Education

December 15, 2023

By NASA EMIT delivers first-of-a-kind maps of minerals in Earth’s dust-source areas, enabling […]

December 11, 2023

By Sarah Cox – The Narwhal When conservationist Eddie Petryshen learned BC Timber […]

December 6, 2023

2023.12.06 Manufacturing has always been an integral part of American life. Paul Revere […]

December 5, 2023

By Paul H. Kupiec – AEI The Secretary of the Treasury and the Financial […]

December 2, 2023

By Ofer Cohen – Science Alert The Earth’s magnetic field plays a big […]

November 27, 2023

By Mihai Andrei – ZME Science The Earth’s surface is a complex mosaic […]

November 24, 2023

By Nouriel Roubini – Project Syndicate It is now common knowledge that economic, […]

November 17, 2023

By Our World in Data Food is the palate’s poetry, the body’s fuel, […]

November 16, 2023

2023.11.16 At Ahead of the Herd, we pride ourselves on being right, when […]

October 21, 2023

By Wolf Richter Our recession-watch here started shortly after the Fed kicked off […]

September 6, 2023

2023.09.06 Mining — like any other sector — has experienced its fair share […]

September 6, 2023

2023.09.06 与任何其他行业一样,采矿业在过去十年中也经历了相当多的问题,影响了其整体声誉和效率。 现在面临着为全球能源转型提供足够矿物的艰巨挑战,该行业必须深入挖掘——无论是字面上还是隐喻上——以提高其绩效。 但问题的根源是多方面的,阻力来自各个方面。关键问题包括全球技能短缺、环境和人权问题以及资金的可用性和使用。 在这些问题得到解决之前,采矿业的价值将无法最大化,并且该行业可能在未来十年遭受同样的命运。 下面,我们将探讨采矿业长期可持续发展的每一个主要障碍,以及该行业已经(或尚未)采取哪些措施来减轻这些风险。 关键技能差距 采矿业面临的最大挑战之一是劳动力老龄化和后继人才缺乏造成的技能差距日益扩大。 科罗拉多矿业学院研究和技术转让副总裁沃尔特·科潘 (Walter Copan) 表示,采矿业正面临着严重的技能差距,再加上即将到来的预期退休人数方面的所谓“灰色海啸”,情况更加严重。 德勤今年早些时候发布的一项研究显示,近 […]

August 25, 2023

By Lance Roberts Fitch’s recent downgrade of the U.S. debt rating alarmed investors […]

August 25, 2023

By Schiffgold The national debt has climbed to a staggering $32.7 trillion. In […]

August 3, 2023

2023.08.02 Earth’s climate is warming a lot faster than many had anticipated. Climate […]

July 29, 2023

By Goldfinger Dolly Varden (TSX-V:DV, OTC: DOLLF) is busy drilling with four diamond […]

July 22, 2023

2023.07.22 Inequality is one of the most volatile aspects of contemporary society, and […]

July 22, 2023

By Ryan McMaken How big is big when it comes to the latest […]

July 13, 2023

2023.07.13 In economics, a “soft landing” widely refers to a moderate economic slowdown […]

July 13, 2023

2023.07.13 在经济学中,“软着陆”广泛指的是在经历了一段成功避免衰退的增长期之后经济适度放缓。从隐喻上讲,它类似于该术语最初在航空领域的使用方式——飞行员试图让飞机平稳着陆而不坠毁。 当肩负着阻止经济因高通胀而过热的任务时,美联储等央行通常会提高利率,使其刚好足以引发经济放缓(即软着陆),但不足以引发严重的经济衰退(称为“硬着陆”)。 虽然定义“软着陆”的量化因素长期以来一直存在争议,但在失业率不大幅飙升(最好低于 5%)的情况下让通胀率回到或接近 2% 的目标通常被视为基本要求。 “软着陆”一词在前美联储主席艾伦·格林斯潘 (Alan Greenspan) 任职期间首次流行,人们普遍认为他在 1994 年至 […]

