Commodities

April 15, 2021

April 15, 2021

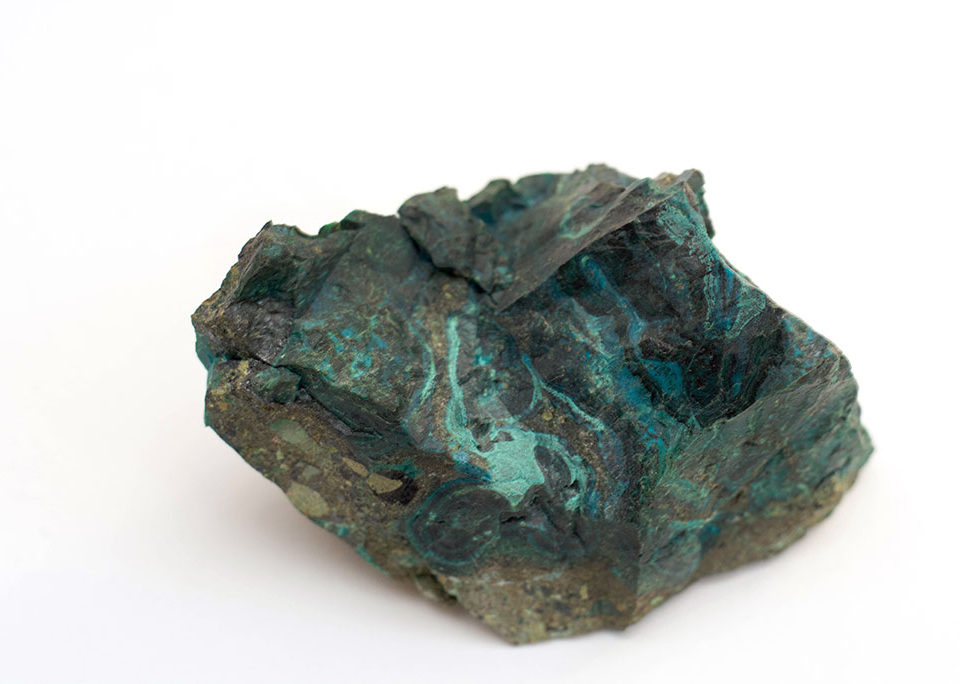

As the first company ever to explore all of the copper and silver-rich areas covered by the CESAR property, Max has so far identified multiple copper-silver target zones, all with significant potential to expand further, demonstrating the presence of a widespread highly prospective copper-silver district.

Do you like it?

April 15, 2021

April 15, 2021

Tinka Resources’ (TSX.V:TK, OTCQB:TKRFF) Ayawilca polymetallic project in Peru just got a whole lot more interesting with the discovery of a new tin zone, that is expected to add significant value to what is already the largest zinc development project in Latin America and one of the biggest zinc resources held by a junior explorer.

Do you like it?

April 14, 2021

April 14, 2021

Gold prices ticked higher on Tuesday after inflation data showed US consumer prices rose in March for the fourth straight month and inflation hit its highest level in 2.5 years.

The US Federal Reserve, whose dual mandate is to keep inflation in the “Goldilocks zone” of around 2% and to control unemployment, has been downplaying inflation, telling the public that even if prices rise, it will only be temporary.

The US Federal Reserve, whose dual mandate is to keep inflation in the “Goldilocks zone” of around 2% and to control unemployment, has been downplaying inflation, telling the public that even if prices rise, it will only be temporary.

Do you like it?

