Markets

March 23, 2023

By macromon Interest payments on the national debt during the current fiscal year (October […]

March 8, 2023

2023.03.08 Has anybody noticed there is something strange going on in commodities? Whether […]

March 2, 2023

By Alasdair Macleod Central banks were happy to suppress interest rates, even into […]

February 24, 2023

2023.02.23 Consumer spending makes up 70% of global GDP. It’s no wonder, therefore, […]

February 23, 2023

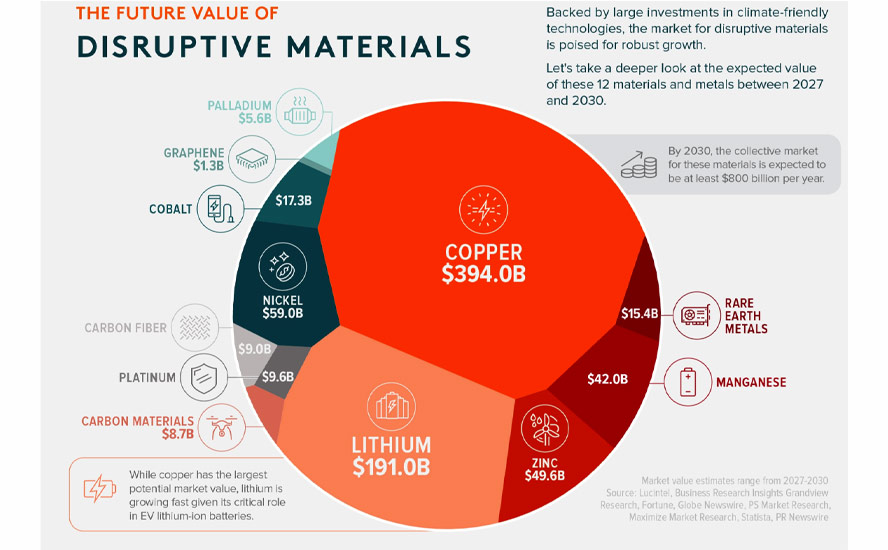

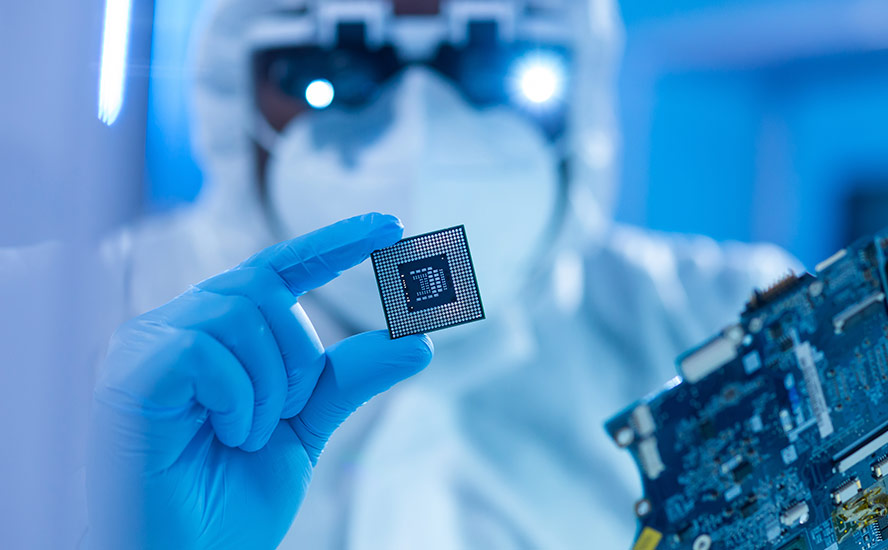

By Aran Ali A select number of materials have a critical role to […]

February 22, 2023

By Archie Hunter After making more money than ever in the last few […]

February 21, 2023

By The Economist After a calm 2010s, in which interest rates hardly budged, inflation is putting […]

