AOTH Copper Road Resources overview with CEO John Timmons – Richard Mills

2023.10.04

Behind Ontario’s mineral wealth is the geological advantage offered by the Mid-Continental Rift, which curves for more than 2,000 km across North America and is one of the world’s great continental rifts. Also called the “Keweenawan Rift”, it stretches across Lake Superior near Marathon, ON, all the way across Minnesota, Michigan, Wisconsin, Iowa, Nebraska and Kansas.

The Mid-Continental Rift is the same structure that formed Lake Superior and the world-class Keweenawan peninsula copper-mining region in the US, which housed the initial copper rush in the mid-1800s and was mined for more than 150 years.

Because of severely fragmented claim ownership there are currently few copper developments on the Ontario side of the Keweenaw, providing an opportunity for Copper Road Resources Inc. (TSXV: CRD), which is among the most active juniors in the area.

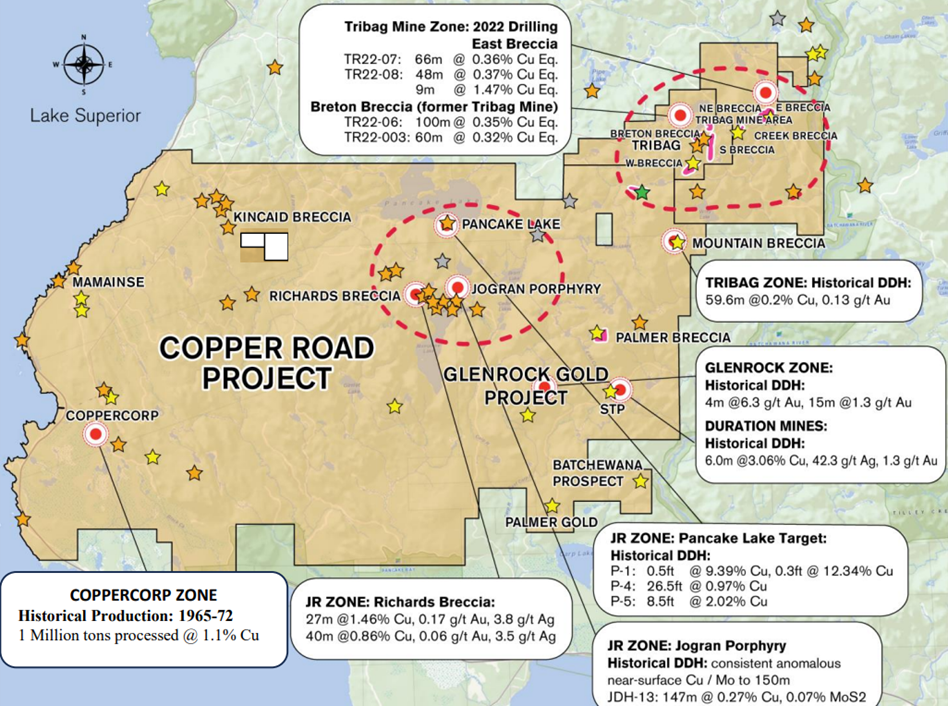

The company’s namesake property covers 21,000 hectares within the Batchewana Bay district, about 85 km north of Sault St. Marie.

President and CEO John Timmons, who took the helm in 2020, said what attracted him to the property was its potential scale. The assemblage included the former Coppercorp mine and the Jogran porphyry (see below for property details). The claim holders were trying to get a deal done on the East breccia target and the Tribag mine, which Copper Road Resources managed to do in March 2021.

According to the news release, the company formerly known as Stone Gold entered into an option agreement with the claim holders through a payment of $240,000 and issuance of 2.3 million shares.

