Who owns the world’s future copper supply?

2021.11.03

Regarding all of the mined commodities, copper stands out as more bullish than the others, owing to tight supply conditions matched against explosive future demand.

Copper’s widespread use in construction wiring & piping, and electrical transmission lines, makes it a key metal for civil infrastructure renewal.

A report by Roskill forecasts total copper consumption will exceed 43 million tonnes by 2035, driven by population and GDP growth, urbanization and electricity demand. Total world mine production in 2020 was only 20Mt.

Source: USGS

The continued movement towards electric vehicles is a huge copper driver. EVs use about four times as much copper as regular internal combustion engine vehicles.

Electrification includes not only cars, but trucks, trains, delivery vans, construction equipment and two-wheeled vehicles like e-bikes, motorcycles and scooters.

Copper, too, is needed for charging stations and renewable energy, particularly in photovoltaic cells used for solar power, and wind turbines.

The base metal is also a key component of the global 5G buildout. Even though 5G is wireless, its deployment involves a lot more fiber and copper cable to connect equipment located within a building.

But this hurtling freight train of copper demand is about to slam into the immovable object of a supply crunch.

The market is expected to face a huge shortfall in the next decade unless the mining industry makes major investments in finding and developing new copper deposits.

A conservative estimate

In 20 years, BloombergNEF says copper miners need to double the amount of global copper production, just to meet the demand for a 30% penetration rate of electric vehicles — from the current 20Mt a year to 40Mt.

Copper consumption by green energy sectors globally is expected to jump five-fold in the 10 years to 2030, data from consultancy CRU Group shows.

Future copper usage is closely tied to meeting carbon emissions targets.

To transition from a fossil fuel-based economy to one run on clean power including the electrification of the global transportation system will require a colossal boost in the production of mined materials, including copper.

Higher penetration of solar, wind and energy storage all will require copious metals.

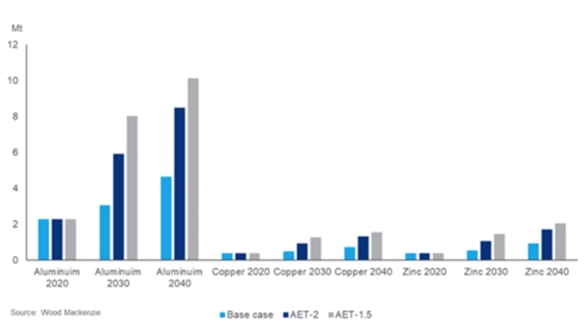

The future looks particularly bright for solar, states a new report from Wood Mackenzie, thus presenting an opportunity for base metals. The Scotland-based commodities consultancy predicts that usage of aluminum, copper and zinc in photovoltaics will double by 2040, prompting an increase in demand.

“Copper is used in high and low voltage transmission cables and thermal solar collectors,” Kamil Wlazly, Wood Mackenzie’s senior research analyst, wrote in the report.

Under a base case scenario, consistent with a 2.8 to 3˚C global warming view, the report expects aluminum demand from solar to rise from 2.4 million tonnes in 2020 to 4.6Mt in 2040; base case copper demand would go from 0.4Mt in 2020 to almost 0.7Mt; and global zinc consumption would double from 0.4Mt 0.8Mt in the base case.

There are two ways for the mining industry to increase copper reserves: it can either find large new deposits to develop into mines; or copper companies can lower their cut-off grades and add new reserves that way.

Replacing reserves through expansion

Some of the world’s largest copper companies are doing everything they can to expand existing mines and acquire prospective new deposits, as they seek to replace their rapidly depleting copper reserves and resources.

In 2017 the Chilean government approved a $2.5 billion expansion of BHP’s Spence copper mine — the diversified miner’s second largest copper mine behind Escondida. In February of this year chief executive Mike Henry said the company needs more “future-facing metals” such as copper. Last year, BHP became the top shareholder in SolGold, an Australian miner developing the Cascabel copper-gold project in Ecuador.