July 7, 2023

2023.07.07 In 2013, then-Liberal Party of Canada leader Justin Trudeau was asked which […]

July 4, 2023

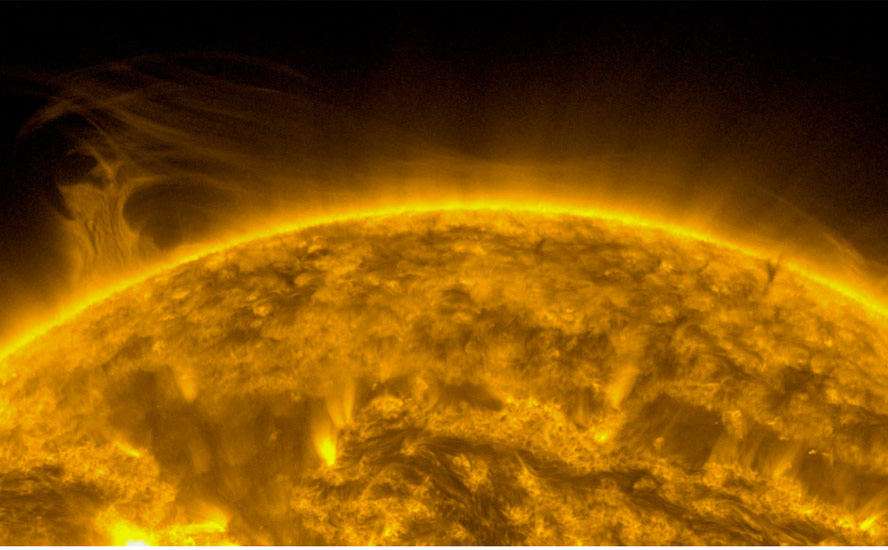

2023.07.04 There are many extreme events that could do massive damage to planet […]

June 18, 2023

By Joseph E. Stiglitz No one argues that policymakers should not think about […]

June 15, 2023

By Goehring & Rozencwajg Conventional oil production has now unequivocally rolled over. Unconventional […]

May 14, 2023

On May 3, Canada’s Parliament passed Bill S-211, the Modern Slavery Act, aimed at […]

May 6, 2023

April 19, 2023

2023.04.19 Most people can remember what they were doing on the blue bird […]

March 26, 2023

By Ian Bremmer Gzero The popular video-sharing app’s Chinese parent company, ByteDance, has […]

March 22, 2023

By The Economist The iraq war began on March 21st 2003, when Baghdad’s night […]

March 16, 2023

By The Economist Only ten days ago you might have thought that the banks […]

March 10, 2023

2023.03.10 The Canadian government is in court this week defending its ban on […]

March 8, 2023

By Eduardo Baptista and Greg Torode BEIJING/HONG KONG, March 8 (Reuters) – China needs the capability […]

March 3, 2023

2023.03.03 Taiwan is a small, densely populated island about 100 miles off the […]

March 3, 2023

BY James Rickards Get ready for screaming headlines beginning in about two months. Why? […]

February 26, 2023

By Katharina Buchholz 46 percent of U.S. adults said a barrier to eating healthy foods was […]