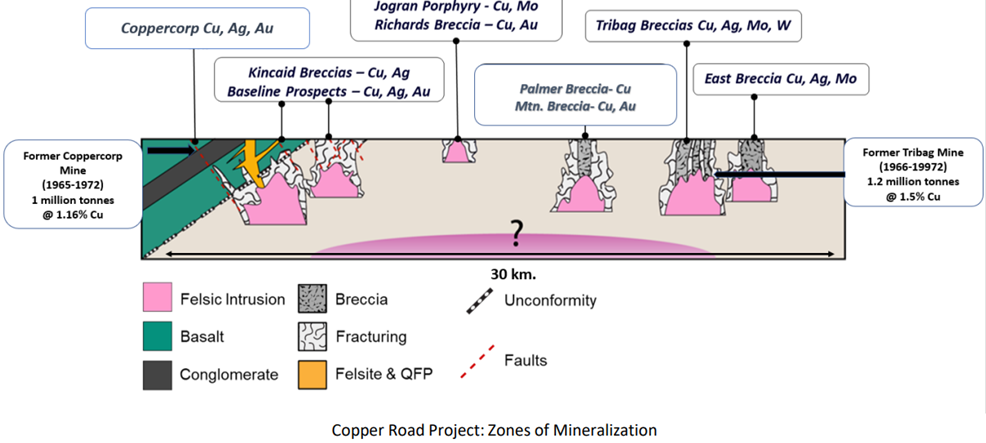

The property package has a proven history of copper production containing two former mines: Tribag, historically, processed 1 million tonnes at 1% Cu, and Coppercorp had historical production of 1Mt at 1.16% Cu.

“When it’s wrapped up next spring, we’ll have this whole district which includes two past producers,” Timmons told AOTH over the phone, talking about CRD’s claim consolidation program’s success, on Monday. “We’ve consolidated 90% of these regional targets so the Tribag Zone along with five known breccias in the area, three of which were previously mined.”

Copper Road property

There are several confirmed zones of mineralization within property boundaries — Tribag, Glenrock, JR (Richards/Jogran) and Coppercorp — each hosting multiple targets for exploration. Together, they span 30 kilometers of CRD owned contiguous claims.

The company is focused on two zones of near-surface mineralization at Tribag and JR, which are approximately 12 km apart.

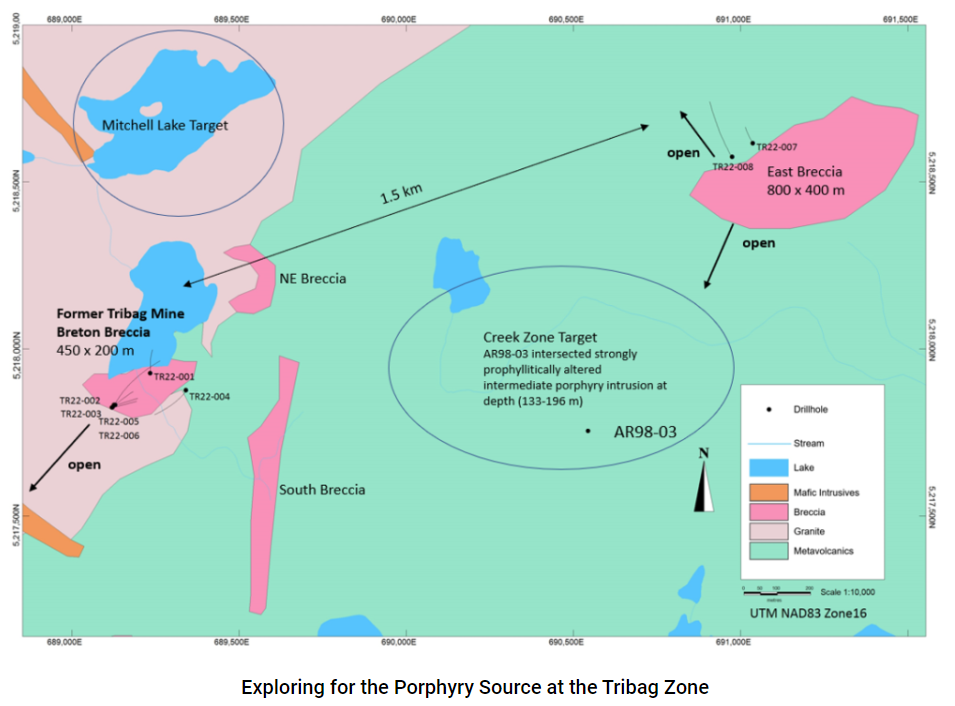

The former Tribag mine represents a porphyry-style copper deposit, consisting of four breccias (Breton, West, East, South). Its reported historical production (1967-74) was predominantly from the Breton breccia.

Historical estimates (historical estimates are not 43-101 compliant and are not to be relied upon for investment purposes) by Teck Resources, its former operator (1966-72) identified 40 million tonnes at 0.4% copper from the Breton breccia, and an estimated 125 million tonnes at 0.13% copper and 0.05% molybdenum from the East breccia.

