Copper and silver: the electrical metals – Richard Mills

2023.09.29

Copper is one of the most important metals with more than 20 million tonnes consumed each year across a variety of industries, including building construction (wiring & piping,) power generation/ transmission, and electronic product manufacturing.

In recent years, the global transition towards clean energy has stretched the need for the tawny-colored metal even further. More copper will be required to feed our renewable energy infrastructure, such as photovoltaic cells used for solar power, and wind turbines.

The metal is also a key component in transportation, and with increasing emphasis on electrification, demand is only going to increase.

Silver, like gold, is a precious metal that offers investors protection during times of economic and political uncertainty.

However, much of silver’s value is derived from its industrial demand. It’s estimated around 60% of silver is utilized in industrial applications, like solar and electronics, leaving only 40% for investing.

As the metal with the highest electrical and thermal conductivity, silver is ideally suited to solar panels. About 100 million ounces of silver are consumed per year for this purpose alone.

Battery electric vehicles contain up to twice as much silver as ICE-powered vehicles. A 2021 Silver Institute report says the auto sector’s demand for silver will rise to 88Moz in five years as the transition from traditional cars and trucks to EVs accelerates. Others estimate that by 2040, electric vehicles could demand nearly half of annual silver supply.

Despite being widely used in many industrial applications, copper and silver are often skipped over in discussions of metals needed for the green economy, with battery metals like lithium, graphite, cobalt and nickel hogging the limelight.

Ahead of the Herd explains why the red and the white metal deserve more credit as decarbonization/ electrification metal mainstays, and why they are, imo, among the top tier of investable commodities.

Copper: Heartbeat of the energy economy

Simply put, electrification doesn’t happen without copper, the heartbeat of the global energy economy.

Along with the usual applications in construction wiring and plumbing, transportation, power transmission and communications, there is now an added demand for copper in electric vehicles and renewable energy systems.

Millions of feet of copper wiring will be required for strengthening the world’s power grids, and hundreds of thousands of tonnes more are needed to build wind and solar farms. Electric vehicles use triple the amount of copper as gasoline-powered cars. There is more than 180 kg of copper in the average home.

However, some of the world’s largest mining companies, market analysis firms and banks, are warning that by 2025, a massive shortfall will emerge for copper, which is now the world’s most critical metal due to its essential role in the green economy.

The deficit will be so large, The Financial Post stated last September, that it could itself hold back global growth, stoke inflation by raising manufacturing costs and throw global climate goals off course.

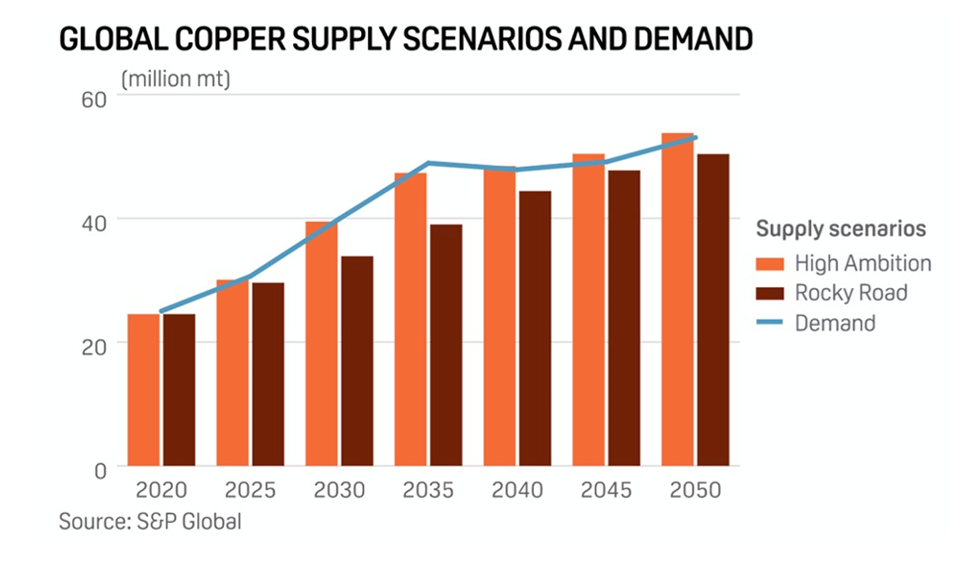

How big are we talking? Well, the speed at which copper demand outpaces supply will depend on the successful meeting of net-zero emission goals. According to a 2022 study by S&P Global, these goals will double the demand for copper to 50 million tonnes annually by 2035. BloombergNEF predicts demand will increase by more than 50% from 2022 to 2040.