Barrick Gold is interested in diversifying into the red metal from the yellow. The company already owns the Porgera mine in Papua New Guinea, which borders Indonesia to the east, with China’s Zijin Mining.

Another big gold miner, Newmont Corp, earlier this year struck a deal with GT Gold, to take over the junior and its Tatogga gold-copper discovery in the Golden Triangle of northwestern British Columbia.

Anglo American has indicated that South Africa would be a good jurisdiction to explore. Copper, nickel, lead, and zinc are among the base metals the company is focusing its global discovery strategy in greenfield and brownfield projects.

Running out of ore

Why are major mining companies so intent on securing new supplies of copper? Quite simply, they are running out of ore.

Without new capital investments, Commodities Research Unit (CRU) predicts global copper mined production will drop from the current 20 million tonnes to below 12Mt by 2034, leading to a supply shortfall of more than 15Mt. Over 200 copper mines are expected to run out of ore before 2035, with not enough new mines in the pipeline to take their place.

Some of the largest copper mines are seeing their reserves dwindle; they are having to dramatically slow production due to major capital-intensive projects to move operations from open pit to underground. Examples include the world’s two largest copper mines, Escondida in Chile and Grasberg in Indonesia, along with Chuquicamata, the biggest open-pit mine on Earth.

These cuts are significant to the global copper market because Chile is the world’s biggest copper-producing nation — supplying 30% of the world’s red metal. Adding insult to injury, copper grades have declined about 25% in Chile over the last decade, bringing less ore to market.

Discovery cupboard is bare

Greenfield and brownfield reserve additions are expected to disappoint through the decade, according to a recent report by Goehring & Rozencwajg Associates. S&P Global Market Intelligence estimates that new discoveries averaged nearly 50Mt annually between 1990 and 2010. Since then, new discoveries have fallen by 80% to only 8Mt per year.

According to Goehring & Rozencwajg, the number of new world-class discoveries coming online this decade “will decline substantially and depletion problems at existing mines will accelerate.”

Also, geological constraints surrounding copper porphyry deposits, a subject few industry analysts let alone investors understand, will contribute to the problems, the report said.

Lowering the cut-off grade

We get that exploration isn’t easy, especially given that most of the world’s big, high-grade deposits have already been found. But why can’t the large copper miners simply tap into their existing reserves to meet growing demand?

The truth is, they have been. Instead of sending exploration teams around the world turning over rocks to find the next gigantic copper deposit, the main way copper companies have added reserves is by lowering their cut-off grades.

The way this is done is fairly simple. A mine plan is based on the “cut-off grade”, which is the minimum grade needed to make a unit of rock economic to extract at a given price. Any ore below this grade stays in the ground. When metal prices rise, the mining company makes more per tonne, so it is able to “lower the cut-off grade” and still make a profit. It’s essentially turning what was previously waste rock at old pricing into mineable ore at the new prices.

By 2015, the industry’s head grade was already 30% lower than in 2001, and the capital cost per tonne of annual production had surged four-fold during that time — both classic signs of depletion.

According to the Goehring & Rozencwajg model, the industry is “approaching the lower limits of cut-off grades,” and brownfield expansions are no longer a viable solution.

“If this is correct, then we are rapidly approaching the point where reserves cannot be grown at all,” the report concluded.

It also shines a light on the importance of making new discoveries in establishing a sustainable copper supply chain.

Over the past 10 years, greenfield additions to copper reserves have slowed dramatically, with tonnage from new discoveries falling by 80% since 2010.

Only 5 new mines, most of the production spoken for

New copper supply is concentrated in just five mines — Chile’s Escondida, Spence and Quebrada Blanca, Cobre Panama and the Kamoa-Kakula project in the DRC.

At Cobre Panana, nearly half of the 300,000 tonnes per year (tpy) production goes to Korea. Under a 15-year offtake agreement, Canadian miner First Quantum Minerals will ship 122,000 tpy of copper concentrates per year from Cobre Panama to South Korean copper smelter LS Nikko.