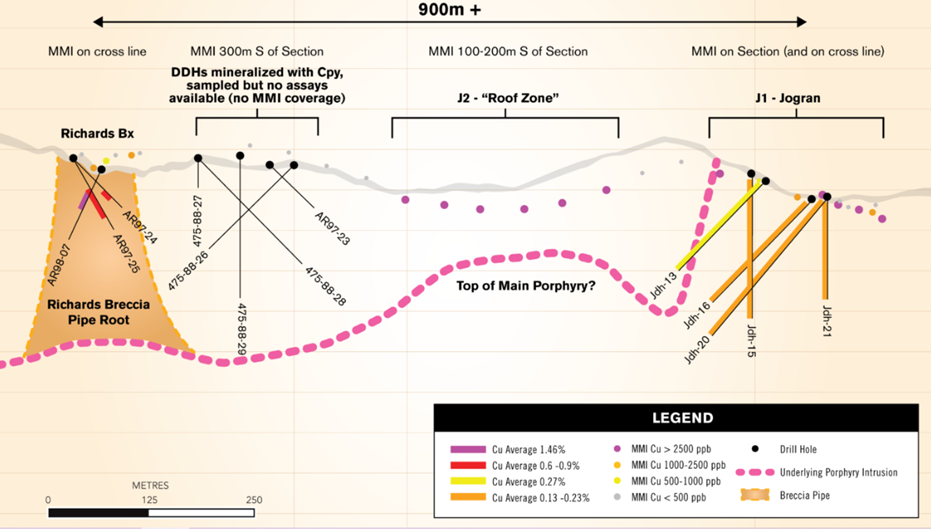

The JR Zone consists of the Richards breccia, a near-surface copper target, and the Jogran surface porphyry, which has been drilled to a depth of 200m. The two targets are located 900m apart.

John Timmons, president and chief executive officer of Copper Road, comments:

“We are eager to see the assays from the JR zone; over the past year, we completed 4,200 metres of diamond drilling and have established both the Tribag and JR zones as large-scale at-surface Cu-Mo-Au-Ag [copper-molybdenum-gold-silver] targets. The JR zone is in the centre of 30 kilometres of mineralization, with two past-producing high-grade copper mines, the Coppercorp to the southwest and the Tribag to the northeast.

“The company believes this region has the potential to deliver several much larger copper-dominant polymetallic deposits based on the extensive Cu-Mo-Au-Ag mineralization throughout this contiguous 24,000-hectare project.”

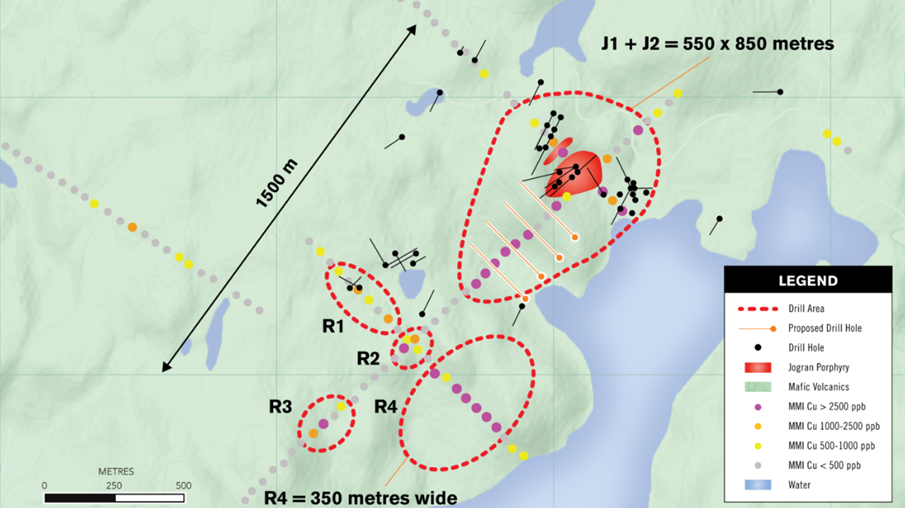

The company believes that the JR zone has a current footprint of copper mineralization that is 1.5 kilometres long and 550 metres wide (open) based on reconnaissance MMI (mobile metal ion) soil lines and historical data compilation completed by the company (see press release dated June 6, 2023).

