Under The Spotlight Dolly Varden Silver

2022.02.11

AOTH’s Rick Mills: Shawn on the 10th of December 2021 Dolly Varden (TSX.V:DV, OTCQX:DOLLF), closed at $0.60 and this was after, on the 6th of December, putting out the consolidation news with Fury Gold Mines (T:FURY). On the 20th of December you put out the Wolf Vein results, on the 31st of January you put out the Kitsol and the Northwestern Torbrit Step-out.

Currently the stock is $0.77. Today let’s discuss the consolidation with Fury Gold Mines and then get into the news on the Wolf Vein, the Kitsault and the Northwestern Torbrit Step-out and all that it means?

Dolly Varden’s CEO Shawn Khunkhun: First of all thank you for taking the time to do this, we’re grateful to be able to get out our story.

I know you’re asking me about the consolidation but before I go there I have to go back and look at this in the context of two years. It’s been two years since I took over as CEO of Dolly Varden and if you look at the last two years Dolly Varden’s shares are up over 200%.

If you look at the GDX it’s up 13% in two years and if you look at the GDXJ it’s flat. We’ve seen a pretty significant rise in our share price, a 214% move, we’ve also seen our market cap grow from 20 million dollars to where today we’re over $100 million.

And on the back of closing the transaction with Fury, we’ll be a $165 million market cap so the company’s growing. What I’ve tried to do as CEO is bring in a team that can fully unlock the value of the district.