The Kamoa-Kakula copper project is a joint venture between Ivanhoe Mines (39.6%), Zijin Mining Group (39.6%), Crystal River Global Limited (0.8%) and the DRC government. Kakula reached commercial production on May 25, 2021, and while output is currently set for 200,000 tpy in Phase 1, a second phase would add 200,000 tpy and peak production would exceed 800,000 tpy.

In June Ivanhoe signed two offtake deals, one with a subsidiary of its partner firm, China’s Zijin Mining; the other with Chinese commodities trader CITIC Metal, to sell each 50% of the copper production from Kakula — the first of two mines involved in the joint venture. In other words, 100% of Kamoa-Kakula’s Phase 1 production goes to China.

That leaves three mines in Chile — Escondida, Spence and Quebrada Blanca’s “QB2” expansion. In 2016 BHP, the majority owner of Chile’s Escondida, the largest copper mine in the world, committed to spend just under $200 million to expand its Los Colorados concentrator. The expansion would help offset declining ore grades and add incremental copper production to reach an average 1.2 million tonnes a year over the next decade. BHP owns a 57.5% share in Escondida, Rio Tinto owns 30%, and the remaining 12.5% is owned by JECO Corp and JECO2 Ltd.

JECO is a Japanese joint venture between Mitsubishi Nippon Mining & Metals and Mitsubishi Materials Corp. It is not immediately clear whether any of Escondida’s production is bought by JECO Corp.

BHP said in February that the expansion of its Spence mine is expected to be completed within one year. Once the operation hits full production, it would produce 300,000 tpy until at least 2026. Spence ownership is split 50-50 between BHP and Santiago-based Minera Spence SA.

Teck Resources’ Quebrada Blanca Phase 2 project is expected to produce 316,000 tpy of copper equivalent for the first five years of its 28-year mine life. In 2019 the Canadian company closed a $1.2 billion transaction whereby Tokyo-based Sumitomo Metal Mining and Sumitomo Corp will, through an $800 million and a $400 million contribution, acquire a 30% interest in project owner Compañia Minera Teck Quebrada Blanca S.A. (“QBSA”). Like Escondida, it is unclear whether the two Japanese companies will take a portion of QB2’s production, or whether they will simply share in the profits.

Summing up, our analysis shows that in four of the five mines where new copper supply is concentrated, there are offtake agreements either in place or implied, with non-Western buyers. In the case of Kamoa-Kaukula, 100% of initial production will be split between two Chinese companies, one of which owns 39.6% of the joint venture project. Nearly half of Cobre Panama’s annual production goes to a Korean smelter under a 2017 offtake agreement. Escondida and Quebrada Blanca are both partially owned by Japanese companies — one can make the assumption that a corresponding percentage of production will be going there.

The numbers don’t work

A new report by Julian Kettle, senior vice president of Wood Mackenzie’s metals and mining division, and senior analyst Kamil Wlazly, says “delivering the base metals to meet [net zero 2050] pathways strains project delivery beyond breaking point from people and plant to financing and permitting.”

Copper, which Woodmac emphasizes “sits at the nexus of the energy transition” stands out particularly.

The report states that 19 million tonnes of additional copper needs to be delivered for net-zero 2050, implying a new Escondida (1Mt annual production) must be discovered and enter production every year for the next 20 years.

Let’s be clear: this does not mean that global copper production will have to rise by 20Mt to 21Mt. It means that world mined copper needs to increase by a million tonnes a year for the next two decades, eventually reaching 40 million tonnes by 2040. One Escondida, or two Collahuasis (0.6Mt annual production) per year, every year, for the next 20.

Let’s be even more conservative. Say the green revolution doesn’t get as far as everybody thinks and we only need 10 million tonnes extra per year by 2040, i.e., 30Mt. This is far from easy to achieve. We’re still talking the equivalent of one Collauhuasi mine per year every year for the next 20.