February 21, 2023

By SchiffGold Despite the hotter-than-expected CPI report, the mainstream still seems convinced that the […]

February 16, 2023

By Dorothy Neufeld Investors are bracing for longer inflation. The Federal Reserve indicated […]

February 16, 2023

By Quoth the Raven Never before has it been more evident why the […]

February 11, 2023

By Quoth the Raven 2023.03.11 It would be a situation where we are […]

February 7, 2023

By Daniel Lacalle 2023.02.07 The monster inflation we’ve endured these past years first […]

February 2, 2023

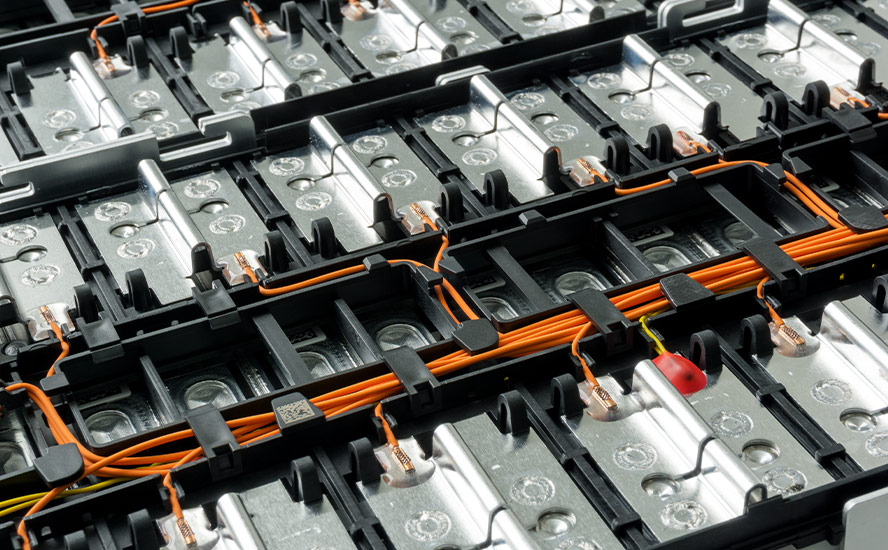

2023.02.02 The transition from fossil fuels to electrified transportation and renewable energy is […]

February 1, 2023

By Wolf Richter 2023.02.01 The Bank of Canada hiked its policy rates by […]

February 1, 2023

By Quoth the Raven 2023.02.01 It’s not the time to celebrate the S&P’s […]

January 31, 2023

BY SCHIFFGOLD 2023.01.31 The mainstream is optimistic about both the economy and the Fed’s […]

January 30, 2023

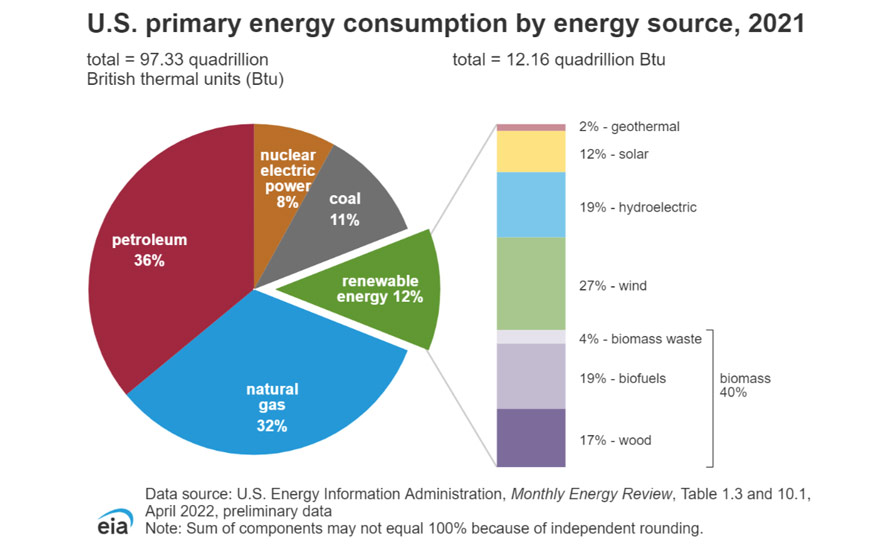

By Bruno Venditti 2023.01.30 Wealthy countries consume massive amounts of natural resources per […]