“The energy transition is going to be dependent much more on copper than our current energy system,” Daniel Yergin, S&P Global vice chairman, told CNBC. “There’s just been the assumption that copper and other minerals will be there. … Copper is the metal of electrification, and electrification is much of what the energy transition is all about.”

In a scenario that meets the Paris Agreement goals (as in the IEA’s Sustainable Development Scenario), the energy sector’s share of total demand must rise significantly over the next two decades to over 40% for copper.

However, looking further ahead in a scenario consistent with climate goals, the expected supply from existing mines and projects under construction is estimated to meet only 80% of the world’s copper needs by 2030, the IEA says.

According to consulting firm McKinsey, electrification is expected to create a 6.5 million ton shortfall at the start of the next decade, highlighting a substantial output gap that the mining industry has to address.

One of the biggest obstacles to higher sales of electric vehicles is limited public charging infrastructure, something governments around the world are spending billions to fix.

To accommodate the demand for electric cars, experts project that more than a million new public EV charging stations will be required in the US by 2030. According to a recent S&P Global Mobility assessment, the US must triple its charging infrastructure by 2025, an 8x increase over the country’s current charging capacities. (Business Insider, Jan. 9, 2023)

In the United States, the firm says there are currently 126,500 Level 2 charging stations, which take about five hours to fully charge an EV, and 20,431 Level 3 stations, which will charge an electric vehicle to 80% capacity in 15-20 minutes. There are also 16,822 Tesla Superchargers and Tesla destination chargers.

President Biden has set a goal of 500,000 public charging stations by 2030, a five-fold increase from the 100,000 in place already.

This objective may already be out of date. S&P Global Mobility says that, assuming there are 7.8 million EVs on American roads in 2025, they will require 700,000 Level 2s and 70,000 Levels 3s.

By 2030, if the number of electric vehicles rises to 28.3 million — a realistic assumption — they will require 2.13 million Level 2 and 172,000 Level 3 public chargers, S&P Global Mobility forecasts. This does not include home charging stations drivers will install.

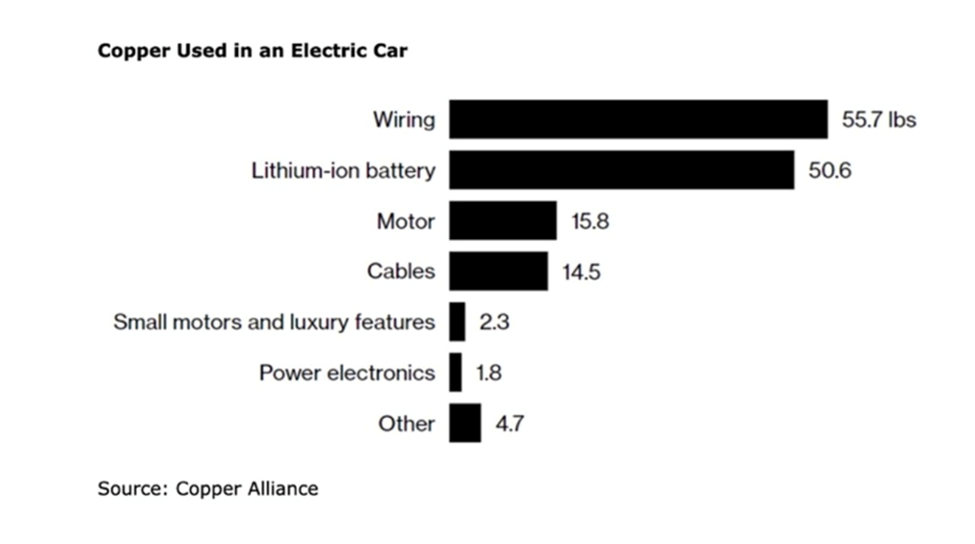

All of this charging infrastructure will require a lot more copper. An average EV contains about 85 kg of the red metal. Charging stations take 0.7 kg (for a 3.3 kW slow charger) or 8 kg (for a 200 kW fast charger), according to the Copper Alliance.

Most of Biden’s new chargers are “Level 2” powered at 6 to 8 kW, so if we assume a copper content of roughly 1.5 kg per charger, an additional 400,000 chargers would need 600,000 kg of copper or 600 tonnes (1 tonne = 1,000 kg).

By 2030, though, S&P expects 28.3 million EVs on US roads, requiring 2.13 million Level 2 and 172,000 Level 3 chargers.

