Cypress Development moves closer to advancing Clayton Valley lithium project towards feasibility

2021.05.30

The lithium market has had a bright start through the first few months of the year, with battery raw materials garnering stronger interest amid a worldwide shift towards clean energy.

Through Q1 2021, lithium carbonate prices in China increased by 72% quarter-on-quarter to $11,500/t, and have continued to climb over recent weeks, exceeding $13,800/t in May.

Lithium hydroxide followed the same trend, increasing by 32% to $9,400/t in Q1 2021 and rising further to $12,750/t in May 2021.

However, the global energy storage revolution is only just getting started.

Industry analysts are forecasting significant demand increases for lithium over the next decade and beyond.

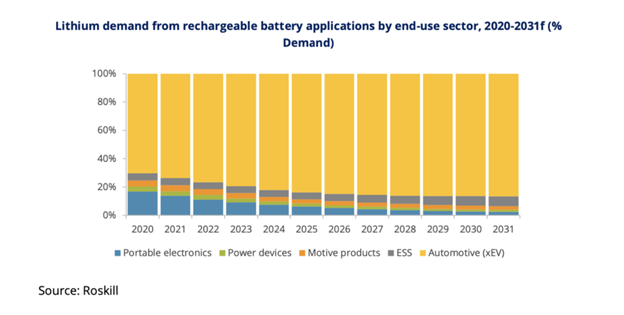

Last year, rechargeable batteries accounted for 65% of total lithium demand, but that figure is likely to exceed 80% by 2025, the latest lithium outlook report by Roskill shows.

According to Roskill analysts, electric and hybrid vehicles – which represented over 70% of demand from lithium-ion battery technologies in 2020 – are expected to increase their dominance of the market share in the period to 2031.

A similar sentiment was echoed by those at Benchmark Minerals, which predicted global demand for lithium carbonate equivalent (LCE) to rise by as much as ten-fold to 5 million tonnes.

As demand for EV batteries accelerates, lithium prices are expected to remain elevated for at least the next couple of years.

Recent analysis by Fitch Solutions suggests that prices of Chinese lithium carbonate could average $13,450/t in 2021 and $15,025/t in 2022, while Chinese lithium hydroxide monohydrate could average $11,950/t in 2021 and $14,300/t in 2022.

Lithium Supply Needed

As EV and grid energy storage applications continue to drive up demand for battery minerals, there comes a time when more lithium production is needed.

As we speak, battery giants and major automakers worldwide are scaling up battery production with mega-factories and actively acquiring lithium through offtake and joint venture agreements.

Currently, there are over 150 large-scale battery mega-factories around the world in the planned production pipeline to 2028 (Benchmark Minerals), all of which are based on lithium-ion batteries becoming an all-purpose energy storage unit that is highly scalable.

The biggest factory known today is Tesla’s $5 billion Gigafactory located near Sparks, Nevada, where the carmaker has been looking to mine lithium on its own close to the site.

Recently named the top mining jurisdiction in the world, the state of Nevada is mostly known for its gold and silver. However, its abundance of lithium resources – conveniently scattered around Tesla’s Gigafactory – has gradually piqued industry interest. Some even consider Nevada to be the next hotspot for lithium mining after Chile’s Atacama Desert.

As of now, there is only one active lithium operation in Nevada (and in the US) — the Silver Peak mine owned by global lithium company Albemarle, which extracts lithium from brine outside of Tonopah.

Another close to operation is the Thacker Pass lithium project in Humboldt County, held by Lithium Americas. The project is host to the largest known lithium resource in the country.

Clayton Valley Lithium Property

One company committed to developing America’s next lithium supply is Cypress Development Corp. (TSX-V: CYP) (OTCQB: CYDVF) (Frankfurt: C1Z1), which presently holds a 100% interest in the Clayton Valley lithium project in southwest Nevada.

The property covers a total area of 5,430 acres and is located immediately east of Albemarle’s Silver Peak mine, North America’s only lithium brine operation, which has been in continuous operation since 1966.

Exploration and development by Cypress have led to the discovery of a world-class resource of lithium-bearing claystone adjacent to the brine field to the east and south of Angel Island, an outcrop of Paleozoic carbonates protruding up through the lakebed sediments.

The future of US lithium supply

Lithium mineralization at Clayton Valley occurs within montmorillonite clays throughout the sediments to a depth of at least 150 metres. Metallurgical testing indicated low-cost processing can be achieved by leaching with low acid consumption (126 kg/t) and high lithium recovery over 85% Li.

These high extractions prove the dominant lithium-bearing minerals present are not hectorite, a refractory clay mineral that requires roasting and/or high acid consumption to liberate the lithium.

The company is currently working towards a feasibility study and permitting of a mine and metallurgical facility for its large deposit of lithium-bearing claystone.

Should everything go according to plan, Clayton Valley would become a viable source of high-purity lithium hydroxide (LiOH) suitable for tier 1 EV battery usage for decades.

Clayton Valley PFS

In a pre-feasibility study (PFS) released in 2020, it is estimated that the Clayton Valley project could produce on average 27,400 tonnes of lithium carbonate equivalent (LCE) per year, at a mining and processing rate of 15,000 tpd of mill feed.

The production figure is based on probable mineral reserves of 213 Mt averaging 1,129 ppm Li (1.28 Mt LCE). Reserves and production plan are derived from an indicated mineral resource of 1,304 Mt averaging 905 ppm Li (6.28 Mt LCE).

The project’s large resource allows the mineral resources and reserves for the PFS to be derived from only a portion of the property (initial pit), showing a mine life of 40-plus years. All resources and reserves are pit-constrained by property and geologic boundaries.

