2 AOTH gold plays for 2023 – Richard Mills

2023.01.07

Gold and silver are both looking to finish higher at the close of 2023’s first week of trading, as the US dollar declined sharply, Friday.

At time of writing, gold was up $35 to $1,869 an ounce, with silver gaining $0.66, just shy of $24/oz. The US dollar index sunk to 103.89, a low point that hasn’t been crossed since the end of June. From a one-year high of 114.10 on Sept. 27, DXY has fallen nearly 10%.

It’s interesting that, while gold was down for most of last year due to a series of consecutive interest rate increases, higher government bond yields and a climbing US dollar, the precious metal had by Dec. 31 won back most of its losses. The same for silver. Gold started the year at around $1,828 an ounce and finished it at just above $1,822. Silver opened 2022 at $23.28 and ended it nearly 3% higher, at $23.93.

At AOTH, we think 2023 is going to be an excellent year for gold, and we have four gold plays for junior resource investors to ponder as they position themselves for the next big upswing in the gold price.

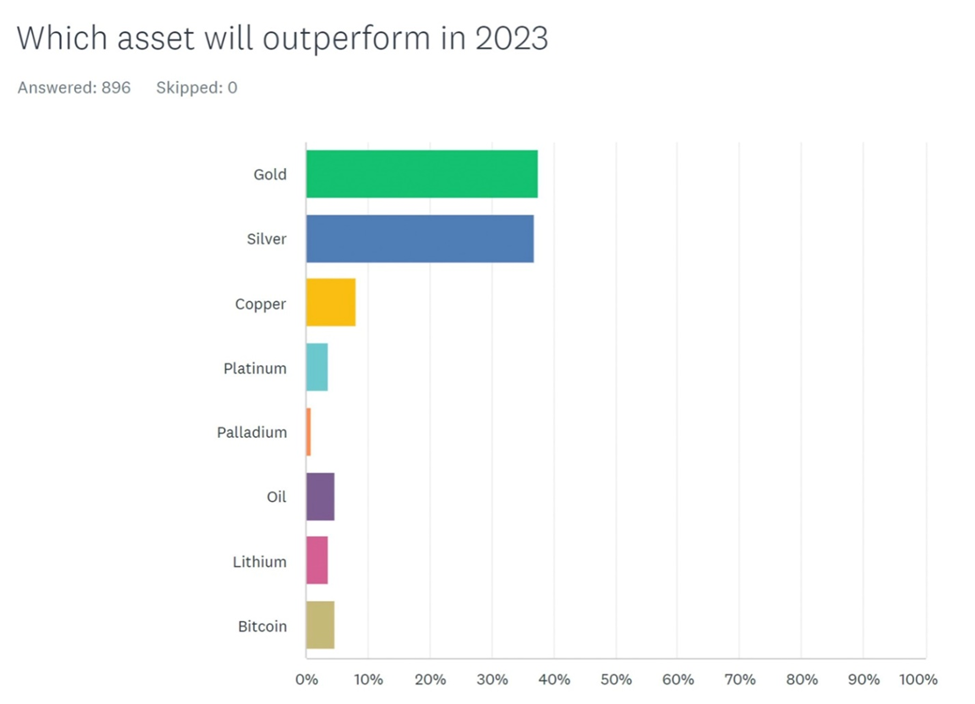

We’re not going out on a limb here. According to Kitco’s recent survey, of 896 retail investor respondents, 37.5% picked gold as the top-performing metal in 2023, while 36.8% opted for silver.

Wall Street is also bullish on gold for 2023, with analysts telling Kitco that gold is well-positioned to rally as the U.S. economy enters a recession, the U.S. dollar peaks, and the Fed reverses its monetary policy tightening.

My readers know I’ve been saying for years, that the best leverage to a rising gold price is a quality junior. In this article, you’ll hear about four companies that, in my humble opinion, are among the most undervalued in the gold exploration sector right now.