Remember this is only for the United States, and it doesn’t include charging stations homeowners might install in their homes, also requiring copper. It also excludes the copper wiring needed to connect all these new charging stations to renewable energy, and the copper in the renewable energy plants themselves.

According to The Faist Group, in 2021 there were about 375,000 public charging stations in Europe, but according to calculations made by McKinsey, a consulting firm, at least 3.4 million will be needed by 2030.

These numbers mesh with another source that said Europe will require 1.3 million chargers by 2025 and 2.9 million by 2030.

So far the amount of copper required is do-able — 10,000 tonnes is 130 times less than the amount of copper produced by the US in 2022 and 520x less than the copper mined by top producer Chile.

However, if Europe meets its goal of 30 million electric cars by 2030, the amount of copper required @ 85 kg per EV, is 2,550,000,000 kg, or 2,550,000 tonnes. This is nearly double US copper production in 2022 of 1,300,000 tonnes, or almost half of Chile’s annual production.

Remember, S&P Global Mobility forecasts 28.3 million EVs in the US by 2030. That’s 28,300,000 x 85 kg per EV.

Remember we are only talking about copper demand for electric vehicles sold in the US and Europe — we aren’t counting higher EV sales in other countries, along with millions more public and private charging stations to service them, all needing copper, plus supplying all the other copper markets, for construction, power transmission, telecommunications, etc.

This equates to nearly five Escondida mines (the largest in the world), with each producing 1 million tonnes per year. Just to provide enough copper for EVs in the United States and Europe. And not including charging stations, which add another nearly 10,000 tonnes combined.

Now let’s consider copper usage in wind power.

According to the Copper Development Association, a 3-megawatt onshore wind turbine takes up to 4.7 tons of copper, with offshore wind turbines requiring even more. Visual Capitalist states that wind farms use approximately 7,766 pounds of copper per megawatt, while an offshore wind installation uses 21,068 pounds per MW.

More copper tonnage is required for solar power systems, approximately 5.5 tons per megawatt, states the CDA, with the red metal used in heat exchangers, wiring and cabling. An estimated 1.9 billion pounds or 861,826 tonnes (861,826,527 kg/1,000) of copper will be needed to power 262 gigawatts of new solar installations between 2018 and 2027 in North America. This is just over the 830,000 tonnes of copper mined by Australia in 2022.

Copper is also used in energy storage made necessary by the intermittent nature of solar and wind power. According to Visual Capitalist, a lithium-ion battery contains 440 pounds of copper per megawatt, with a flow battery needing 540 lbs/MW.

Last but not least, we have copper usage in electricity transmission.

According to the Copper Alliance, the U.S. electric transmission network contains more than 600,000 circuit miles of lines, of which 240,000 are high-voltage lines. Copper is a key material for transmission and is used in structural frames, conductor lines, cables, transformers, circuit breakers, switches and substations.