There are currently no new copper mines entering production, that we are aware of, exceeding 200,000 tonnes per annum, let alone 500,000 tonnes, or a million tonnes.

The odds of finding enough new copper to meet these goals are decidedly low, when the following are taken into consideration:

Development time. It takes many years to bring a copper deposit into production. According to Bloomberg Intelligence, the average lead time from first discovery to first metal has increased by four years from previous cycles, to almost 14 years. In places like the United States and Canada, where miners face strict permitting regulations that can cause significant delays, it’s not unusual for a copper mine to take 20 years to develop.

Offtake agreements: We make a clear distinction between global copper supply and the global copper market. Mined copper that is locked up by offtake agreements should not rightly be lumped in with global supply, because it will never reach the United States, Canada or Europe. Instead, this copper will go straight to smelters in China for use in Chinese industry, to South Korean smelters for South Korean industry, and to Japanese smelters for Japanese industry. We have shown that four out of the five major copper projects in the pipeline right now either have offtake agreements in place with non-Western countries (South Korea and China), or the mines are partially owned by Japanese companies that have a say in where some of the mined copper is destined. (i.e. Japan). We can hardly call this situation Western security of supply, when most of the raw copper material (cathodes or concentrate) is going to China, South Korea and Japan, who then turn around and sell more expensive copper end products to North America and Europe.

Resource nationalism. Because the number of discoveries has been falling and existing deposits are being quickly depleted, resource extraction companies have had to diversify, away from geo-politically safe countries.

Resource nationalism is the tendency of people and governments to assert control, for strategic and economic reasons, over natural resources located on their territory.

A recent study pointed to 34 countries that have seen a significant increase in resource nationalism risk over the past year. Countries now rated “extreme risk”, according to the March 2021 report by Verisk Maplecroft, include major African copper producers Zambia and the DRC. Reuters reports that 42% of global copper production is under political uncertainty right now, that could affect future production. In Chile there is proposed legislation that, if approved by the Chilean Senate, would impose a royalty as high as 75% on sales of copper, if copper is above $4 like currently. In a May note, Goldman Sachs said the new law could put at risk 1 million tonnes of annual copper supply representing about 4% of global output. Also in May the DRC government banned the export of copper and cobalt concentrate, the same month that Ivanhoe Mines’ massive Kamoa-Kakula copper project reached commercial production. Zambia is reportedly considering an overhaul of it tax regime, despite the fact that copper miners there have halted $2 billion of planned investments because a 10% royalty tax introduced in 2019 makes the projects unviable, according to an industry lobby group.

Climate change. A rise of 1.5 C is considered to be the tipping point, beyond which further warming is expected to have disastrous consequences. We know that Chile, the world’s biggest copper producer, has problems with water and is having to desalinate seawater used for mining copper in the country’s arid north. Cochilco, the country’s copper commission, estimates the use of desalination by mining to increase 156% through 2030, with 90% of the desalinated seawater used for copper processing. Reuters said that severe droughts are drying up rivers and reservoirs vital for production of zero-emission hydropower in several countries. In some cases, this means governments will have to rely more heavily on fossil fuels, potentially setting back international efforts to fight global warming. As climate change makes already scarce water and mineral resources more difficult and expensive to access, the protection of existing mines and the hunt for new deposits will intensify, resulting in potentially lower production, higher operating costs and conflicts between both water and land users. With much of the world currently experiencing droughts, and signs of climate change occurring more frequently and powerfully, it seems to me that global warming poses a very real risk to future metals output.

It’s going to be hard enough to maintain the current 20Mt copper production let alone doubling it. Remember, over 200 copper mines are expected to run out of ore before 2035, with not enough new mines in the pipeline to take their place.

Beyond electrification and decarbonization, we will still need enough copper for all its other uses, in construction wiring & plumbing, infrastructure build outs, transmission lines, etc. On top of this there is the surging need for copper in developing countries, whose populations want to “live like an American” (or Canadian, or heaven forbid, a resource-guzzling Australian).

