Goldshore hits more high-grade at Moss Lake

2021.12.12

Goldshore Resources (TSXV: GSHR) (OTC: GSHRF) (FRA: 8X00) has embarked on an extensive 100,000-meter drill program on its flagship Moss Lake project that will run until mid-2022.

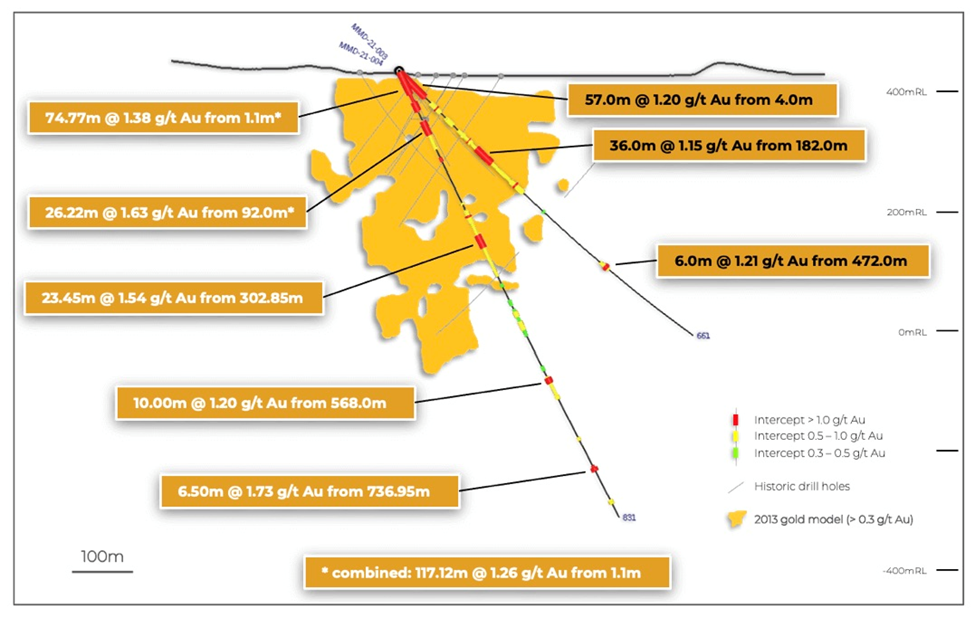

This week Goldshore released two more holes from the program, the highlight being a number of higher-grade zones within large, low-grade envelopes. The best intercept was 117.12 meters @ 1.16 g/t Au from 1.1m in hole MMD-21-004. Deeper down, the hole cut 17m @ 2.40 g/t Au from 57 meters and 26.2m @ 1.63 g/t from 92m. The hole also returned 23.45m @ 1.54 g/t from 302.85m.

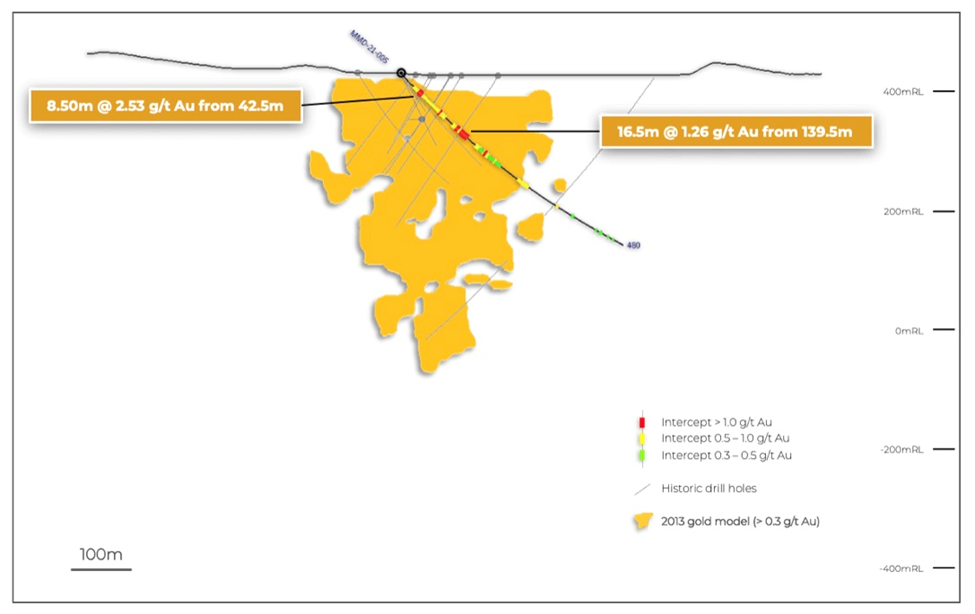

Hole MMD-21-005 featured an 8.5-meter intercept at 2.53 g/t Au from 42.5m and 16.5m at 1.26 g/t from 139.5m.

Two main takeaways from the Dec. 8 news release are the significant volume additions and the expanding drill capacity.

According to Goldshore, Mineralization continues to be intersected laterally and at depth, significantly expanding the width and depth of mineralization compared to the 2013 grade model. MMD-21-004 has extended the width and depth of mineralization, relative to the 2013 model, by 38% and 56%, respectively.