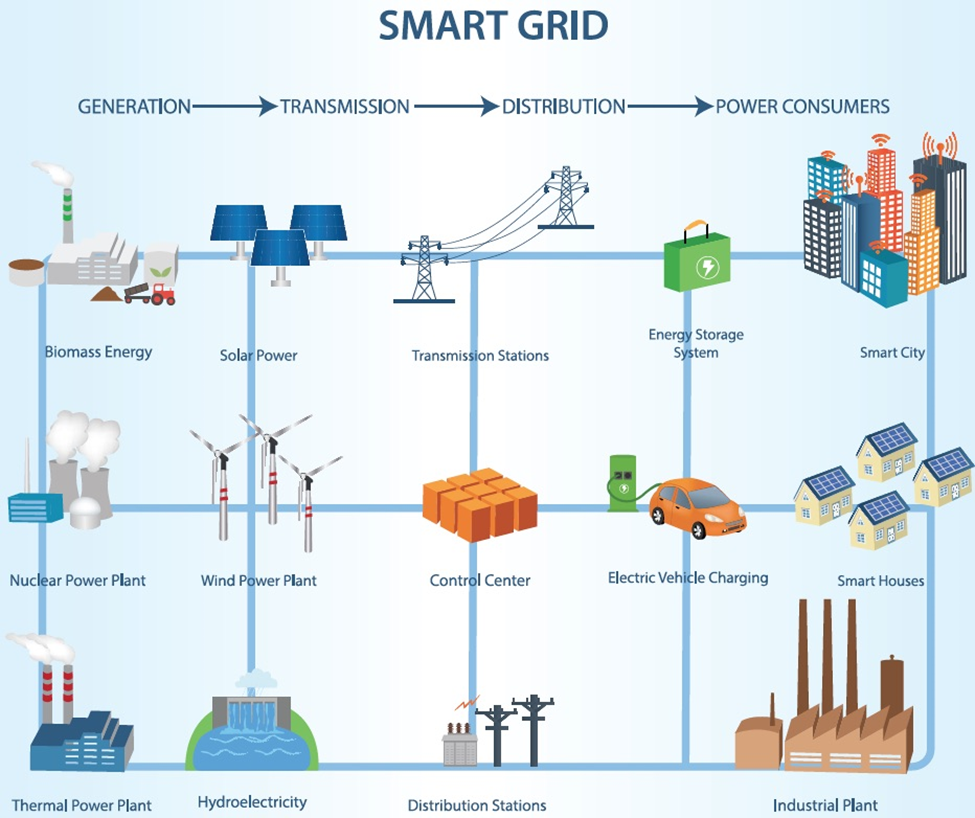

As the grid evolves, even more copper will be required. The Copper Alliance notes there is a general trend away from large, remote, utility-scale power plants, and towards thousands of distributed energy resources situated closer to end users. These “microgrids” employ a so-called “intelligent network” that allows adjustments to be made to balance the electrical power in the grid, locally and regionally.

The “smart grid” refers to how the national grid has been developed to recognize blackouts and to respond more quickly. According to the Copper Alliance:

Generally speaking, the grid is becoming more active. Internet connectivity and big data allow smart grid and microgrid operators to better predict electrical supply and demand. When a natural outage does occur due to a weather event, a wayward branch or an act of sabotage, the smart grid can quickly respond and provide electricity where it is needed to balance the grid intelligently…

The new electrical infrastructure will be more secure, more reliable and more energy-efficient than ever before. And there is no doubt that it will use plenty of copper. More copper will be required for use in equipment such as:

• Switching and monitoring of electrical loads, which will be digitally controlled to balance supply and demand in real time;

• Collecting power from many DERs, decentralizing the generation of power and creating virtual power plants (VPPs); and

• In energy storage systems, which will allow for time-shifting and peak shaving of electrical supply and demand.

Silver: A massive supply gap

Analysts have long been pointing to a severe shortage of silver due to the relentless growth in demand for the metal, which is used in many industrial applications such as automotive and electronics.

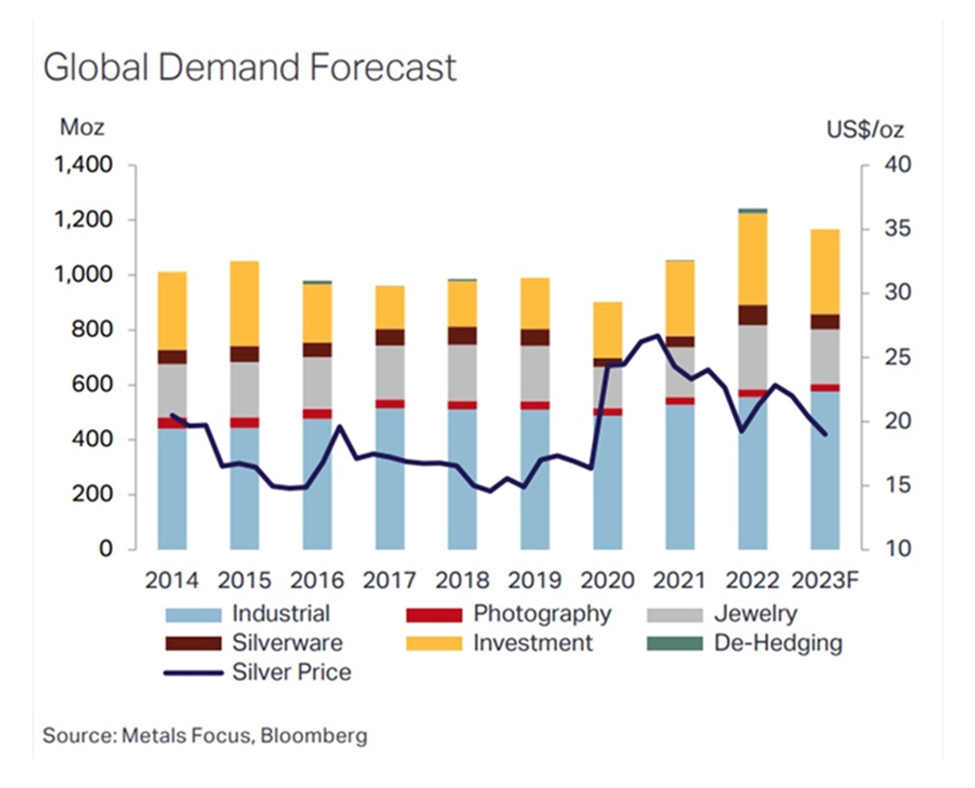

New industry figures help to paint a clearer picture. Data from the Silver Institute shows that global silver demand has increased by 38% since 2020 as world economies continue to recover from the Covid-19 pandemic.

