Education

November 10, 2022

2022.11.10 At Ahead of the Herd, we pride ourselves on being right, when […]

November 5, 2022

2022.11.15 In 2021 the world’s militaries spent USD$2.1 trillion, marking the seventh straight […]

November 3, 2022

2022.11.03 The US Federal Reserve is grappling with how to reduce inflation, which […]

October 24, 2022

2022.10.24 Chrystia Freeland is Canada’s Deputy Prime Minister and the Minister of Finance. […]

October 19, 2022

2022.10.19 For more than a year, the US dollar has been gaining strength […]

October 18, 2022

2022.10.18 Although British Columbia experienced an unusually cold and wet spring, delaying the […]

October 7, 2022

2022.10.07 Unusually warm weather and forest fires burning into October are two signs […]

October 5, 2022

2022.10.05 A new research paper by the International Monetary Fund estimates that the […]

September 17, 2022

2022.09.17 This year has seen a correction in the gold price, commensurate with […]

September 3, 2022

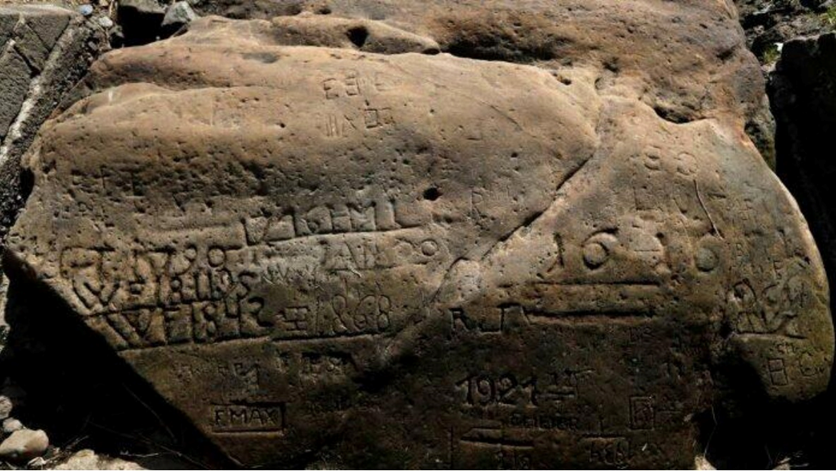

2022.09.03 Hundreds of years ago, early Europeans hit with a devastating drought thought […]

June 24, 2022

2022.06.24 British Columbia is once again locked into a weather pattern seemingly dictated […]

June 17, 2022

2022.06.17 We call ourselves Ahead of the Herd because we see things before […]

June 9, 2022

2022.06.09 Last month, we reported that Tesla, the largest electric vehicle manufacturer, was removed […]

June 7, 2022

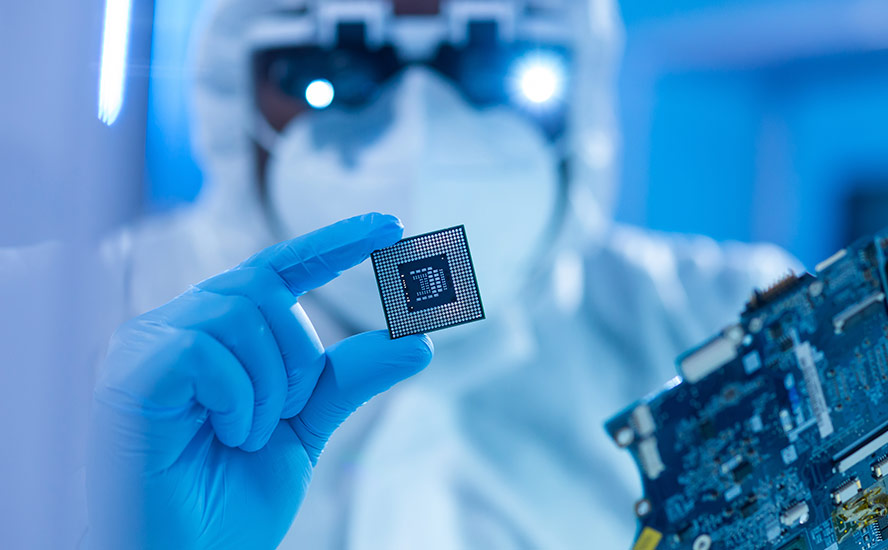

2022.06.07 While the Covid-19 pandemic was dominating headlines in 2020, another major crisis […]

June 3, 2022

2022.06.03 History tells us that previous Fed rate hikes to deal with uncomfortably […]

May 31, 2022

2022.05.31 With inflation in the US reaching its highest in 40 years, there […]

May 30, 2022

2022.05.30 A comparison of this year’s grocery bills to last year’s yields a […]

May 28, 2022

2022.05.28 The climate on planet Earth is changing, and a lot faster than […]

May 27, 2022

2022.05.27 TV BROADCAST NETWORKS and TIMES: CANADA: BNN Bloomberg – Saturday May 28 @ 8:00pm ET, Sunday May […]

May 26, 2022

2022.05.26 When Russia invaded Ukraine in February, pundits explained it as President Vladimir […]

May 24, 2022

2022.05.24 It’s slightly mind-blowing to know that, while 70% of the Earth’s surface is […]

May 20, 2022

2022.05.20 As shareholders demand that companies place more emphasis on environmental, social and […]

May 19, 2022

2022.05.19 Consumers today are mostly worried about gasoline prices approaching “unaffordable” territory, but […]

May 12, 2022

2022.05.12 A comparison of this year’s grocery bills to last year’s yields a […]

May 1, 2022

2022.05.01 The green economy is one of the most important buzzwords of the […]

April 29, 2022

2022.04.29 In our last article, we discussed a proposed new economic model for […]

April 27, 2022

2022.04.27 Modern Monetary Theory, or MMT, posits that rather than obsessing about how […]

April 24, 2022

