Max to fly geophysical survey over CESAR’s AM District – Richard Mills

2023.09.02

Max Resource Corp (TSX.V: MAX; OTC: MXROF; Frankfurt: M1D2) continues to advance its CESAR project in Colombia, by initiating the first extensive high-resolution airborne geophysical survey in the Cesar Basin.

CESAR is situated along the copper-silver-rich Cesar Basin of northeastern Colombia. This region provides access to major infrastructure resulting from oil & gas and mining operations, including Cerrejón, the largest coal mine in South America, held by Glencore.

In 2022, Max executed a two-year co-operation agreement with Endeavour Silver, a mid-tier precious miner operating four mines in Mexico, to help the company significantly expand its landholdings at CESAR. In turn, Endeavour will hold an underlying 0.5% NSR.

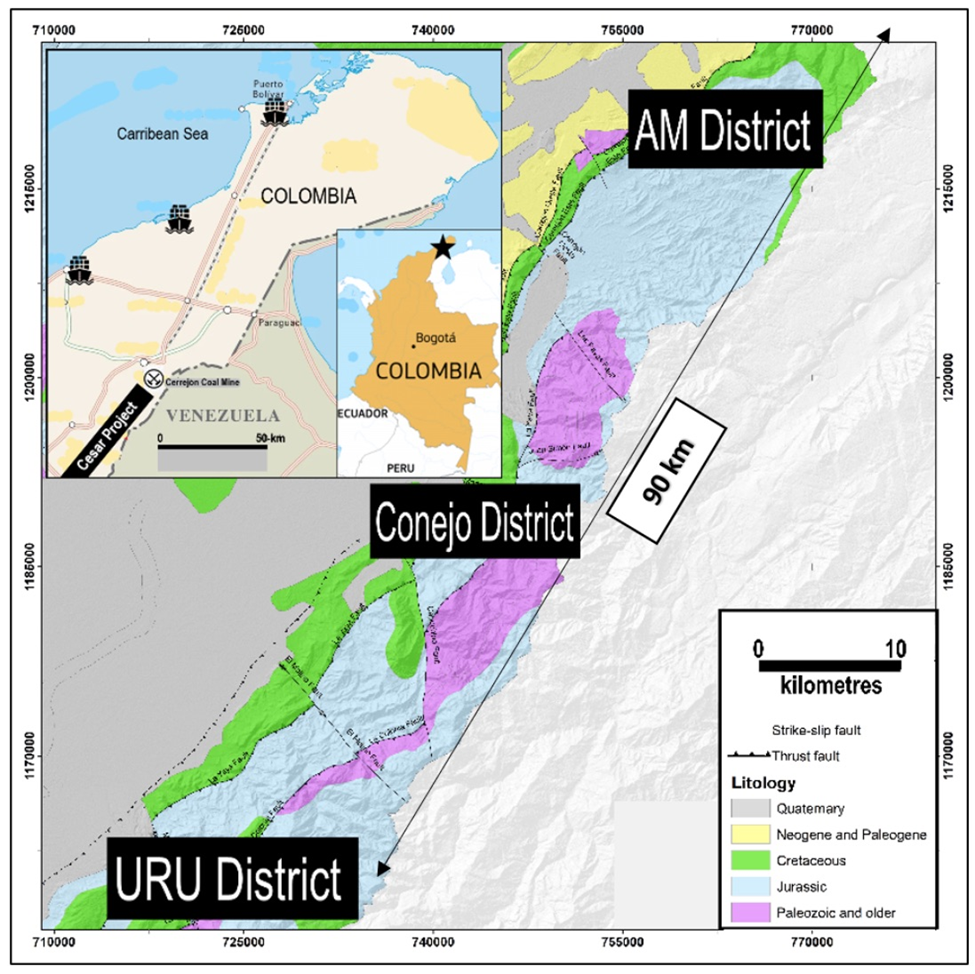

Max’s mining concessions span over 188 km², representing the largest area prospective for copper in the prolific Cesar sedimentary basin. The property is divided between three major copper-silver zones (AM, Conejo and URU) located along a 90-km-long belt.

