 23, 2022

2022.08.23 Inflation is at a 40-year high, making commodities, which protect investments from […]

August 19, 2022

2022.08.19 Years of neglecting its critical metal supplies is finally catching up with […]

August 16, 2022

2022.08.16 In 1979, then US Federal Reserve Chair Paul Volcker faced a serious […]

August 8, 2022

2022.08.08 The US dollar is the most important unit of account for international […]

August 6, 2022

2022.08.05 The US Federal Reserve started off declaring that historically high levels of […]

July 16, 2022

2022.07.16 Copper is one of our most important metals with more than 20 […]

July 12, 2022

2022.07.12 The South China Morning Post reported in January that China is fast-tracking 102 major […]

July 6, 2022

2022.07.06 In George Orwell’s book ‘1984’, the world is divided among three superpowers, […]

June 29, 2022

2022.06.29 Last week was a bad one for mining & metals. Amid fears […]

June 23, 2022

2022.06.23 Inflation is at a 40-year high, making commodities, which protect investments from […]

June 18, 2022

2022.06.18 The dollar is the most important unit of account for international trade, […]

June 17, 2022

2022.06.17 We call ourselves Ahead of the Herd because we see things before […]

May 31, 2022

2022.05.31 With inflation in the US reaching its highest in 40 years, there […]

May 30, 2022

2022.05.30 A comparison of this year’s grocery bills to last year’s yields a […]

May 19, 2022

2022.05.19 In economics parlance, the term “soft landing” refers to a cyclical slowdown […]

April 29, 2022

2022.04.29 In our last article, we discussed a proposed new economic model for […]

April 27, 2022

2022.04.27 Modern Monetary Theory, or MMT, posits that rather than obsessing about how […]

April 26, 2022

2022.04.26 For shrewd investors looking to diversify their portfolios with low-risk, high-return assets, […]

April 24, 2022

2022.04.24 In our last article, ‘If it can’t be grown it must be […]

April 24, 2022

2022.04.24 Last year mining analysts Mike Kozak and Matthew O’Keefe of Cantor Fitzgerald […]

April 22, 2022

2022.04.22 A recession is what results when an economy stops growing. The National […]

April 14, 2022

2022.04.14 The new “commodities super-cycle” touted by many including Goldman Sachs, may be […]

March 19, 2022

2022.03.19 Food inflation has historically been the catalyst for many popular uprisings, from […]

February 25, 2022

2022.02.25 In 2021, commodities outperformed all other asset classes, and they are expected […]

February 14, 2022

2022.02.14 The move away from fossil-fuel-powered vehicles to EVs run on batteries is […]

February 12, 2022

2022.02.12 Commodities are considered one of the best places to park investment capital […]

February 8, 2022

2022.02.08 Someone born in 1979 is 43 years old this year. No doubt […]

February 7, 2022

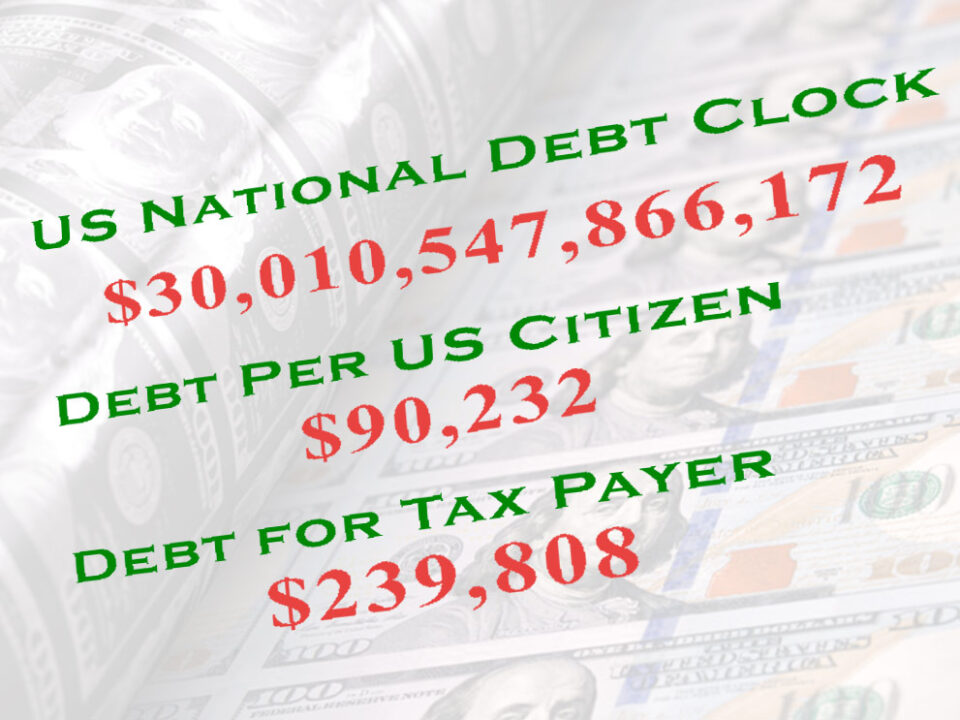

2022.02.07 The United States reached a new milestone this week, but it’s nothing […]

January 21, 2022

2022.01.21 Inflation is the rate at which prices within a basket of goods […]

January 15, 2022

2022.01.05 Inflation is one of the best determinants of gold price movements, because […]

January 11, 2022

2022.01.11 China and Japan are by far the largest buyers of US Treasuries. […]

December 28, 2021

The modernization and electrification of our global transportation system will require a change hitherto unprecedented in the history of civilization. Not even the shift from horse and buggy to the crank-start Ford Model T can compete with what it will take to electrify the billion-plus cars on the planet’s roads, and eventually put a complete stop to noxious tailpipe emissions resulting from the combustion of gasoline and diesel fuel, that are poisoning the air we breathe.

