Good calls: 3 AOTH predictions that came true – Richard Mills

2022.11.10

At Ahead of the Herd, we pride ourselves on being right, when it comes to macroeconomic trends that underpin our key investment theses.

When looking for an investment our method involves a thematic approach, studying global, long-term trends. Then study the different sectors to select the one that is going to match up well with what we think is the overriding theme. This is top-down investing.

The second part of our search for dominant long term investments is a bottom-up approach. This is where we find individual companies in the specific sector we have chosen to invest in.

I have always maintained, that “As a general rule, the most successful man in life is the man who has the best information.” (Benjamin Disraeli) Being correct about a trend, and timing it right, is what gives AOTH investors the edge, setting them apart from the average punter.

Following are three investable ideas we were bang on this year.

1. Diesel prices

Top reasons why diesel fuel will get more expensive

Figuratively, diesel is what powers the engine of the global economy; industries like agriculture, construction and transportation all rely on it to survive. This means as long as diesel prices go up, the end products of those activities (e.g. food) will also cost more, as we’re seeing right now (US inflation in September was running at 8.2%).

The chief economist at Moody’s Analytics estimates that 17% of the acceleration of goods price inflation is due to the high cost of diesel, which is currently more than gasoline.

Unfortunately, the days of expensive consumer goods are far from over; much of that can be linked to the knock-on effects from diesel.

On May, 19, 2022, we presciently wrote, the main reasons why diesel fuel is likely to get more expensive going forward, are: Diesel — Driver of the Economy; Depleted Diesel Stocks; Shortage Everywhere; Too Few Refineries; and Russia Situation. Read more

Six months later, our forecast has proven 100% correct.

Diesel outages are already apparent in North Carolina and Oklahoma, and there are limits on purchases in Tennessee. A radio host recently published and commented on a photo of a sign that said “NO DIESEL” outside of Allentown, Pennsylvania.

When Hal Turner topped off his diesel-fueled GMC pickup truck last weekend in northeastern PA, the price was $6.45 a gallon. When Turner took delivery of his truck in January, 2021, diesel cost $2.89!

In mid-October, Oilprice.com reported that diesel supplies are so tight,

Business Insider reported on Nov. 5 that diesel inventories have sunk far below emergency levels, with EIA data showing the United States only has 25 days supply left, the least since 2008. As a result, November delivery prices have already surged almost 40%.

US distillate stocks have fallen to 106 million barrels, which is the lowest since records began back in 1982.

The anatomy of the shortage comes down to refiners who slowed their refining during the pandemic, due to lower consumer demand, while at the same time, truckers kept buying diesel at high levels as they continued to make deliveries.

Although, it’s fair to say that supply was tightening even before the onset of covid-19. According to the Washington Post, Five refineries have shut down in the United States in just the past two years [2018- 2020], reducing the nation’s refining capacity by about 5 percent and eliminating more than 1 million barrels of fuel per day from the market, leaving the remaining facilities straining to meet demand.

Recent shutdowns were partly due to less fuel demand because of covid lockdowns, and also because of an anticipated boom in demand for EVs, that would render a lot of refining capacity obsolete. The latter has yet to happen amid continued strong demand for diesel.

Experts worry that the diesel shortage will worsen already sky-high consumer prices as suppliers are forced to pass down the costs.

U.S. buyers have begun snapping up diesel cargos originally sailing for Europe.

European fuel demand remains robust, resulting in a shortage, with a French refinery workers’ strike being a contributing factor, alongside upcoming maintenance-related refinery closures, Oilprice.com said.

Other reasons Europe is likely to continue seeing a tight diesel fuel market, include the fact that:

- While Europe is currently buying a lot of Russian diesel to fill the supply-demand gap, this will end in February when an embargo on Russian fuel kicks in;

- As Argus reported, the continent is in for a major diesel supply shock due to strong demand and low inventories as a result of unplanned outages at European refineries; and

- There is little incentive to build inventories because the diesel market is in strong backwardation, meaning the spot price is higher than the prices of futures.

