Themes Matter

2017.06.25

When looking for an investment your method should involve a thematic approach, studying global long term dominant trends. Then study the different sectors in order to select the one that is going to match up well with what you think is the soon to be overriding theme. This is top down investing.

The second part of your search for the dominant investment is a bottom up approach. This is where you find individual companies in the specific sector you have chosen to invest in.

So what is that investable theme I mentioned earlier?

So what is that investable theme I mentioned earlier?

Today we are at the start of a major, at least decade long transition in how energy is produced and stored. A global energy transition, from the burning of fossil fuels for energy and transportation, to using renewable non-polluting solar and wind energy is underway.

Specifically, what are the energy metals that are going to make the much needed increased adoption of renewable energy possible?

Manganese

The United States Geological Survey (USGS) says the U.S. is 100% dependent on other countries for Manganese. Manganese, so crucial for steel making is a basic building block any nation needs for its economic foundation.

Aside from iron manganese is the most essential mineral in the production of steel. You can’t produce steel without adding 10 to 20 lbs. of Electrolytic Manganese Metal (EMM) per ton of iron. The US government has classified manganese as a strategic metal for over a hundred years. This is not hard to understand when manganese has no substitute in its many steel applications and has itself become a substitute for other more expensive metals in certain alloys.

There are no mines producing manganese ore in the U.S. or Canada. There are no domestic suppliers of EMM in North America – China controls 97% of the world trade in electrolytic manganese metal (EMM) and you can’t make steel without it.

The same circuits that make EMM make electrolytic manganese dioxide (EMD). EMD is a key ingredient in the production of lithium-ion, lithiated-ion, alkaline and zinc/manganese batteries. The U.S. is the largest consumer of EMD worldwide.

It seems North America needs a long term ‘domestic’ supply chain of manganese – from mine to battery. It’s becoming apparent that North America’s supply of EMM, and more advanced products such as EMD, should no longer be based on the goodwill of China.

Vanadium

Every sunny afternoon there’s a remarkable amount of the sun’s energy, in the form of solar power, fed into the electricity grid. The problem is that all this new electricity from the sun is coming through the grid at the wrong time of day. Between noon and 4pm is a trough in power demand. It’s during peak hours of demand in the evening when all this excess energy can be utilized.

Wind power encounters the same intermittency problems as solar power – sometimes the wind blows, sometimes it doesn’t, sometimes the sun shines sometimes it doesn’t.

Renewable Energy’s Problem Solved

An emerging market opportunity is rapidly developing for vanadium pentoxide (V2O5) to be used as the main ingredient, the electrolyte, in the vanadium redox flow battery (VRFB) aka the Vanadium Flow Battery (VFB) or V flow battery.

Vanadium Flow Battery’s can store large amounts of energy almost indefinitely, which makes them perfect for wind/solar farms, industrial and utility scale applications, to supply remote areas, or to provide backup power.

How VFB’s work

Batteries store energy and generate electricity by a reaction between two different materials, usually zinc and manganese.

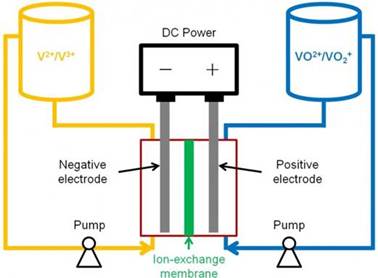

In VFB batteries, these materials are liquid and have different electric charges. Both liquids (V2+/V3+ and VO2+/VO2+) are pumped into a tank. A thin membrane separates the two liquids but the liquids are able to react and an electric current is generated.

Vanadium is used because it can convert back and forth from its various different states which carry different positive charges. The risk of cross contamination is eliminated as only one material is used. They are also safer, as the two liquids don’t mix causing a sudden release of energy.

The liquids have an indefinite life, so the replacement costs are low and there are no waste disposal problems. Also, battery life is extended potentially infinitely. By using larger electrolyte storage tanks VFB’s can offer almost unlimited energy capacity and they can be left completely discharged for long periods with no ill effects.

Introducing hydrochloric acid into the electrolyte solution almost doubles the storage capacity and enables the system to work over a far greater range of temperatures, from -40°C to +50°C.

V-flow batteries offer the best deployable large battery storage technology developed so far.

Vanadium has also begun to play a role in applications for electric and hybrid vehicles. Vanadium acts as a supercharger to batteries by increasing the energy density and voltage of the battery. This is important for electric and hybrid vehicle performance since energy density equates to distance/range, while voltage equates to torque.

Feldspar

Feldspars are found in granite type pegmatite rocks which are a mixture of feldspar minerals together with quartz and mica.

Tempered Glass

K-spar and Na-spar are increasingly being used in the fabrication of tempered glass and solar panels.

Tempered glass, or as it’s more commonly known safety glass, is used in place of other glass products where increased strength and safety is required. Tempered glass is up to six times the strength of normal plate glass. Because the glass is so strong it can effectively resist wind pressure and impact.

