Politics

December 15, 2023

By Michael Maharrey The Federal Reserve just surrendered to inflation. Fed officials won’t call […]

December 14, 2023

2023.12.14 In this ‘Under the spotlight’ written interview Rick Mills, editor of the […]

December 11, 2023

By Sarah Cox – The Narwhal When conservationist Eddie Petryshen learned BC Timber […]

December 11, 2023

By Wolf Richter – Wolf Street So this was not a rate-cut jobs report […]

December 7, 2023

By Quoth the Raven Over the weekend I had the pleasure of talking […]

December 6, 2023

2023.12.06 Manufacturing has always been an integral part of American life. Paul Revere […]

December 5, 2023

By Paul H. Kupiec – AEI The Secretary of the Treasury and the Financial […]

November 30, 2023

By Jonathan Newman – Mises Wire Are the chickens coming home to roost […]

November 28, 2023

By Jeremy Powell – MISES WIRE From the onset of the current Israeli-Hamas […]

November 28, 2023

By Tyler Durden – ZeroHedge Quantitative tightening isn’t working. At least not in the […]

November 27, 2023

By Colin McClelland – Mining.com The price of uranium will hit triple-digits for […]

November 27, 2023

November 27, 2023

November 26, 2023

2023.11.26 China is already gobbling up copper and copper ore at an incredible […]

November 26, 2023

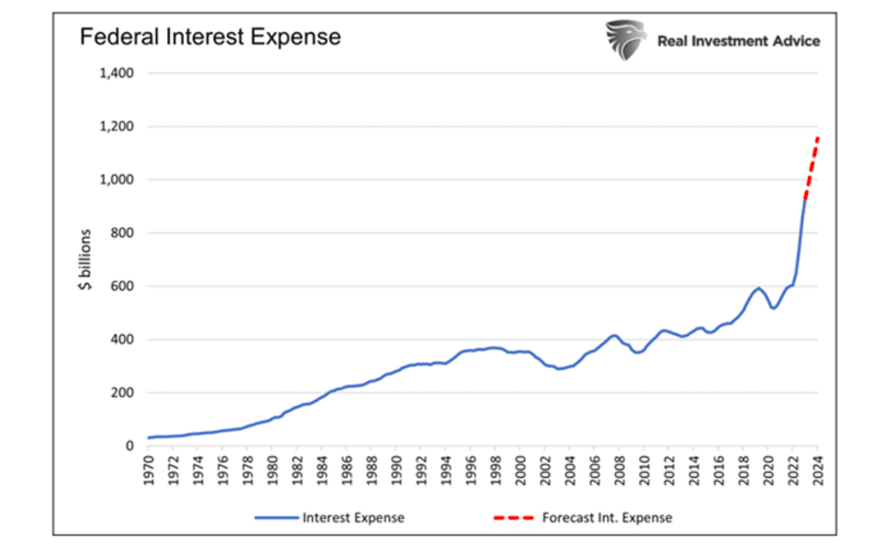

Penn Wharton University of Pennsylvania PWBM estimates that—even under myopic expectations—financial markets cannot […]

November 26, 2023

By Daniel Lacalle – MISES WIRE Market participants who assume rate cuts will […]

November 26, 2023

By Martin Armstrong – Armstrong Economics All the media is so anti-common sense […]

November 24, 2023

By Nouriel Roubini – Project Syndicate It is now common knowledge that economic, […]

November 23, 2023

By Tyler Durden – ZeroHedge It’s unusual for the Federal Reserve to hike […]

November 23, 2023

By Wolf Richter – Wolf Street The Fed, the ECB, the BOC, the […]

November 23, 2023

By Shang-Jin Wei – Project Syndicate Beyond undermining the rules-based international trading system, […]

November 20, 2023

By Stephen S. Roach US President Joe Biden and Chinese President Xi Jinping’s […]

November 16, 2023

2023.11.16 At Ahead of the Herd, we pride ourselves on being right, when […]

November 15, 2023

By Connor O’Keeffe Interventionism creates a mixed economy between socialism and capitalism where […]

November 13, 2023

By Peter St. Onge Sovereign debt is eating the world. Lining up a […]

November 12, 2023

By Nouriel Roubini With Israel embarked on a military campaign to eliminate Hamas […]

November 10, 2023

By Connor O’Keeffe In 2002, President George W. Bush cited the now famous […]

November 9, 2023

By Melissa Parke Nuclear history is rife with near-misses, with disaster averted by […]

November 9, 2023

The Economist The ballistic missiles that arced from Yemen to Israel on October 31st […]

November 9, 2023

By Peter Schiff Now, had they used another form of taxation, had the […]