2. Food inflation

5 reasons why food will get more expensive

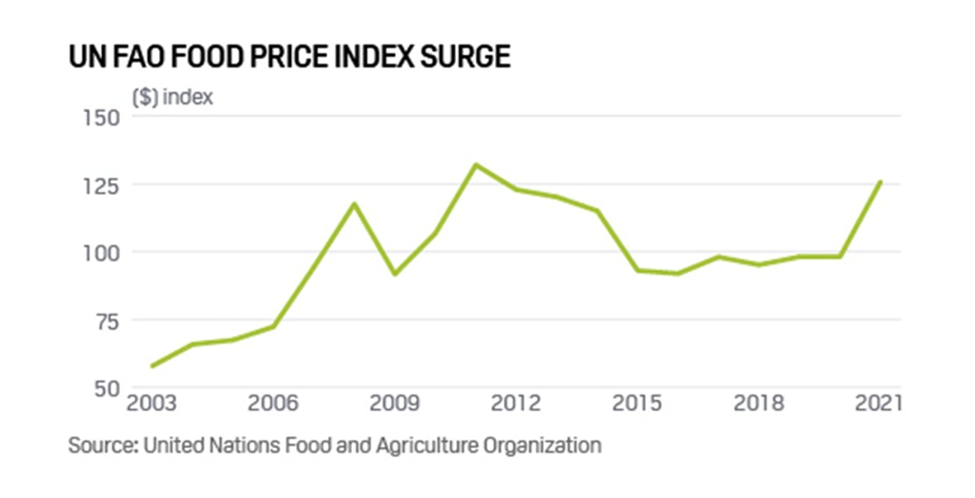

Globally, food prices have been soaring since the turn of the year, with the FAO Food Price Index reaching a record high during the month of March. This was coming off a year in which prices jumped 28%, the highest in a decade.

The index averaged 135.9 points in October 2022, virtually unchanged from September. An upturn in the Cereal Price Index countered drops in the indices for vegetable oils, dairy, meat and sugar. With the latest updates, the FFPI has dropped 23.8 points (14.9%) from its peak in March, but remained 2.7 points (2%) above its value in the corresponding month last year. (FAO press release, Nov. 4, 2022)

For those hoping for a “cooldown” of food prices, unfortunately that is unlikely to happen anytime soon. In our May 12, 2022 article, we identified five reasons why food will continue to get more expensive, and has: Soaring Fertilizer Prices; Lower Crop Yields; Rising Energy Prices; War in Ukraine; Monetary Policies & Stimulus Spending.

There is an obvious correlation between high diesel prices and food inflation — one that we nailed in 5 reasons why food will get more expensive.

Without diesel fuel, trucks, trains and cargo ships can’t operate. It literally greases the wheels of the US, and the global, economy. If products can’t be moved due to a shortage of diesel, everything starts to run out, starting with food.

Experts are flagging higher prices for goods, and risks to food supply, as truckers pay more to fill up their rigs. Without diesel fuel, sooner or later, there won’t be any re-deliveries to supermarkets, which only keep a maximum of three days food on their shelves.

Even if deliveries keep rolling, higher transportation costs feed into higher prices for consumers, worsening already high inflation.

In the United States, the September Consumer Price Index (CPI) rose 8.2%, nearly a 40-year high. Food prices increased by 11.2%, year on year, down 0.2% compared to August, but in continuation of an upward trend that started the year at 7%. (Read more)

Canadians are also seeing the fastest increases in food prices in 40 years, the result of extreme weather, Russia’s invasion of Ukraine, and supply chain disruptions.

While there could be some reprieve next year, for example on products with wheat in them after Russia restored a grain deal with Ukraine, the cost of agricultural production has increased in 2022 due to overall inflation. This also impacts the heightened costs around dairy products including milk and butter, according to Sylvain Charlebois, a professor in food distribution and policy at Dalhousie University and the senior director of the Agri-Food Analytics Lab, via CTV News.