Why gold?

Before we get to the companies, a brief summary on why we’re so bullish on gold.

Among the factors favoring precious metals in 2023, are wobbly stock markets — the S&P 500 lost 19% last year in its worst performance since 2008, and analysts at major banks are forecasting that indices will retest their 2022 lows in the first half; higher US Treasury yields commensurate with still-hawkish monetary policies from most of the world’s major central banks; worries about economic growth in China, the US and the European Union; and the continued Russia-Ukraine war, in particular its effects on commodities supply.

After suffering for much of 2022 due to an elevated US dollar and higher bonds yields, gold has trended up since the beginning of November, fueled by market turbulence, rising recession expectations, and more gold purchases from central banks underpinning demand.

“In general, we are looking for a price-friendly 2023 supported by recession and stock market valuation risks — an eventual peak in central bank rates combined with the prospect of a weaker dollar and inflation not returning to the expected sub-3% level by year-end — all adding support,” CNBC quotes Ole Hansen, head of commodity strategy at Saxo Bank.

“In addition, the de-dollarization seen by several central banks last year when a record amount of gold was bought look set to continue, thereby providing a soft floor under the market.”

(Russia is the poster-child of de-dollarization and, ipso facto, gold accumulation. The Central Bank of Russia has reduced its holdings of US Treasuries to only $2 billion from more than $150 billion in 2012. At the same time, the CBR has increased its gold reserves by more than 1,350 tonnes, putting Russia in fifth place among the world’s top gold-holding countries. On Dec. 29, the Financial Post reported central banks are hoovering up gold at the fastest pace since 1967.)

While the dollar was the trade in 2022, in 2023 the tables have turned and gold is hot again.

Personally I see four good rationales to dump US dollars and focus on gold: the fast-rising odds of negative US growth this year; the worst inflation in 40 years that is probably going to be a lot stickier than most people believe; an unsustainable national debt that is quickly heading over $32 trillion; and never-before-seen toxic partisanship on Capitol Hill that is likely to gum up the gears of government and result in legislative gridlock for the next four years. “Not a good look,” President Biden quipped, referring to the inability of House Republicans to unify behind a speaker candidate. That’s true especially for foreign investors holding US dollar-denominated assets.

The Fed will arguably be forced into unwinding its tight monetary policy, becoming more dovish in the first half of the year, as the central bank is confronted by evidence of a downward-spiraling US economy and/or the widely anticipated recession.

The signs of a faltering economy include continued high inflation, especially food and energy, that is not reflected in the Fed’s preferred inflation index, the core PCE; a slowdown in consumer spending; plunging PMIs and an inverted yield curve.

The latest piece of bad economic news is the job market faltering. NPR reported on Friday that Hiring slowed since the first half of last year, when employers were adding more than 400,000 jobs a month, on average. And a further slowdown is expected, as businesses brace for a possible recession.

I see the Fed reducing its rate hikes to 25 basis points before the end of the first quarter and pausing by the middle of the year. A reversal could follow shortly thereafter — lower interest rates are always a bullish signal for precious metals. When the Fed turns dovish, we expect gold (and silver) to spike.

Here are two gold plays (one I already own (GTCH) and one I’m going to buy), to consider before that happens:

Nighthawk Gold Corp. (TSX:NHK, OTCQX:MIMZF)

