Markets

December 20, 2023

By Wolf Richter – WOLF STREET Foreign holders have not kept up buying the the incredibly […]

December 19, 2023

By Niccolo Conte – Visual Capitalist Global government debt is projected to hit $97.1 […]

December 19, 2023

By Daniel Lacalle Although the Federal Reserve and the European Central Bank’s message regarding interest rate cuts […]

December 19, 2023

By Yahoo Finance (Bloomberg) — OPEC’s one-time nemesis — US shale — is […]

December 17, 2023

By Felix Richter – Statista Despite inflation causing financial headaches in many households across […]

December 13, 2023

By Marcus Lu According to the IMF, the most indebted poor countries in […]

December 12, 2023

By Willem H. Buiter – Project Syndicate While proponents of central bank digital […]

December 6, 2023

By James Eagle As the world’s reserve currency, the U.S. dollar made up 58.4% of […]

December 4, 2023

By James K. Galbraith – Project Syndicate Once again, larger deficits and higher […]

November 30, 2023

By Business Insider Incentive to cut? $7.6 trillion of US government debt will […]

November 30, 2023

November 29, 2023

2023.11.29 For over a year now the main topic of discussion has been […]

November 29, 2023

By Peter Millard – Bloomberg The Panama Canal Authority, which normally handles about 36 ships […]

November 29, 2023

By Gary Wagner – Kitco A major component of today’s strong upside move […]

November 26, 2023

2023.11.26 China is already gobbling up copper and copper ore at an incredible […]

November 19, 2023

By Michael Maharrey For the first time in several months, the Consumer Price […]

November 18, 2023

By The Wall STreet Journal Overseas private investors and central banks now own […]

November 17, 2023

By Felix Richter U.S. retail sales declined for the first time since March last […]

November 17, 2023

By Our World in Data Food is the palate’s poetry, the body’s fuel, […]

November 16, 2023

2023.11.16 At Ahead of the Herd, we pride ourselves on being right, when […]

November 15, 2023

By Citizen Watch Report The interest payments on the national debt alone used […]

November 15, 2023

By Felix Richter Inflation in the U.S. cooled down more than expected in […]

November 13, 2023

By Doug Alexander Drought has made the Panama Canal a chokepoint for the flow […]

November 10, 2023

By Felix Richter According to the New York Fed’s Quarterly Report on Household Debt […]

November 10, 2023

By Tyler Durden The clamor for a US recession has grown louder in […]

November 9, 2023

By Peter Schiff Now, had they used another form of taxation, had the […]

November 8, 2023

By Kinvestor Arlen and Bob dive into the world of investing risk, the […]

November 7, 2023

2023.11.07 For more than three decades, the price of money has been falling. […]

November 7, 2023

By Thorsten Polleit In the international fixed-income markets, interest rates are rising, and […]

November 5, 2023

By Martin Armstrong Bank of England governor Andrew Bailey said in a press conference: […]

November 3, 2023

By Schiffgold After setting a record through the first half of the year, central […]

November 3, 2023

By Alasdair Macleod The day of reckoning for unproductive credit is in sight. […]

November 3, 2023

By Daniel Lacalle According to the U.S. Treasury, year-end data from September 2023 […]

November 2, 2023

By Michael Matulef The threat of hyperinflation has haunted fiat money economies throughout […]

October 31, 2023

By Frank Giustra The mining industry has had its share of abuse over the […]

October 28, 2023

2023.10.28 It must suck to be a bond investor these days. Bond markets […]

October 26, 2023

By Patrick Barron Your ability to hold real cash, not just bank balances […]

October 21, 2023

By Wolf Richter Our recession-watch here started shortly after the Fed kicked off […]

October 12, 2023

By The Economist The bond market is sending a hopeful message about the strength […]

October 12, 2023

By Quoth the Raven There has never been a point in history like […]