Last year, demand for silver surged by 18% to a record 1.24 billion ounces against a stagnant supply, stretching the market deficit to a second straight year, the Silver Institute said in its latest publication.

According to the 2023 World Silver Survey, the global silver market was undersupplied by 237.7 million ounces in 2022, which the Institute says is “possibly the most significant deficit on record.”

What’s more unsettling is that it took just two years of undersupply — the 2022 deficit and the 51.1 million oz shortfall from 2021 — to wipe out the cumulative surpluses from the previous decade, and this demand-supply gap is likely to remain for the foreseeable future.

“We are moving into a different paradigm for the market, one of ongoing deficits,” said Philip Newman at Metals Focus, the research firm that prepared the Silver Institute’s data.

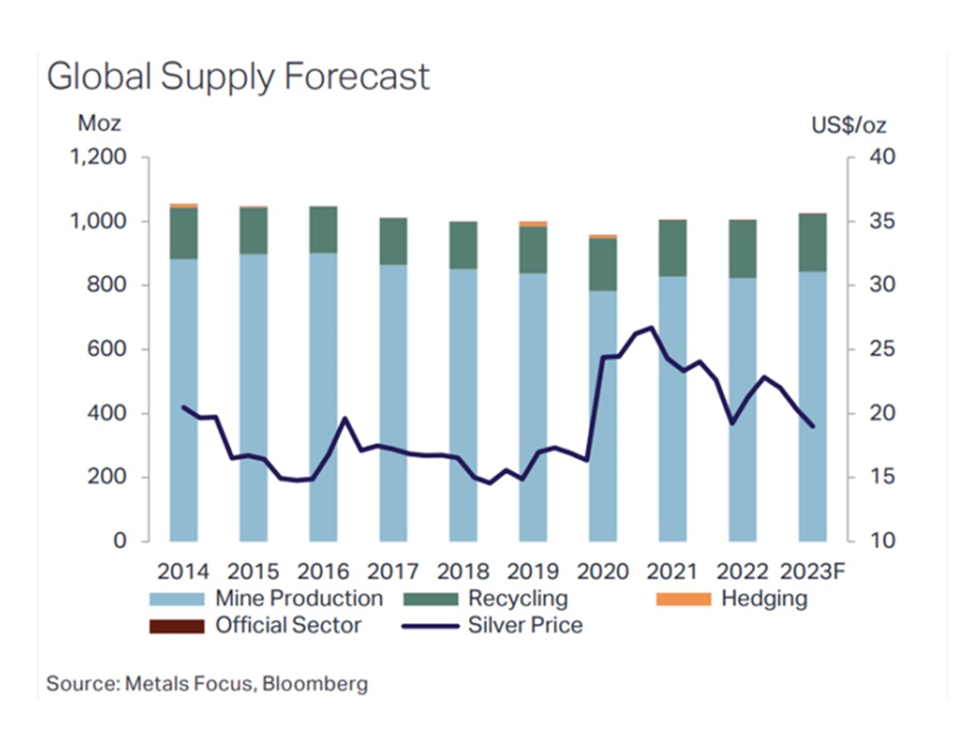

This year, we are most likely going to see a repeat of last year, with solid demand and a slight increase (2%) in mine production.

The Silver Institute is forecasting another 1.17 billion ounces being demanded this year, against a projected supply of 1.02 billion ounces. While this would close the gap to 142.1 million ounces, it would still be the second-largest deficit in over two decades.

Looking into the next decade, the Institute is expecting demand — and hence the supply shortall — to grow even further as the global transition to renewable energy intensifies.

As the metal with the highest electrical and thermal conductivity, silver is ideally suited to solar panels. A 2020 Saxo Bank report stated that “potential substitute metals cannot match silver in terms of energy output per solar panel.”

Using silver as conductive ink, photovoltaic cells transform sunlight into electricity. Silver paste within the solar cells ensures the electrons move into storage or towards consumption, depending on the need. It is estimated that approximately 100 million ounces of silver are consumed per year for this purpose alone.

Analysis by BMO Capital Markets has annual silver consumption by the solar industry growing even higher at 85% to about 185 million ounces within a decade.