3. Crypto implosion

5 reasons to consider gold over crypto

The mainstreaming of cryptocurrency has made many wonder whether it could actually replace gold’s role as a portfolio diversifier.

Some believe that the likes of Bitcoin has proven its worth as an asset that can offer superior returns during economic downturns, an environment under which gold has traditionally thrived.

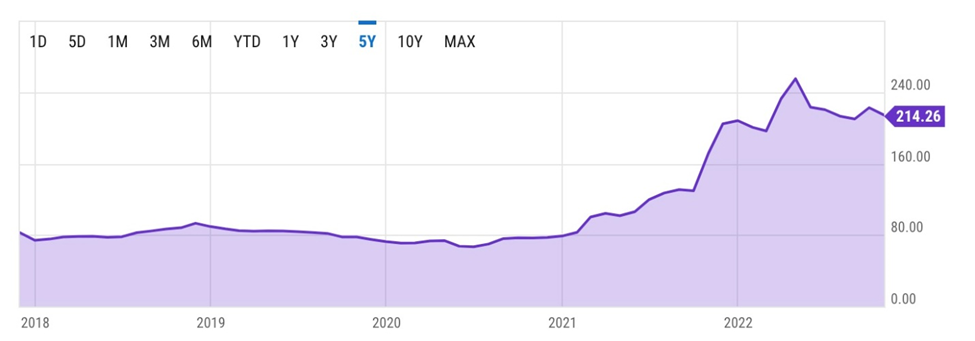

While the crypto market performed well in 2020 and 2021, 2022 has been a far different story. According to Forbes, High-profile financial meltdowns at Bitcoin, Celsius, and Terraform Labs, which together wiped out hundreds of billions in market value, helped trigger a flight from the cryptocurrency market, driving its value from $2.9 trillion last fall to less than $900 billion [actually $835B] today.

Another good demonstration of why I don’t like the comparison between gold and cryptocurrency, is what happened over the past few days. US financial regulators are reportedly investigating whether beleaguered crypto-exchange FTX.com properly handled customer funds.

The investigations by the SEC and the CFTC relate to the liquidity crisis at FTX, that led to a buyout of its non-US operations by rival exchange Binance Holdings Ltd.

However, when on Nov. 9 the Binance takeover looked to be in jeopardy, the crypto market, to put it crudely, “shit the bed”.

According to Bloomberg, via Yahoo Finance,

Cryptocurrencies extended declines to the lowest levels in two years as Binance is seen increasingly unlikely to follow through on its takeover of FTX.com.

Bitcoin, the largest token by market value, fell as much as 9.9% to $16,853 on Wednesday, the least since November 2020. That brings this week decline to almost 20%. It reached a record high of almost $69,000 a year ago. Just about every digital coin was struggling: Ether, Solana, Polkadot and Avalanche all dropped…

The sense of dread that swept across clients of fallen crypto exchange FTX.com was so intense that they pulled out $430 million worth of Bitcoin in the space of just four days. FTX had more than 20,000 Bitcoins going into Sunday, according to data from CryptoQuant. That fell to almost zero by Wednesday after fears about FTX.com’s financial health led customers to flee.

Bitcoin, which dominates the cryptocurrency space, is down 75% over the past year, @ USD$15,904.40, at time of writing.

Compare this to spot gold, which admittedly has lost ground in 2022, as the Federal Reserve and central banks worldwide raise interest rates, and the US dollar remains firm. But year over year, gold is only down 9.2%, and I strongly believe that gold is soon heading higher.

The Fed, the debt, China and gold

Could a wave of buying from disillusioned crypto owners into precious metals be next?

For many reasons, gold is still the preferred option given its various advantages over crypto:

Volatility

The idea of investing in stock alternatives is to protect your investment against market volatility with a stable asset. Ironically, most cryptocurrencies are extremely volatile, and even a “safe” one like Bitcoin is more of a risk-on asset like stocks. This is because cryptos are oftentimes subjected to the “media effect” — meaning their values are heavily influenced by investor sentiment and media hype.

