If it can’t be grown it must be mined

2022.04.24

Last year mining analysts Mike Kozak and Matthew O’Keefe of Cantor Fitzgerald wrote in a research note: “The adage of ‘if it can’t be grown it must be mined’ serves as a reminder that electric vehicles, transitional energy, and a green economy start with metals.”

Old vs new economy

Less developed countries tend to have agriculture and manufacturing-based economies, a developing country has a manufacturing and a service-based economy, and developed countries tend to have service-based economies. (Wikipedia). Examples include financial & legal services, software development, computer engineering, financial technology (fintech), and blockchain/ cryptocurrencies.

The latter in my opinion is to the detriment of society because service economies don’t create new wealth. For example, software is designed to make many industries more efficient. But the software would be useless if the industries didn’t already exist. Civil engineering software that makes traffic move more efficiently is only possible because the roads and cars, made from raw materials, were there first.

Service, or knowledge economies, are not creating new wealth, the wealth has already been created in the tangible objects that preceded the services that came along to manage them.

Due to our fascination with computers, social networks, and intellectual capital, we seem to have lost our connection with real, tangible goods, that starts with materials dug up or farmed. With the addition of skilled labor, these materials are transformed into goods, or foods, thus creating a value chain that provides income for workers involved in every step of their creation. This value chain is the only way to create new wealth.

But the consumer doesn’t see this value chain, all they see is the finished product. Rare is the cell phone user who has a full appreciation of all the metals that went into their phone, including copper, tellurium, lithium, cobalt, manganese and tungsten.

It’s the same with food. A grocery shopper’s only connection to the land or the ocean is the slab of meat, chicken or fish sitting on a piece of Styrofoam wrapped in plastic. Likely they have never been to a farm to see the animals raised, let alone seen them slaughtered, nor do they understand that fertilizer containing nitrogen, phosphorous and potassium, and made from natural gas, is essential for growing crops.

Benefits of mining

Many people have a one-sided view of mining, i.e., that it is dirty, dangerous, polluting and better done someplace else. While the industry has certainly done its fair share of harm, including exposing underground miners to disease-causing particles; tailings dam ruptures; and the accidental release of toxic chemicals into the environment, I’m here to tell you that the world simply cannot function with it.

Minerals are essential components of cars, energy plants, solar panels, wind turbines, fertilizers, machinery and building construction.

“For the most part, it seems the majority of the news we hear about mining is negative. However, it is important to remember how important mining is to our civilization and standard of living. It’s interesting to reflect on how we reached our current perception of mining because, during most of our history, mining has had priority over most other activities.

As Homos Sapiens developed and the population grew, communities began to replace the nomadic lifestyle. Early tribes located around primary resources of food, water, and shelter were readily available. Soon after, the location of other natural resources began to have an impact on human settlement. Mined materials were probably among the first materials traded. Some tribes may have had regular access to chert or obsidian, highly valued for their sharp edges. Others may have had access to the best clay for making pots, bowls, or other utensils. Early trading required that humans develop more enhanced communication skills and could be considered the basis of civilization.

Our current reliance on mining is covered in this short VIDEO. It shows that everything we depend on is either made from minerals or relies on minerals for its production and distribution.” Earth Systems, A Brief History of Mining

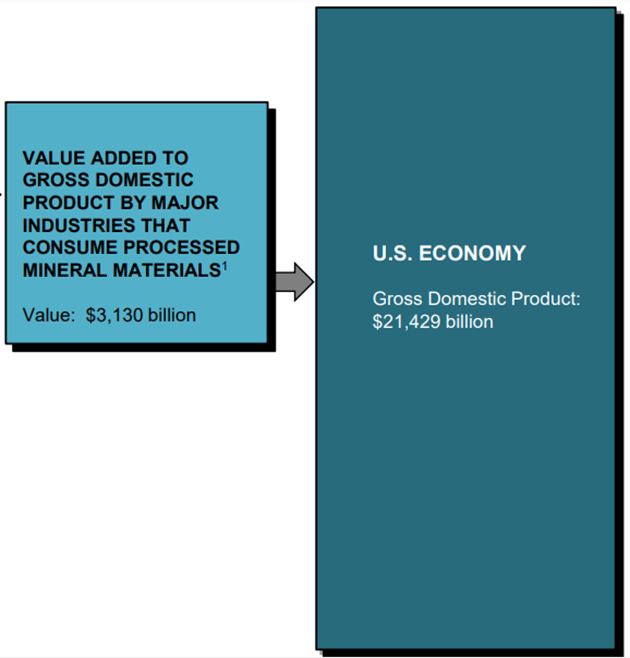

The mining industry is the starting point of a value chain that starts with resource extraction and ends with the sale of countless end products. According to a study by the World Economic Forum, the mining and metals industry moves a $1 trillion economy.