Cesar Basin

The Cesar Basin has a Jurassic-Triassic stratigraphy characterized by Cu-Mo-Au porphyry and porphyry-related vein systems in the upper levels, and sediment-hosted-style Cu-Ag deposits lower down.

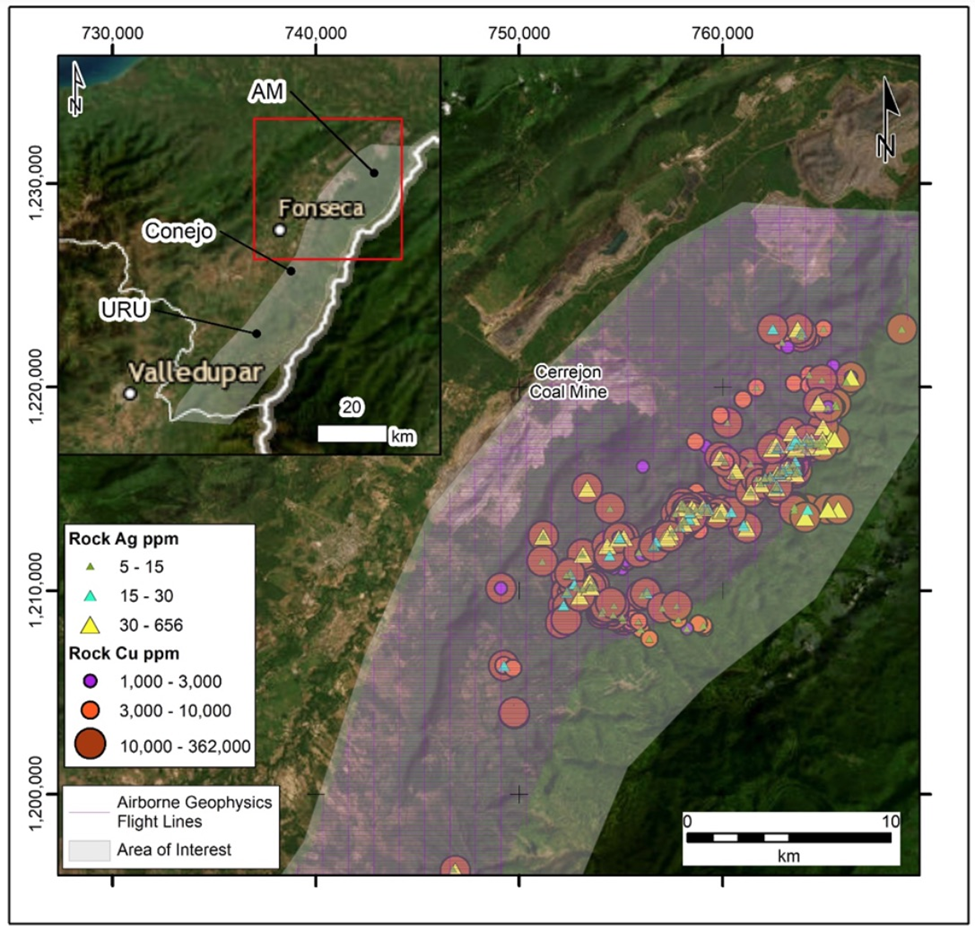

In the north of the basin, classic stacked red-bed outcrops with extensive lateral continuity have been rock-sampled within the 32-km-long AM District. Highlight values of 34.4% copper and 305 g/t silver have been documented in these sedimentary red-bed sequences.

The Conejo District, midway south, demonstrates mineralization at the contact of intermediate and felsic volcanics which outcrops over 3.7 km. The average of surface samples at a 2.0% cut-off grade comes in at 4.9% copper.

To the south, 2022 inaugural drilling was initiated at two mineralized surface exposures, located 750m apart and lying within the URU District’s 20-km-long, 2-km-wide mineralized target area.

This URU drill program was the first opportunity to test continuity of the structurally controlled copper-silver mineralization within the volcanic host rocks.

Depositional models

Currently, there are two depositional models being used for the CESAR project.