April 11, 2021

April 11, 2021

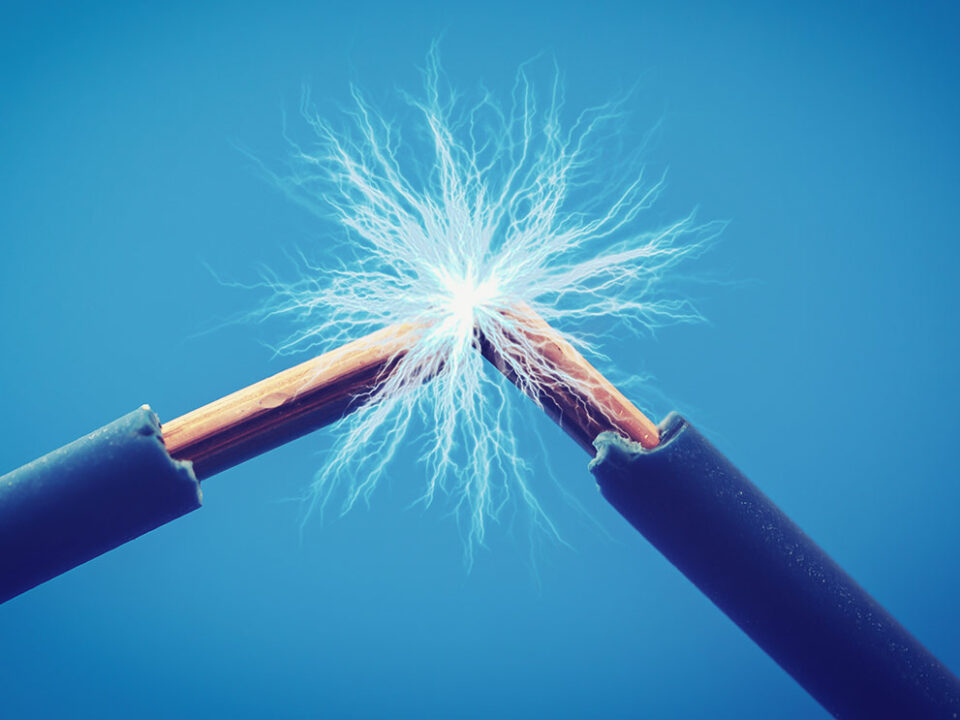

“The adage of ‘if it can’t be grown it must be mined’ serves as a reminder that electric vehicles, transitional energy, and a green economy start with metals. The supply chain for batteries, wind turbines, solar panels, electric motors, transmission lines, 5G — everything that is needed for a Green Economy starts with metals and mining. Demand for these metals, principally lithium, nickel and cobalt on the battery side and copper, uranium and rare earth elements on the energy side is expected to rise rapidly.”

Do you like it?

April 10, 2021

April 10, 2021

Among those actively exploring the mineral-rich regions of Mexico, one miner that is on a fast track to achieving intermediate status is Canada’s Magna Gold Corp. (TSXV: MGR, OTCQB: MGLQF), which has been actively acquiring and developing quality precious metals properties in Mexico.

