Cypress lithium pilot plant up and running

2021.11.12

A 2020 World Bank report entitled ‘The Mineral Intensity of the Clean Energy Transition’, estimated that production of minerals underpinning the clean energy shift, such as the battery metals graphite, lithium and cobalt, would have to increase by nearly 500% by 2050 to meet global demand for renewable energy technology.

Cleaning up the planet, and “going green” will not be possible without major reductions in carbon emissions from the two largest economies, the US and China.

President Biden is pushing forward on climate-oriented programs that distance himself from his predecessor and are a nod to the Democratic left that supported his bid for president.

His $1.1 trillion infrastructure spending package, just passed by Congress, is aimed at transitioning the US transportation system to battery-powered vehicles and supporting renewable wind and solar energies over carbon-based sources like coal and natural gas.

Vehicle electrification is a major part of the legislation’s focus. It would provide $7.5B for low-emissions buses and ferries, and aims to deliver thousands of electric school buses to districts across the country. Another $7.5B would go towards building a nationwide network of plug-in EV chargers.

This past August, Biden signed an executive order requiring that half of all US new vehicle sales be electric by 2030.

$65 billion is earmarked for rebuilding the electrical grid including thousands of new miles of power lines and expanding renewable energy, according to the White House.

From an initial social spending/ climate package of $3.5 trillion, panned by Republicans for containing a wish-list of “progressive” priorities, Biden’s Build Back Better legislation is now $1.75 trillion and has as its centerpiece over $550 billion to tackle climate change and the transition to clean energy.

SP Global notes The biggest chunk of the climate and clean energy investment — $320 billion — would provide for 10-year expanded tax credits for “utility-scale and residential clean energy, transmission and storage, clean passenger and commercial vehicles, and clean energy manufacturing,” according to a three-page summary from the White House.

US battery plants burgeoning

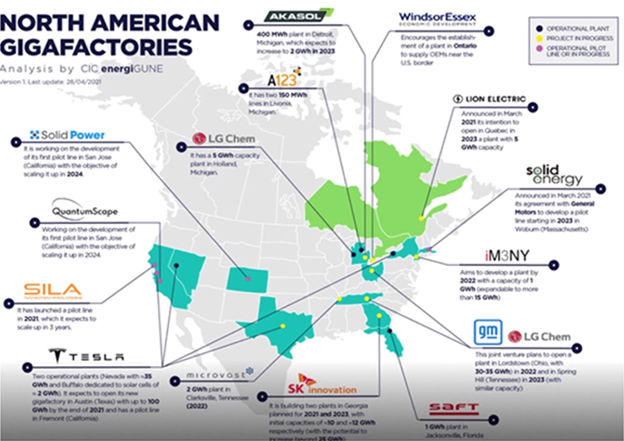

In the United States, there are a number of battery plants in the works to join Tesla, whose first gigafactory in Nevada started production of battery cells in 2017. The company has a plant in Buffalo, New York, and plans to open a third (US plant) in Texas by the end of this year. Tesla also has a “pilot line” at its facility in Fremont, California, for R&D technologies.

In 2020 General Motors announced plans to install its first battery cell factory in Ohio, a project called Ultium Cells launched with its Korean partner LG Chem. The latter opened a plant in Holland, Michigan in 2013.

Another South Korean company, SK Innovation, is planning on opening the first of two battery plants in Georgia early next year; the company is a supplier to Volkswagen and Ford.

The latter along with American auto icon GM have big plans to electrify their fleets. Ford announced plans to boost spending on electrification by more than a third, and aims to have 40% of its global volume electric by 2030, which translates to more than 1.5 million EVs based on last year’s sales.

GM reportedly aspires to halt all sales of gas-powered vehicles by 2035, with plans to invest $27 billion in electric and autonomous vehicles over the next five years.

There are currently 11 EV start-ups racing to catch up with market leader Tesla, fueled by money from Wall Street. They include Rivian out of Irvine, California, Lucid Motors based in Newark, CA, Lordstown Motors from Ohio, Nikola Corp (Phoenix), Fisker (Los Angeles), Faraday & Future (Los Angeles), Canoo (Torrance), NIO, Li Auto and XPing from China, and Arrival, based in London.