February 24, 2023

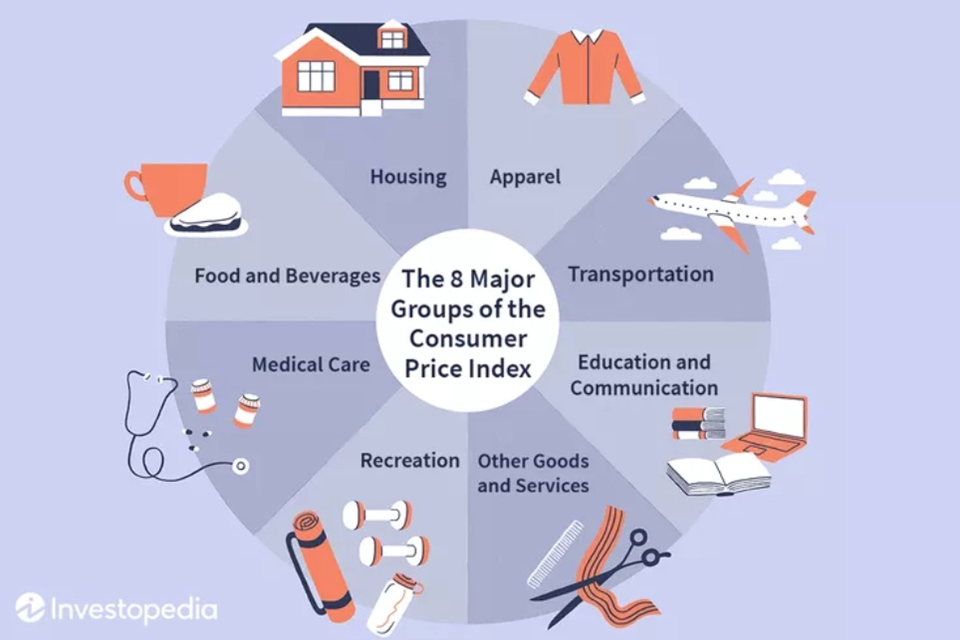

2023.02.23 Consumer spending makes up 70% of global GDP. It’s no wonder, therefore, […]

February 20, 2023

By Iain Davis In 1935, Major General Smedley Butler’s seminal book “War Is […]

February 19, 2023

By PROJECT AIR FORCE Over the past two decades, China’s People’s Liberation Army […]

February 15, 2023

By Jonathan Tirone Russia’s nuclear exports have surged since the invasion of Ukraine, […]

February 14, 2023

By Gilbert Fontana Our plans to buy new things, travel, invest, and save […]

February 12, 2023

By Scott Sutherland This is apparently the first time such a phenomenon has […]

January 30, 2023

By Bruno Venditti 2023.01.30 Wealthy countries consume massive amounts of natural resources per […]

January 26, 2023

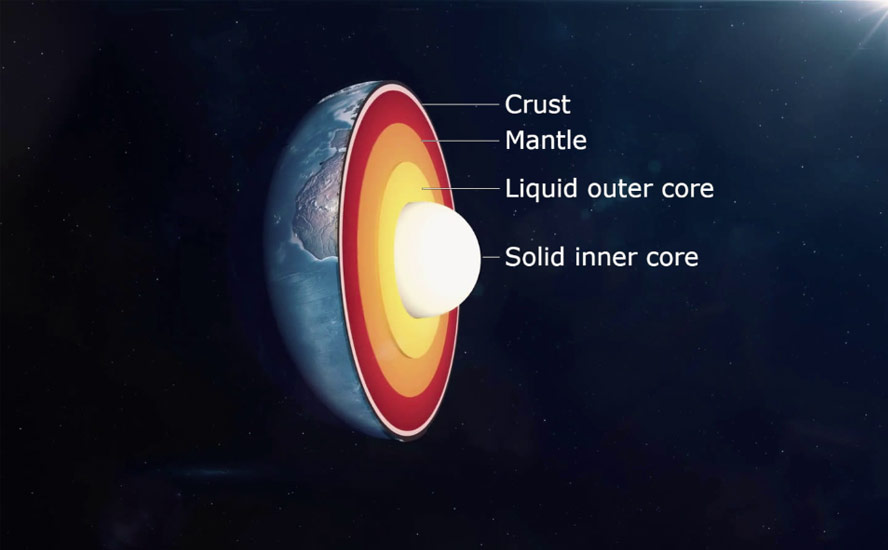

By Scott Sutherland 2023.01.26 The solid metal core of Earth doesn’t rotate perfectly […]

January 22, 2023

By Brian Boone 2023.01.22 So far, in the 2020s, farmers, food processors, suppliers, […]

January 21, 2023

2023.01.21 A democracy is a political system in which all members have an […]

January 17, 2023

By Jeff Thomas 2023.01.17 “A democracy is always temporary in nature; it simply cannot […]

January 1, 2023

What gets me, though, is how bad Canadian politicians are at negotiating. Here we finally have a resource that should give us significant leverage in dealing with our largest trading partner, ie., critical metals. In return for offering our minerals and our mining expertise, what are we asking for in return? I’ve yet to discover anything in print.

December 31, 2022

It seems fitting that the year we are expecting to see an unprecedented rise in US government spending and money-printing to spur an economic recovery, marks the 50th anniversary of the end of the gold standard.