January 28, 2023

2023.01.28 The shift to a world powered by renewable energy and run on […]

January 28, 2023

By Egon von Greyerz 2023.01.28 “The risk of over-tightening by the European Central Bank […]

January 27, 2023

By Joseph E. Stiglitz 2023.01.27 NEW YORK – Despite favorable indices, it is […]

January 26, 2023

By Quoth the Raven 2023.01.26 Friend of Fringe Finance Lawrence Lepard released his most recent […]

January 23, 2023

By The Economist 2023.01.23 Winter has come—and it isn’t pretty Chief executives of the […]

January 22, 2023

By Brian Boone 2023.01.22 So far, in the 2020s, farmers, food processors, suppliers, […]

January 18, 2023

By Thomas Biesheuvel, Dinesh Nair and Jack Farchy, with assistance from Archie Hunter, Annie […]

January 17, 2023

By Govind Bhutada 2023.01.17 Hard commodities had a roller coaster year in 2022. […]

January 14, 2023

2023.01.14 US inflation cooled in December, putting the US Federal Reserve on track […]

January 1, 2023

What gets me, though, is how bad Canadian politicians are at negotiating. Here we finally have a resource that should give us significant leverage in dealing with our largest trading partner, ie., critical metals. In return for offering our minerals and our mining expertise, what are we asking for in return? I’ve yet to discover anything in print.

December 31, 2022

It seems fitting that the year we are expecting to see an unprecedented rise in US government spending and money-printing to spur an economic recovery, marks the 50th anniversary of the end of the gold standard.

Done at the time to fight an economic crisis, we are still feeling the effects of this disastrous decision, five decades on.

In this article, we explain why President Nixon did what he did, and why every promise that unshackling the US government from the requirement of maintaining the dollar's value in terms of gold would mean for the United States, has been broken.

Done at the time to fight an economic crisis, we are still feeling the effects of this disastrous decision, five decades on.

In this article, we explain why President Nixon did what he did, and why every promise that unshackling the US government from the requirement of maintaining the dollar's value in terms of gold would mean for the United States, has been broken.