October 12, 2023

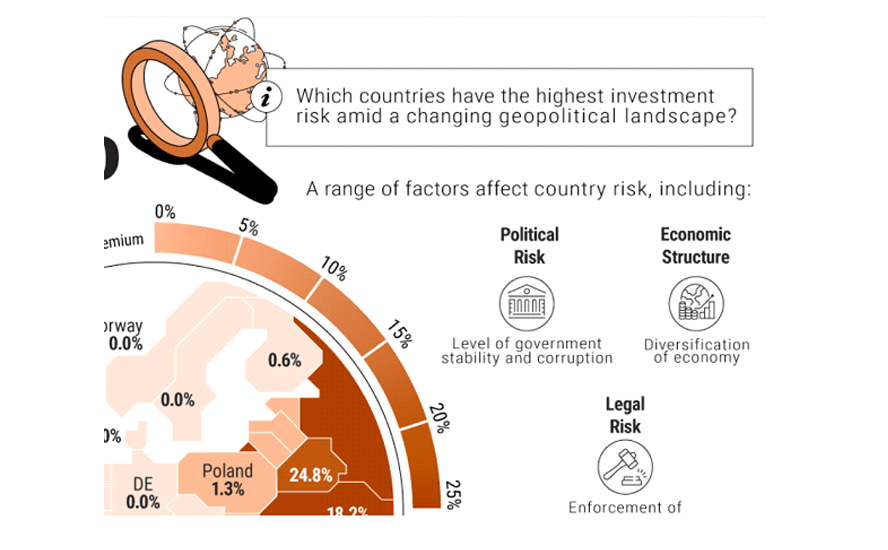

By Dorothy Neufeld What is the risk of investing in another country? Given […]

October 11, 2023

By Dow Jones A major Wall Street bank is warning about the risk that […]

October 11, 2023

By Daniel Lacalle The Biden administration has signed a stopgap bill to prevent […]

October 10, 2023

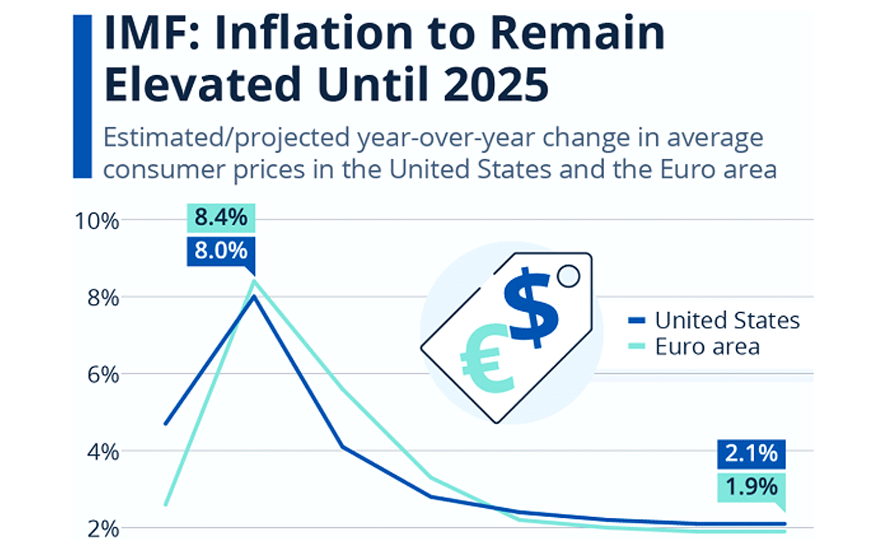

By Felix Richter Despite inflation coming down notably from its 2022 highs in recent […]

October 5, 2023

By the Economist It is a brave investor who calls the end of a […]

October 3, 2023

By The Economist For a while, after the end of the cold war, it […]

September 30, 2023

By CARLA NORRLÖF Measuring dollar dominance requires a closer look at the many […]

September 30, 2023

By Ancient Origins In the 1600s, before Bitcoin and cryptocurrencies, Europe experienced a […]

September 27, 2023

By Quoth the Raven “Probably the first bond market to crack up will […]

September 16, 2023

By Peter Schiff Most people think everything is fine. The Fed is getting […]

September 15, 2023

By Katharina Buchholz The de-dollarization of the world economy has been thrust back into […]

September 15, 2023

Russia and the Saudis are driving up oil and diesel prices. But these […]

September 14, 2023

By Rich Miller US policymakers led by Federal Reserve Chair Jerome Powell have been […]

September 13, 2023

2023.09.13 It was exactly six months ago when the US regional banking crisis […]

September 13, 2023

By Winifred Amase According to the World Bank, global seaport trade traffic reached […]

September 12, 2023

By Barry Eichengreen Whether the dollar retains its global role will depend not […]