Done at the time to fight an economic crisis, we are still feeling the effects of this disastrous decision, five decades on.

In this article, we explain why President Nixon did what he did, and why every promise that unshackling the US government from the requirement of maintaining the dollar's value in terms of gold would mean for the United States, has been broken.

Done at the time to fight an economic crisis, we are still feeling the effects of this disastrous decision, five decades on.

In this article, we explain why President Nixon did what he did, and why every promise that unshackling the US government from the requirement of maintaining the dollar's value in terms of gold would mean for the United States, has been broken.

December 30, 2022

When looking for an investment, the approach I take involves looking at the global, big picture conditions. I study trends, read the news, basically watch and listen to what’s going on in the world. Then I study the different sectors to select the one (or ones) that I think is going to match up well with the overriding, long-term theme. This is top-down investing.

The second part of my search for the dominant investment is a bottom-up approach. This is where I find individual companies, in the specific sector I have chosen to invest in.

The second part of my search for the dominant investment is a bottom-up approach. This is where I find individual companies, in the specific sector I have chosen to invest in.

December 27, 2022

2022.12.27 The Thucydides Trap is a term invented by Graham Allison, a professor […]

December 21, 2022

2022.12.21 A cross-the-board ‘Debt Jubilee’ might sound radical, but a reading of history […]

December 12, 2022

2021.12.12 Dried-up rivers and alarmingly low reservoir levels are manifestations of climate change. […]

December 8, 2022

2022.12.08 Over the past year, relentlessly rising interest rates (because of the global […]

December 7, 2022

2022.12.07 The economist who predicted the financial crisis sees a “long and ugly” […]

December 4, 2022

2022.12.04 Economist Nouriel Roubini believes the world economy is lurching toward an unprecedented […]

December 2, 2022

2022.12.02 An upcoming copper supply deficit could be hastened by an uptick in […]

November 17, 2022

2022.11.17 “This American carnage stops right here and stops right now,” President-elect Donald […]