In the Silver Institute’s report, demand from photovoltaics climbed 15% last year to 140.3 million ounces, and is expected to surge another 28% to 161.1 million ounces in 2023.

Longer term, demand from the solar market is expected to keep up this pace. The institute, which references a World Bank projection for the energy technology segment as a basis for its predictions, forecasts that consumption could eventually hit 500 million ounces by 2050.

For context, total silver demand in 2022 was 1.242 billion ounces, meaning solar panels alone could by mid-century account for half of silver demand, compared to just 14% forecasted for 2023.

In fact, changes to solar power technology are accelerating demand for silver, and with little additional mine production on the horizon, this could widen the existing supply deficit.

According to Bloomberg New Energy Finance, the standard passivated emitter and rear contact cell will likely be overtaken in the next two to three years by tunnel oxide passivated contact and heterojunction structures. While PERC cells need about 10 milligrams of silver per watt, TOPCon cells require 13 milligrams and heterojunction 22 milligrams.

A recent Bloomberg story notes the difficulty in quickly cranking up silver supply, given that only 20% comes from primary silver mines. Rather, the vast majority, around 80%, of silver is mined as a by-product of lead, zinc, copper and gold.

Newly approved projects could be a decade away from production, with the University of New South Wales forecasting the solar sector could exhaust up to 98% of global silver reserves by 2050.

5G technology is set to become another big new driver of silver demand. Among the 5G components requiring silver, are semiconductor chips, cabling, microelectromechanical systems (MEMS), and Internet of things (IoT)-enabled devices.

The Silver Institute expects silver demanded by 5G to more than double, from its current ~7.5 million ounces, to around 16Moz by 2025 and as much as 23Moz by 2030, which would represent a 206% increase from current levels.