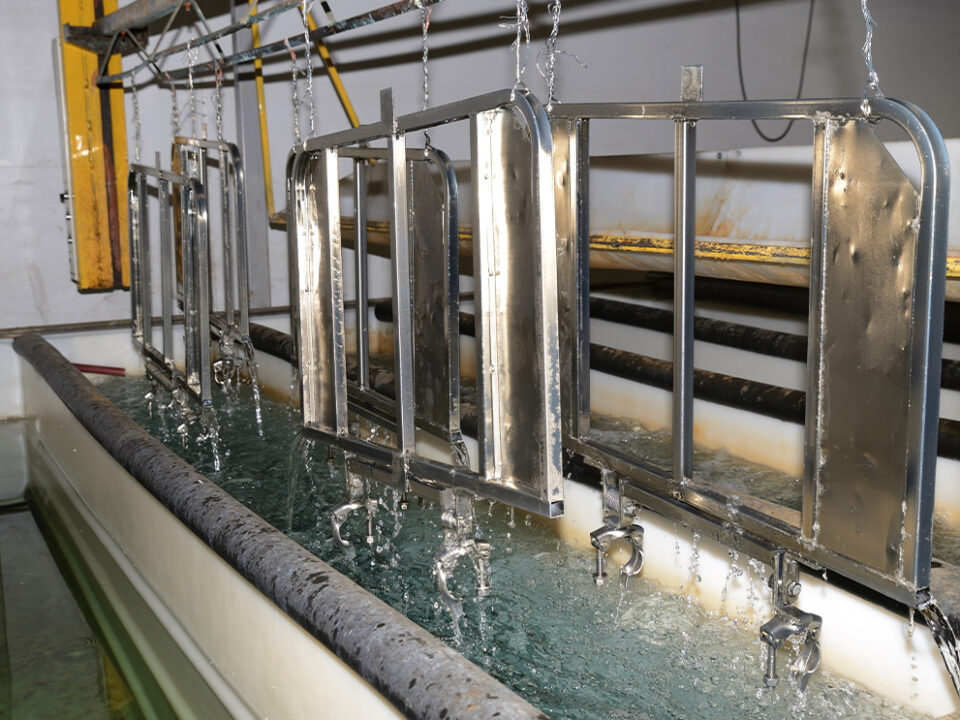

The company’s flagship project is the past-producing San Francisco mine, located 150 km north of Hermosillo, Sonora’s state capital. The 47,395-hectare property consists of two previously mined open pits (San Francisco and Chicharra) — which Magna plans to reopen soon — and associated heap leaching facilities located close to the San Francisco pit.

The company’s flagship project is the past-producing San Francisco mine, located 150 km north of Hermosillo, Sonora’s state capital. The 47,395-hectare property consists of two previously mined open pits (San Francisco and Chicharra) — which Magna plans to reopen soon — and associated heap leaching facilities located close to the San Francisco pit.

Do you like it?

April 9, 2021

April 9, 2021

Dolly Varden’s goal is to try and extend Torbrit through some step-out drill holes, and to get into the high-grade, 500g to 1kg material. There are early indications of other Torbrit “look-alikes” along a 4.5-km trend. Through drilling, Dolly Varden wants to prove up another Torbrit and drastically increase the size of the resource which in all categories is about 44Moz at an average grade of 300 g/t. A key part of the exploration thesis is the fact that the rocks hosting the mineralization on the property are the same age as some of the other large deposits found in the Golden Triangle including Eskay Creek.

Do you like it?

April 6, 2021

April 6, 2021

Exploits Discovery Corp. is a Canadian mineral exploration company focused on the acquisition and development of mineral projects in Newfoundland, Canada. The Company holds the Middle Ridge, True Grit, Great Bend, Mt. Peyton, Jonathans Pond, and Gazeebow projects, which cumulatively cover an area over 2,000 km². All projects within Exploits’ portfolio lie within the Exploits Subzone and Gander River Ultramafic Belt (GRUB) of the Dunnage Zone, which contain the majority of Newfoundland’s gold mineral occurrences and exploration efforts, including New Found Gold’s 2019 discovery of 92.86 g/t Au over 19.0 meters near surface. The Exploits Subzone has been the focus of major staking and financing throughout 2020, with increased exploration activities forecasted in the area moving into 2021.

Do you like it?

April 5, 2021

April 5, 2021

Years of neglecting its critical metal supplies is catching up with the United States, as demand for the raw materials needed to build a new green economy that rejects fossil fuels gears up.

Do you like it?