2022.04.24 In our last article, ‘If it can’t be grown it must be […]

April 24, 2022

2022.04.24 Last year mining analysts Mike Kozak and Matthew O’Keefe of Cantor Fitzgerald […]

April 22, 2022

2022.04.22 A recession is what results when an economy stops growing. The National […]

April 16, 2022

2022.04.16 The gold-oil ratio is an important indicator of the global economy’s health. […]

April 14, 2022

2022.04.14 The new “commodities super-cycle” touted by many including Goldman Sachs, may be […]

April 4, 2022

2022.04.04 March 1, 2022 could well be looked back upon as a monumental […]

February 5, 2022

2022.02.05 We have come to terms that a global transition to clean energy […]

January 19, 2022

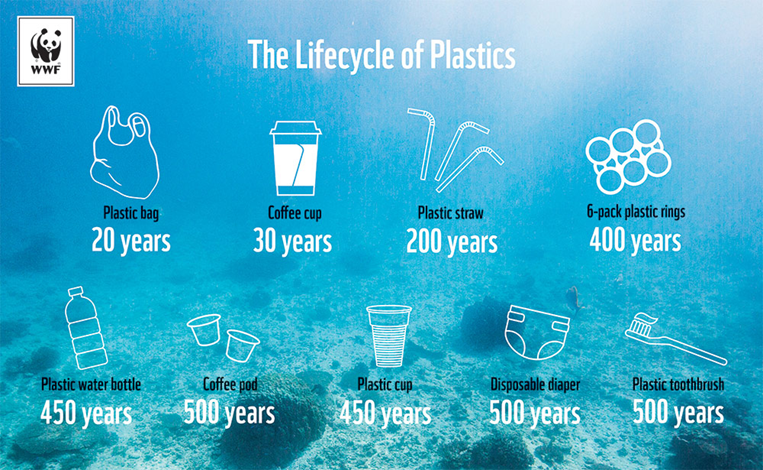

Evanesce tackling single-use plastic problem with 100% compostable straws and Styrofoam alternatives

2022.01.19 Think about this: Every time you buy a soft drink that comes […]

January 11, 2022

2022.01.11 China and Japan are by far the largest buyers of US Treasuries. […]

January 7, 2022

2022.01.07 The United States and its allies, such as Canada, the UK, the […]

December 28, 2021

2021.12.22 An especially cold fall and an even colder blast of winter on […]

December 28, 2021

The modernization and electrification of our global transportation system will require a change hitherto unprecedented in the history of civilization. Not even the shift from horse and buggy to the crank-start Ford Model T can compete with what it will take to electrify the billion-plus cars on the planet’s roads, and eventually put a complete stop to noxious tailpipe emissions resulting from the combustion of gasoline and diesel fuel, that are poisoning the air we breathe.

For now, thorium is a theoretical solution to our energy dilemma, but it could be much more than that. A concerted effort to develop thorium reactor technology could provide stable, clean, base-load power for millions, something that is not possible with renewables due to the intermittency factor and the current early stages of renewable battery storage technology. It is safer and better for the environment than uranium and can even use radioactive waste as feedstock for the nuclear reaction, thus killing two birds with one stone. The market is not yet ready for thorium, but when it is, a whole new mining sector and supply chain will be born.

For now, thorium is a theoretical solution to our energy dilemma, but it could be much more than that. A concerted effort to develop thorium reactor technology could provide stable, clean, base-load power for millions, something that is not possible with renewables due to the intermittency factor and the current early stages of renewable battery storage technology. It is safer and better for the environment than uranium and can even use radioactive waste as feedstock for the nuclear reaction, thus killing two birds with one stone. The market is not yet ready for thorium, but when it is, a whole new mining sector and supply chain will be born.