The sediment-hosted stratiform copper-silver mineralization found in the southern end (URU and Conejo zones) is interpreted to be analogous to the Central African Copper Belt (CACB), while the northern end (AM zone) is compared to the Kupferschiefer deposits in Poland.

It’s estimated that nearly 50% of the copper known to exist in sediment-hosted deposits is contained in the CACB, headlined by Ivanhoe’s 95-billion-pound Kamoa-Kakula discovery in the Democratic Republic of Congo.

Kupferschiefer, considered to be the world’s largest silver producer and Europe’s largest copper source, is an orebody ranging from 0.5 to 5.5m thick at depths of 500m, grading 1.49% copper and 48.6 g/t silver. The silver yield is almost twice the production of the world’s second-largest silver mine.

Exploration on the AM mining concessions this year has confirmed Max’s hypothesis that the mineralization found at the northern end of the property is sediment-hosted and stratiform, similar in style to the Kupfershiefer.

2023 exploration

This past January, Max drilled two scout holes down dip from surface exposures at the Herradura target. The holes were spaced 250m apart and drilled to a depth of approximately 350m. Both intersected multiple copper-replacement beds containing malachite and chalcocite with copper values ranging from 0.04% to 0.96%.

Meanwhile, the first diamond drill program last fall at the 74 km² URU District also demonstrated proof of concept. The program was designed to test the continuity of the structurally controlled copper-silver mineralization within the volcanic host rocks similar to the CACB.

Drilling at the URU-C and URU-CE targets, located 0.75 km apart, confirmed the continuation of copper-silver mineralization at depth.

At URU-C, a 9.0m of 7.0% copper and 115 g/t silver surface discovery was confirmed at depth by drill hole URU-12, which intersected 10.6m of 3.4% copper and 48 g/t silver. At URU-CE, 19 meters of 1.3% copper discovered in outcrop was confirmed by drill hole URU-9, which intersected a broad zone of copper oxide returning 33.0m of 0.3% copper from 4.0m, including 16.5m of 0.5% copper.

Field crews continue to discover and sample new mineralized outcrops including the recently identified AM-7 target. AM-7 represents the seventh discovery by Max in the AM District. It encompasses five historical open-cut copper workings extending over 700 meters.

With this discovery, the company has identified and is evaluating 21 targets along the Cesar 90-km-long belt for potential drill testing. Initial efforts have been concentrated on those targets with the greatest size potential with work that includes the following field activities:

- Systematic chip and channel sampling of the mineralized outcrops;

- Detailed geological and structural mapping of each showing;

- Trenching where possible to expose additional mineralization;

- Target scale prospecting and soil sampling;

- Ground geophysical surveys.

While Max has demonstrated that the Cesar Basin is fertile for copper-silver mineralization over a large area, only a fraction of the basin has been explored. Therefore, Max says its geological teams are dedicated to regional exploration, with the goal of discovering additional copper-silver prospects over a thousand square kilometers.

Geophysical survey

The company reported this week that it has started a high-resolution airborne magnetic and radiometric survey over the AM District, where as mentioned, Max drilled two scout holes down dip from surface exposures at the Herradura target.

The fixed-wing 4,000-line-km survey will collect data along 125-meter spacings at a height of 100m. The flight lines are oriented east-west and cover more than 400 km² of highly prospective ground. Survey results will be used to help develop and refine drill targets by mapping the lithologies and the geological structures that control mineralization.

“This is the first extensive high-resolution airborne survey conducted in the Cesar basin and it will be an important dataset as we continue to advance the Cesar Copper-Silver Project. The data will allow the Company to pinpoint areas with the greatest potential for significant accumulation of copper silver minerals by identifying where the permissive lithologies have had the greatest amount of structural preparation,” Max’s VP Exploration Bruce Counts said in the Aug. 31 news release.

“Max will review the data as it is collected and complete preliminary interpretations that can be followed up in the field,” he concluded.

Max Resource Corp.

TSXV:MAX; OTC:MXROF; Frankfurt:M1D2

Cdn$0.15 2023.08.31

Shares Outstanding 161.9m

Market cap Cdn$24.2m

MAX website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Max Resource Corp. (TSXV:MAX). MAX is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf MAX

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.