The Big Three Commodities of Electrification and Decarbonization

2021.11.01

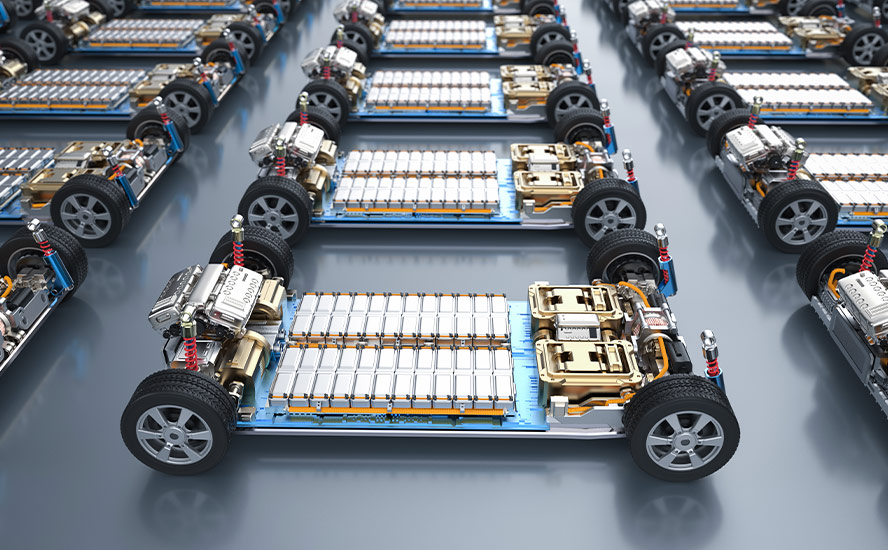

Rick Mills, author of the aheadoftheherd.com newsletter, discusses the long-term investment case for the three most critical inputs or raw materials in the race to electrify and decarbonize the globe: copper, lithium, and graphite. Unfortunately, Rick says that each of these are under major control by China and what this means for investors looking to gain exposure to these important commodities.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Related posts

June 3, 2024

June 3, 2024

April 17, 2024