December 21, 2021

2021.12.21 The gold to oil ratio is an important indicator of the global […]

December 7, 2021

2021.12.07 What does it mean to go hungry? The United Nations says hunger […]

November 25, 2021

National Geographic says the problem of discarded plastic is so severe, that if nothing is done, by 2050 the oceans will contain more plastic than fish, ton for ton.

Especially worrying are “nanoplastics” — pieces that are so tiny, they are able to penetrate human cell walls.

Especially worrying are “nanoplastics” — pieces that are so tiny, they are able to penetrate human cell walls.

November 23, 2021

2021.11.23 British Columbia residents are learning new climate science terms being used by […]

November 18, 2021

2021.11.18 Residents of southern British Columbia only had a few weeks of peace […]

November 1, 2021

2021.11.01 https://www.financialsense.com/podcast/20100/big-three-commodities-electrification-and-decarbonization Rick Mills, author of the aheadoftheherd.com newsletter, discusses the long-term investment […]

October 21, 2021

2021.10.21 While the concept of wellness has been around for ages, it was […]

October 15, 2021

2021.10.15 The balance of trade is an important barometer of a country’s economic […]

September 22, 2021

2021.09.22 Economists love to tout theories that investors can use to predict the […]

September 21, 2021

2021.09.21 The selloff in stocks that started last week and continued on Monday […]

September 10, 2021

2021.09.10 There is an old joke often told about economists: Three economists are […]

September 8, 2021

2021.09.08 Lower interest rates and massive asset purchases by central banks are the […]

September 1, 2021

2021.09.01 A year and a half into the covid-19 battle, with no end […]

August 20, 2021

2021.08.20 Gold prices are slipping as talk of a “taper tantrum” has investors […]

August 18, 2021

2021.08.18 It was hard to believe the wildfire situation in British Columbia could […]

August 13, 2021

August 9, 2021

2021.08.09 Where should a smart investor park their savings in this current market, […]

August 6, 2021

2021.08.06 If rising food prices are ruining your appetite, you’re not alone. Costs […]

July 27, 2021

2021.07.27 A scorching summer heat wave, thought to that killed over 700 Vancouver-area […]

July 20, 2021

2021.07.20 Heads of state gathered on Dec. 12, 2015, for the 21st conference […]

June 11, 2021

What’s the point of making supposedly “green” battery components when the refining process is so dirty?

May 27, 2021

Joe Biden’s position on mining has always been murky.

Publicly the veteran Senator turned US President says all the right things to show mine workers he is on their side. Away from the cameras Biden is listening to the anti-mining left wing of his Democratic Party controlled by liberal progressives and environmentalists, doing whatever he can to scupper new mining projects and oil pipelines.

Publicly the veteran Senator turned US President says all the right things to show mine workers he is on their side. Away from the cameras Biden is listening to the anti-mining left wing of his Democratic Party controlled by liberal progressives and environmentalists, doing whatever he can to scupper new mining projects and oil pipelines.

May 23, 2021

Resource nationalism is the tendency of people and governments to assert control, for strategic and economic reasons, over natural resources located on their territory. It has been identified as one of the key risks for investors in the natural resources sector.

Miners are easy targets because mining is a long-term investment and one that is especially capital intensive. Mines are also immobile, so mining companies are at the mercy of the countries in which they operate. Outright seizure of assets happens using the twin excuses of historical injustice and environmental or contractual misdeeds. There is no compensation offered and no recourse.

Miners are easy targets because mining is a long-term investment and one that is especially capital intensive. Mines are also immobile, so mining companies are at the mercy of the countries in which they operate. Outright seizure of assets happens using the twin excuses of historical injustice and environmental or contractual misdeeds. There is no compensation offered and no recourse.

May 14, 2021

Continuing the US (and Canadian) economic recovery is obviously important but it should not come on the backs of the poor who bear the most weight of inflation, particularly increases in food prices.

Government officials need to be aware of how their monetary and fiscal policies are impacting the most vulnerable in society.

Government officials need to be aware of how their monetary and fiscal policies are impacting the most vulnerable in society.

May 3, 2021

Look up the word sustainable in the Oxford English dictionary and you get the following definition: “avoidance of the depletion of natural resources in order to maintain an ecological balance.”

Unfortunately the world’s ecological balance has not been right for a very long time. As a society, we are consuming resources far more quickly than we are replacing them, which is the very definition of unsustainable.

Unfortunately the world’s ecological balance has not been right for a very long time. As a society, we are consuming resources far more quickly than we are replacing them, which is the very definition of unsustainable.