Lithium M&A

The mining industry was headlined by several major deals involving lithium firms in October.

Rock Tech Lithium plans to locate its first battery metals smelter within a 90-minute drive of Tesla’s gigafactory under construction outside Berlin, in a bet that Germany will take the lead in Europe’s electric vehicle transition.

South Korea’s LG Energy Solution, one of the biggest EV battery makers globally, recently agreed to buy as much as 100,000 tonnes of lithium a year as part of a six-year “take-or-pay” deal with Vancouver-based Sigma Lithium Corp., which controls a hard rock lithium deposit in Brazil.

China’s top battery maker, Contemporary Amperex Technology (CATL), outbid Ganfeng Lithium to acquire Canadian miner Millennial Lithium Corp., which holds lithium assets in Argentina.

As China’s largest lithium compounds producer and the world’s biggest lithium company by market value, Ganfeng has gone on an acquisition spree over the years, having invested in several lithium projects in Argentina (Caucharí-Olaroz, Mariana), Australia and China.

In August, Ganfeng proceeded with a takeover of Mexico-focused lithium developer Bacanora, and in the same month, inked a four-year supply deal with Australia’s Core Lithium for 300,000 tonnes of spodumene concentrate, a partly processed form of the battery material.

China’s Zijin Mining, known for its status as a major gold and copper producer, announced its first foray into the lithium sector with a $770 million purchase of Neo Lithium, outbidding many other Chinese bidders.

Neo Lithium’s main asset is a high-grade brine operation in Argentina, with CATL already being one of its backers.

In total, Bloomberg Intelligence analyst Christopher Perrella estimates five companies essentially control the $4 billion global lithium market, two of which are Chinese.

US lithium dependency

At AOTH we’ve been covering the topic of US critical minerals insecurity in the face of China’s mining and processing dominance, for over a decade.

In a recent interview with Cris Sheridan of Financial Sense, I discussed the long-term investment case for the three most critical inputs in the race to electrify and decarbonize: lithium, graphite and copper.

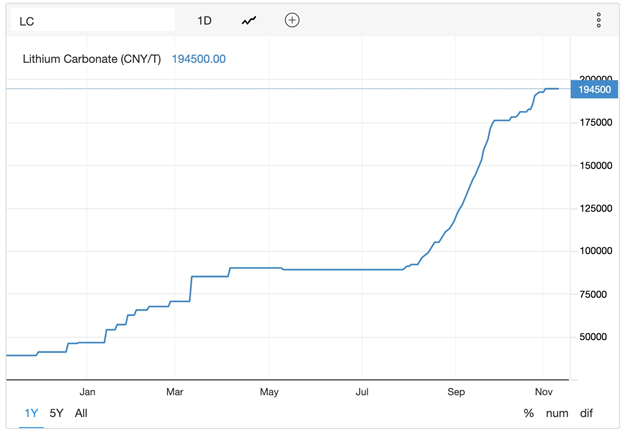

China controls most of the world’s lithium processing and makes over 60% of the world’s lithium-ion batteries. The prices of lithium carbonate and hydroxide, both used in the li-ion battery cathode, have soared this year on break-neck demand.

Source: Trading Economics

Rio Tinto has said even if they had another 60 Jadar lithium mines, that wouldn’t fill the supply-demand gap, with EV sales expected to hit 55% of total vehicle sales as early as 2030. That represents 65 million units, and 3 million tonnes of lithium in just eight years, compared to the 400,000 tonnes of lithium per year mined currently.

Even if you combine all existing operations with future projects, that’s only 1Mt of future lithium, compared to the 3Mt we need by 2030. With all that is going on in the US — Biden’s clean energy agenda; America now the world’s second largest EV manufacturer behind China; new battery plants being built including Tesla’s second gigafactory in Texas; billions worth of EV investments coming from major carmakers like Ford, GM, VW and Mercedes, battery-makers such as Korea’s SK Innovation; and 11 electric vehicle start-ups such as Rivian — we would expect there to be a lot of lithium needed to satisfy a burgeoning domestic mine to battery to EV supply chain.

In fact there is only one US lithium mine, Albemarle’s Silver Peak in Nevada, outputting a tiny 5,000 tonnes of lithium carbonate per year, according to the US Geological Survey.