The JR zone is just one of several alkalic porphyry targets across the property, which also includes, among others, the former Tribag mine, Con-Negus and Gimlet Lake. The company currently compares these targets with well-known alkalic porphyry deposits and clusters in British Columbia, such as Galore Creek, Mt. Milligan, Mt. Polley, Afton-Ajax (Iron Mask) and Copper Mountain.

Last year, Copper Road completed 3,000m of drilling at the Tribag Zone, with all eight holes returning significant intervals of near-surface mineralization (i.e., 9m at 1.47% copper equivalent), proving the continuity, depth, and additional mineralization outside of historical models at the Breton breccia.

The company this year raised $400,000 through a private placement, putting it in a good position to accomplish its exploration goals.

“We’ve done regional lake sediments by helicopter, stream sediments, MMI lines across targets, 1,200 meters of drilling which we’ll have assays to come shortly, lots of data compilation, looking at this thing and understanding these targets are much bigger,” said Timmons.

Due to fragmented claim ownership and regional staking closures, the JR Zone has only seen limited diamond drilling into these near-surface porphyry and breccia-hosted Cu-Mo-Au-Ag targets.

Historical exploration by Jogran Mines (1964), Phelps Dodge (1966), Duration Mines (1988), and Aurogin Resources (1997) encountered relatively broad near-surface intersections of copper mineralization that is still untested below 150m in the porphyry, and below 75m in the breccia.

“It hasn’t been drilled since 1965 and they returned decent intersections there, 140 meters of reasonable-grade copper @ 0.23% to 0.27%, very strong moly present,” said Timmons, noting the previous operators didn’t test for silver, rhenium or gold. He added:

“The Richards breccia is a little over a kilometer away and they’re returning intersections of 27 meters @ 1.5% percent copper, 40 meters of 0.8%. Again, they weren’t looking for gold so there hasn’t been any exploration there since 1998.”

2023 drilling

The recently completed drill campaign, which totaled 1,224 meters in seven holes (no twinning of holes was done), was designed to demonstrate that the JR Zone hosts a shallow mineralized porphyry and high-grade breccia in the center of the land package.

The drilling is the first step in proving the JR Zone as a large-scale zone of economic copper mineralization at shallow depths.

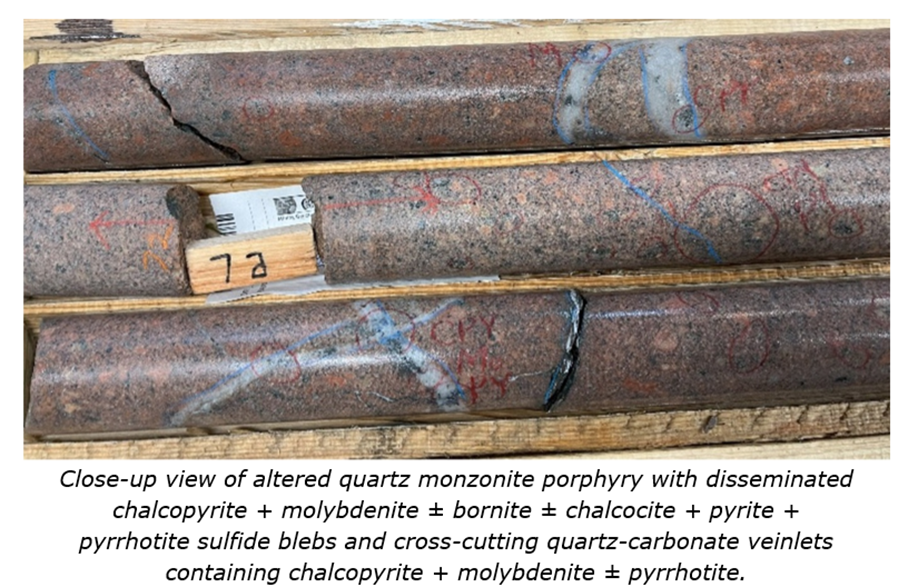

At the Jogran porphyry target, two holes intersected broad zones of copper mineralization — 194 meters and 137 meters, respectively. Mineralization is seen as chalcopyrite + molybdenite ± bornite + pyrite + pyrrhotite disseminations, and in quartz veinlets hosted in a quartz-sericite-pyrite (phyllic) altered quartz monzonite porphyry.

