May 2, 2021

May 2, 2021

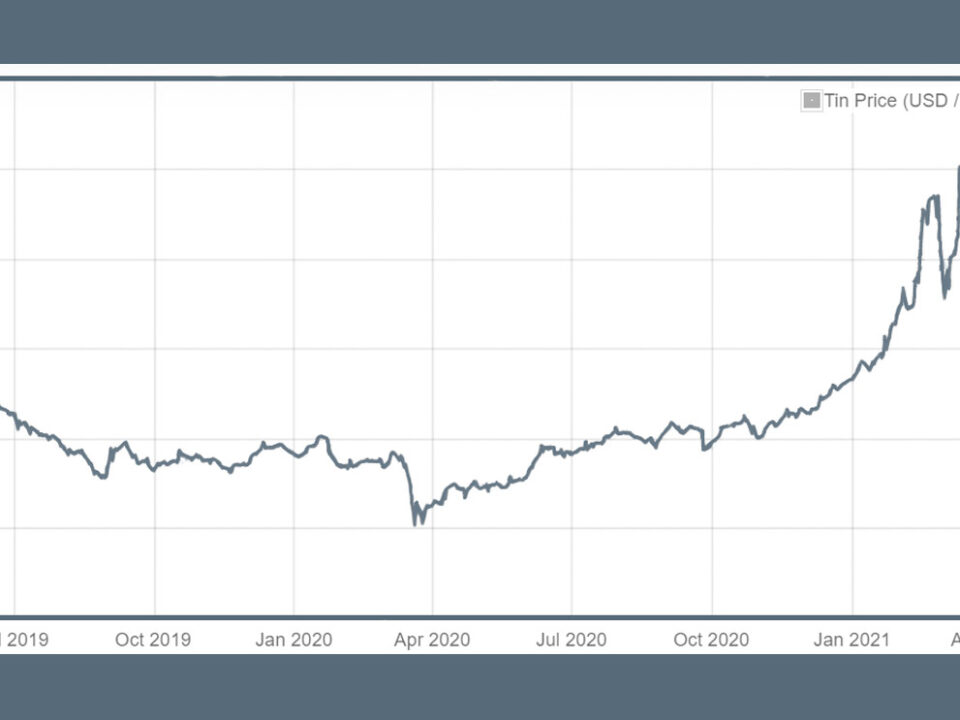

Tin currently has the highest value of the major base metals, three times the value of copper and nine times the value of zinc.

Chances are the value of zinc could stay high for a while. This is because the global tin market is in the midst of a historic squeeze (or one might call a “super squeeze”).