Great stuff. The drilling contractor has mobilized two more rigs bringing the total to four, with an additional rig expected to be on site before Christmas.

Cross-section of drill holes MMD-21-003, 004 and 005, showing the intercepts relative to the 2013 grade model (yellow).

Results of drilling so far have not disappointed, giving us a glimpse of what may be a significant mineralized system within northwestern Ontario, a historically productive gold-mining province. From the first three holes reported in November, the highlight was hole MMD-21-001, which was mineralized over 550 meters. This corresponds to an estimated true thickness of 422m and a 52% increase over the historical resource model.

Several higher-grade zones were identified including 57 meters at 1.20 g/t Au from 4.0m; 36m at 1.15 g/t from 182m; and 31m at 1.18 g/t from 122m.

The property is located in an excellent jurisdiction with a number of major gold deposits nearby, including Kirkland Lake Gold’s Detour project with 15.7Moz proven and probable reserves at 0.82 g/t Au, New Gold’s Rainy River with 2.6Moz P&P at 1.06 g/t Au, and Cote (IAMGOLD & Sumitomo) with 7.3Moz P&P at 1.0 g/t Au.

Moss Lake itself hosts a number of gold and base metal rich deposits. These include the Moss Lake deposit, the East Coldstream deposit, the historically producing North Coldstream mine and the Hamlin zone, all of which occur over a mineralized trend exceeding 20 km in length.

“The drilling intercept of 117.12m @ 1.26 g/t Au, essentially from surface, reaffirms our view that the Moss Lake gold project contains a significant volume of +1 g/t Au mineralization that can underpin a meaningful, economic gold deposit. The fact that we are continuing to intersect gold mineralization outside of the volume modelled in 2013 also affirms our belief that the deposit is wider and larger than previously interpreted,” Goldshore’s President & CEO, Brett Richards, commented on this week’s news.

Richards, a mining industry veteran with 34 years experience, has held executive roles with established miners like Roxgold, Katanga Mining and Kinross. Given his track record in project development, there’s every reason to believe that Goldshore can unlock the million-ounce opportunity at Moss Lake.

When asked what appealed to him about the project, Richards said: “We have a very large land package in a very good jurisdiction. We have already identified 4Moz of historical resource and a number of targets along strike and a 20 km known mineralized trend.

“We have been gifted a very good starting point,” he added.

Richards also noted the Moss Lake project, despite having a number of companies’ fingerprints on it, is under drilled.

“The historical drilling goes down to 250 meters but this deposit (historically) is 2 km long and about three quarters of a km wide, and we see significant expansion potential in every direction,” he said.

Although the company says it’s too soon to develop a conceptual model, the best result from hole MMD-21-004 (117.12m @ 1.26 g/t Au from 1.1m) suggests there is an expectation of continued mineralization behind the drill hole to the north, a technical overview within the news release says.

Peter Flindell, VP Exploration, commented: “These drilling results confirm the caliber of results received since the start of the drilling program and confirm the significant widths of higher grade, +1 g/t Au mineralization. Our plan to expand the drilling fleet over winter will allow us to reach our targeted monthly meterage of 10,000m and allow us to test extensions to Moss Lake suggested by our airborne geophysical survey, as well as infill the gold deposit to support next year’s Preliminary Economic Analysis.”

Conclusion

Flindell’s comments are reassuring. They confirm that Goldshore is delivering on what it says it will do, and that it plans on moving the project to a PEA as early as next year.

When I talked to Brett Richards in September he told me, candidly,

“I’m a big believer in speed to market. I think there’s a lot of things that we’re doing to not only accelerate development, but accelerate decision-making points down the road for whomever it is we partner with and I say that very openly because realistically the team at Goldshore are probably not going to build the Moss Lake deposit into a gold mine. Somebody will, but chances are good it won’t be us.”

In other words, Richards has his eye on the take-over prize.

This is a guy who understands the value of gold in the ground. From our talk, he said,

“[If] I just take the historic resource at what the base case was back in 2013, and let’s remember gold in Canadian dollars was at par, $1,546 oz, the NPV (5% discount) of the project was $353 million pre-tax. If we sensitize that now up to $1,700 and I make inflation adjustments for capex, opex and forex, at a $1,700 gold price today the NPV of this project pre-tax, before we do anything, is $1.032 billion. So this is a billion-dollar project before we get started and it’s just under $600 million after tax NPV (5% discount) so this is a 32% IRR (internal rate of return). This is a real project.”

Two months later and Goldshore is posting, imo, excellent results, highlighted by a very respectable 1.16 g/t Au over 116 meters. Significantly, the deposit is wider and larger than management had previously thought.

The market hasn’t yet woken up to Goldshore but the way they’re going, and with so many holes still left to drill and report, this stock has legs that should carry it well into 2022.

Goldshore Resources Inc.

TSXV: GSHR, OTC: GSHRF, FRA:8X00

Cdn$0.60, 2021.12.10

Shares Outstanding 100.3m

Market cap Cdn$69.2m

GSHR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Goldshore Resources Inc. (TSXV: GSHR) GSHR is a paid advertiser on Richard’s site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.