December 16, 2022

2022.12.16 For decades, China has dominated critical minerals, with Canada and the US, […]

December 12, 2022

2021.12.12 Dried-up rivers and alarmingly low reservoir levels are manifestations of climate change. […]

December 8, 2022

2022.12.08 Over the past year, relentlessly rising interest rates (because of the global […]

December 7, 2022

2022.12.07 The economist who predicted the financial crisis sees a “long and ugly” […]

December 4, 2022

2022.12.04 Economist Nouriel Roubini believes the world economy is lurching toward an unprecedented […]

December 1, 2022

2022.12.01 The US Federal Reserve continues to grapple with inflation, which at 7.7% […]

November 16, 2022

2022.11.16 Canada and the United States are finally getting serious about protecting their […]

November 11, 2022

2022.11.11 Gold and silver prices jumped on Thursday following the release of October’s […]

November 5, 2022

2022.11.15 In 2021 the world’s militaries spent USD$2.1 trillion, marking the seventh straight […]

November 3, 2022

2022.11.03 The US Federal Reserve is grappling with how to reduce inflation, which […]

October 24, 2022

2022.10.24 Chrystia Freeland is Canada’s Deputy Prime Minister and the Minister of Finance. […]

October 19, 2022

2022.10.19 For more than a year, the US dollar has been gaining strength […]

September 26, 2022

2022.09.26 It appears the days of being a “one trick pony” mining company […]

September 22, 2022

2022.09.22 At the Federal Reserve’s annual retreat in Jackson Hole, Wyoming, Chairman Jerome […]

September 17, 2022

2022.09.17 This year has seen a correction in the gold price, commensurate with […]

September 6, 2022

2022.09.06 At the start of August, British homeowners saw an 80% increase in […]

September 2, 2022

2022.09.02 Russia’s invasion of Ukraine may have the unforeseen consequence of weakening the […]

August 23, 2022

2022.08.23 Inflation is at a 40-year high, making commodities, which protect investments from […]

August 19, 2022

2022.08.19 Years of neglecting its critical metal supplies is finally catching up with […]

August 16, 2022

2022.08.16 In 1979, then US Federal Reserve Chair Paul Volcker faced a serious […]

August 8, 2022

2022.08.08 The US dollar is the most important unit of account for international […]

August 6, 2022

2022.08.05 The US Federal Reserve started off declaring that historically high levels of […]

July 16, 2022

2022.07.16 Copper is one of our most important metals with more than 20 […]

July 12, 2022

2022.07.12 The South China Morning Post reported in January that China is fast-tracking 102 major […]

July 6, 2022

2022.07.06 In George Orwell’s book ‘1984’, the world is divided among three superpowers, […]

June 29, 2022

2022.06.29 Last week was a bad one for mining & metals. Amid fears […]

June 23, 2022

2022.06.23 Inflation is at a 40-year high, making commodities, which protect investments from […]

June 18, 2022

2022.06.18 The dollar is the most important unit of account for international trade, […]

June 17, 2022

2022.06.17 We call ourselves Ahead of the Herd because we see things before […]

May 31, 2022

2022.05.31 With inflation in the US reaching its highest in 40 years, there […]

May 30, 2022

2022.05.30 A comparison of this year’s grocery bills to last year’s yields a […]

May 19, 2022

2022.05.19 In economics parlance, the term “soft landing” refers to a cyclical slowdown […]

April 29, 2022

2022.04.29 In our last article, we discussed a proposed new economic model for […]

April 27, 2022

2022.04.27 Modern Monetary Theory, or MMT, posits that rather than obsessing about how […]

April 26, 2022

