Palladium One hits high-grade PGEs at LK

2020.07.25

Palladium One (TSX-V:PDM) has found initial success at the drill bit, indicated by the first results from a 2020 winter drill program at its open-pit Läntinen Koillismaa (LK) PGE-Cu-Ni Project, located in north-central Finland.

Highlight assays from the Phase 1 program at the Kaukua target include 32.55 meters grading 2.86 grams per tonne palladium equivalent (Pd_Eq) from 33 meters downhole, giving credence to the company’s open-pit concept at Kaukua, where a maiden resource estimate published last year showed 635,000 Pd_Eq ounces of indicated resources grading 1.80 g/t Pd-Eq, and 528,000 Pd_Eq ounces inferred with grades of 1.50 g/t Pd_Eq.

The 32.55m intersection in hole LK20-001 included 16 meters @ 3.64 g/t Pd_Eq, and 1.30m @ 5.70 g/t Pd_Eq. Broken down by metal, the 32.55m section had a total PGE count of 1.82 g/t, including 1.22 g/t palladium, 0.46 g/t platinum and 0.14 g/t gold. There was also 0.23% copper and 0.16% nickel.

The 16.00m section featured total PGEs of 2.43 g/t, including 1.67 g/t palladium, 0.59 g/t platinum and 0.18 g/t gold (plus 0.27% copper and 0.18% nickel), while the 1.30m section contained 2.78 g/t palladium, 0.93 g/t platinum and 0.25 g/t gold, along with 0.41% copper and 0.18% nickel.

All drill results are true widths, estimated to be around 90% of drilled width.

Dill holes 2 through 5 have not yet been released.

The 5-hole program targeted a previously untested up dip portion of the Kaukua deposit (Figure 1 and 2) with the goal of upgrading current inferred resources to indicated, and outlining near-surface mineralization which could form part of a future bulk sample. The company is awaiting the results of the other four holes.

The 2019 NI 43-101 resource (@0.3 g/t Pd cut-off) put Palladium One on a path to developing an open-pit PGE-nickel-copper mine in Finland.

The company wishes to add at least a couple million more ounces of palladium-equivalent resources in the Kaukua area. The current Kaukua resource is contained within 1-km of strike length, was drilled targeting a 2008 chargeability anomaly, and Palladium One has identified a much larger chargeability anomaly immediately south of the existing resource and this one is over 4-km in length. How many more ounces will there be? We are not sure yet. We are waiting for the results from the step-out hole immediately south and east of the existing resource as plotted above.

The Comapny has significantly increased the exploration potential at its LK platinum-group element (PGE) and base-metals project, earlier this year acquiring the adjacent 20,000-hectare Kostonjarvi (KS) property.

It has significantly increased the exploration potential at its LK platinum-group element (PGE) and base-metals project, earlier this year acquiring the adjacent 20,000-hectare Kostonjarvi (KS) property.

In January PDM commenced an induced polarization (IP) survey, designed to zero in on shallow zones of conductivity, containing higher sulfide concentrations. These zones are being drill-tested with up to 5,000 meters of diamond drilling.

Phase 1 drilling was suspended in March due to Covid-19, but Palladium One is now planning on restarting the drill rigs in August.

According to a July 14 news release, Initial drilling will be focused on expanding known mineralization to the east of existing drill intercepts in the Kaukua South zone, which hosts a greater than four (4) kilometer long Induced Polarization chargeability anomaly.

The drill targets are based on a highly successful winter IP survey, which identified multiple new IP chargeability anomalies at Kaukua South, where 3.5 km of the 4 km-long strike has never been drilled.

“Considering that Kaukua South has known PGE-rich mineralization similar to the Kaukua deposit, it will be a primary focus of our resumed drill program,” Derrick Weyrauch, Palladium One’s President and CEO, commented.

Before Covid-19 the cashed-up company drilled nearly 2,000 meters of the 5,000-meter program, and completed five grids of an IP survey that included the following target areas: Kaukua South, Murtolampi, Haukiaho, Haukiaho East, and Tilsa.

Market update

Currently and for the foreseeable future, palladium is facing constricted supply. The palladium market has been in deficit for eight straight years, mostly to do with structural problems in South Africa, where platinum mining companies are under constant pressure to contain costs, because their mines are very deep, hot and labor-intensive. They also face frequent strikes.

In April, South African mining output fell the most since 1981, as restrictions to curb the spread of Covid-19 ground most of industry to a halt.

According to Statistics South Africa, production of platinum group elements (including palladium) dropped 62%, from a year earlier.

In May, the country’s biggest platinum miner, Sibanye-Stillwater, suspended production guidance, while Anglo American Platinum (Amplats) and Impala Platinum Holdings (Implats) both cut their output forecasts.

The country produces three-quarters of the world’s platinum and about 40% of its palladium.

Norilsk Nickel, one of the world’s largest palladium producers with mines on the Taimyr and Kola Peninsulas in Siberia, has said it is planning to ease market tightness by shifting more production to investment-grade palladium ingots, from the powdered form required by industrial end users. We are not certain of the logic behind reducing industrial supply and increasing investment bar inventory and how such an action will help alleviate the supply shortfall that industry is trying to cope with…

Earlier this month, BNN Bloomberg reported Norilsk’s operations have “barely missed a beat” compared to producers in South Africa, who are struggling to ramp up production following the national virus lockdown.

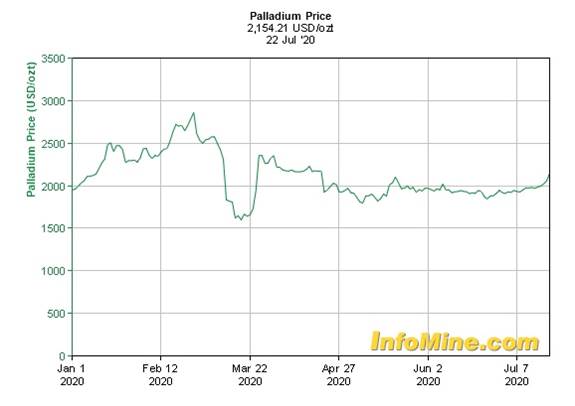

Palladium prices have slipped back a bit since the pre-pandemic record high of $2,880 an ounce, but the platinum group element appears to have the wind at its back as the auto industry begins to recover from a severe slowdown, owing to coronavirus-related plant closures and slack consumer demand for new vehicle purchases.

Both are used in catalytic converters needed to meet increasingly stringent government standards to reduce tailpipe emissions.

Analysts say the palladium market is likely to remain in deficit. The median result from a recent poll of 32 analysts and traders found that palladium will average $2,050 an ounce this year and $2,138 in 2021.

Palladium One

TSX.V:PDM, OTC:NKORF, Frankfurt:7N11

Cdn$0.095, 2020.07.17

Shares Outstanding 125,548,599m

Market cap Cdn$11.2m

PDM website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard does not own shares of Palladium One (TSX.V:PDM). PDM is a paid advertiser on Richard’s site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.