On the other hand, gold and silver are known commodities that have been fundamentally embedded in the financial system for decades, so no amount of media hype could sway public perception of the metal. It has no positive correlation with the stock market, and therefore is less vulnerable to its ups and downs.

Unlike many risky assets, gold has been able to reliably hold value over time despite episodes of fluctuations. During inflationary periods, it even outperforms the market as investors turn to gold as a hedge; this trend has held true for over 50 years. Major cryptos like Bitcoin, though, remain unproven in this regard.

Liquidity

Another factor that comes into the gold vs. crypto debate is liquidity: how easily the asset can be converted into cash. Although Bitcoin and many other cryptocurrencies trade 24 hours a day around the globe, they are less liquid than other asset classes. Transactions involving Bitcoin et al. generally come with a cost and/or time delay, which is also a contributing factor to its price volatility.

While the increased number of trusted Bitcoin exchanges has greatly improved the liquidity problem over the years, crypto’s liquidity remains largely dependent on the platform, the time of day, and the amount being cashed out.

Meanwhile, gold has always been an extremely liquid asset; most of the time, bullion can be easily exchanged for cash, as it’s universally recognized around the world. Nearly 90% of the world’s annual gold production changes hands each day.

In fact, data from the World Gold Council (WGC) shows that the precious metal is actually the second most liquid asset after S&P 500 stocks.

Regulations

Because gold already has an established system for trading, weighing and tracking, the regulations that govern this market are generally very clear and rigid. Unlike stocks and currency, gold cannot be manufactured on the spot and must be mined from the ground. This also makes forgery or fraud extremely difficult, thus protecting gold owners.

Crypto, however, does not offer investors the same degree of protection. Since this market is still in its infancy stage, the regulatory infrastructure to ensure that users are safe is not yet in place. While it’s true that a major cryptocurrency like Bitcoin is much less vulnerable to theft thanks to its encrypted and decentralized system, it is not immune to its own regulatory risks.

For example, in some countries, the central bank may worry that crypto could undermine the stability of the monetary system, and therefore take certain measures to control this emerging market, including creating an uneven playing field to put crypto at a disadvantage.

Taking the most extreme measure to date was China, which outright banned all crypto activity in September 2021 and is now promoting its own digital currency.The threat of regulatory action in other parts of the world will continue to pose a great risk for crypto investors, something that the more “legal” gold market is immune to.

Utility

Unlike crypto, which mostly serves as a medium of exchange in the form of a digital currency, gold has a variety of uses across many industries, such as fashion, arts, electronics, and more. Gold’s place in human history is also much richer, dating as far back as 5,000 years ago; today, the precious metal is still deeply worshiped by cultures all over the world.

Given its multi-functional utility and revered status as a symbol of wealth, gold has been able to withstand the ravages of time and maintain its prominence through every era of human civilization.

In the future, gold is expected to continue to hold value from generation to generation, as no other metal will ever replace it.

Rarity

What’s really underpinning gold’s value is simply how rare this yellow-colored metal is. For every billion kilograms of the Earth’s crust, there is about 4 kg of gold (hence the “precious metals” label) — this fraction is even less than other precious metals like silver and platinum. And once the ore is mined, the extraction process of gold is also very complex and costly.

It is estimated that all the gold metal mined throughout history would fit into a square box with sides measuring around 20 meters, demonstrating just how scarce the metal is.

Although some cryptocurrencies like Bitcoin are also rare given the limited supply, investors will always have a wide selection of digital assets to choose from, and in a sense, the investment possibilities in crypto are unlimited.

Gold investors, meanwhile, have only a limited number of options aside from buying the physical metal; they can either place money into funds that replicate the value of gold (i.e. gold-backed ETFs), or consider contracts that give them the right to buy the asset later on (options and futures). They can also purchase the shares of junior resource companies, which historically, offer the best leverage to a rising gold price.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.