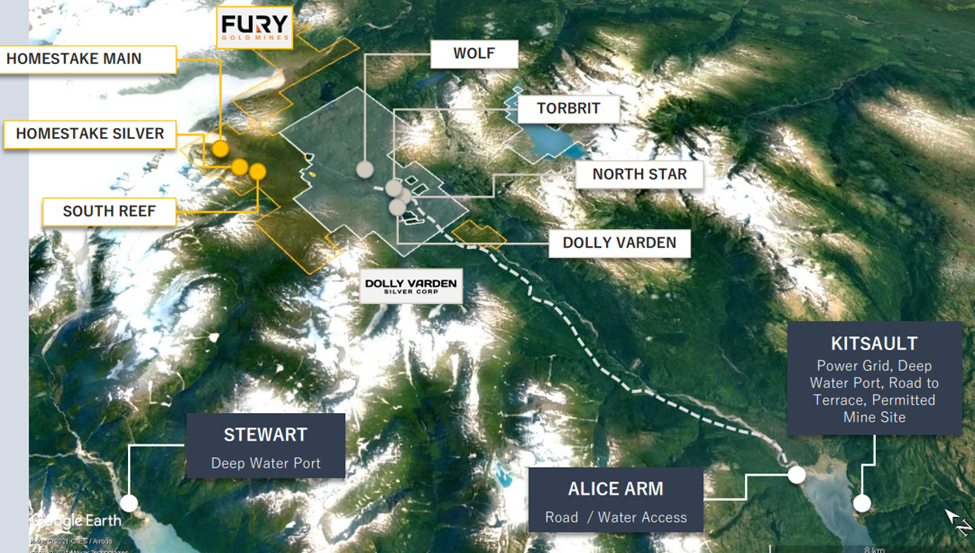

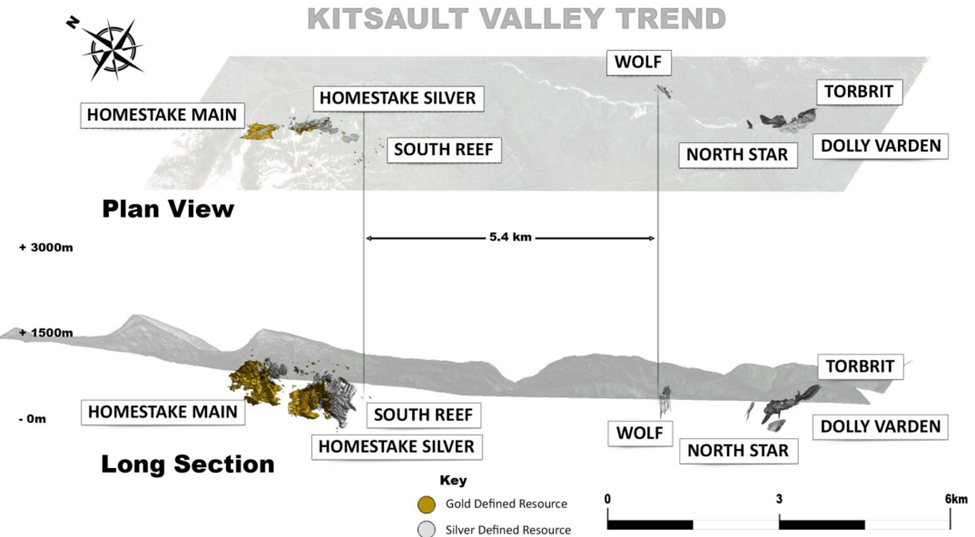

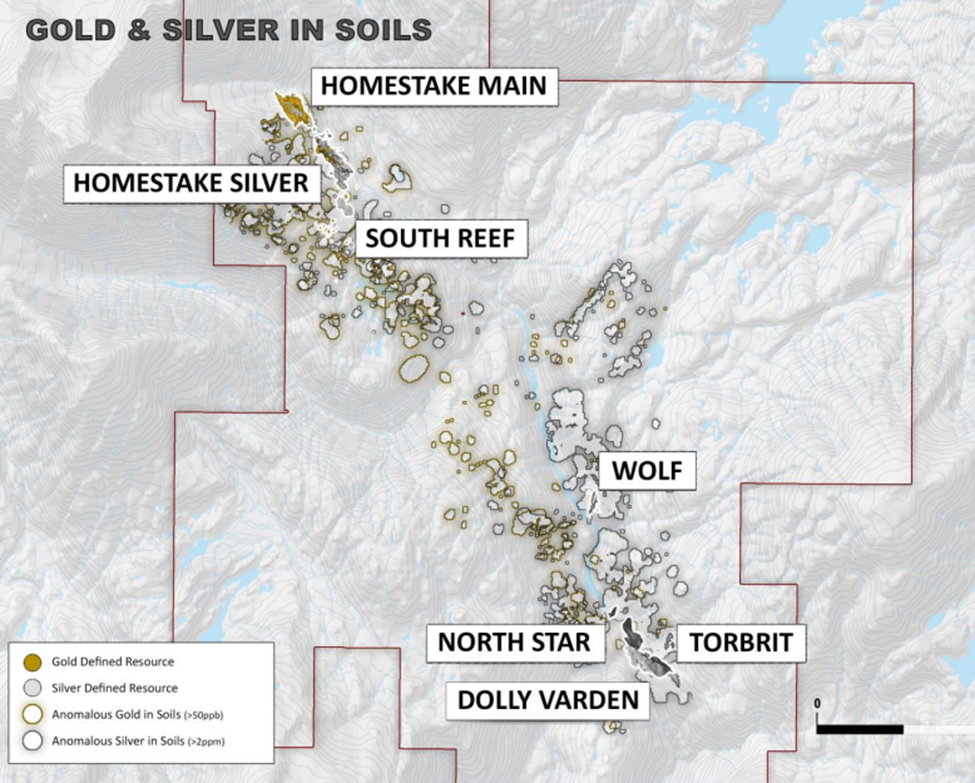

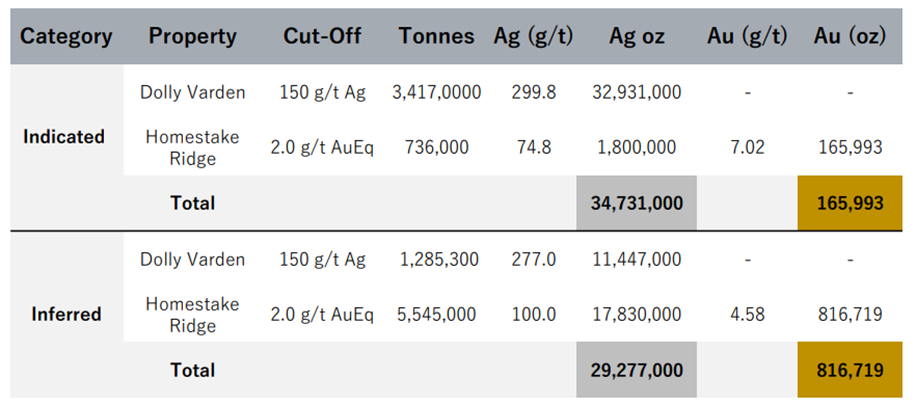

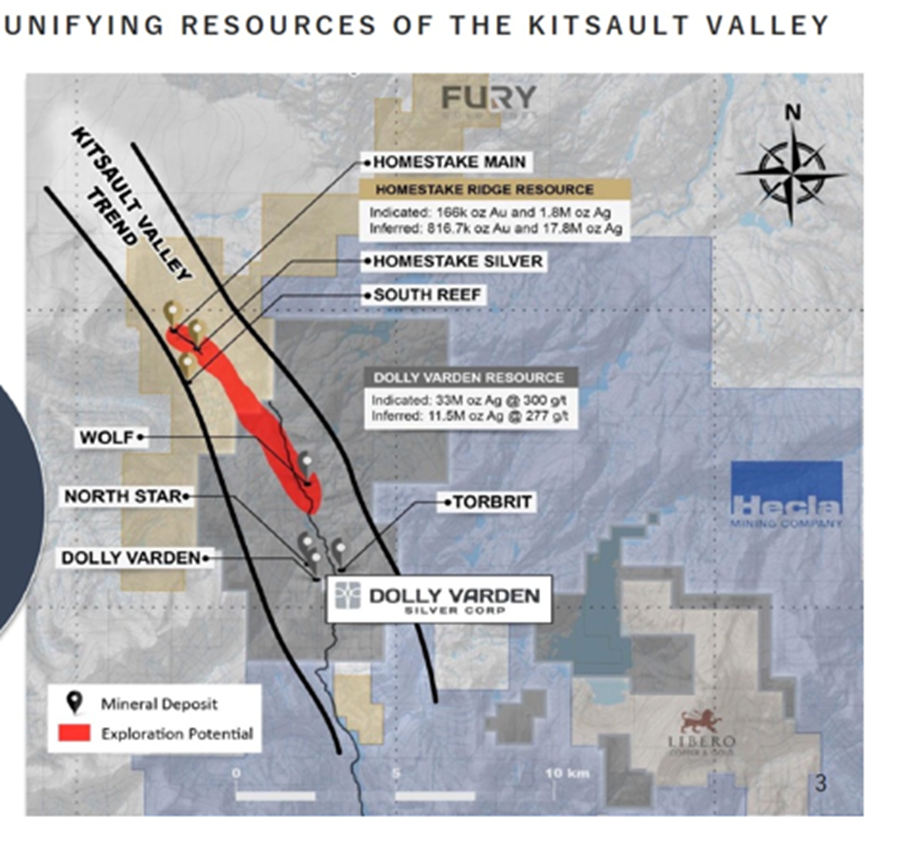

On December 6 we announced a definitive agreement to acquire [Fury Gold Mines’] Homestake Ridge. What we’re doing there Rick is we’re unifying 15 km of the Kitsault Valley trend. It’s not about the ounces that are in the ground, it’s not about the 44 million ounces that are on the Dolly Varden side of the property it’s not about the million ounces of gold and the 20Moz of silver we’re acquiring from Fury. It’s not about this combined 140Moz silver resource, it’s all about the prospectivity, the 5 km of potential in between the two projects that has never been explored and it’s about the potential of taking our current resources and expanding and growing them.

In addition to unification, this consolidation is getting the project to a size and scale where we can now start looking at development and having an eye towards production, remember we have also put out some very positive drill results.

In addition to the 5.5 km that lie in between the two projects we’ve got gaps on our side of the ground. We’ve got our four deposits, three of them are clustered on the south side of the property and there’s 2 km gaps in between the big deposits on the property, which are Torbrit, and Wolf.

The Dec. 20th news release that you were referring to was the Wolf discovery, we’re filling in that 2-km gap. Maybe Rob if you want to touch on that 94-meter downdip extension we hit at Wolf and just talk about the geological importance through your technical lens?

Rob Van Egmond, Dolly Varden’s Chief Geologist: Thanks Shawn, that was a downdip extension of Wolf so like Shawn said the Wolf deposit, one of the four deposits that make up our current mineral resource, is about 2 km north of Torbrit. We wanted to look back to the south, back towards Torbrit, so we drilled down dip and got a good intercept, 17.5m @ 214 g/t silver, but within that there was 1.22m of 1,500 g/t silver. That’s typical of what we see in a lot of the deposits, you have a wide intercept of good grade and then you have a nice high-grade within that.