The truth, in regards to the world’s mineral resources, is that we in the western developed countries are usually not in control of supply.

Bloomberg NEF shows just over five times more lithium is needed in 2030 compared to current levels. In the absence of new North American lithium supply, this lithium will have to come from China, which as I stated, processes the majority of the world’s lithium and makes nearly two-thirds of all lithium batteries.

It is ridiculous to think that the US can rely on China for delivering a steady and reliable supply of lithium (and other critical minerals it has locked up), given an increasingly belligerent China, in trade, politics and militarily.

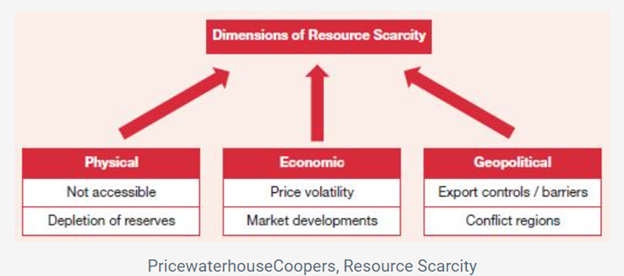

“The spectre of resource insecurity has come back with a vengeance. The world is undergoing a period of intensified resource stress, driven in part by the scale and speed of demand growth from emerging economies and a decade of tight commodity markets. Poorly designed and short-sighted policies are also making things worse, not better. Whether or not resources are actually running out, the outlook is one of supply disruptions, volatile prices, accelerated environmental degradation and rising political tensions over resource access.” Chatham House, Resources Futures

There are many serious concerns in regards to global resource extraction that we need to consider:

- Resource nationalism/Country risk, political instability of supplier

- A looming skills shortage

- Competition with Chinese mining investment, smaller areas open for exploration

- Low hanging fruit – the high quality large deposits have already been found, lower economic attractiveness of new projects, cost inflation

- Supply bottlenecks for much needed and scarce equipment

- The manipulation of supplies ie speculation and concentrated ownership of LME stocks

- Rising capex/opex, lack of financing options, capital project execution

- Lack of innovation and technological advancements

- Declining open pit production, ongoing operational issues

- Lack of recognition for population growth, growing middle class w/disposable incomes and urbanization as on-going demand growth factors

- Environmental group and labor risks, mining unrest – lack of a social license to operate, incredibly difficult and lengthy permitting processes

- Climate change, accidents and natural disasters

- Lack of infrastructure or poor infrastructure access, attacks on supply infrastructure

- Price and currency volatility

- Fraud and corruption

- Access to raw materials at competitive prices has become essential to the functioning of all industrialized economies.

Accessing a sustainable, and secure, supply of raw materials is going to become the number one priority for all countries. Increasingly we are going to see countries ensuring their own industries have first rights of access to internally produced commodities and they will look for such privileged access from other countries.

Numerous countries are taking steps to safeguard their own supply by:

- Stopping or slowing the export of natural resources

- Shutting down traditional supply markets

- Buying companies for their deposits

- Project finance tied to off take agreements

Cypress Development Corp

Cypress Development Corp. (TSXV:CYP, OTCQB:CYDVF, Frankfurt:C1Z1) has a sizeable lithium deposit in Nevada from which they are trying to produce lithium hydroxide, the preferred lithium product for EV batteries. They see themselves profiting from a lithium market segment that is expected to see high demand and potential shortfalls in coming years, especially in North America as the production of battery cells and electric vehicles ramps up.

Cypress’s Clayton Valley lithium deposit would be mined from neither brine nor hard rock, but claystone. An average production rate of 15,000 tonnes per day to produce 27,400 tonnes LCE annually over a +40-year mine life means the project stacks up extremely well against any of the 10 deposits listed here. The company, in our opinion, is extremely undervalued, having already completed a preliminary economic assessment (PEA) and a prefeasibility study.

Most recently attention has focused on a pilot plant the company is running to test its lithium extraction process.

The pilot plant is located at a metallurgical facility 100 miles south of Beatty, Nevada, owned and operated by del Sol Refining Inc., which is permitted under the State of Nevada for chemicals use with permits in place with the US Environmental Protection Agency (EPA).

The initial operation of the pilot plant will focus on chloride-based leaching to confirm the results of the company’s scoping study on lithium extraction.