In China, even after years of economic growth, per capita copper usage was just 7.1 kg in 2013 (the latest year I could find). As China’s populace urbanizes, builds up its infrastructure and becomes more of a consuming society, there is no reason to suspect Chinese copper consumption won’t approach or even surpass US, Japanese and South Korean levels. There are 1.39 billion people in China, even a slight increase in Chinese consumption will translate into enormous demand growth.

India, with its 1.36 billion people, is presently using just 0.4 kg of copper per person. The country is modernizing and needs to invest heavily in electrical power infrastructure. According to the International Energy Agency (IEA), India’s power production will need to rise by up to 20% annually to keep pace with its economic and population growth. Just meeting the required power target would double India’s annual copper consumption.

Africa is expected to drive global growth over the next several decades, as populations there climb, but dwindle elsewhere.

According to the International Monetary Fund (IMF) the consumption of metals typically grows together with income until real GDP per capita reaches about $15,000 – $20,000, as countries go through a period of industrialization and infrastructure construction.

A few countries stand out as well below the IMF’s $15,000:

Indonesia – $11,812

Philippines – $8,908

India – $6,700

Pakistan – $4,690

Since they are still a considerable distance from the point where further increases in GDP per capita no longer increase copper consumption per person, Indonesia, the Philippines, India and Pakistan (and the other 113 out of 180 countries listed below the IMF’s $15,000 cut-off) will likely continue to add significantly to global copper demand for some time to come.

According to the Minerals Education Coalition every American will need 950 pounds (430 kg) of copper over their lifetime.

We already have one billion people out of today’s current population slated to become significant consumers by 2025. Most will not be Americans but they are going to want a lot of things that we in the Western, developed world take for granted — electricity, plumbing, appliances, AC etc.

Can everyone who wants to, live an American lifestyle? Can everyone everywhere else have everything we in North America have? The answer is a resounding no!

Even if we mined every last discovered, and undiscovered, pound of land-based copper, the expected 8.1 billion people in the developing world by 2050 would only get three quarters of the way towards copper use parity per capita with the US.

Of course the rest of us, the other 1.5 billion people expected to be on this planet by 2050, aren’t going to be easing up, we’re still going to be using copper at prestigious rates while our developing world cousins play catch-up.

Even with a 30% penetration of EVs, a relatively conservative estimate, we need to find another 20 million tonnes of copper per year over 20 years, i.e., 40 million tonnes by 2040, compared to the current global mined production of 20Mt.

A goal like that is not insurmountable, but it will take major investments in copper exploration, at a scale that has never before been attempted. Any copper junior with a deposit of significant size and grades, will have no problem attracting a major or mid-tier acquirer, that can help finance a future copper mine and bring it to commercial production.