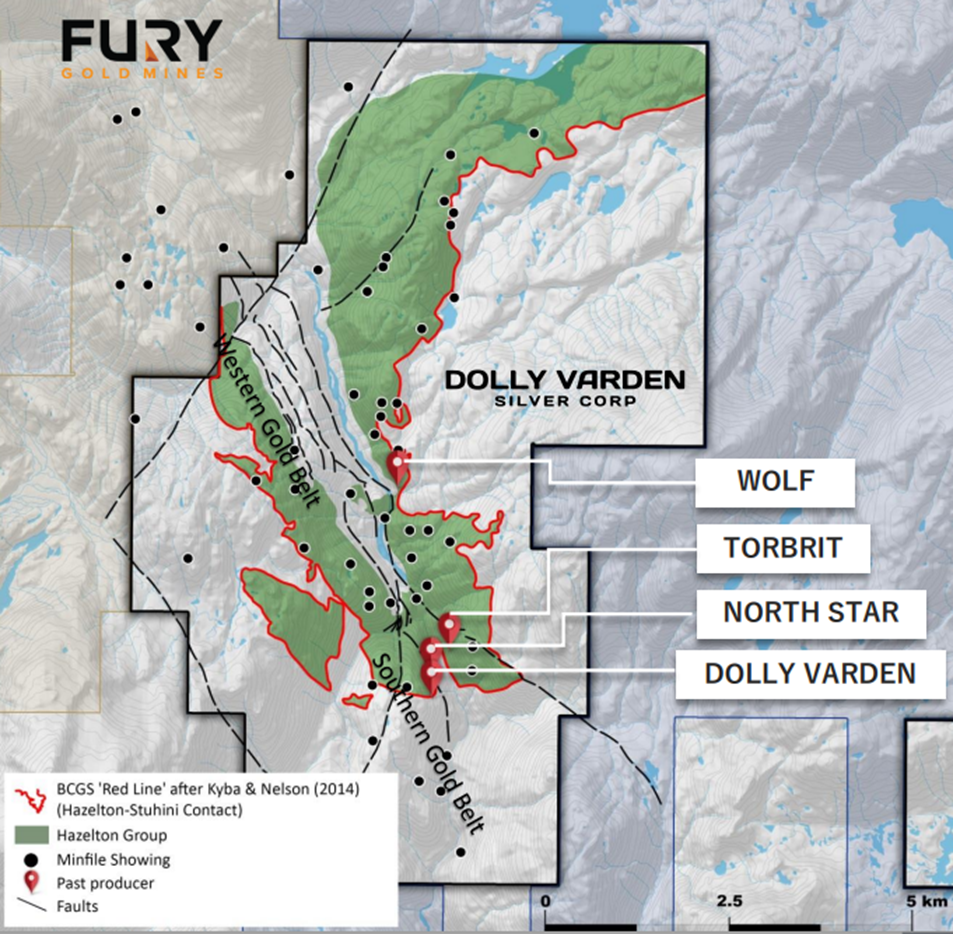

The significance of the step-out is not only obviously extending the resource but when we drilled into it we set up on a sediment wedge so within that synform (the whole valley is a synform which is a topographical feature composed of sedimentary layers in a concave formation), there is a cap of sediments, the Upper Hazelton, that sits right at the top of the Hazelton, and to the east of that the volcanics appear on the side of the valley. That area of alteration, the volcanics, is a strong potassic alteration with sodium depletion which is a signature of mineralization and heat flow, mainly in volcanogenic-style mineralization and also with epithermal veins we have in the area.

So, the significance of this hole is that we drilled through that sediment cap and encountered the volcanics underneath before intercepting the Wolf Vein. The sediments are acting like a cap rock, the alteration that we see from the airborne radiometrics we flew ends at that sediment cap, but when we drilled through it that alteration is still quite strong.

The significance of all of this is it opens up the whole center of the valley. The alteration trends right up to Homestake Ridge so we’re quite excited to get underneath that sediment wedge and start exploring that 5.5-km trend, as Shawn said between Wolf and Homestake Ridge.