The pilot plant is planned to operate at a rate of one tonne/day and will be designed for correct interaction and testing of the major components within the extraction process and assessment of the resulting lithium products.

According to Cypress, the program will provide essential data for a planned feasibility study and enable the company to produce marketing samples to support negotiations with potential offtake and strategic partners.

On Thursday the company reported the launch of extraction testing of lithium-bearing claystone, with test work ongoing utilizing chloride-based leaching combined with the Chemionex—Lionex process for Direct Lithium Extraction (DLE).

“The pilot plant is operating as designed. Leaching is now underway on lithium clay,” said Bill Willoughby, Cypress’s President and CEO, in the Nov. 10 news release.

Plant operations are under the direction of Continental Metallurgical Services, Llc., with support from del Sol Refining, Inc., and Chemionix Inc.

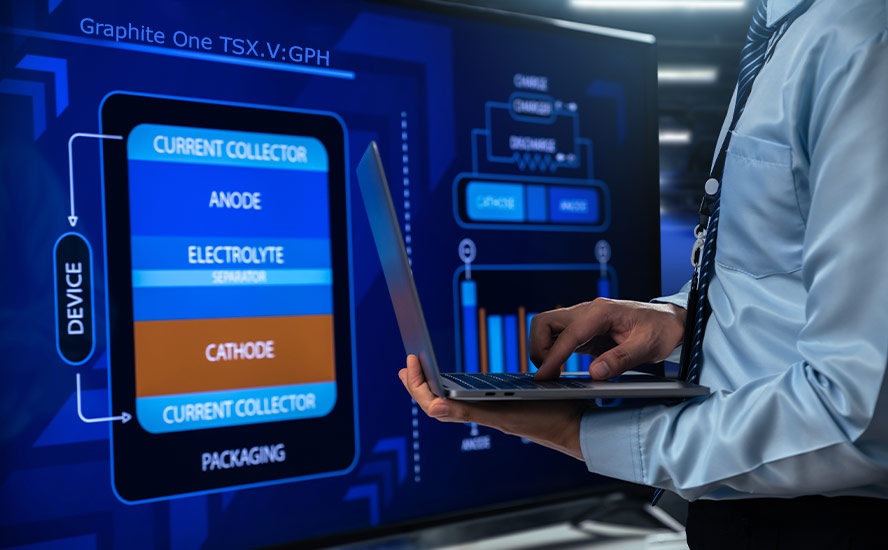

The pilot plant has four main sections, with two additional processing steps conducted off-site at NORAM Engineering and Constructors laboratory in Richmond, British Columbia, just outside of Vancouver:

- The leaching section will work to improve leach conditions and confirm lithium extraction into pregnant leach solution (PLS).

- The tailings handling section will utilize a counter current decantation arrangement of thickener settlers and flocculant mixing, with the objective of determining materials handling, moisture content and water consumption.

- The PLS treatment section will remove impurities prior to introduction into the DLE process through two-stage neutralization and filtration; a tertiary stage will follow the DLE process prior to recycling of solution back to leaching.

- The DLE section consists of Chemionex’s—Lionex DLE technology and will test compatibility of the PLS to be further concentrated with this process. Cypress was granted an option, upon completion of the pilot plant program, to license this process for commercial use at its project.

- The final two off-site steps will treat the concentrated lithium solution from the DLE portion of the pilot plant to produce lithium hydroxide and test the stripped leach solution for compatibility for recycling to the leaching section of the plant.

Conclusion

Cypress’s pilot plant success has been noticed by the market; CYP’s stock price is more than double what it started the year at, closing on Thursday at $2.34/sh compared to $1.00 on Jan. 4. Cypress belongs to a select group of junior resource companies with quality properties in the United States, that has the potential of becoming a crucial link in the emerging North American mine to electric-vehicle battery supply chain.

We’re looking forward to seeing the results of the pilot plant lithium extraction process as Cypress continues down its development path towards commercial production.

Cypress Development Corp.

TSXV:CYP, OTCQB:CYDVF, Frankfurt:C1Z1

Cdn$2.34, 2021.11.11

Shares Outstanding 126.6m

Market cap Cdn$298.1m

CYP website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Cypress Development Corp. (TSXV:CYP)

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.