At the Richards breccia target, two of four holes encountered wide intersections of copper mineralization of 37 meters and 49 meters, respectively. The mineralization at Richards consists of chalcopyrite + pyrite ± pyrrhotite ± chalcocite aggregates disseminations, and veinlets hosted in a chlorite-sericite-carbonate-pyrite altered breccia. The drilling successfully extended the breccia 50-60m vertically below known mineralization.

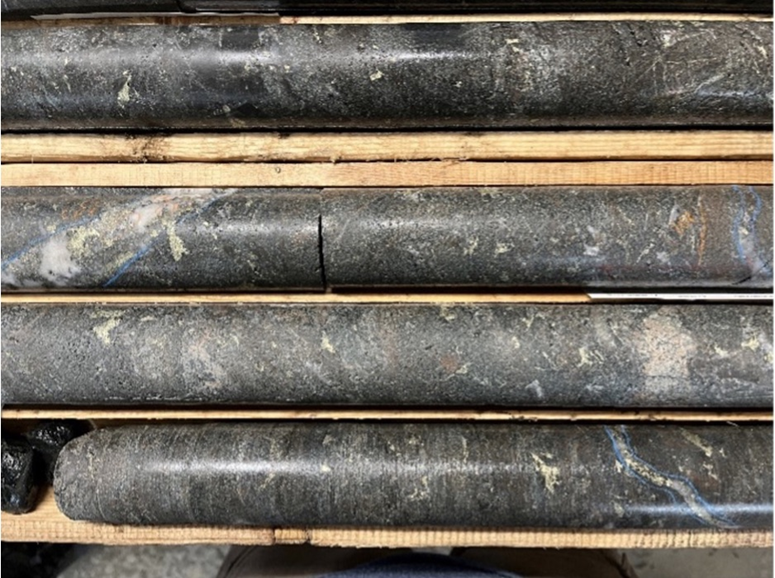

Timmons told me the intersections of porphyry and breccia are “some of the longest out of there in recent years,” and he is energized by the amount of chalcopyrite, a copper mineral, in the drill core, seen below.

Assays from both targets are pending.

Future plans

Asked how management prioritizes targets within such a large land package, Timmons said they are starting with the known mineralization and then looking to expand. While finding more at depth is important, the more immediate concern is identifying the shallow copper, which at grades of 0.4% to 0.5% Cu, would be open-pittable.

“Is there depth? Absolutely it’s open, but instead of chasing these 1,000-meter [deep] targets, we’ll start with the near-surface copper and prove more of it.”

After it receives assays, Copper Road plans to further explore the JR and Tribag zones with geophysical surveys and more drilling.

“We’re looking to raise more capital and get back on the ground with a strong geophysics program, IP across both the JR and the Tribag zones, to be followed up with a lot of drilling,” Timmons said, adding there are other targets to be explored within JR. “The Gimlet SW target which is 2 km from the JR Zone intersected numerous porphyry intrusions over a 950 m historical drill hole. We think if we point into the mag high, we’re going to have some success there.”

Conclusion

Though still in its early days, there’s lots to like about the Copper Road project, including its large size with several mineralized zones of open-pittable grade copper near surface and at depth, plus other untested areas.

We also can’t ignore its location. The Mid-Continental Rift is the same structure that formed Lake Superior and the world-class Keweenawan peninsula copper mining region in the US, which housed the initial copper rush in the mid-1800s and was mined for more than 150 years.

This means there’s potentially lots of copper yet to be found in this area, as industry leaders like Teck did in the 1960s, except this time around CRD will be using 80 years newer exploration techniques. The assays from the 1,200m drill program at the JR Zone are expected within a few weeks. The news flow should continue well into the fall and tell us more about the project’s full potential.

I like Copper Road’s Copper Road Project because of how prospective the huge, now consolidated, 30km contiguous property already is, and how much potential for resource increase and discovery potential there is.

And the fact that this was realized long before it was consolidated, then the amalgamation was undertaken, and was successful, shows quality, capable, and aggressive management.

Copper Road Resources

TSXV:CRD

Cdn$0.09, 2023.10.02

Shares Outstanding 53m

Market cap Cdn$4.7m

CRD website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Copper Road Resources

(TSXV:CRD). CRD is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of CRD

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.