November 5, 2023

By Ryan McMaken We find substantial evidence that the “strength” of the job […]

October 27, 2023

October 15, 2023

By The Economist Robert gates, a former defence secretary who served Republican and […]

October 11, 2023

By Michael Lebowitz On October 5, 2023, Treasury Secretary Janet Yellen made a […]

October 11, 2023

By Dow Jones A major Wall Street bank is warning about the risk that […]

October 3, 2023

By The Economist For a while, after the end of the cold war, it […]

October 2, 2023

By Stephen S Roach The debate over the difference between tactics and strategy […]

October 1, 2023

By Katharina Buchholz Government shutdowns aren’t all that rare: Since 1976, there have been […]

September 27, 2023

By The Tribune A top Australian envoy on Tuesday claimed China is putting […]

September 17, 2023

By Ernest Hoffman The Biden administration is proposing a dramatic overhaul of a 151-year-old law […]

September 11, 2023

By The Economist In many ways the bri has lived up to the hype. More […]

September 8, 2023

2023.09.08 A while ago, we insinuated that the Federal Reserve may just be […]

September 8, 2023

2023.09.08 不久前,我们暗示美联储可能能够实现其传说中的“软着陆”,而从目前美国经济的发展情况来看,这一预测看起来相当精明。 正如我们在之前的文章中详述的那样,线索一直存在:作为经济活动很大一部分驱动力的美国大公司正在赚取巨额利润,这意味着更高的就业率和消费者的可支配收入。 仅仅通过提高价格来适应通胀主题,不断上升的利率除了提高利润外什么也没做。事实上,利息支付占税后利润的百分比实际上处于 60 年来的最低水平!因此,标普 500 指数收复了 2022 年熊市一半以上的损失也就不足为奇了,而且正如华尔街所声称的那样,现在正处于牛市。 正如我们之前多次讨论过的,央行不能仅仅因为无力承担而继续加息(请注意,目前美国联邦债务的年度支付额为 32.6 万亿美元,即将达到 […]

September 8, 2023

September 7, 2023

By ARVIND SUBRAMANIAN and JOSH FELMAN Following the BRICS’ recent announcement that it will add […]

September 7, 2023

By Katharina Buchholz The G20, which is meeting this weekend in New Delhi, India, […]

September 7, 2023

By Visual Capitalist The US reliance on copper is expected to increase from […]

September 6, 2023

2023.07.28 For over a year now, the financial talking heads have been discussing […]

September 6, 2023

2023.09.06 Mining — like any other sector — has experienced its fair share […]

September 6, 2023

2023.09.06 与任何其他行业一样,采矿业在过去十年中也经历了相当多的问题,影响了其整体声誉和效率。 现在面临着为全球能源转型提供足够矿物的艰巨挑战,该行业必须深入挖掘——无论是字面上还是隐喻上——以提高其绩效。 但问题的根源是多方面的,阻力来自各个方面。关键问题包括全球技能短缺、环境和人权问题以及资金的可用性和使用。 在这些问题得到解决之前,采矿业的价值将无法最大化,并且该行业可能在未来十年遭受同样的命运。 下面,我们将探讨采矿业长期可持续发展的每一个主要障碍,以及该行业已经(或尚未)采取哪些措施来减轻这些风险。 关键技能差距 采矿业面临的最大挑战之一是劳动力老龄化和后继人才缺乏造成的技能差距日益扩大。 科罗拉多矿业学院研究和技术转让副总裁沃尔特·科潘 (Walter Copan) 表示,采矿业正面临着严重的技能差距,再加上即将到来的预期退休人数方面的所谓“灰色海啸”,情况更加严重。 德勤今年早些时候发布的一项研究显示,近 […]

September 4, 2023

By The Economist From offices in America’s State Department and Russia’s Ministry of Defence, officials […]

September 4, 2023

August 29, 2023

By Jan Kallberg Ukraine’s counteroffensive is making substantial progress. Russia’s generals will know this, […]

August 28, 2023

By Daniel Lacalle The summit of the so-called BRICS (Brazil, Russia, India, China, and […]

August 28, 2023

By Emily Vance Despite thousands of years of caring for these lands and […]

August 27, 2023

By JIM O’NEILL Now that the BRICS (Brazil, Russia, India, China, and South […]

August 27, 2023

By Doug Casey International Man: Since 2020, coups have replaced pro-Western governments in Guinea, […]

August 25, 2023

By Schiffgold The national debt has climbed to a staggering $32.7 trillion. In […]

August 24, 2023

By Nouriel Roubini China and America both need to pursue policies that will […]