April 2, 2021

April 2, 2021

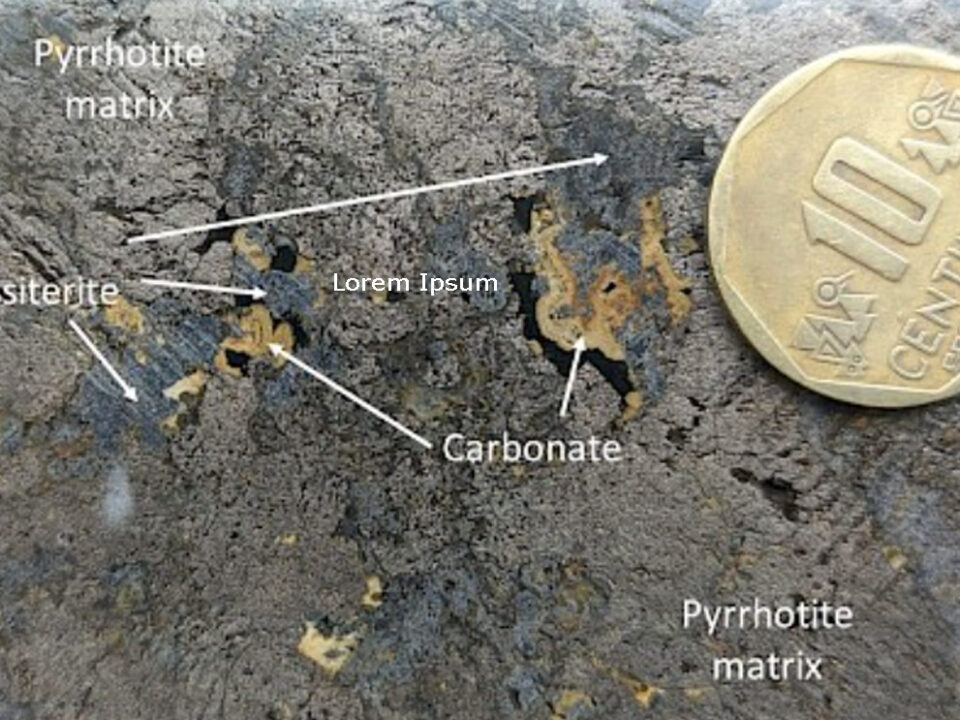

Though early stage, the possibility of widespread sulfide nickel mineralization at Surimeau looks promising. The grades and rock value given here are conservative; the 0.224% Ni used to calculate the rock value of US$41.83 per tonne is based on only three intercepts from three holes drilled at Surimeau, less than 200m. Highlights from summer 2020 grab sampling show grades up to 0.495% Ni. If those grades start showing up in drill core, Renforth could really be onto something.

Do you like it?

April 2, 2021

April 2, 2021

As Victory Resources Corp. (CSE: VR) (FWB: VR61) (OTC: VRCFF) continues to scale up mining operations on multiple properties across North America, the company has made a significant management change to reflect its broadening exploration focus that now includes battery metals.

Do you like it?

March 30, 2021

March 30, 2021

Mainstream media and the large mining companies are finally catching on to what we at AOTH have been saying for the past two years: the copper market is heading for a severe supply shortage due to a perfect storm of under-exploration/ lack of discovery of new deposits, clashing with a huge increase in demand due to electrification and decarbonization.

Do you like it?

March 27, 2021

March 27, 2021

The common denominator for each countries climate action plan is electric vehicles; that’s easy to identify. But whether economies can acquire sufficient raw materials to reach “full electrification” is another story — it's a problem that has yet to be solved.

For years, the US has been heavily reliant on foreign supply of minerals required for key areas such as national defense, electronics and medical equipment, and its EV sector is no different.

Under Trump’s executive order (September 2020), graphite was identified as one of four minerals considered essential to the nation’s “national security, foreign policy and economy.”

For years, the US has been heavily reliant on foreign supply of minerals required for key areas such as national defense, electronics and medical equipment, and its EV sector is no different.

Under Trump’s executive order (September 2020), graphite was identified as one of four minerals considered essential to the nation’s “national security, foreign policy and economy.”

Do you like it?

March 25, 2021

March 25, 2021

Max Resource Corp (TSXV:MXR, OTC:MXROF, Frankfurt: M1D2) continues to make good progress at its CESAR copper-silver project in Colombia, this week announcing high-grade results from the CONEJO discovery at CESAR North

Highlight assays greater than 9% copper and 50 grams per tonne (g/t) silver included 12.5% copper + 83.5 g/t silver over 5X5 meters; 10.4% copper + 95 g/t silver over 5 meters by 5 meters; 10.5% copper + 50.1 g/t silver over 3X2 meters; and 9.5% copper + 120 g/t silver over 1 meter by 1 meter.

Highlight assays greater than 9% copper and 50 grams per tonne (g/t) silver included 12.5% copper + 83.5 g/t silver over 5X5 meters; 10.4% copper + 95 g/t silver over 5 meters by 5 meters; 10.5% copper + 50.1 g/t silver over 3X2 meters; and 9.5% copper + 120 g/t silver over 1 meter by 1 meter.

Do you like it?

March 25, 2021

March 25, 2021

Unsurprisingly, many of the base metals, which are invaluable to many sectors of the global economy, are found within Canada’s critical minerals list. Among them is zinc, an essential ingredient used to build our roads, bridges, buildings, and cars.