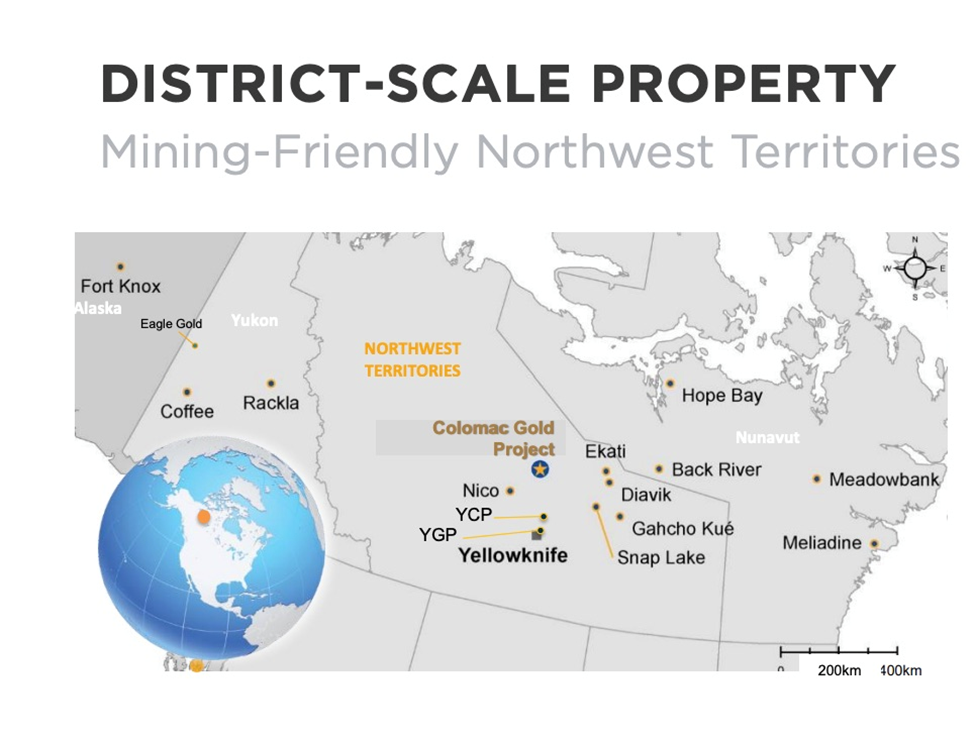

Nighthawk Gold owns more than 930 square kilometers within the Indin Lake Greenstone Gold Belt, 220 km north of Yellowknife, in the Canadian Northwest Territories. The company is advancing several highly prospective gold exploration targets in this district-scale land package, which by comparison, is around the same area as Hong Kong, or triple the size of the size of the Timmins, Ontario gold camp.

The Colomac project is comprised of the Colomac Centre Area “hub” of five deposits, and two higher-grade satellite deposits. Together, they have a mineral resource estimate (MRE) of 46.4 million tonnes grading 1.38 grams per tonne Au, for 2.06 million ounces in the open-pit indicated category, and 7.8Mt grading 2.38 g/t, for 0.60Moz inferred.

Underground, there is 0.62Moz indicated and 0.73Moz inferred.

Mineralization has been intersected outside of the 2022 MRE pit shells. Grassroots targets with gold occurrences include the Colomac Main Deposit, along with the following deposits: 24, Kim, Goldcrest, 27, Treasure Island, Grizzly Bear, Cass, Damoti, Nice, Swamp, North Ica, Laurie Lake, Albatross, Andy Lake, JPK, Lexidin, Fishhook, Echo-Indin and Diversified.

Historical operations focused on open-pit mining the Colomac deposit during a depressed gold price environment compared to currently. Over 12 million tonnes were milled and more than 500,000 ounces of gold were produced during the 1990s, providing validation of the current Colomac geological model and mineral resource estimation.

The large-scale, open-pittable project has the potential to be one of the biggest in Canada and the US, with simple metallurgy. Underground resource estimates provide optionality.

Nighthawk Gold Corp.