Safety glass also has a unique fracture pattern. Called ‘dicing’ it shatters into small pieces rather than creating long and razor sharp shards.

Fully tempered glass is used in applications like doors, side lights, shower and tub enclosures, interior partitions, storm doors, patio-door assemblies, and escalator and stairway balustrades. As a glazing product it is used in windows and in spandrel areas (for wind pressure, impact and thermal stress resistance). Special building applications include sloped glazing, racquetball courts, skylights and solar panels.

The domestic motor vehicle industry employs tempered glass as side and rear windows in automobiles, trucks, and multi-purpose vehicles.

Manufacturing industries use tempered glass in refrigerators, furniture, ovens, shelving, and fireplace screens.

“The Global Tempered Glass Market is poised to grow at a CAGR of around 7.7% over the next decade to reach approximately US$71.5 billion by 2025.” Tempered Glass Market Analysis By Application (Automotive, Construction,) And Segment Forecasts To 2022

Solar Glass

The solar industry’s current demand for glass is less than 3% of the overall market. However, with the huge growth in the solar industry this situation is changing.

According to Greentech Media for the first time ever, U.S. solar ranked as the number one source of new electric generating capacity, growth of nonresidential installations surpassed residential solar for the first time since 2011 and the U.S. solar market nearly doubled its annual record, topping out at 14,625 megawatts of solar PV installed in 2016.

Oxford University researchers say solar’s share of global electricity will grow from roughly 1.5% today, to as much as 20% by 2027.

For the first time, more solar systems came online in 2016 than natural gas power plants – the top source of electricity in the US in 2015 – as measured in megawatts. Solar capacity is irrefutably going up, and prices are collapsing.

Solar windows

Rooftops are the obvious place for a solar panel because they receive more direct sunlight than a building’s façade. But because of their sheer square footage certain building façades can be tapped as sources of solar-power generation.

Experts say that, depending on the number of south-facing windows and the building’s location, solar panel tempered glasstechnology could provide from 20% to 30% of a buildings energy needs.

Tempered Solar Glass Tiles

Tesla’s CEO Elon Musk has recently made the claim Solarcity’s new solar roof tiles will be cheaper than a conventional roof even without adding in the cost of electricity saved. The tiles have embedded solar photovoltaic cells between multi-layered tempered glass.

Imery’s Performance Metals closed its U.S. feldspar production site in December 2013. The company had previously been supplying 50% of U.S. production. Imery’s lost production, the highest quality K-spar, is being made up by imports of Spanish feldspar.

There is one U.S. feldspar supplier left, and their focus is on pottery, not solar. There is no high quality K-spar or Na-spar production in the U.S. or Canada (except for a privately owned mine in S.W. Quebec, it’s product is used for crowns and implants), for solar glass or solar roof tile applications.

Conclusion

At Ahead of the Herd we know – I was one of the first to bring it to your attention – that there was a global long term dominant investable trend started in 2009. Unfortunately the term ‘government boondoggle’ comes to mind over Obama’s and the Dems rollout. But there’s no doubt an idea was planted (ahead of the herd investors have been profiting ever since), and has since grown into one of the most dominant global investable themes.

There is a global energy transition – from the burning of fossil fuels for energy and transportation, to using renewable non-polluting solar and wind clean energy underway.

It’s your authors opinion that manganese (no North American production), vanadium (no North American production), and the feldspars (no North American production), are going to be as hugely important to the adoption of clean renewable energy (solar, wind and geothermal), and the energy storage market (which includes EV’s/power tools), if not more so going forward, then lithium, graphite and cobalt presently are to the adoption of just electric vehicles/power tools.

When a metal’s, indeed any commodities supply side is constrained, in combination with strong demand, that commodity is in a situation that almost guarantees upward pressure on its price. Add in geo-political concerns about the commodities major producers and a share price rise for the junior resource company, who can potentially supply said commodity is, in this author’s opinion already baked in.

For us as retail investors the trick is to find that potential future producer. To do that I’ve found the best way is taking a thematic approach, a top down bottom up methodology. My due diligence is done and I’ve got three junior resource company’s on my radar screen who own deposits of manganese, vanadium and K-spar. In North America.

What’s on your radar screen?

Richard (Rick) Mills

Richard’s articles have been published on over 400 websites, including:

WallStreetJournal, USAToday, NationalPost, Lewrockwell, MontrealGazette, VancouverSun, CBSnews, HuffingtonPost, Beforeitsnews, Londonthenews, Wealthwire, CalgaryHerald, Forbes, Dallasnews, SGTreport, Vantagewire, Indiatimes, Ninemsn, Ibtimes, Businessweek, HongKongHerald, Moneytalks, SeekingAlpha, BusinessInsider, Investing.com, MSN.com and the Association of Mining Analysts.

Sign up for Ahead Of The Herd’s free highly acclaimed newsletter.

***

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified.

Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.