November 10, 2022

2022.11.10 At Ahead of the Herd, we pride ourselves on being right, when […]

November 5, 2022

2022.11.15 In 2021 the world’s militaries spent USD$2.1 trillion, marking the seventh straight […]

November 3, 2022

2022.11.03 The US Federal Reserve is grappling with how to reduce inflation, which […]

October 24, 2022

2022.10.24 Chrystia Freeland is Canada’s Deputy Prime Minister and the Minister of Finance. […]

October 19, 2022

2022.10.19 For more than a year, the US dollar has been gaining strength […]

October 18, 2022

2022.10.18 Although British Columbia experienced an unusually cold and wet spring, delaying the […]

October 7, 2022

2022.10.07 Unusually warm weather and forest fires burning into October are two signs […]

October 5, 2022

2022.10.05 A new research paper by the International Monetary Fund estimates that the […]

September 17, 2022

2022.09.17 This year has seen a correction in the gold price, commensurate with […]

September 3, 2022

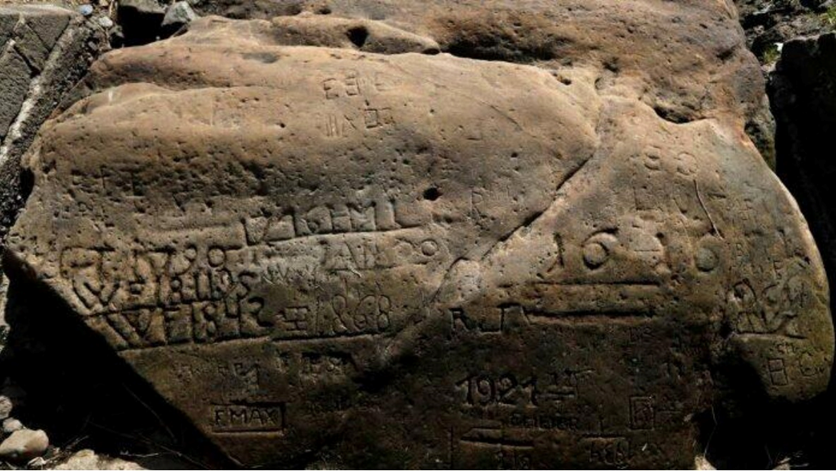

2022.09.03 Hundreds of years ago, early Europeans hit with a devastating drought thought […]

June 24, 2022

2022.06.24 British Columbia is once again locked into a weather pattern seemingly dictated […]

June 17, 2022

2022.06.17 We call ourselves Ahead of the Herd because we see things before […]

June 9, 2022

2022.06.09 Last month, we reported that Tesla, the largest electric vehicle manufacturer, was removed […]

June 7, 2022

2022.06.07 While the Covid-19 pandemic was dominating headlines in 2020, another major crisis […]

June 3, 2022

2022.06.03 History tells us that previous Fed rate hikes to deal with uncomfortably […]

May 31, 2022

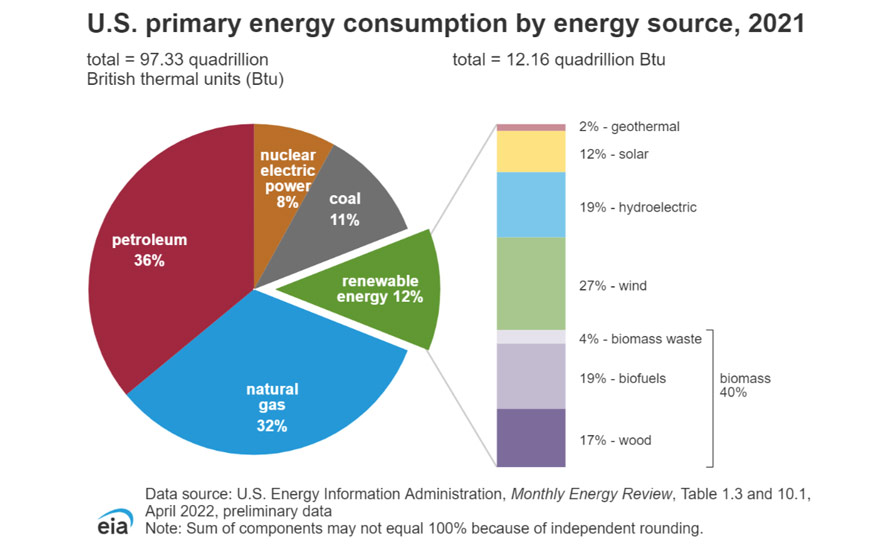

2022.05.31 With inflation in the US reaching its highest in 40 years, there […]

May 30, 2022

2022.05.30 A comparison of this year’s grocery bills to last year’s yields a […]

May 28, 2022

2022.05.28 The climate on planet Earth is changing, and a lot faster than […]

May 27, 2022

2022.05.27 TV BROADCAST NETWORKS and TIMES: CANADA: BNN Bloomberg – Saturday May 28 @ 8:00pm ET, Sunday May […]

May 26, 2022

2022.05.26 When Russia invaded Ukraine in February, pundits explained it as President Vladimir […]

May 24, 2022

2022.05.24 It’s slightly mind-blowing to know that, while 70% of the Earth’s surface is […]

May 20, 2022

2022.05.20 As shareholders demand that companies place more emphasis on environmental, social and […]

May 19, 2022

2022.05.19 Consumers today are mostly worried about gasoline prices approaching “unaffordable” territory, but […]

May 12, 2022

2022.05.12 A comparison of this year’s grocery bills to last year’s yields a […]

May 1, 2022

2022.05.01 The green economy is one of the most important buzzwords of the […]

April 29, 2022

2022.04.29 In our last article, we discussed a proposed new economic model for […]

April 27, 2022

2022.04.27 Modern Monetary Theory, or MMT, posits that rather than obsessing about how […]

April 24, 2022

2022.04.24 In our last article, ‘If it can’t be grown it must be […]

April 24, 2022

2022.04.24 Last year mining analysts Mike Kozak and Matthew O’Keefe of Cantor Fitzgerald […]

April 22, 2022

2022.04.22 A recession is what results when an economy stops growing. The National […]