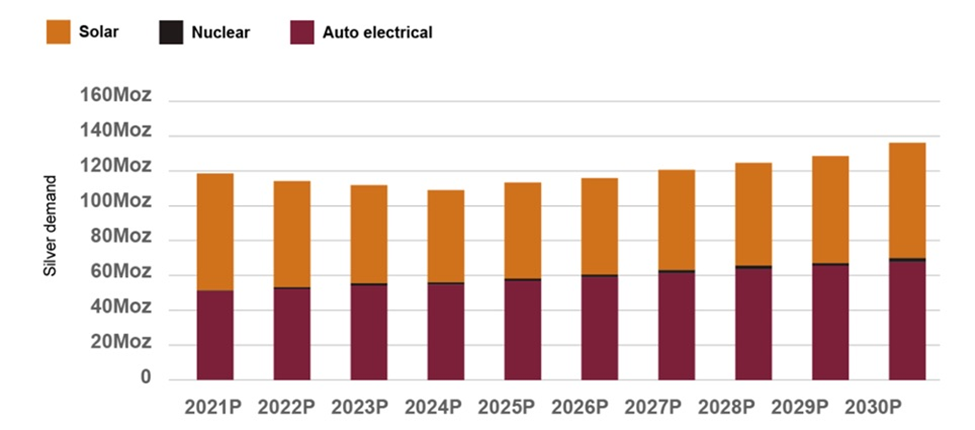

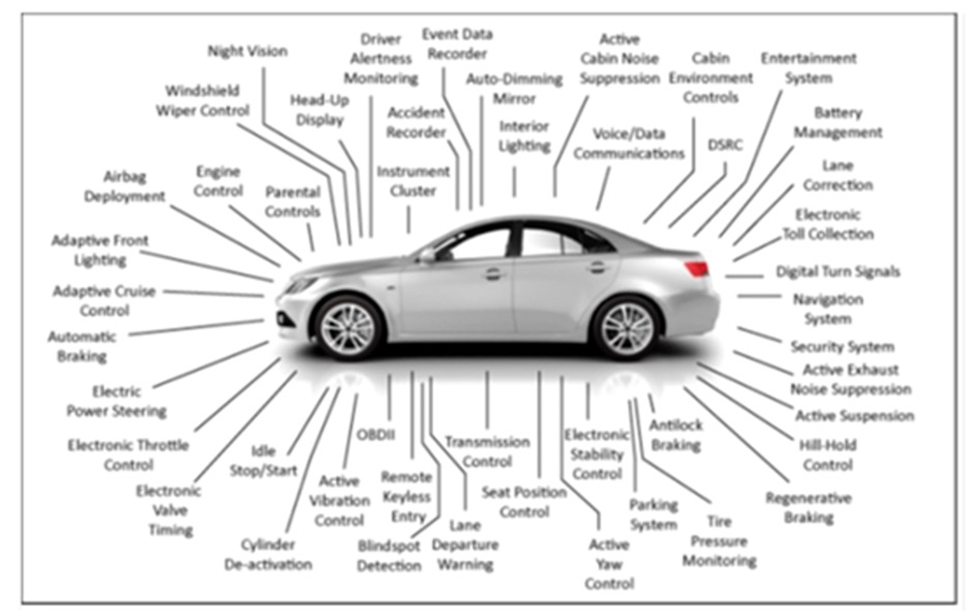

A third major industrial demand driver for silver is the automotive industry. Silver is also found in many car components throughout vehicles’ electronic systems, and despite not being used in batteries, its superior electrical properties make it hard to replace across a wide and growing range of automotive applications.

Source: The Silver Institute

A Silver Institute report says battery electric vehicles contain up to twice as much silver as ICE-powered vehicles, with autonomous vehicles requiring even more due to their complexity. Charging points and charging stations are also expected to demand a lot more silver.

It estimates the sector’s demand for silver will rise to 88Moz in five years as the transition from traditional cars and trucks to EVs accelerates. Others estimate that by 2040, electric vehicles could demand nearly half of annual silver supply.

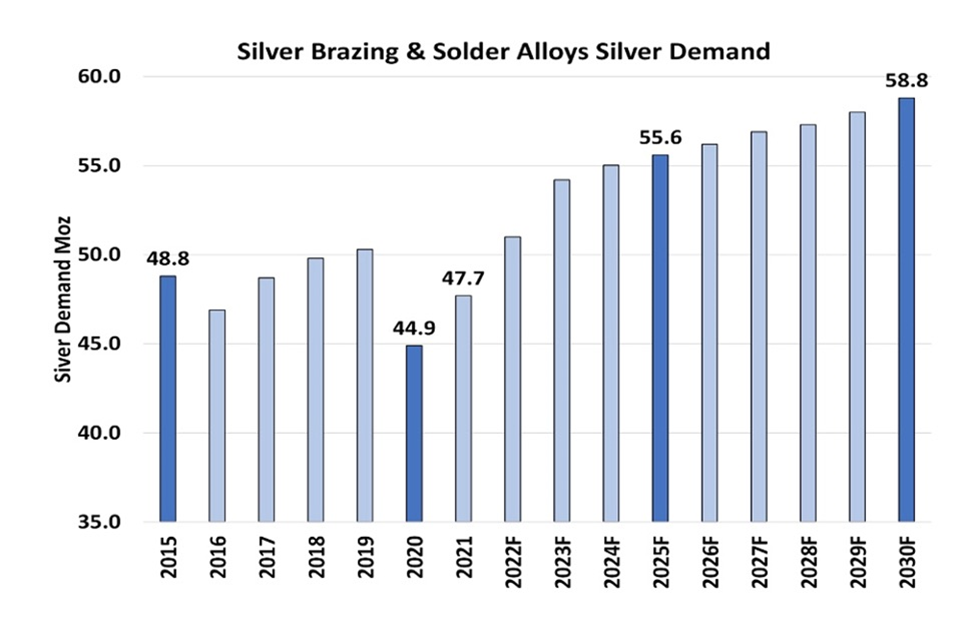

In 2021, brazing and soldering alloys used 47.7Moz of silver, representing 9.3% of the total industrial demand for silver that year. Last year brazing and alloys accounted for 49Moz.

By 2030, the demand for silver used in brazing and soldering is forecast to reach 58.8Moz, a 23% increase over 2021, according to a Silver Institute report titled ‘Silver in Brazing and Solder Alloy Materials’.

Another Silver Institute backgrounder explains the difference between brazing and soldering. Brazing is when materials are joined at temperatures above 600 degrees Celsius while soldering is the term for the joining process at temperatures below 600 C.

The backgrounder also says that without silver, none of these connections would be as strong, leakproof or as electrically conductive:

Adding silver to the process of soldering or brazing helps produce smooth, leak-tight, electrically conductive and corrosion-resistant joints. Silver brazing alloys are used in everything from air-conditioning and refrigeration to electric power distribution. They are also crucial in the automobile and aerospace industries.

Silver brazes and solders combine high tensile strength, ductility and thermal conductivity. Silver-tin solders are used for bonding copper pipe in homes, where they not only eliminate the use of harmful lead-based solders previously used, but also provide the piping with silver’s natural antibacterial action.