For now, thorium is a theoretical solution to our energy dilemma, but it could be much more than that. A concerted effort to develop thorium reactor technology could provide stable, clean, base-load power for millions, something that is not possible with renewables due to the intermittency factor and the current early stages of renewable battery storage technology. It is safer and better for the environment than uranium and can even use radioactive waste as feedstock for the nuclear reaction, thus killing two birds with one stone. The market is not yet ready for thorium, but when it is, a whole new mining sector and supply chain will be born.

For now, thorium is a theoretical solution to our energy dilemma, but it could be much more than that. A concerted effort to develop thorium reactor technology could provide stable, clean, base-load power for millions, something that is not possible with renewables due to the intermittency factor and the current early stages of renewable battery storage technology. It is safer and better for the environment than uranium and can even use radioactive waste as feedstock for the nuclear reaction, thus killing two birds with one stone. The market is not yet ready for thorium, but when it is, a whole new mining sector and supply chain will be born.

December 21, 2021

2021.12.21 The gold to oil ratio is an important indicator of the global […]

December 18, 2021

2021.12.18 Several months after the US Federal Reserve began describing the country’s inflation […]

December 17, 2021

2021.12.17 The US Federal Reserve announced this week what many market participants were […]

December 16, 2021

2021.12.16 A government generally has two “levers” it can pull, to help get […]

November 5, 2021

2021.11.05 The US Federal Reserve has done what market participants widely expected it […]

October 26, 2021

2021.10.26 The US Federal Reserve’s official line is that inflation is only temporary, […]

October 23, 2021

2021.10.23 Thanksgiving is a time to appreciate the food on our tables, but […]

October 15, 2021

2021.10.15 The balance of trade is an important barometer of a country’s economic […]

September 10, 2021

2021.09.10 There is an old joke often told about economists: Three economists are […]

September 8, 2021

2021.09.08 Lower interest rates and massive asset purchases by central banks are the […]

August 20, 2021

2021.08.20 Gold prices are slipping as talk of a “taper tantrum” has investors […]

August 6, 2021

2021.08.06 If rising food prices are ruining your appetite, you’re not alone. Costs […]

May 15, 2021

One company that aims to address the common problems faced by blockchain networks is Arcology, a blockchain company 30% owned by Codebase Ventures Inc. (CSE: CODE) (FSE: C5B) (OTCQB: BKLLF).

Inspired by the challenges associated with ethereum's mass adoption, the Arcology team is developing a radically new blockchain ecosystem designed to scale at unprecedented speed by reducing costs and increasing enterprise capabilities.

Inspired by the challenges associated with ethereum's mass adoption, the Arcology team is developing a radically new blockchain ecosystem designed to scale at unprecedented speed by reducing costs and increasing enterprise capabilities.

May 14, 2021

Continuing the US (and Canadian) economic recovery is obviously important but it should not come on the backs of the poor who bear the most weight of inflation, particularly increases in food prices.

Government officials need to be aware of how their monetary and fiscal policies are impacting the most vulnerable in society.

Government officials need to be aware of how their monetary and fiscal policies are impacting the most vulnerable in society.