SK: Thanks Rob, just expanding on that, on Jan. 31st Rick you mentioned the results we put out from Kitsol, and all the Torbrit drilling we released, we honed in on the headline number 354 g/t silver over 12m, 1,200 g/t silver over 0.7m, what we’re seeing if you look at Torbrit that’s the biggest deposit on the property, the Kitsol Vein is just off from Torbrit, we’re filling in that gap, Kitsol Vein to Main Torbrit. We also had some success going off to North Star where there’s several very positive high-grade silver intercepts over wide intervals. We’re really encouraged by the grades we’re seeing, we’re really encouraged at the widths we’re seeing, and we’re having ongoing exploration success on the Dolly Varden side of the property and all the deposits, Torbrit, North Star, Wolf, There’s a lot of room for growth/ expansion, but getting the district to the size and scale that will attract a major or enable us to make a production decision is the key.

RM: There has been a lot of M&A in the GT recently and the Homestake Ridge/ Fury acquisition general meeting is coming up.

SK: Yes just in the last three years alone we’ve seen $4.8 billion worth of M&A activity in the Golden Triangle and the bulk of that has been led by Newcrest [Mining]. Newcrest is the third largest gold miner on the planet, they have ambitions to be number one, and there are less than half a dozen camps globally they are very interested in consolidating.

I’d just like to give a message out to all the shareholders voting is now open we’ve got a special general meeting on Feb. 22. We’re putting this acquisition of Homestake Ridge out to our shareholders. We’ve already got our largest shareholders like Eric Sprott Eric owns about 17% of Dolly Varden, Eric has signed a support agreement, he’s voting in favor of the transaction. I’d just like to encourage all the shareholders to get out and vote.

We’ve had overwhelming support from our large institutional shareholders and once we close this transaction and move forward, we’re really excited about the 2022 drill season. We’ve got some big plans of drilling at Homestake Ridge and Dolly Varden and in between the two projects.

We expect a very active season because we expect three drill rigs turning 30,000m to 50,000m this season. That’s three to five times more then in 2021. That’s going to produce a steady flow of results/ news.

From the standpoint of investors what you have in Dolly Varden is a company that has, if you look at it through a silver lens, 140Moz of silver equivalent at extremely high grades, north of 300 g/t. That’s a foundation of a high-grade resource in a safe jurisdiction that’s seen a flurry of M&A activity. But the real potential here is what’s not in the resource, its the expansion potential, the potential exploration upside.

RM: What are the next steps?

SK: The next step is, can we take Dolly Varden to 300Moz silver equivalent? The targets are there, the cash is there, the team is there, it’s been a great initial two years, despite a down silver price in 2021 and a flat gold price. We continue to grow our share price and grow our market cap.

If we’re able to do that in a sideways or a down precious metals market, what can we do if we get the wind at our backs? If we get a breakout in metals prices, if we can lead when others are lacking, Dolly Varden is going be a top name going forward. As you can hear in my voice Rick, we’re excited, we’re energized, we’ve been adding to the team, and Homestake Ridge is a huge transaction that we’re looking forward to sinking our teeth into.

We’re going to be adding some tremendous directors to our team: Tim Clark CEO of Fury will be joining our board of directors, Michael Henrichsen their VP Exploration as well, and Ivan Bebek is coming on as an advisor. We’re humbled we’re going to work with such talented people from Fury to unlock the value of the combined company.

RM: I’m looking at your ‘Unifying Resources of the Kitsault Valley,’ it really does highlight something that’s extremely important because it shows, up in the northern part of the valley, the Homestake Main, Homestake Resource, the Homestake Silver and the South Reef. You’ve then got, heading south, a 5.5km underexplored gap showing where Dolly’s mineralization occurs. It’s a picture that’s easy to put together in your mind why you’re consolidating, why you’re doing this, especially after digesting the information given above.

RVE: Filling that gap is the logical step for this consolidation. These aren’t just two properties side by side. We have this sediment wedge, now we know the alteration continues underneath, so that’s where we’re going be targeting our exploration, the gap between the Homestake and Dolly Varden deposits.

In these types of volcanogenic deposits, and the Homestake, more epithermal, structurally controlled, you see a deposit every 2 kms. There’s a big gap in there that you could easily fit a couple more deposits in, in terms of spatial relationship. You see that in a lot of these volcanogenic districts, where they’re little pods… it’s not one huge deposit, it’s smaller pods in various basins.