Tin-silver-copper solders are used by two-thirds of Japanese manufacturers for reflow and wave soldering, and by about 75% of companies for hand soldering. (Wikipedia)

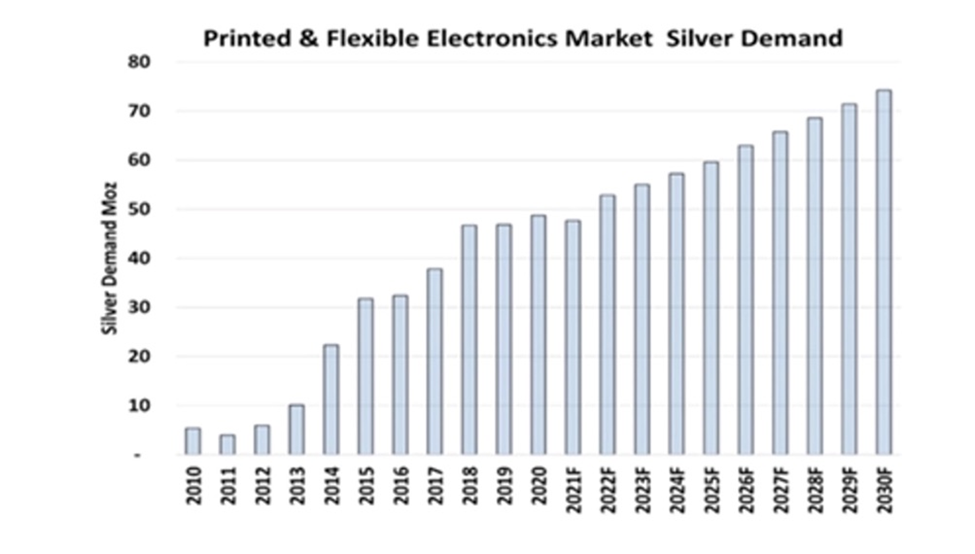

Finally, silver demand for “printed and flexible electronics” is forecast to increase 54% over the next nine years, rising from 48Moz in 2021 to 74Moz in 2030, meaning a consumption of 615Moz during this time frame.

A Silver Institute news release describes them as “mainstays” in a variety of electronic products, including sensors that measure everything from temperature, pressure and motion, to moisture, relative humidity and carbon monoxide. They are also used in medical devices, mobile phones, appliance displays and consumer electronics.

Source: Precious Metals Commodity Management LLC

In 2021, a comprehensive report by Sprott titled ‘Silver’s Clean Energy Future’ found that three areas of growing demand for silver — solar, automotive and 5G — potentially account for more than 125 million ounces in 10 years. This doesn’t include the growth in investment demand for silver, which as mentioned represents about 40% of usage.

Conclusion

Copper and silver are essential metals when it comes to the transition from fossil-fueled transportation and power generation to electricity-based systems.

A good argument can be made that to get the electrical juice flowing from any kind of energy source to any type of energy storage device, you have to have copper and silver.

Electric vehicles use triple the amount of copper as gasoline-powered cars. There’s copper in the wiring, lithium-ion battery, motor and cables. Charging stations will also need copper. President Biden has set a goal of 500,000 public charging stations by 2030, a five-fold increase from the 100,000 in place already. A charging station takes up to 8 kg of copper, depending on how long it takes to charge the EV.

Millions of feet of copper wiring will be required for strengthening the world’s power grids, and hundreds of thousands of tonnes more are needed to build wind and solar farms.

As the metal with the highest electrical and thermal conductivity, silver is ideally suited to solar panels. A 2020 Saxo Bank report stated that “potential substitute metals cannot match silver in terms of energy output per solar panel.”

Despite not being used in batteries, silver’s superior electrical properties make it hard to replace across a wide and growing range of automotive applications.

Battery electric vehicles contain up to twice as much silver as ICE-powered vehicles. Charging stations are also expected to demand a lot more silver.

5G technology is set to become another big new driver of silver demand. Among the 5G components requiring silver, are semiconductor chips, cabling, microelectromechanical systems (MEMS), and Internet of things (IoT)-enabled devices.

Silver is an important component of brazing and soldering, the process of joining pieces of metal together. The Silver Institute says that adding silver to the process of soldering or brazing helps produce smooth, leak-tight, electrically conductive and corrosion-resistant joints. Silver brazing alloys are used in everything from air-conditioning and refrigeration to electric power distribution. They are also crucial in the automobile and aerospace industries.

The transition to an electrified economy doesn’t happen without copper and silver, which is why in my opinion they are among the most highly investable commodities now, and for the foreseeable future. The danger, for end users, and opportunity, for resource investors, of coming shortages for both metals, only strengthens my thesis.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.