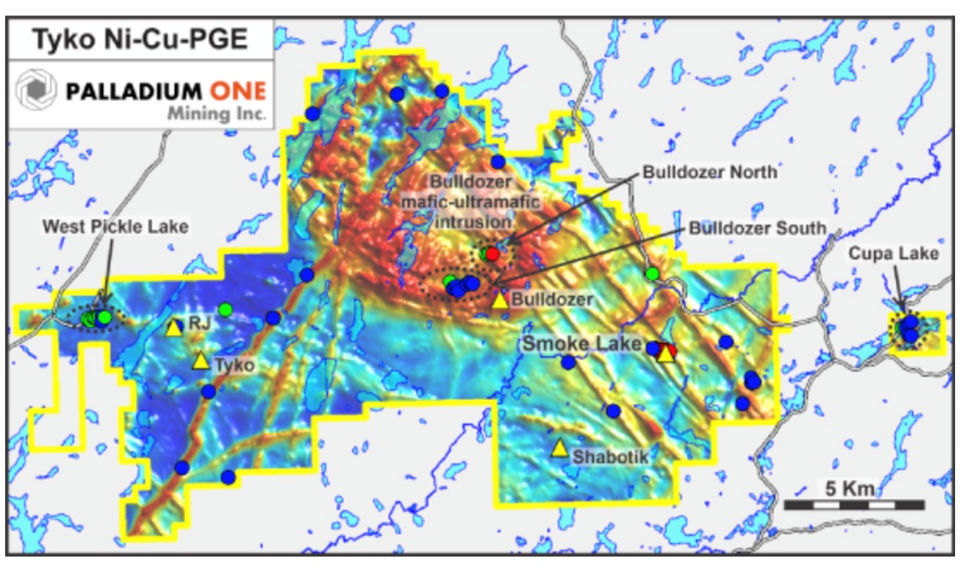

Max Resource Corp

Within an underexplored region of northeastern Colombia, Max Resource Corp. (TSXV:MXR, OTC:MXROF, Frankfurt: M1D2) has not only been finding high-grade copper zones at its flagship CESAR property, but expanding these areas, confirming the potential existence of a massive copper-silver system comparable to the biggest in the world.

Max has interpreted the sediment-hosted stratabound copper-silver mineralization in the Cesar Basin to be analogous to both the Central African Copper Belt (CACB) and the Polish Kupferschiefer deposits. Almost half of the copper known to exist in sediment-hosted deposits is contained in the CACB, including Ivanhoe Mines’ 95-billion-pound Kamoa-Kakula copper deposit in the Congo.

Kupferschiefer, the world’s largest silver producer and Europe’s biggest source of copper, is an orebody ranging from 0.5 to 5.5m thick at depths of 500m, grading 1.48% Cu and 48.6 g/t Ag. The silver yield is almost twice the production of the world’s second largest silver mine.

CESAR lies along the copper-silver rich 200-kilometre-long Cesar Basin in northeastern Colombia. This region enjoys major infrastructure resulting from oil & gas and mining operations, including Cerrejon, the largest coal mine in Latin America, now held by global miner Glencore.

Max’s initial discoveries in 2020 exploration featured highlight values of 34% copper and 205 grams per tonne silver.

The Vancouver-based company is currently focused on the URU and CONEJO zones, two discoveries Max made at CESAR North this year, among five discovery zones identified since the company took ownership of the CESAR project in late 2019.

While the northern part of the 90-km-long CESAR North has been characterized as “Kupferschiefer-style” mineralization, the southern part containing URU and CONEJO are suspected to be more “Central African” in nature.

Kupferschiefer deposits are envisioned as huge flat-lying sheets of sedimentary copper. These slabs of “copper shale” can run for several kilometers but they are relatively thin, with an average mining thickness of just 2 meters, shown below.

By comparison, CACB-type mineralization has some thickness to it, and there may be feeder zones running into the orebody.

To understand why Max thinks the URU Zone mineralization is Central African, read our Oct. 6 article.

For a major copper producer to be interested in buying or partnering with an exploration company, the property under consideration needs to be high-grade, of sufficient size to warrant capital investment for a multi-year, preferably multi-decade operation, and be scalable to the major’s needs.

Let’s summarize what we know so far:

Max has been sampling and assaying rock chip samples from select areas within the CESAR Basin for going on two years now. There have been comparisons the Central African Copper Belt containing Ivanhoe’s sizeable Kamoa-Kaukula copper mine that reached production earlier this year, as well as the Kupferscheifer copper-shale deposits in Poland, one of the largest endowments of copper in the world. We don’t yet know how large CESAR is but we know that Max has successfully identified copper mineralization at surface in a number of areas of the 200-km-long CESAR Basin, making this a potential district-scale copper-silver system.

“We’re consistently finding areas securing of applications that look attractive from a regional perspective, we don’t go out there until they’re secure and 90% of the time there’s copper everywhere,” CEO Brett Matich told me over the phone, last week.

Of course, it’s one thing to find widespread copper-silver on surface and quite another to pick an area to target and drill. From all we’ve written on Max over the past 24 months, we see the most promising zones in this regard are the two recent discoveries, URU and CONEJO.