September 8, 2023

2023.09.08 A while ago, we insinuated that the Federal Reserve may just be […]

September 8, 2023

2023.09.08 不久前,我们暗示美联储可能能够实现其传说中的“软着陆”,而从目前美国经济的发展情况来看,这一预测看起来相当精明。 正如我们在之前的文章中详述的那样,线索一直存在:作为经济活动很大一部分驱动力的美国大公司正在赚取巨额利润,这意味着更高的就业率和消费者的可支配收入。 仅仅通过提高价格来适应通胀主题,不断上升的利率除了提高利润外什么也没做。事实上,利息支付占税后利润的百分比实际上处于 60 年来的最低水平!因此,标普 500 指数收复了 2022 年熊市一半以上的损失也就不足为奇了,而且正如华尔街所声称的那样,现在正处于牛市。 正如我们之前多次讨论过的,央行不能仅仅因为无力承担而继续加息(请注意,目前美国联邦债务的年度支付额为 32.6 万亿美元,即将达到 […]

September 8, 2023

By Goehring & Rozencwajg Commodities and related natural resource markets were broadly weak […]

September 6, 2023

2023.07.28 For over a year now, the financial talking heads have been discussing […]

September 6, 2023

2023.09.06 Mining — like any other sector — has experienced its fair share […]

September 6, 2023

2023.09.06 与任何其他行业一样,采矿业在过去十年中也经历了相当多的问题,影响了其整体声誉和效率。 现在面临着为全球能源转型提供足够矿物的艰巨挑战,该行业必须深入挖掘——无论是字面上还是隐喻上——以提高其绩效。 但问题的根源是多方面的,阻力来自各个方面。关键问题包括全球技能短缺、环境和人权问题以及资金的可用性和使用。 在这些问题得到解决之前,采矿业的价值将无法最大化,并且该行业可能在未来十年遭受同样的命运。 下面,我们将探讨采矿业长期可持续发展的每一个主要障碍,以及该行业已经(或尚未)采取哪些措施来减轻这些风险。 关键技能差距 采矿业面临的最大挑战之一是劳动力老龄化和后继人才缺乏造成的技能差距日益扩大。 科罗拉多矿业学院研究和技术转让副总裁沃尔特·科潘 (Walter Copan) 表示,采矿业正面临着严重的技能差距,再加上即将到来的预期退休人数方面的所谓“灰色海啸”,情况更加严重。 德勤今年早些时候发布的一项研究显示,近 […]

September 5, 2023

By Felix Richter Some of the world’s leading car makers are among the exhibitors […]

September 5, 2023

By Quoth the Raven Yet while mildly “bad news” may be “good news” (or may not be, as stocks […]

September 4, 2023

2023.09.04 Scandals involving industrial metals are becoming a common occurrence, and it appears […]

September 4, 2023

2023.09.04 涉及工业金属的丑闻正在变得司空见惯,而且似乎没有采取任何措施来阻止此类事件一次又一次发生。 本周,欧洲最大的铜生产商 Aurubis 发现其库存中缺少价值数百万美元的废金属,成为最新的受害者。该公司认为,失踪金属的背后是供应商和员工之间的阴谋,目的是操纵其回收业务中的废金属原木,该业务原定于 9 月底结束。 该公司本身并不开采矿石,而是购买大量含铜废料,从近乎全新的制造边角料到旧电缆、管道和电子电路板。然后,它每天加工数千吨这些材料以生产精炼金属。 其网站称该公司从“30 多个采矿合作伙伴和一些贸易商”采购金属精矿。 “我们目前所知的是,我们的一些回收供应商似乎操纵了他们向我们提供的原材料的细节,他们一直在与我们采样部门的员工合作,向我们隐瞒短缺情况,” 投资者关系和企业沟通副总裁安吉拉·塞德勒 (Angela […]

August 31, 2023

By Felix Richter The number of job openings in the United States continued […]