Among the forces that drive mining, are population growth, income growth and urbanization, all of which increase the need for minerals.

According to the United Nations, the world’s population is expected to reach 9.7 billion by the year 2050 and 10.9 billion by 2100.

Some think that technology will eventually find substitutes for metals. If only it were so easy. According to a Yale study that evaluated metals used in various consumer products, “not one metal has an ‘exemplary’ substitute for all its major uses,” and for some of them a substitute for each of its primary uses does not exist at all, or is inadequate.

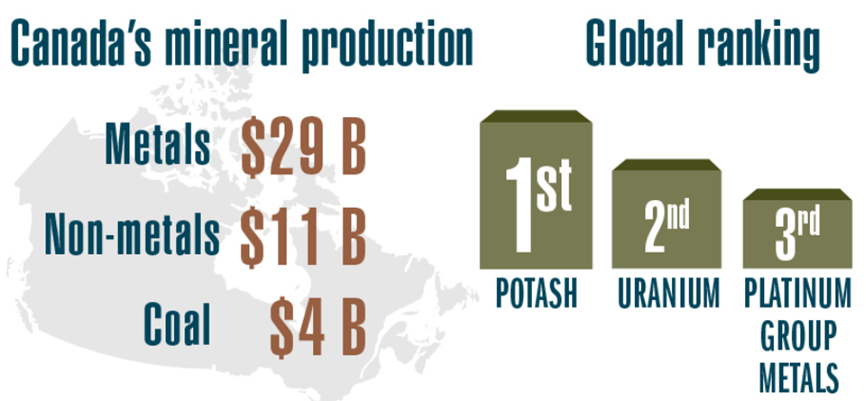

Mining is the economic foundation for a number of countries especially in the developing world. The International Council on Mining and Metals found at least 70 countries are extremely dependent on the mining industry, with mining accounting for up to 90% of foreign direct investment in low-middle income countries.

In these places, mining employment literally puts food on the table.

Anti-miners certainly don’t recognize how far the industry has come, in terms of adopting high-tech and sustainable practices. According to a piece contributed to the Schneider Electric blog:

“The top mining companies have made and continue to make massive investments in breakthrough technologies, such as autonomous systems, IoT (Internet of Things) and sensing technologies, adaptative supply chain, simulation, and the use of drones for environmental and production management.”

What if we couldn’t mine?

Despite all of these reasons to continue mining, some persist in contemplating life without it. A recent article in BBC Future Planet performed a “thought experiment” that takes the reader on an intellectual journey from the day all mining ceases. Summarizing the main points, we learn that:

- The first casualty of no mining would be jobs. Ghost towns would be created overnight, and an estimated 4 million jobs worldwide would be terminated. Another 100 million make their living from artisanal (small-scale, often unregulated) mining.

- The next problem would be energy. With 35% of the world still reliant on coal, many countries would experience an immediate energy crisis. Damage control might come in the form of rolling blackouts, energy rationing and even a three-day workweek.

- Electricity consumption we currently take for granted, such as using the internet and charging cell phones, would quickly become luxuries.

- Stocks of gravel and sand, needed to make concrete, would be depleted within two to three weeks, and there would be a rush to develop better processes for recycling concrete. In the short term, housing starts would plummet, raising home prices.

- The temperature in homes would become increasingly uncomfortable as gas stores began depleting after a handful of weeks, reducing power for heating and cooling.

- After about two months, the mining halt would hit metals. Copper stockpiles would dwindle to nothing in six to 10 weeks, and for Cu and other mined commodities, their prices would skyrocket.

- Three months after the end of mining, stockpiles of rare earths and other technology metals would be gone, causing panic in the industries that rely on them, such as automaking, electronics, construction and pharmaceuticals.

- It’s around this time that supply chains would collapse, accompanied by a run on oil. According to the BBC, the US strategic petroleum reserve, the world’s largest oil stockpile, contains just 730 million barrels — enough for three months. Once oil stockpiles run out, the production of petroleum products would cease, leading to the end of fossil fuels.