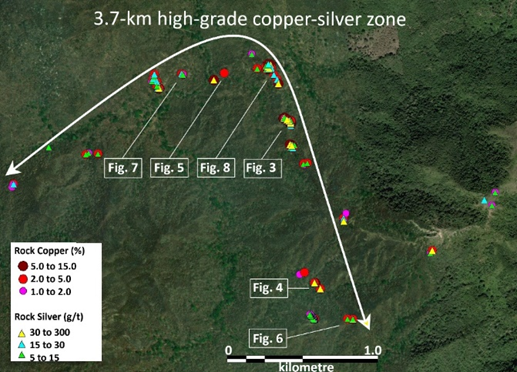

CONEJO really stands out for the grades Max is achieving there. The zone now extends over 3.3-km of strike with average grade of 4.9% copper using a 2% cut-off.

To date, 13 rock samples returned values greater than 8% copper; 53 returned values greater than 5% copper; 93 returned values 2% copper and above; 36 returned values greater than 20 g/t silver over widths ranging from 0.5 to 20m. Highlight values are 12.5 % copper and 126 g/t silver.

In addition, composite results include 7.5% copper and 86 g/t silver over widths of 6.0m (Figure 3); 5.2% copper and 46 g/t silver over widths of 10.0m and 3.2% copper and 32 g/t silver over withs of 10.0m.

A 2% cut-off grade is unheard of these days when copper grades over 1% are considered excellent. CONEJO doesn’t appear to have the same amount of volume as URU but the high grades suggest it wouldn’t need as much volume to delineate a resource and mine it.

URU’s grades are a little lower than CONEJO’s but the mineralization Max is encountering suggests it could have scale.

The fact that the mineralization has been identified through mountainous topography (between 400m and 1,200m) strongly suggests there is a lot of potential for volume from base to hill-top, which could indicate a major copper-silver system emplaced throughout. The zone has been expanded to 48 square kilometers, and it remains open in all directions. That’s an exciting prospect.

Speaking of undefined outer limits, Max has been criticized for doing a lot of surface sampling but no drilling. However drilling was never part of the initial game plan. The first mission was to accumulate as much land and find as much copper and silver as they could. Max has pretty well accomplished this task. And they’re not grabbing land willy-nilly, just to say they’re expanding the property. As Matich stated above, everywhere they’ve found and recorded mineralization it has been on land that prospecting has shown there to be copper and silver.

The next step is to define the outer limits of the mineralization. For Max this is a nice problem to have; in most of the areas they’ve been, they haven’t found an end to it. We could be talking about immense, district-scale or even regional scale copper-silver systems.

Sooner or later however the company will have to stop trying to expand the mineralization and begin to infill-drill what they’ve got. The process would be: find the hot spots, conduct induced polarization (IP) geophysics, then drill, baby, drill.

This is Max’s exploration plan going forward. It’s important to recognize that this plan didn’t exist previously. It’s a new strategy, as was confirmed to me in talking to Brett Matich last week. He told me,

“These areas are being evaluated for proposed drilling in Q1, so we’re starting to talk about drilling, the steps are, one, fill in the field work, delineate the targets, follow up with IP on the targets and then drill. The idea is to have multiple drill targets that’s what the focus is on.”

Interest in MAX’s CESAR project has been strong, with multiple non-disclosure agreements in place to advance the project, including a collaboration agreement with an industry-leading copper producer. There have been three field visits to the site (undisclosed parties), with a fourth one reportedly in the works.

Major mining companies are only interested in large mineral deposits or deposits that are scalable to their needs. The way Max is going, CESAR appears to fit their criteria.

Max Resource Corp.

TSXV:MXR, OTC:MXROF, Frankfurt:M1D2

Cdn$0.18 2021.11.01

Shares Outstanding 86.3m

Market cap Cdn$18.1m

MXR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Max Resource Corp. (TSXV:MXR). MXR is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.