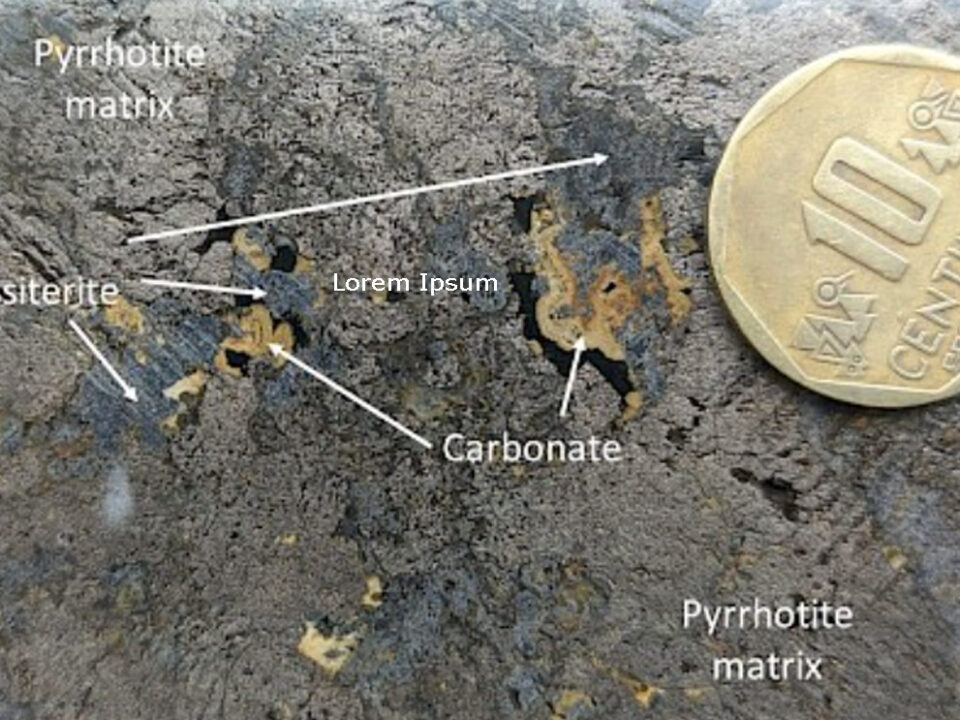

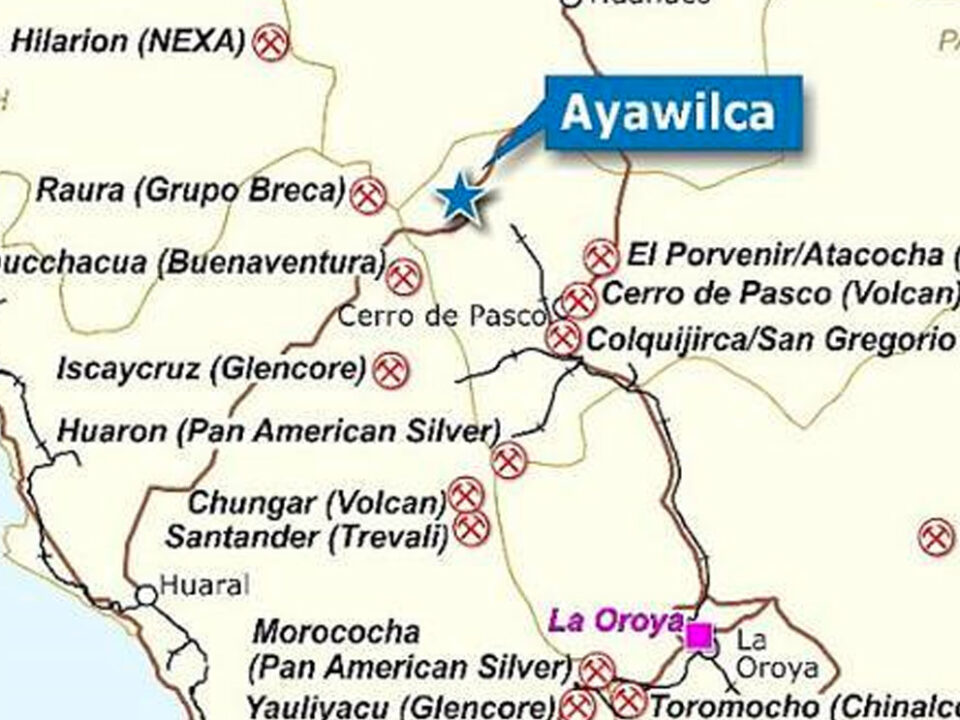

One potential source of tin that we should be looking at lies in the Pasco region of central Peru. This is where we find Tinka Resources (TSXV:TK, OTCP:TKRFF) and its flagship Ayawilca project.

Chances are the value of zinc could stay high for a while. This is because the global tin market is in the midst of a historic squeeze (or one might call a “super squeeze”).

One potential source of tin that we should be looking at lies in the Pasco region of central Peru. This is where we find Tinka Resources (TSXV:TK, OTCP:TKRFF) and its flagship Ayawilca project.

Do you like it?

April 27, 2021

April 27, 2021

The United States is back in the fold of countries pledging to reduce greenhouse gas emissions, and that is helping to drive demand for an assemblage of metals that a global push to decarbonize and electrify is expected to require.

Do you like it?

April 15, 2021

April 15, 2021

Tinka Resources’ (TSX.V:TK, OTCQB:TKRFF) Ayawilca polymetallic project in Peru just got a whole lot more interesting with the discovery of a new tin zone, that is expected to add significant value to what is already the largest zinc development project in Latin America and one of the biggest zinc resources held by a junior explorer.

Do you like it?

March 19, 2021

March 19, 2021

Peru-focused Tinka Resources (TSXV:TK, OTCP:TKRFF) has the backing of a major player in the Peruvian zinc and silver market, adding significant heft to its flagship Ayawilca zinc-silver play.

Nexa Resources (TSX:NEXA), one of the world’s largest zinc producers, and owner of the only zinc smelter in Peru, purchased 28.895 million common shares from an arms-length shareholder, giving the Luxembourg-based firm an 8.8% stake in Tinka.

The transaction means Tinka Resources now has two major miners as shareholders — the other being Buenaventura SA (NYSE:BVN) — along with JP Morgan UK.

Nexa Resources (TSX:NEXA), one of the world’s largest zinc producers, and owner of the only zinc smelter in Peru, purchased 28.895 million common shares from an arms-length shareholder, giving the Luxembourg-based firm an 8.8% stake in Tinka.

The transaction means Tinka Resources now has two major miners as shareholders — the other being Buenaventura SA (NYSE:BVN) — along with JP Morgan UK.

Do you like it?

March 5, 2021

March 5, 2021

Several factors influence gold prices (mainly the US dollar, gold ETF inflows/ outflows, inflation rate, bond yields, safe haven demand, physical gold demand, gold supply) but none is more reliable than real interest rates.

The demand for gold moves inversely to interest rates — the higher the rate of interest, the lower the demand for gold, the lower the rate of interest the higher the demand for gold.

The demand for gold moves inversely to interest rates — the higher the rate of interest, the lower the demand for gold, the lower the rate of interest the higher the demand for gold.

Do you like it?

February 27, 2021

February 27, 2021

21.02.27 Industrial metals are on an absolute tear with no signs of slowing […]

Do you like it?

February 13, 2021

February 13, 2021

2021.02.13 Despite zinc’s low profile among resource investors, it is the fourth most […]

Do you like it?

January 25, 2021

January 25, 2021

2021.01.25 The Covid-19 crisis has served as a catalyst for a new “commodity […]

January 15, 2021

January 15, 2021

January 15, 2021 Silver is one of the first metals that humans discovered […]

December 23, 2020

December 23, 2020

2020.12.23 The next time you crack open a can of beer, you might […]

October 17, 2020

October 17, 2020

2020.10.17 Despite recent headwinds, it looks to be clear sailing going forward for […]

May 3, 2019

May 3, 2019

2019.05.03 Zinc and lead prices are movin’ on up again, following a two-week hiatus […]

February 13, 2019

February 13, 2019

2019.02.13 On Tuesday zinc inventories in London Metal Exchange (LME) warehouses sunk into […]