The Akie property is an advanced exploration project with drill indicated resources owned by Vancouver’s ZincX Resources Corp. (TSXV: ZNX).

The Akie property is an advanced exploration project with drill indicated resources owned by Vancouver’s ZincX Resources Corp. (TSXV: ZNX).

Do you like it?

March 23, 2021

March 23, 2021

Goldman Sachs says that the next structural bull market for commodities will be driven by spending on green energy.

The fossil-fueled based transportation system needs to be electrified, and the switch must be made from oil, gas, and coal-powered power plants to those which run on solar, wind and thorium-produced nuclear energy. If we have any hope of cleaning up the planet, before the point of no return, a massive decarbonization needs to take place.

In a recent report, commodities consultancy Wood Mackenzie said an investment of over $1 trillion will be required in key energy transition metals over the next 15 years, just to meet the growing needs of decarbonization.

The fossil-fueled based transportation system needs to be electrified, and the switch must be made from oil, gas, and coal-powered power plants to those which run on solar, wind and thorium-produced nuclear energy. If we have any hope of cleaning up the planet, before the point of no return, a massive decarbonization needs to take place.

In a recent report, commodities consultancy Wood Mackenzie said an investment of over $1 trillion will be required in key energy transition metals over the next 15 years, just to meet the growing needs of decarbonization.

Do you like it?

March 21, 2021

March 21, 2021

The thawing of permafrost is yet another manifestation of climate change, that populations living near it will have to deal with in the coming decades as global warming accelerates, particularly in the polar regions

Mining is often deemed complicit in the rise of greenhouse gas emissions, given its use of heavy machinery and ground disturbance, but in this case, in areas where the ground is permanently frozen but starting to thaw, operations can be negatively impacted, and big miners are having to shell out millions. We have seen the implications of thawing permafrost at Teck’s Red Dog Mine in Alaska, and at Norilsk Nickel’s Oktyabrsky and Taimyrsky mines in Siberia.

The problem is not going away; in fact, there is every indication it will get worse.

Mining is often deemed complicit in the rise of greenhouse gas emissions, given its use of heavy machinery and ground disturbance, but in this case, in areas where the ground is permanently frozen but starting to thaw, operations can be negatively impacted, and big miners are having to shell out millions. We have seen the implications of thawing permafrost at Teck’s Red Dog Mine in Alaska, and at Norilsk Nickel’s Oktyabrsky and Taimyrsky mines in Siberia.

The problem is not going away; in fact, there is every indication it will get worse.

Do you like it?

March 20, 2021

March 20, 2021

It is not very often that every hole of an exploration drill program returns gold intersections as good as or better than expected, but that is exactly what junior miner Getchell Gold Corp. (CSE:GTCH, OTCQB:GGLDF) has done so far from drilling at its Fondaway Canyon project in the world-famous mining state of Nevada.

Last year’s drilling has already shown that the gold mineralization at Fondaway Canyon is thick and broad, with high-grade intervals that were not accounted for in the company’s geological model. The mineralization remains open, and every indication shows that it could continue.

The significant potential for extensions is likely to be investigated further in this year’s exploration program, as Getchell continues its path towards building ounces at what it believes could be another Carlin-style gold system.

Last year’s drilling has already shown that the gold mineralization at Fondaway Canyon is thick and broad, with high-grade intervals that were not accounted for in the company’s geological model. The mineralization remains open, and every indication shows that it could continue.

The significant potential for extensions is likely to be investigated further in this year’s exploration program, as Getchell continues its path towards building ounces at what it believes could be another Carlin-style gold system.

Do you like it?

March 19, 2021

March 19, 2021

Peru-focused Tinka Resources (TSXV:TK, OTCP:TKRFF) has the backing of a major player in the Peruvian zinc and silver market, adding significant heft to its flagship Ayawilca zinc-silver play.

Nexa Resources (TSX:NEXA), one of the world’s largest zinc producers, and owner of the only zinc smelter in Peru, purchased 28.895 million common shares from an arms-length shareholder, giving the Luxembourg-based firm an 8.8% stake in Tinka.

