Victory Resources

July 6, 2022

July 6, 2022

2022.07.06 Seasoned junior resource investors know, success comes not so much from what […]

Do you like it?

June 1, 2022

June 1, 2022

2022.06.01 Victory Resources’ (CSE:VR, FWB:VR61, OTC:VRCFF) Smokey lithium project is about 35 km […]

Do you like it?

May 18, 2022

May 18, 2022

2022.05.18 Despite an economic slowdown in China due to the return of the […]

Do you like it?

March 10, 2022

March 10, 2022

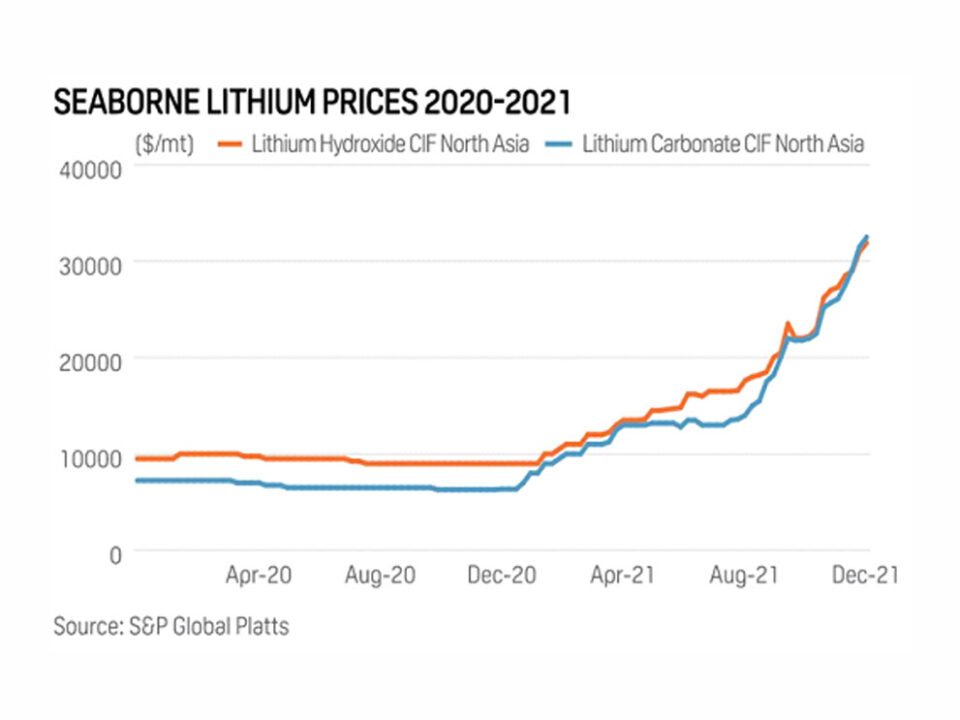

2022.03.10 Lithium is without question one of the most sought-after commodities right now, […]

Do you like it?

January 20, 2022

January 20, 2022

2022.01.20 Electrification and decarbonization are anticipated to be one of the biggest investment […]

Do you like it?

October 14, 2021

October 14, 2021

2021.10.14 The mining industry has been headlined by several major deals involving lithium […]

Do you like it?

September 25, 2021

September 25, 2021

2021.09.25 The global lithium market has seen a resurgence this year as governments […]

Do you like it?

September 5, 2021

September 5, 2021

2021.09.05 Victory Resources’ (CSE:VR, FWB:VR61, OTC:VRCFF) Loner property in Nevada is located 35 km […]

Do you like it?

July 13, 2021

July 13, 2021

2021.07.13 Drills could soon pierce targets at Victory Resources’ Smokey Lithium project (CSE:VR, FWB:VR61, […]

Do you like it?

May 16, 2021

May 16, 2021

One international mining company that is committed to exploring Nevada’s mineral-rich regions is Victory Resources Corp. (CSE: VR) (FWB: VR61) (OTC: VRCFF), which has been actively looking at precious metals opportunities in the state and recently expanded its focus to battery metals.

Do you like it?

April 2, 2021

April 2, 2021

As Victory Resources Corp. (CSE: VR) (FWB: VR61) (OTC: VRCFF) continues to scale up mining operations on multiple properties across North America, the company has made a significant management change to reflect its broadening exploration focus that now includes battery metals.

Do you like it?

March 9, 2021

March 9, 2021

Flush from a recent financing, and with a drill permit in hand, Victory Resources Corp. (CSE:VR, FWB: VR61, OTC:VRCFF) is preparing to drill its two flagship properties, Loner in Nevada and Mal-Wen in south-central British Columbia.

Consistently ranked among the best regions in the world for gold exploration, the western state of Nevada offers a low-risk, high-reward opportunity for gold juniors.

Consistently ranked among the best regions in the world for gold exploration, the western state of Nevada offers a low-risk, high-reward opportunity for gold juniors.

Do you like it?

March 5, 2021

March 5, 2021

Several factors influence gold prices (mainly the US dollar, gold ETF inflows/ outflows, inflation rate, bond yields, safe haven demand, physical gold demand, gold supply) but none is more reliable than real interest rates.

The demand for gold moves inversely to interest rates — the higher the rate of interest, the lower the demand for gold, the lower the rate of interest the higher the demand for gold.

The demand for gold moves inversely to interest rates — the higher the rate of interest, the lower the demand for gold, the lower the rate of interest the higher the demand for gold.

Do you like it?

February 25, 2021

February 25, 2021

2021.02.25 Gold has been taking a beating in recent weeks, the sell-off prompted […]

Do you like it?

January 21, 2021

January 21, 2021

2021.01.21 Precious metals are coming off a victorious year that saw gold and […]