April 14, 2021

Gold prices ticked higher on Tuesday after inflation data showed US consumer prices rose in March for the fourth straight month and inflation hit its highest level in 2.5 years.

The US Federal Reserve, whose dual mandate is to keep inflation in the “Goldilocks zone” of around 2% and to control unemployment, has been downplaying inflation, telling the public that even if prices rise, it will only be temporary.

The US Federal Reserve, whose dual mandate is to keep inflation in the “Goldilocks zone” of around 2% and to control unemployment, has been downplaying inflation, telling the public that even if prices rise, it will only be temporary.

April 13, 2021

ESG was a dominant theme running through this year’s AME Roundup conference in Vancouver.

Ross Beaty, chairman of Pan American Silver and Equinox Gold, said “It’s just critical. Every single meeting you have with investors, it’s number one on the topic (list).”

Ross Beaty, chairman of Pan American Silver and Equinox Gold, said “It’s just critical. Every single meeting you have with investors, it’s number one on the topic (list).”

April 10, 2021

As pioneers of a leading-edge addiction recovery solution based on psychedelic medicine, Entheon Biomedical Corp. (CSE: ENBI) (FSE: 1XU1) has been actively expanding its business over the past weeks. The culmination of that work is the release of a potentially groundbreaking product in the field of psychedelic therapy, which would also represent the company’s first revenue stream.

April 9, 2021

Amid bombastic statements that scared US consular officials and alienated allies, like calling North Korea’s Kim Jong-un “rocket man”, rejecting the Iran nuclear deal and declaring that the US embassy would be moved from Tel Aviv to Jerusalem, former President Trump occasionally had flashes of brilliance.

One such instance was said to have occurred regarding Taiwan.

According to John Bolton’s memoir, Trump liked to point to the tip of a Sharpy and say, “This is Taiwan,” then motion to the desk in his Oval Office and say “This is China. Taiwan is like two feet from China, we are 8,000 miles away. If they invade there isn’t a f&%*ing thing we can do about it.”

One such instance was said to have occurred regarding Taiwan.

According to John Bolton’s memoir, Trump liked to point to the tip of a Sharpy and say, “This is Taiwan,” then motion to the desk in his Oval Office and say “This is China. Taiwan is like two feet from China, we are 8,000 miles away. If they invade there isn’t a f&%*ing thing we can do about it.”

March 31, 2021

As the fight against the coronavirus continues to take center stage, an insidious environmental problem is getting worse: plastic pollution.

The global health crisis has prompted a rush for single-use plastic just as governments around the world were taking steps to curtail or ban its usage. Demand has surged for everything from face shields and gloves to takeaway food containers and bubble wrap for online shopping — most of which cannot be recycled and is ending up as waste.

The global health crisis has prompted a rush for single-use plastic just as governments around the world were taking steps to curtail or ban its usage. Demand has surged for everything from face shields and gloves to takeaway food containers and bubble wrap for online shopping — most of which cannot be recycled and is ending up as waste.

March 19, 2021

One of the most iconic and successful ventures to come out of the 2017 crypto mania was a blockchain-based game called CryptoKitties.

As CryptoKitties’ popularity grew, so too did investor interest. In 2018, top venture capital firms Andreesen Horowitz and Union Square Ventures pumped $12 million into the development studio responsible for the original game.

To demonstrate its superiority to the Ethereum network, Codebase announced last month that Arcology has released an improved version of CryptoKitties. The new game — called LightspeedKitties — was optimized to take advantage of Arcology’s processing power and native ability to dynamically adjust to network demands.

As CryptoKitties’ popularity grew, so too did investor interest. In 2018, top venture capital firms Andreesen Horowitz and Union Square Ventures pumped $12 million into the development studio responsible for the original game.

To demonstrate its superiority to the Ethereum network, Codebase announced last month that Arcology has released an improved version of CryptoKitties. The new game — called LightspeedKitties — was optimized to take advantage of Arcology’s processing power and native ability to dynamically adjust to network demands.

March 18, 2021

CBD start-up Love Hemp Group PLC (AQSE:LIFE, OTCQB:WRHLF) one of the UK's leading CBD and Hemp product suppliers, and UFC®, the world's premier mixed martial arts organization, today announced a five-year agreement that names Love Hemp the Official Global CBD Partner of UFC®.

The multi-million-dollar, five-year deal pairs the world’s premier mixed martial arts organization, and the largest pay-per-view event provider, with the leading UK supplier of hemp and cannabidiol (CBD) products.

The multi-million-dollar, five-year deal pairs the world’s premier mixed martial arts organization, and the largest pay-per-view event provider, with the leading UK supplier of hemp and cannabidiol (CBD) products.