The transaction means Tinka Resources now has two major miners as shareholders — the other being Buenaventura SA (NYSE:BVN) — along with JP Morgan UK.

Nexa Resources (TSX:NEXA), one of the world’s largest zinc producers, and owner of the only zinc smelter in Peru, purchased 28.895 million common shares from an arms-length shareholder, giving the Luxembourg-based firm an 8.8% stake in Tinka.

The transaction means Tinka Resources now has two major miners as shareholders — the other being Buenaventura SA (NYSE:BVN) — along with JP Morgan UK.

Do you like it?

March 16, 2021

March 16, 2021

North America relies heavily on foreign supplies of critical minerals — the raw materials it needs to become a leader in high technology, transportation, energy, and defense. Materials like lithium, graphite, and tin.

For years, the United States and Canada did not bother to explore for these minerals and build mines. Globalization brought with it the mentality that all countries are free traders, and friends. Dirty mining and processing? NIMBY. Let China do it, let the DRC do it, let whoever do it.

China recognized opportunity knocking and answered the door

For years, the United States and Canada did not bother to explore for these minerals and build mines. Globalization brought with it the mentality that all countries are free traders, and friends. Dirty mining and processing? NIMBY. Let China do it, let the DRC do it, let whoever do it.

China recognized opportunity knocking and answered the door

Do you like it?

March 12, 2021

March 12, 2021

Renforth Resources (CSE:RFR, OTC:RFHRF, WKN:A2H9TN) continues to make good progress on its Parbec gold project in Quebec, releasing a cache of drill results to the market on Tuesday, March 9.

The highlight from was 21.45 meters grading 5.57 grams per tonne (g/t) gold, between 254.8m and 276.2m meters in hole PAR-20-112. Two higher-grade sub intervals returned 6.27 g/t Au over 16.7m and 37.3 g/t Au over 1m.

The highlight from was 21.45 meters grading 5.57 grams per tonne (g/t) gold, between 254.8m and 276.2m meters in hole PAR-20-112. Two higher-grade sub intervals returned 6.27 g/t Au over 16.7m and 37.3 g/t Au over 1m.

Do you like it?

March 12, 2021

March 12, 2021

Mainstream media and the large mining companies are finally catching on to what we at AOTH have been saying for the past two years: the copper market is heading for a severe supply shortage due to a perfect storm of under-exploration/ lack of discovery of new deposits, clashing with a huge increase in demand due to electrification and decarbonization.

Copper is trading over $4.00 a pound this year on rapidly tightening physical markets, rebounding economic growth especially in China, the top metals consumer, and the expectation that the era of low inflation in key economies may soon be over.

Copper is trading over $4.00 a pound this year on rapidly tightening physical markets, rebounding economic growth especially in China, the top metals consumer, and the expectation that the era of low inflation in key economies may soon be over.

Do you like it?

March 6, 2021

March 6, 2021

Is America’s infrastructure spending worth it? So far, the answer would lean towards a yes.

A report published by the American Society of Civil Engineers (ASCE) this week has validated the nation’s recent success in improving its infrastructure, while justifying the need for additional government spending.

A report published by the American Society of Civil Engineers (ASCE) this week has validated the nation’s recent success in improving its infrastructure, while justifying the need for additional government spending.

Do you like it?

March 5, 2021

March 5, 2021

The exploration success accumulated by Max Resource Corp. (TSX.V: MXR; OTC: MXROF; Frankfurt: M1D2) over the past year has not gone unrecognized.

Recently, the company was named one of the top 10 performing mining stocks in the 2021 TSX Venture 50, having seen its value increase more than three-fold over the past year. The TSX Venture 50 ranks the top 50 stocks from over 1,600 companies listed on the TSX Venture Exchange.

Last year’s winners included well-recognized names such as K92 Mining Inc., Great Bear Resources Ltd. and Discovery Metals Corp. Some of these have gone on to become billion-dollar market cap companies.