TSX:NHK, OTCQX:MIMZF

Cdn$0.43, 2023.01.06

Shares Outstanding 122.9m

Market cap Cdn$52.8m

NHK website

Getchell Gold (CSE:GTCH, OTCQB:GGLDF)

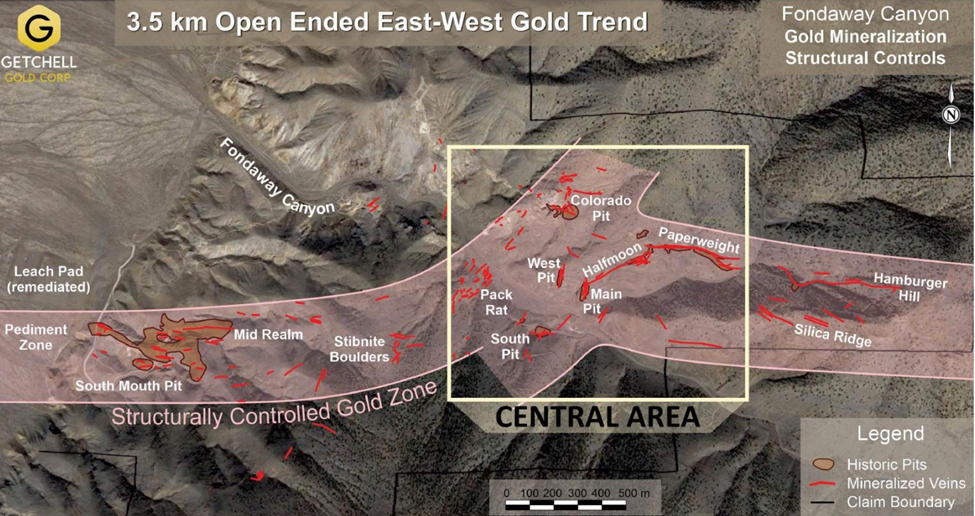

Getchell Gold’s Fondaway Canyon gold project is in Nevada, a jurisdiction that is consistently recognized as number one in the world for mining investment. Getchell carried out three drill programs at Fondaway, in 2020, 2021 and 2022. Their aim was to significantly upgrade the 2017 resource estimate into a new resource, that combined the drill results from all three drill programs.

The new resource estimate, released in November, nearly doubles the previous one, of 1.1 million ounces. It is 2 million ounces, including 550,000 ounces in the indicated category grading 1.56 grams per tonne, and 1.5Moz inferred, grading 1.23 g/t. There are nine holes that haven’t been included in the resource estimate because they missed the cut-off date, and Getchell plans to do a lot more drilling in 2023. Meaning the next RE will be even bigger.

In a year-end interview with AOTH, President Mike Sieb said the scenario they’re looking at for Fondaway Canyon, is an initial fairly sizeable open pit that will then transition to an underground operation, to continue following the gold trends to greater depths.

Sieb makes a great point about the mineralization remaining open: “The geological model has connected the dots for about 800 meters downdip, roughly the same on strike, and completely remains open — not only external to the drilling but also in between the areas that we’ve drilled.”

“Rick we don’t know how much gold is there. We’ve been drilling for three years and we have yet to hit the extents of the mineralization either along strike left-right or downdip, the mineralization still carries on,” he told me. “Our last deepest drill hole, downdip, is still as strong as some of the drill holes that you see at surface. As yet there is no indication that the gold mineralization is coming to any sort of truncation at Fondaway Canyon.”

Sieb says the resource estimate is just the first milestone for Getchell Gold. The next step is what he describes as “an extremely aggressive and more ambitious exploration program [in 2023],” with the goal of delivering a preliminary economic assessment by the end of the year.

Another compelling aspect of GTCH is its tight share structure, only 105 million shares outstanding, which is remarkable considering how much has been accomplished in three years. The drilling budget has been kept reasonable and a minimal amount of share dilution has occurred.

At AOTH we believe that Fondaway Canyon will become a mine and it’s only a matter of time before a share price correction occurs reflecting Getchell’s progress on the development path.

Getchell Gold Corp.

CSE:GTCH, OTCQB:GGLDF

Cdn$0.45, 2023.01.06

Shares Outstanding 105m

Market cap Cdn$47.3m

GTCH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Getchell Gold Corp. (CSE:GTCH). GTCH is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.