The large size — combined with its surface exposure and flat-lying nature — is a key feature of claystone deposit. This would allow mining with a negligible strip ratio of 0.29:1 due to minimal overburden and no interbedded waste, and no drilling or blasting in excavation.

As such, the Clayton Valley project has the potential to be a sustainable low-cost producer of lithium.

“These positive results take us closer to our goal of developing a world-class lithium deposit. Cypress’s land position and resources afford us the opportunity for a long-life project with low operating costs and potential to be a significant source of lithium for the United States,” Cypress CEO Dr. Bill Willoughby stated at the time of the PFS release.

Pilot Plant Program

In March, Cypress took a vital step in advancing the Clayton Valley project towards production by announcing the development of a lithium extraction pilot plant for the lithium-bearing claystone.

The pilot plant will be located at a metallurgical facility south of Beatty, Nevada, owned and operated by del Sol Refining Inc., which is permitted under the State of Nevada for chemicals use with permits in place with the U.S. Environmental Protection Agency (EPA).

The purpose of the program is to ensure all the processes work together as a single unit, and to identify and resolve any scale-up or potential operational issues, in accordance with the recommendations outlined in the company’s 2020 PFS.

The initial operation of the pilot plant will focus on chloride-based leaching to confirm the results of the company’s scoping study on lithium extraction.

The pilot plant is planned to operate at a rate of one tonne/day and will be designed for correct interaction and testing of the major components within the extraction process and assessment of the resulting lithium products.

According to Cypress, the program would provide essential data for a planned feasibility study and enable the company to produce marketing samples to support negotiations with potential offtake and strategic partners.

Service Agreements

This week, Cypress announced that equipment deliveries are on track and plant assembly is expected to commence by month-end at the leased facility in Amargosa Valley, Nevada. The pilot plant remains on schedule and is expected to be fully operational in July 2021.

Cypress has also entered into a service agreement with Chemionex Inc., an Ontario-based company and innovator in hydrometallurgical process development and direct lithium extraction technology (DLE), to advise on the DLE section of the pilot plant.

As planned, the plant at the Amargosa Valley site will be configured into three primary sections: leaching, tailings handling and DLE.

Offsite testing of product and stripped leach solutions will be conducted at NORAM Engineering and Construction Ltd.’s BC Research laboratory in Richmond, Canada. The overall plant operation will be supervised by Continental Metallurgical Services LLC in conjunction with Cypress and del Sol Refining personnel.

Each section in the plant will have specific objectives. The leaching section will work to optimize leach conditions and confirm lithium extraction into pregnant leach solution.

The tailings handling section will utilize a counter current decantation arrangement of thickener settlers and flocculant mixing determined by Pocock Industrial with the objective of determining materials handling, moisture content and water consumption.

Chemionex, under a separate purchase agreement, will provide the equipment for the DLE section of the pilot plant. Additionally, Cypress will be granted an option upon completion of the pilot plant program to license Chemionex’s proprietary Lionex DLE technology for commercial use at its Clayton Valley project.

Both the purchase and option agreements are at an advanced stage of preparation.

The work conducted by NORAM will treat the concentrated lithium solution from the DLE portion of the pilot plant to produce lithium hydroxide and test the stripped leach solution for compatibility in recycling to the leaching portion of the plant.

Water Rights Purchase

Meanwhile, Cypress is also proceeding with due diligence work with respect to the recently announced letter agreement for water rights in Clayton Valley, Nevada.

Earlier this month, Cypress announced it has signed a letter of intent to purchase the water rights from Nevada Sunrise Gold Corp. The LOI was another major milestone for Cypress, as it would allow the company to fulfill the water supply requirements of its lithium project.

The parties are working towards completion of a purchase agreement on or before June 7, 2021.

As stated in the May 10 news release, the water permit allows for 1,770 acre-feet of water for mining, milling and domestic use per year. This amount represents the largest volume of permitted water available in Clayton Valley, which is a fully appropriated hydrogeographic basin.

With the exception of a single limited use permit, the Nevada Division of Water Resources has maintained that no new permits will be made available for water appropriation within the Clayton Valley basin.

Nevada Sunrise has successfully defended its water rights in recent years, including a 2019 settlement agreement with another party.

“Groundwater in the southwest US is a limited resource, and it was known early on that acquiring water rights would be a sensitive and critical step for Cypress’ lithium project,” CEO Bill Willoughby said in the media release.

“We believe the timing is right to enter into this agreement given the advanced stage of our project.”

Conclusion

Ever since acquiring the lithium claims back in early 2016, Cypress has made tremendous progress in bringing the Clayton Valley project closer and closer to production, with sampling and drilling leading to a positive PFS.

The study showed a potential 40-plus-year operation capable of producing 27,400 tonnes of LCE at an industry-low cash cost of $3,400 per tonne.

In terms of size and cost-efficiency, there are only a handful of sedimentary-hosted lithium projects that are currently comparable to Clayton Valley — such as ioneer Ltd.’s Rhyolite Ridge and Lithium Americas’ Thacker Pass.

However, Cypress represents a much more enticing investment opportunity given the company’s relatively lower market capitalization of around $100 million, and to date, the company has had no problem raising capital to advance the Clayton Valley project.

Earlier in the year, the junior miner saw its bought deal offering upsized due to strong investor demand. With those proceeds, the company now has over $20 million in its treasury and is fully financed to complete ongoing work on its property, starting with the pilot plant program.

This will be critical to the company’s goal of advancing the Clayton Valley lithium project towards feasibility study, which we look forward to later this year.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Cypress Development Corp. (TSX.V:CYP).

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.