Recently, the company was named one of the top 10 performing mining stocks in the 2021 TSX Venture 50, having seen its value increase more than three-fold over the past year. The TSX Venture 50 ranks the top 50 stocks from over 1,600 companies listed on the TSX Venture Exchange.

Last year’s winners included well-recognized names such as K92 Mining Inc., Great Bear Resources Ltd. and Discovery Metals Corp. Some of these have gone on to become billion-dollar market cap companies.

Do you like it?

February 23, 2021

February 23, 2021

2021.02.23 Gold and copper are up, the dollar is down, and bond yields […]

Do you like it?

October 24, 2020

October 24, 2020

2020.10.24 Joe Biden’s performance in Thursday night’s presidential debate was solid. The former […]

October 3, 2020

October 3, 2020

2020.10.03 Global equities churned on Friday after the stunning revelation that US President […]

August 14, 2020

August 14, 2020

2020.08.14 Commodity prices rise and fall with economic conditions. Conventional wisdom has it […]

July 25, 2020

July 25, 2020

2020.07.25 Nothing glitters like gold but it’s copper that literally makes the world […]

July 17, 2020

July 17, 2020

2020.07.17 The US economy continues to flounder like an East Coast freighter bashed […]

June 26, 2020

June 26, 2020

2020.06.26 In accepting the Democratic nomination for the presidency on July 2, 1932, […]

May 7, 2020

May 7, 2020

2020.05.07 Cleaner skies owing to covid-19 lockdowns appear to be the silver lining […]

April 6, 2020

April 6, 2020

2020.04.06 As I write and you read, the world economy is getting pummeled, […]

April 1, 2020

April 1, 2020

2020.04.01 Benjamin Franklin once said; “Out of adversity comes opportunity.” The adversity the […]

February 9, 2020

February 9, 2020

2020.02.09 As the third most-consumed metal on earth, behind iron and aluminum, copper […]

February 5, 2020

February 5, 2020

2020.02.05 Just in time (JIT) is an inventory system designed to efficiently match […]

December 4, 2019

December 4, 2019

2019.12.04 As world leaders gather in London this week for the NATO Summit, […]

October 17, 2019

October 17, 2019

2019.10.17 In 2010 the US Department of Energy’s Critical Materials Strategy included lithium as one […]

October 5, 2019

October 5, 2019

2019.10.05 When China closed its door to all US agricultural exports in August, […]

September 25, 2019

September 25, 2019

2019.09.25 Despite evidence of a slowing economy, shipments of raw materials are gliding […]

July 17, 2019

July 17, 2019

2019.07.17 A lot of resource investors stop listening to corporate presentations when they […]

June 1, 2019

June 1, 2019

2019.06.01 The trade feud between the US and China has deteriorated into trench […]

May 9, 2019

May 9, 2019

2019.05.09 The ongoing battle between the United States and China for economic supremacy […]

April 23, 2019

April 23, 2019

2019.04.23 “Whoever has an army has power.” – Mao Zedong In March Italy […]

April 19, 2019

April 19, 2019

2019.04.19 Copper bulls are running this week, as the red metal used in […]

April 17, 2019

April 17, 2019

2019.04.17 Is the age of the gas-powered automobile coming to an end? Doubtful. […]

March 30, 2019

March 30, 2019

2019.03.30 In North America, electric vehicles are still a niche market, with most […]

February 16, 2019

February 16, 2019

2019.02.16 Gold markets were rocking on Tuesday, lifted by a basket of factors […]

February 14, 2019

February 14, 2019

2019.02.14 Infrastructure is the physical systems – the roads, power transmission lines and […]

February 13, 2019

February 13, 2019

2019.02.13 On Tuesday zinc inventories in London Metal Exchange (LME) warehouses sunk into […]

January 23, 2019

January 23, 2019

2019.01.23 Some of the world’s largest copper mines are slashing production, thus feeding […]

January 12, 2019

January 12, 2019

2019.01.12 The markets are up and down like a bride’s nightgown, as my […]

October 25, 2018

October 25, 2018

2018.10.25 Copper had one of it best years ever in 2017, rising 27% […]

October 10, 2018

October 10, 2018

2018.10.10 The stock market pullback of the last couple of weeks has shown […]