- The final destination of this thought experiment is hunger. A chronic shortage of fertilizer leads to lower crop yields and food shortages. A few months after no mining, global food supplies would be in crisis.

Conclusion

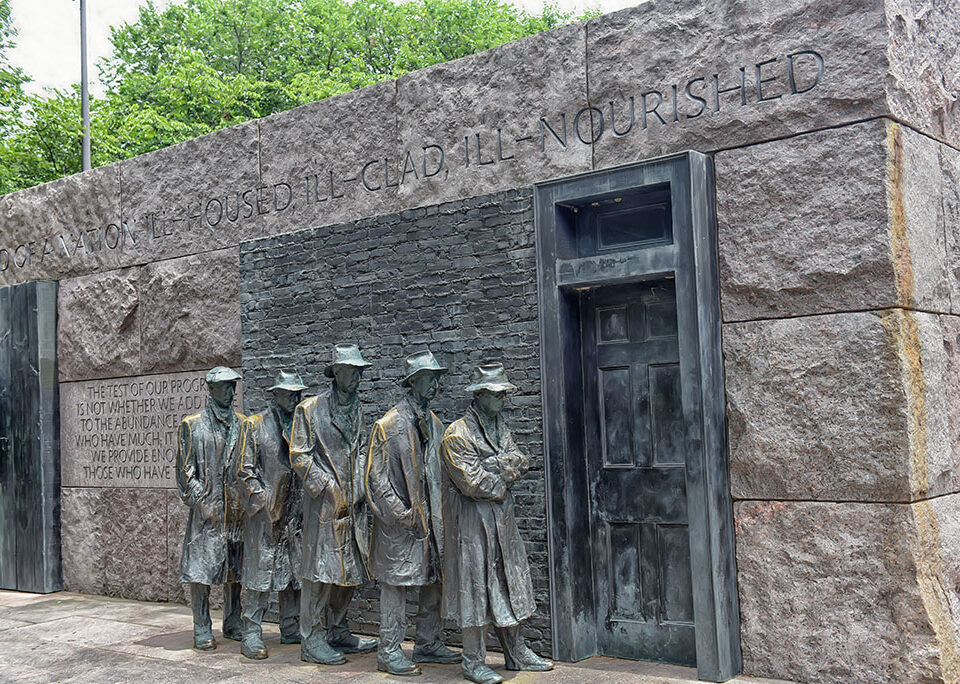

Mining is seen by some as a necessary evil whose environmentally destructive practices should be stopped, or at least, shouldn’t take place anywhere near them. They don’t realize or care that without mining, there would be no modern society: no steel to make bridges, no copper wiring that powers homes and businesses, no uranium to fuel nuclear reactors, no jewelry, no rare earths to make smart phones, solar panels, color monitors and TVs. Usually they want resource extraction halted, at all costs — the minerals or the oil kept in the ground.

The reality is that mining, and for the time being, oil and gas production, is necessary and here to stay. As technology moves forward, the need for metals and the impetus for mining grows stronger, not weaker.

Rather than wishing we didn’t have to mine, we should be pooling our efforts into how we can mine more, and better, so that we are not left behind in the global rush to control the world’s metal supplies — especially those needed for the new economy, including lithium, graphite, nickel and cobalt for lithium-ion batteries, silver and silicone for solar panels, copper for renewable energy/ electricity transmission, and rare earths for wind turbines.

All too often mining is impeded by governments who put up road blocks in the form of over-regulation that causes unacceptable delays, and who give too many special interests a say in mine building, which should be seen as being in the national interest.

We only have to look at what is happening with the dwindling stockpiles of industrial metals right now, to imagine what the future holds in a world with less mining. Inventories across London Metal Exchange warehouses of copper, lead, nickel, zinc and tin haven’t been this low for 20 years.

Going, going, gone. Is that what we have to look forward to in a world without mining? “If it can’t be grown, it must be mined” isn’t just a credo for miners. Unless we want to see constant blackouts, hunger on a massive scale, widespread shortages of thousands of everyday items we currently take for granted, along with a plummeting standard of living that takes us back to the pre-mining Stone Age, we need to wake up to the fact that our very survival as a species depends on the extraction and processing of minerals.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.