August 30, 2023

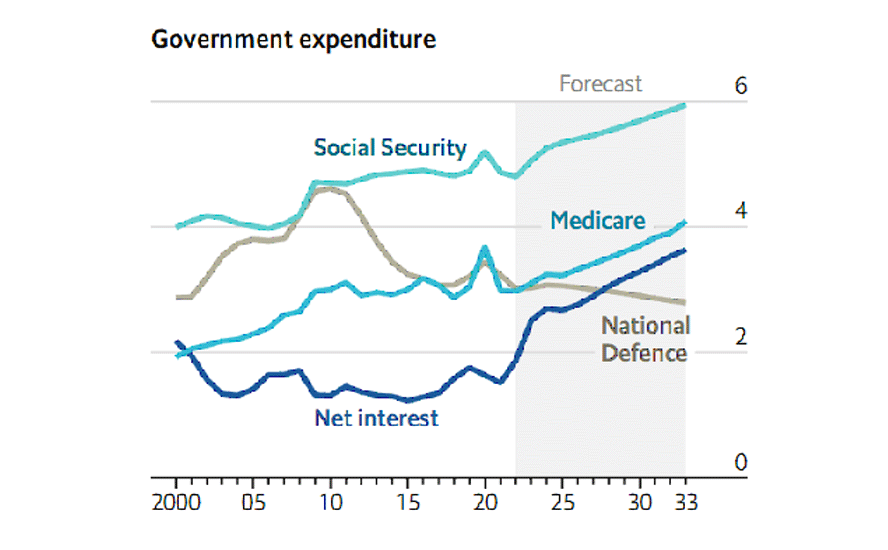

2023.08.30 The US officially has a debt problem, in the present and in […]

August 30, 2023

2023.08.30 美国目前以及未来都正式存在债务问题。截止到目前,美国的国债总额略低于 33 万亿美元,占国内生产总值(GDP)的 122%!然而,更大的问题在于其增长速度,导致利息支付不断膨胀。 根据国会预算办公室(CBO)的预测,未来 30 年的利息支付将达到约 71 万亿美元,并在 2053 年占据所有联邦收入的 35%。 […]

August 28, 2023

By Daniel Lacalle The summit of the so-called BRICS (Brazil, Russia, India, China, and […]

August 27, 2023

By JIM O’NEILL Now that the BRICS (Brazil, Russia, India, China, and South […]

August 27, 2023

By Doug Casey International Man: Since 2020, coups have replaced pro-Western governments in Guinea, […]

August 26, 2023

By Alexander William Salter “Predictions are hard, especially about the future,” the old […]

August 25, 2023

By Schiffgold The national debt has climbed to a staggering $32.7 trillion. In […]

August 23, 2023

By Felix Richter Over the past two decades, the world has witnessed a profound […]

August 17, 2023

2023.08.17 Inequality is one of the most volatile aspects of contemporary society, and […]

August 16, 2023

2023.08.16 Faced with the grim prospect of falling short of our climate targets, […]

August 16, 2023

2023.08.16 面对达不到气候目标的严峻前景,寻找更多实现电气化和脱碳所需的矿物的竞赛变得越来越重要。 提供整个全球能源行业分析和数据的国际能源署 (IEA) 预测,到 2040 年,用于电动汽车和电池存储的矿物需求将增长至少 30 倍。 锂的增长应该是最快的,在可持续发展情景中,需求增长超过 40 倍,其次是石墨、钴和镍(约 20-25 […]

August 11, 2023

2023.08.11 The markets for two of agriculture’s staple crops, rice and wheat, are […]

August 10, 2023

2023.08.10 Global warming has raised the economic status and political importance of critical […]

August 10, 2023

By The Economist Latin America is no stranger to supplying the world with […]

August 9, 2023

By David McKay A DECLINE in the copper price since the beginning of the year […]

August 8, 2023

By Niccolo Conte The push towards a more sustainable future requires various key […]

August 6, 2023

By Dorothy Neufeld Total global debt stands at nearly $305 trillion as of the first […]

August 5, 2023

By Goehring & Rozencwajg Are we in a commodity supercycle? In this episode, Adam […]

August 2, 2023

By Dorothy Neufeld Total global debt stands at nearly $305 trillion as of the first […]

July 27, 2023

2023.07.27 By now, we’ve probably surrendered to the fact that food prices will […]

July 27, 2023

2023.07.27 到目前为止,我们可能已经接受了这样一个事实:世界各地的食品价格将继续变得更加昂贵。 在加拿大,平均食品杂货账单不断上涨。对一些家庭来说,现在已经难以承受。 6 月份,加拿大食品通胀同比增长 9.1%,紧跟 5 月份增长的 9%。 与正在放缓的 2.8% 的总体通胀率相比,食品价格的走势似乎是一个大问题。 加拿大统计局上个月通过 […]

July 24, 2023

By Goehring & Rozencwajg Incredibly, by 2016 commodity prices had sold off to […]

July 20, 2023

2023.07.20 On July 9 the US dollar index (DXY) slipped under 100 for […]

July 20, 2023

By Egon von Greyerz In spite of unprecedented risks in investment markets, for the […]

July 16, 2023

By QUOTH THE RAVEN No better, more reliable forecaster of the US business […]

July 13, 2023

By SCHIFFGOLD One of the singularities of the present time is the American position […]

July 9, 2023

2023.07.09 We are moving into a multipolar reserve-currency world where the dollar will […]

June 18, 2023

Warming temperatures and thawing sea ice could soon allow for the expansion of […]