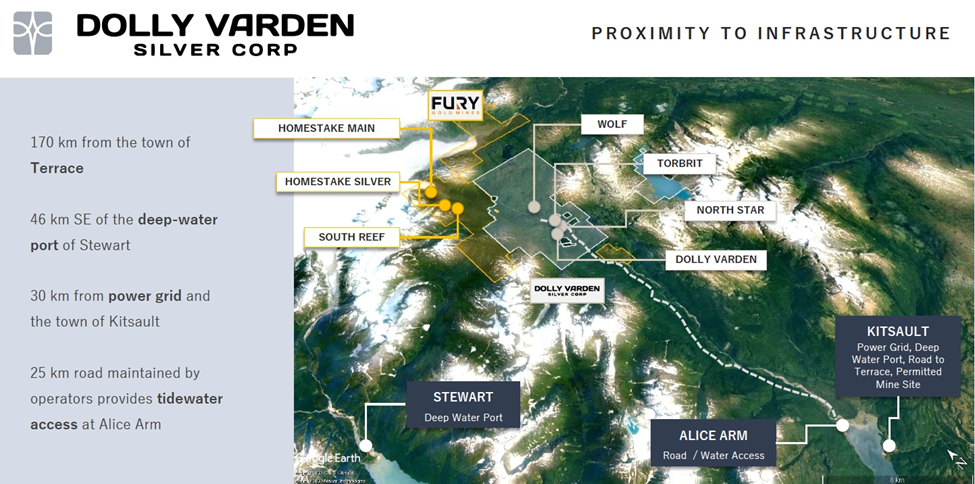

RM: Yes, and those two pictures show that quite well. You’ve also got access to Alice Arm and Kitsault, there is a lot of infrastructure in the area.

RVE: Yes it plays into the “hub and spoke” model where you have a central processing unit, be it half way up the valley between Homestake Ridge and Dolly Varden, Fury’s previous PEA already had an area picked out because the valley does open up near the top and flatten out, but you also have the old Kitsault moly mine, that’s still a permitted mine site so you can also bring everything down to tidewater at Alice Arm.

RM: It makes for a hell of an interesting project when you add up all the different aspects to it, kind of picture it in your mind of what could be. You really do see the potential there.

RVE: Exactly and even the infrastructure off to the east, Highway 37 and there’s some logging roads leading in, it’s only 20 km from Homestake Ridge over a little pass.

SK: I think the big advantage we have is the 25-km road that comes in from Alice Arm from tidewater right onto our property. For us to extend that road onto Homestake Ridge, it’s just a few kilometers. We’ve unified one valley. Unlike some of our neighbors in the northern part of the Golden Triangle, their projects are on steep mountain tops, above the tree line, where they get hit with a lot of snow.

We’ve got a tremendous area from the standpoint of its location, when you factor in our proximity to Terrace, our availability to tap into the BC hydropower grid, the fact that we’re on tidewater. The fact that, ahead of this consolidation we secured the surface rights in and around Alice Arm, not only the road that goes up onto our property but also the surface rights around the port, is a real win. As Rob mentioned Kitsault being a fully permitted future mine site, there’s many future paths for development here, so tremendous infrastructure.

Now we’ve got enough size and scale with our mineral endowment, but also we’ve locked in so much prospectivity, securing 15 km of the same rock types that host the big deposits in the area. I think the Golden Triangle is in its infancy and this area to the south is just totally untouched.

RM: Shawn and Rob would you like to say something each to wrap up?

SK: Dolly Varden has a tremendous start, with our million ounces of gold, 63Moz of silver coming together after this transaction that’ll be voted on Feb. 22.

But I believe, beyond the existing combined resources it’s about what ounces there are to be discovered. You look at Eskay Creek, forget all the gold that was produced, there’s 200Moz of silver @ 2,200 g/t. That’s the type of targets we’re looking at drilling into.

The Fury team has done some tremendous work studying some tremendous targets, it’s going to be a really exciting summer to test their best targets, and to continue testing targets around Torbrit, Wolf, North Star.

We also have the potential to be re-rated after the transaction so lots to look forward to at Dolly Varden.

RVE: We hope to be drilling by the beginning of June at Dolly Varden. We’ll get a month in of three drill rigs there, and then move them up to Homestake Ridge., When we get pushed out by snow up top there we’ll move back down the valley and completed more at Dolly Varden, again.

RM: Thanks Shawn and Rob it’s been great talking with you, and we’ll talk again soon.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Dolly Varden Silver Corp. (TSXV:DV). DV is a paid advertiser on Richard’s site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.