August 17, 2023

2023.08.17 Inequality is one of the most volatile aspects of contemporary society, and […]

August 11, 2023

2023.08.11 The markets for two of agriculture’s staple crops, rice and wheat, are […]

August 10, 2023

2023.08.10 Global warming has raised the economic status and political importance of critical […]

August 8, 2023

2023.08.08 Country risk is one of the most important factors to consider in […]

August 8, 2023

By Niccolo Conte The push towards a more sustainable future requires various key […]

July 27, 2023

2023.07.27 By now, we’ve probably surrendered to the fact that food prices will […]

July 27, 2023

2023.07.27 到目前为止,我们可能已经接受了这样一个事实:世界各地的食品价格将继续变得更加昂贵。 在加拿大,平均食品杂货账单不断上涨。对一些家庭来说,现在已经难以承受。 6 月份,加拿大食品通胀同比增长 9.1%,紧跟 5 月份增长的 9%。 与正在放缓的 2.8% 的总体通胀率相比,食品价格的走势似乎是一个大问题。 加拿大统计局上个月通过 […]

July 26, 2023

2023.07.06 The recently attempted coup by Yevgeny Prigozhin, head of Russia’s mercenary Wagner Group, […]

July 22, 2023

2023.07.22 Inequality is one of the most volatile aspects of contemporary society, and […]

July 13, 2023

2023.07.13 In economics, a “soft landing” widely refers to a moderate economic slowdown […]

July 13, 2023

2023.07.13 在经济学中,“软着陆”广泛指的是在经历了一段成功避免衰退的增长期之后经济适度放缓。从隐喻上讲,它类似于该术语最初在航空领域的使用方式——飞行员试图让飞机平稳着陆而不坠毁。 当肩负着阻止经济因高通胀而过热的任务时,美联储等央行通常会提高利率,使其刚好足以引发经济放缓(即软着陆),但不足以引发严重的经济衰退(称为“硬着陆”)。 虽然定义“软着陆”的量化因素长期以来一直存在争议,但在失业率不大幅飙升(最好低于 5%)的情况下让通胀率回到或接近 2% 的目标通常被视为基本要求。 “软着陆”一词在前美联储主席艾伦·格林斯潘 (Alan Greenspan) 任职期间首次流行,人们普遍认为他在 1994 年至 […]

July 7, 2023

2023.07.07 In 2013, then-Liberal Party of Canada leader Justin Trudeau was asked which […]

June 18, 2023

Warming temperatures and thawing sea ice could soon allow for the expansion of […]

June 18, 2023

By Joseph E. Stiglitz No one argues that policymakers should not think about […]

June 13, 2023

By Martin Armstrong Released today, the latest figures from SIPRI reveal an annual […]

June 6, 2023

May 31, 2023

By Addison Graham China offered the trade and investment that Latin American leaders can’t […]

May 30, 2023

By Goldman Sachs As the U.S. and China coexist, compete, and confront each […]

May 30, 2023

By Nouriel Roubini The G7 countries may have set out to deter China […]

May 24, 2023

By The Economist By failing to raise America’s debt ceiling in time, Congress […]

May 9, 2023

By The Economist Ever since British troops vanquished Qing dynasty forces in the Opium […]

May 9, 2023

May 6, 2023

May 3, 2023

By Kenneth Rogoff Over the past few years, China has significantly expanded its […]

April 27, 2023

2023.04.27 In 2020 British Columbia’s NDP government approved LNG Canada, the first megaproject […]

April 27, 2023

By James Rickards I’ve said to the military and intelligence community, “I don’t think […]

April 19, 2023

2023.04.19 Most people can remember what they were doing on the blue bird […]

April 2, 2023

by Doug Casey Throughout history, governments have used crises—real or imagined—to eliminate freedoms, expand […]

March 30, 2023

2023.03.30 Should we leave the creation of new money in the hands of […]

March 26, 2023

By Ian Bremmer Gzero The popular video-sharing app’s Chinese parent company, ByteDance, has […]

March 23, 2023

By macromon Interest payments on the national debt during the current fiscal year (October […]

March 22, 2023

By The Economist The iraq war began on March 21st 2003, when Baghdad’s night […]

March 20, 2023

By The Economist Asia’s biggest democracy and, in Japan, its richest one, were […]

March 20, 2023

By Egon von Greyerz Anyone who doesn’t see what is happening will soon lose […]

March 16, 2023

By The Economist Only ten days ago you might have thought that the banks […]

March 12, 2023

By Goehring & Rozencwajg Crude oil fundamentals are very tight and risk getting […]

March 8, 2023

2023.03.08 Americans are leaning more on their credit cards and home-equity lines of […]