2022.04.26 For shrewd investors looking to diversify their portfolios with low-risk, high-return assets, […]

April 24, 2022

2022.04.24 In our last article, ‘If it can’t be grown it must be […]

April 24, 2022

2022.04.24 Last year mining analysts Mike Kozak and Matthew O’Keefe of Cantor Fitzgerald […]

April 22, 2022

2022.04.22 A recession is what results when an economy stops growing. The National […]

April 14, 2022

2022.04.14 The new “commodities super-cycle” touted by many including Goldman Sachs, may be […]

March 19, 2022

2022.03.19 Food inflation has historically been the catalyst for many popular uprisings, from […]

February 25, 2022

2022.02.25 In 2021, commodities outperformed all other asset classes, and they are expected […]

February 14, 2022

2022.02.14 The move away from fossil-fuel-powered vehicles to EVs run on batteries is […]

February 12, 2022

2022.02.12 Commodities are considered one of the best places to park investment capital […]

February 8, 2022

2022.02.08 Someone born in 1979 is 43 years old this year. No doubt […]

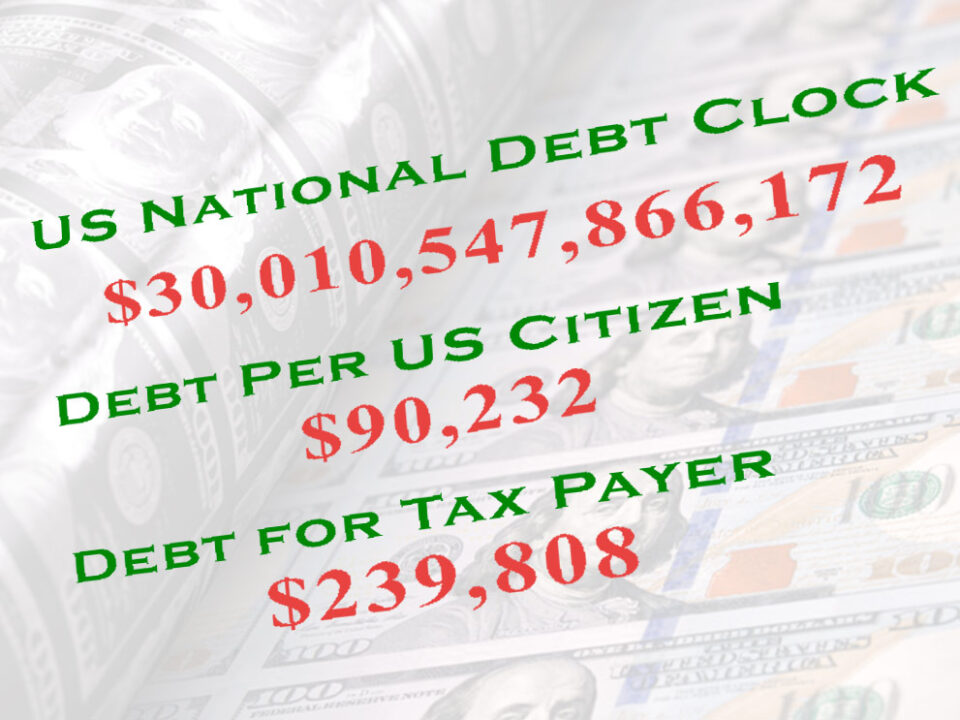

February 7, 2022

2022.02.07 The United States reached a new milestone this week, but it’s nothing […]

January 21, 2022

2022.01.21 Inflation is the rate at which prices within a basket of goods […]

January 15, 2022

2022.01.05 Inflation is one of the best determinants of gold price movements, because […]

January 11, 2022

2022.01.11 China and Japan are by far the largest buyers of US Treasuries. […]

December 28, 2021

The modernization and electrification of our global transportation system will require a change hitherto unprecedented in the history of civilization. Not even the shift from horse and buggy to the crank-start Ford Model T can compete with what it will take to electrify the billion-plus cars on the planet’s roads, and eventually put a complete stop to noxious tailpipe emissions resulting from the combustion of gasoline and diesel fuel, that are poisoning the air we breathe.

For now, thorium is a theoretical solution to our energy dilemma, but it could be much more than that. A concerted effort to develop thorium reactor technology could provide stable, clean, base-load power for millions, something that is not possible with renewables due to the intermittency factor and the current early stages of renewable battery storage technology. It is safer and better for the environment than uranium and can even use radioactive waste as feedstock for the nuclear reaction, thus killing two birds with one stone. The market is not yet ready for thorium, but when it is, a whole new mining sector and supply chain will be born.

For now, thorium is a theoretical solution to our energy dilemma, but it could be much more than that. A concerted effort to develop thorium reactor technology could provide stable, clean, base-load power for millions, something that is not possible with renewables due to the intermittency factor and the current early stages of renewable battery storage technology. It is safer and better for the environment than uranium and can even use radioactive waste as feedstock for the nuclear reaction, thus killing two birds with one stone. The market is not yet ready for thorium, but when it is, a whole new mining sector and supply chain will be born.

December 21, 2021

2021.12.21 The gold to oil ratio is an important indicator of the global […]

December 18, 2021

2021.12.18 Several months after the US Federal Reserve began describing the country’s inflation […]

December 17, 2021

2021.12.17 The US Federal Reserve announced this week what many market participants were […]

December 16, 2021

2021.12.16 A government generally has two “levers” it can pull, to help get […]